Florida Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

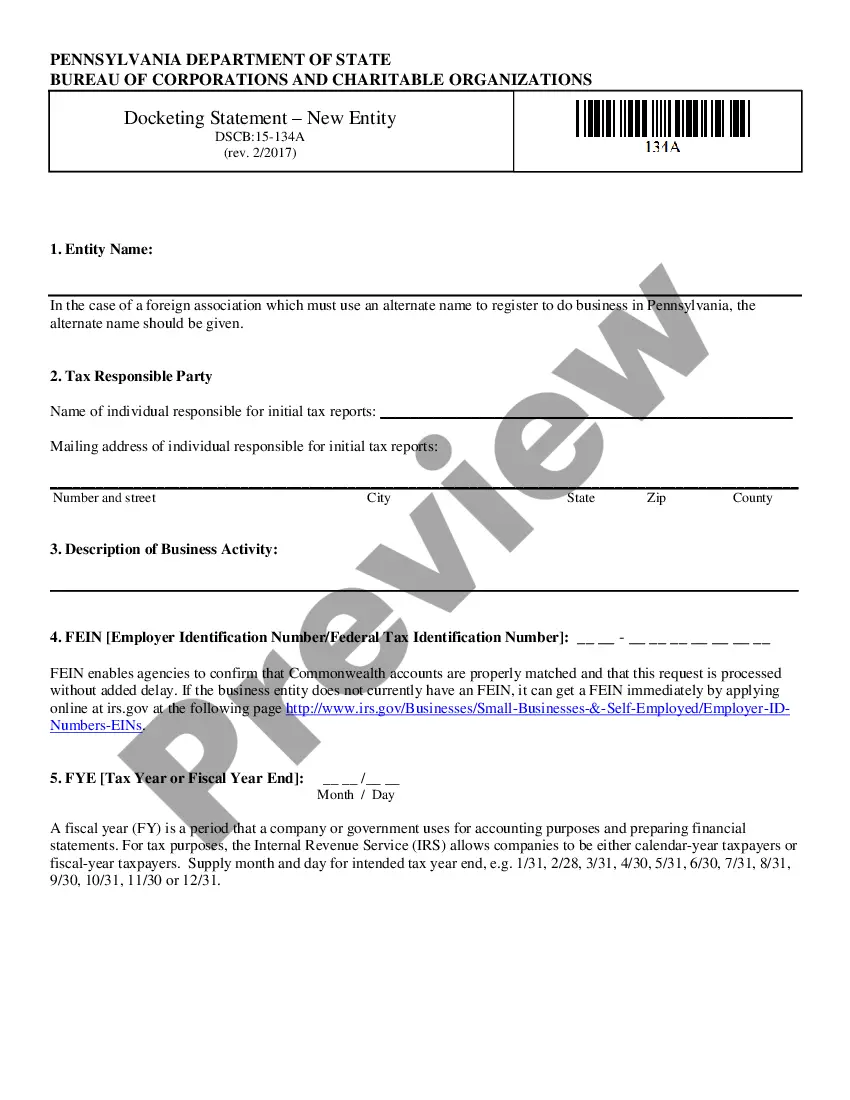

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

US Legal Forms - one of several greatest libraries of legitimate forms in America - gives a wide array of legitimate record web templates you may obtain or print. While using internet site, you can get 1000s of forms for company and person uses, sorted by groups, says, or search phrases.You will find the most recent versions of forms just like the Florida Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. within minutes.

If you have a subscription, log in and obtain Florida Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. from the US Legal Forms library. The Down load button will show up on every single kind you look at. You have access to all previously downloaded forms in the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, allow me to share straightforward directions to get you began:

- Be sure you have picked the best kind for your metropolis/state. Go through the Review button to analyze the form`s articles. Read the kind information to ensure that you have selected the correct kind.

- If the kind does not fit your demands, make use of the Research discipline near the top of the display to get the one who does.

- In case you are satisfied with the shape, affirm your choice by visiting the Get now button. Then, select the costs program you want and provide your references to register for an bank account.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal bank account to perform the financial transaction.

- Pick the structure and obtain the shape on the product.

- Make modifications. Fill out, revise and print and signal the downloaded Florida Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Each design you put into your account does not have an expiry day and is the one you have permanently. So, if you would like obtain or print one more copy, just visit the My Forms portion and then click about the kind you will need.

Get access to the Florida Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. with US Legal Forms, probably the most comprehensive library of legitimate record web templates. Use 1000s of professional and state-certain web templates that fulfill your small business or person requirements and demands.