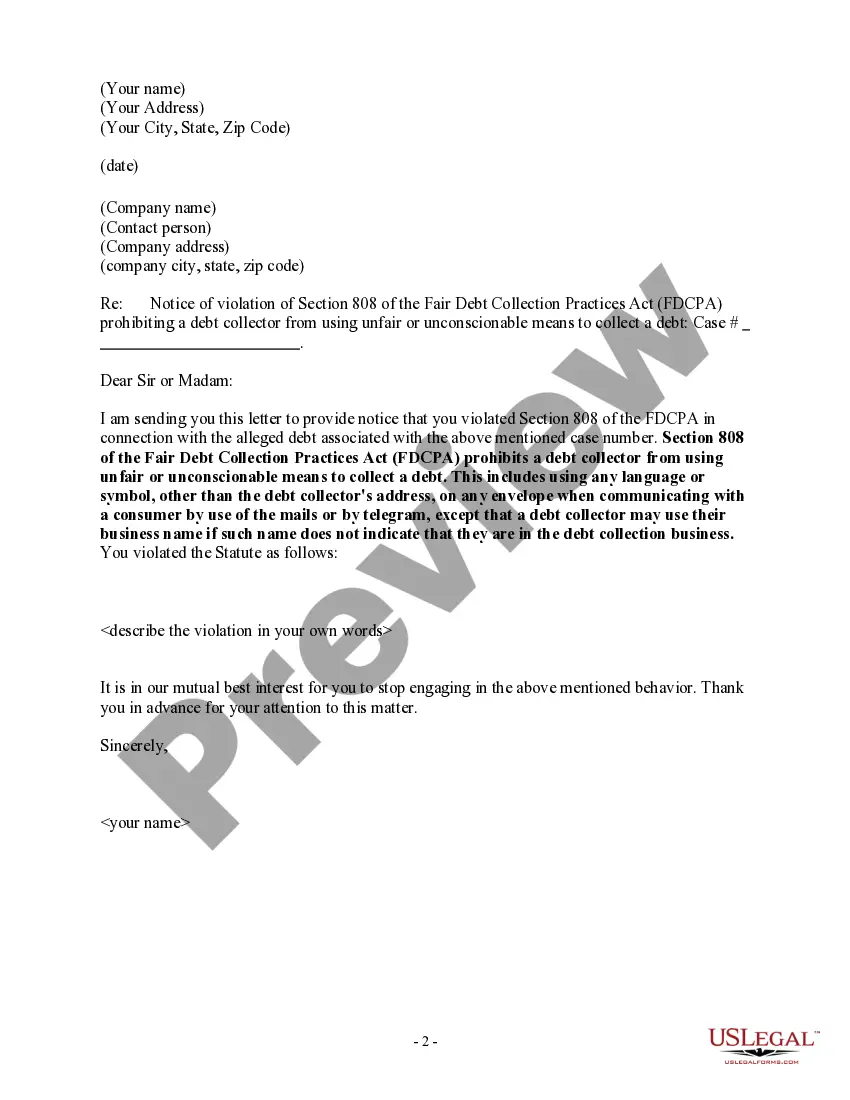

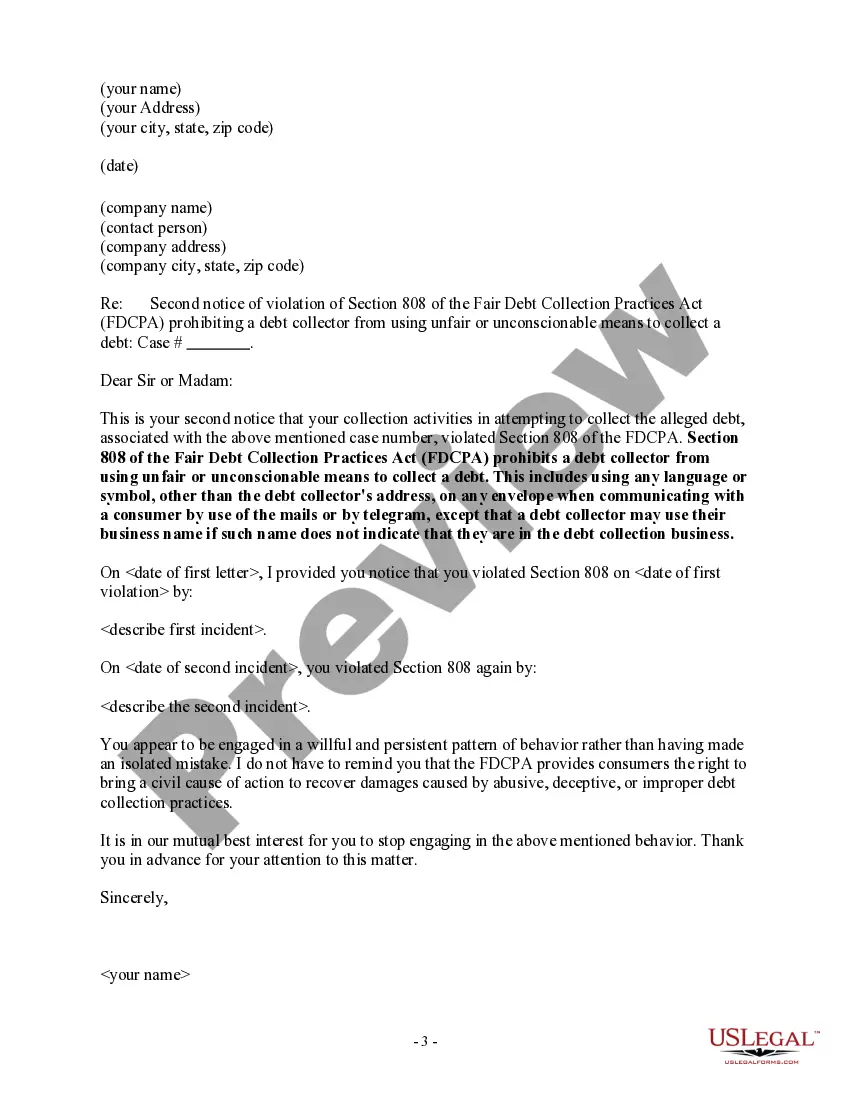

Florida Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal document used in Florida to address instances where a creditor or debt collector has violated the Fair Debt Collection Practices Act (FD CPA) by misrepresenting the appearance of an official legal document related to a debt. This violation is specifically focused on the improper presentation of documents that can mislead or deceive the consumer. Keywords: Florida, Notice of Violation, Fair Debt Collection Practices Act, FD CPA, creditor, debt collector, misrepresentation, appearance, legal document, debt, deceive, consumer. Types of Florida Notice of Violation of Fair Debt Act — Improper Document Appearance: 1. Alleged Forgery: This type of violation occurs when a creditor or debt collector presents a document that appears to be forged or falsely created, giving a misleading impression of authenticity and legality. 2. Misleading Document Formatting: In this case, a creditor or debt collector manipulates the formatting or layout of a document related to the debt, creating confusion and misrepresenting important information. 3. False Legal Terminology: This violation involves the use of misleading or inaccurate legal terminology in an attempt to intimidate or mislead the consumer into believing they are facing legal consequences when none exist. 4. Improper Logos or Letterheads: When a creditor or debt collector uses unauthorized or false logos or letterheads on a document, it can create a false impression of credibility, authority, or affiliation with a governmental agency or law enforcement. 5. Falsified Signatures: This type of violation occurs when a creditor or debt collector presents a document with forged or falsified signatures, deceiving the consumer into believing the document has been properly executed. 6. Altered Dates: Altering or manipulating the dates on a document is another way that a creditor or debt collector may violate the Fair Debt Collection Practices Act, as it can mislead the consumer about the timeline of the debt and potential legal actions. 