A Florida Complex Will — Max. Credit Shelter Marital Trust to Children is a legal document that combines multiple estate planning strategies to help individuals protect and distribute their assets in the state of Florida. This specialized trust is designed to take full advantage of a deceased person's federal estate tax exemption while ensuring the financial well-being of their spouse and children. Here are some relevant keywords and explanations related to this topic: 1. Florida Complex Will: A legally binding document that outlines an individual's wishes regarding the distribution of their assets after death, specifically tailored to comply with Florida state laws. 2. Max. Credit Shelter Marital Trust: Also known as a bypass trust or an A-B trust, this type of trust is commonly used to maximize estate tax exemptions available to married couples. It shelters assets from estate taxes upon the death of the first spouse, ensuring they pass directly to the next generation while providing income and benefits to the surviving spouse. 3. Children's Trust: Within a Florida Complex Will, a specific children's trust may be established to protect and manage a deceased person's assets for the benefit of their children. This trust can ensure that children receive their inheritance according to prearranged provisions and provide certain safeguards to prevent mismanagement or misuse of assets. 4. Estate Tax Exemption: The maximum amount of assets that can be transferred at death without incurring federal estate tax. By utilizing the max. credit shelter marital trust, individuals can fully utilize their estate tax exemption, reducing or eliminating estate taxes altogether. 5. Generation-Skipping Transfer Tax: A tax on assets transferred to beneficiaries more than one generation below the transferor. Incorporating a Florida Complex Will — Max. Credit Shelter Marital Trust to Children can help minimize or eliminate this tax liability when passing assets directly to grandchildren or subsequent generations. 6. Irrevocable Trust: A trust that, once established, cannot be modified or changed by the granter. This type of trust is commonly used in complex estate planning to provide tax benefits and protect assets against potential creditor claims or legal disputes. 7. Probate: The legal process of validating a will and distributing assets after someone's death. A Florida Complex Will may help minimize the probate process, allowing for a more efficient distribution of assets and potentially reducing administrative costs. Overall, a Florida Complex Will — Max. Credit Shelter Marital Trust to Children provides a comprehensive estate planning solution for individuals wanting to devise an effective strategy to protect their assets, reduce tax burdens, and ensure the financial security of their spouse and children. Consulting with an experienced estate planning attorney is crucial to navigating this complex legal framework and tailoring it to one's unique circumstances.

