A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Florida Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

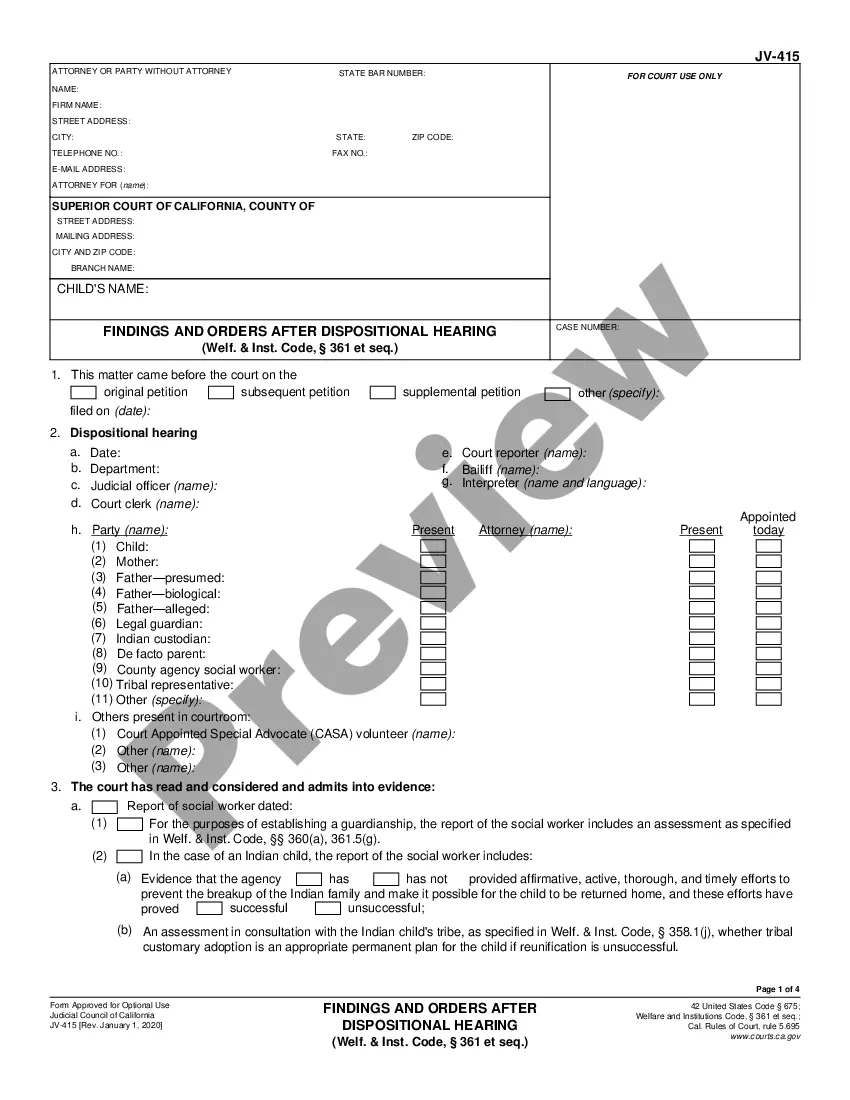

How to fill out Florida Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

Are you presently inside a place that you need files for both business or individual reasons just about every day time? There are a lot of legal papers web templates accessible on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms offers 1000s of develop web templates, like the Florida Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check, that are composed to meet federal and state needs.

Should you be currently acquainted with US Legal Forms web site and have your account, just log in. After that, you can obtain the Florida Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check design.

If you do not have an accounts and need to start using US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for the proper area/area.

- Make use of the Review button to review the shape.

- Look at the explanation to actually have chosen the right develop.

- When the develop is not what you`re seeking, utilize the Research industry to get the develop that meets your requirements and needs.

- Once you discover the proper develop, simply click Get now.

- Pick the pricing prepare you would like, fill out the desired information to make your bank account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a practical document file format and obtain your copy.

Locate each of the papers web templates you might have bought in the My Forms food selection. You may get a additional copy of Florida Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check whenever, if necessary. Just click the needed develop to obtain or print out the papers design.

Use US Legal Forms, the most substantial assortment of legal varieties, in order to save some time and stay away from mistakes. The support offers appropriately created legal papers web templates which you can use for an array of reasons. Make your account on US Legal Forms and commence producing your lifestyle easier.

Form popularity

FAQ

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

According to UCC § 3-113, if a financial instrument, such as a check, is undated, its official date is the date on which it first came into the possession of the person or business listed on it. Since banks follow the UCC, your undated check will be deposited.

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Several banks now offer a service where your paycheck is available one or two days before the regular payday if your employer uses direct deposit. This early direct deposit of your paycheck could help you keep up with bills and avoid late fees, especially on bills due around the time you receive your salary.

Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice. Contact your bank or credit union to learn what its policies are.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.