7. Fake Court Documents: Serious violations involve the presentation of fabricated court documents, falsely suggesting that legal proceedings have been initiated or are imminent, in order to intimidate the consumer into taking action. 8. Improper Document Formatting: This violation involves the intentional manipulation of font, font size, or spacing in a way that makes the document difficult to read or understand, thus misleading the consumer about the debt's validity or obligations. It is important for Florida residents to be aware of their rights under the FD CPA and to promptly address any notice of violation of the Fair Debt Act — Improper Document Appearance. If you believe a creditor or debt collector has breached these regulations, it is advisable to seek legal counsel to protect your interests and ensure you are treated fairly and in accordance with the law.

Florida Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Florida Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - one of the greatest libraries of authorized kinds in the States - delivers an array of authorized record web templates you can obtain or print out. Utilizing the website, you can find a huge number of kinds for business and individual purposes, categorized by groups, states, or keywords.You can find the newest variations of kinds just like the Florida Notice of Violation of Fair Debt Act - Improper Document Appearance within minutes.

If you already have a registration, log in and obtain Florida Notice of Violation of Fair Debt Act - Improper Document Appearance from your US Legal Forms catalogue. The Obtain key can look on each form you look at. You have access to all previously downloaded kinds in the My Forms tab of the bank account.

If you want to use US Legal Forms for the first time, here are simple recommendations to get you started out:

- Ensure you have picked the best form to your city/area. Click on the Review key to analyze the form`s content. Browse the form description to ensure that you have chosen the appropriate form.

- If the form doesn`t suit your needs, make use of the Search field on top of the display screen to obtain the one who does.