Marital Trust

Description

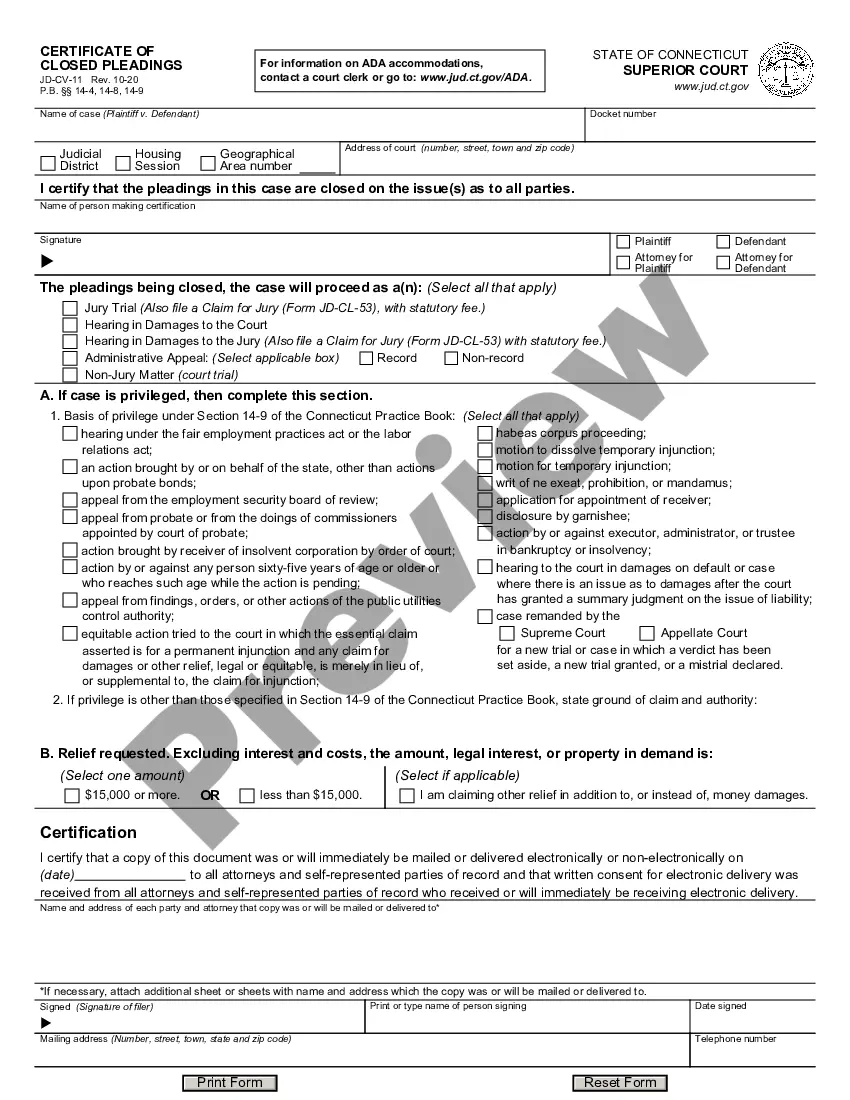

How to fill out Florida Complex Will - Max. Credit Shelter Marital Trust To Children?

Have you been in a place that you need to have papers for both enterprise or specific functions nearly every time? There are tons of legitimate document themes available on the net, but discovering types you can rely on is not effortless. US Legal Forms gives 1000s of form themes, just like the Florida Complex Will - Max. Credit Shelter Marital Trust to Children, which are composed in order to meet federal and state specifications.

If you are presently familiar with US Legal Forms site and have a free account, merely log in. After that, you can download the Florida Complex Will - Max. Credit Shelter Marital Trust to Children template.

Should you not offer an profile and need to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is for the appropriate town/county.

- Utilize the Preview switch to examine the shape.

- Read the description to ensure that you have selected the appropriate form.

- In the event the form is not what you are trying to find, take advantage of the Look for discipline to get the form that fits your needs and specifications.

- If you discover the appropriate form, just click Acquire now.

- Pick the costs prepare you would like, complete the required information and facts to generate your money, and purchase an order with your PayPal or charge card.

- Decide on a hassle-free document format and download your duplicate.

Locate every one of the document themes you might have bought in the My Forms food selection. You can aquire a further duplicate of Florida Complex Will - Max. Credit Shelter Marital Trust to Children any time, if required. Just click on the necessary form to download or printing the document template.

Use US Legal Forms, by far the most extensive variety of legitimate types, in order to save time as well as avoid errors. The assistance gives appropriately created legitimate document themes which can be used for a selection of functions. Produce a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

The primary benefit of CSTs is that the surviving spouse can use the trust's principal and income during the remainder of their lifetime, for example, for medical or educational expenses. The remaining assets then pass to the beneficiaries and are not subject to estate taxes.

Typically, assets you place in trust for your beneficiaries are eligible for a step-up in basis if the trust is revocable, and therefore considered part of your taxable estate. But with an irrevocable trust (which exists outside of your estate), trust assets do not receive a step-up in tax basis.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

The tax basis of the assets in a CST is stepped up only once?at the death of the first spouse?unlike with portability, where the tax basis would be stepped up a second time upon the death of the second spouse.

When the credit shelter trust is initially funded upon the death of one spouse, the assets that are placed under the trust receive a step-up in basis. This is an important consideration, because any assets held in a CST don't receive a second step-up in basis upon the death of the surviving spouse.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.