- Should you be pleased with the shape, verify your choice by clicking the Get now key. Then, pick the pricing prepare you prefer and supply your accreditations to sign up for the bank account.

- Approach the financial transaction. Make use of your credit card or PayPal bank account to perform the financial transaction.

- Find the file format and obtain the shape on the product.

- Make modifications. Load, edit and print out and sign the downloaded Florida Notice of Violation of Fair Debt Act - Improper Document Appearance.

Every web template you included in your bank account lacks an expiry time and is also the one you have permanently. So, if you want to obtain or print out another backup, just go to the My Forms section and then click in the form you need.

Obtain access to the Florida Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, one of the most extensive catalogue of authorized record web templates. Use a huge number of skilled and express-certain web templates that meet up with your company or individual requires and needs.

Form popularity

FAQ

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

(1) The use or threat of use of violence or other criminal means to harm the physical person, reputation, or property of any person. (2) The use of obscene or profane language or language the natural consequence of which is to abuse the hearer or reader.

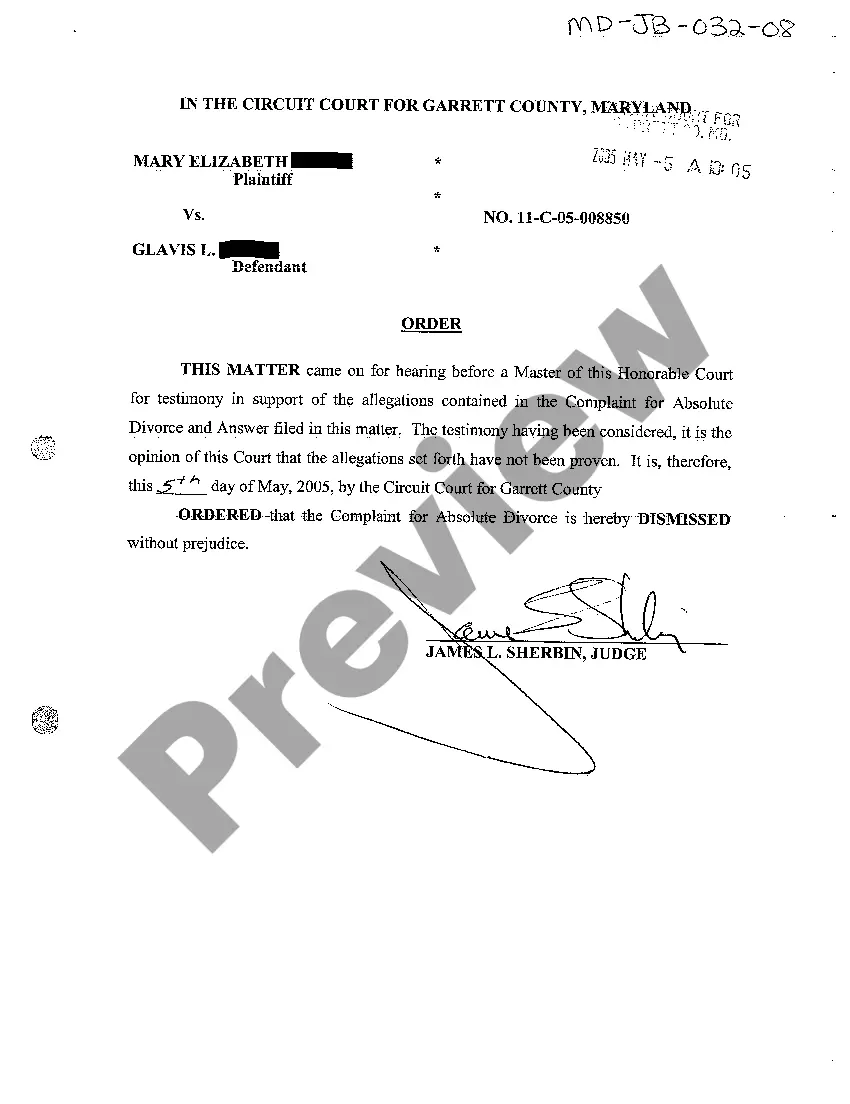

What's the Best Defense Against a Credit Card Lawsuit? Fraud/identity theft. Bankruptcy discharge. Previous debt settlement. Expired statute of limitations. Error by debt purchaser. Credit card company's mistake.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Debt collectors cannot make false or misleading statements. For example, they cannot lie about the debt they are collecting or the fact that they are trying to collect debt, and they cannot use words or symbols that falsely make their letters to you seem like they're from an attorney, court, or government agency.

To respond to the debt collector's lawsuit in Florida, you simply need to file an answer with the county court within 20 days of being served with the summons and deliver a copy of your answer form to the person suing you.

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts. If you don't owe the bill, don't pay anything ? ever.