Florida Master Agreement between Credit Suisse Financial Products and Bank One National Association

Description

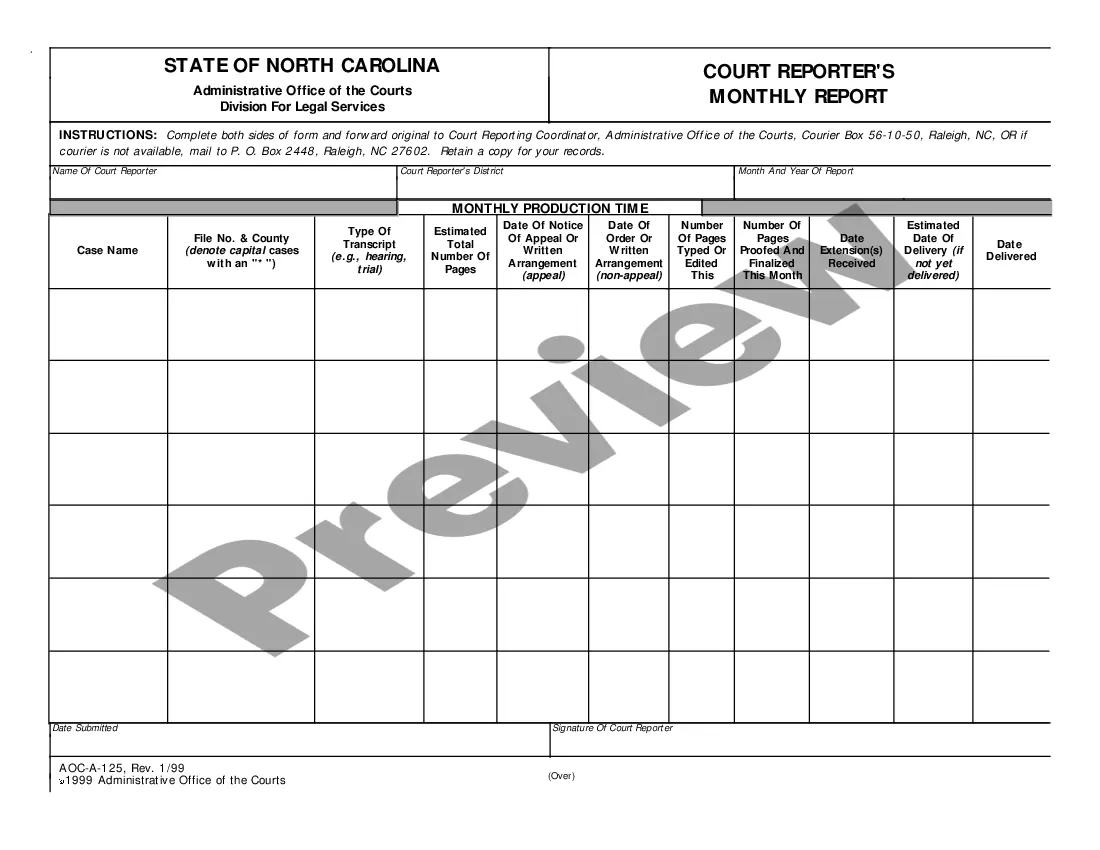

How to fill out Master Agreement Between Credit Suisse Financial Products And Bank One National Association?

US Legal Forms - one of many greatest libraries of legitimate types in the States - delivers a wide range of legitimate file layouts you can download or print out. Utilizing the site, you can get 1000s of types for organization and personal reasons, sorted by classes, suggests, or keywords and phrases.You will discover the latest variations of types just like the Florida Master Agreement between Credit Suisse Financial Products and Bank One National Association in seconds.

If you already have a registration, log in and download Florida Master Agreement between Credit Suisse Financial Products and Bank One National Association in the US Legal Forms library. The Acquire switch will show up on every single develop you see. You get access to all earlier acquired types inside the My Forms tab of the accounts.

If you want to use US Legal Forms initially, here are basic guidelines to get you started out:

- Be sure to have selected the best develop to your city/region. Click on the Review switch to review the form`s content. See the develop description to ensure that you have selected the appropriate develop.

- In case the develop does not match your needs, make use of the Research industry on top of the display to get the one that does.

- Should you be satisfied with the shape, confirm your choice by simply clicking the Purchase now switch. Then, pick the prices prepare you prefer and offer your credentials to register for the accounts.

- Approach the deal. Utilize your Visa or Mastercard or PayPal accounts to complete the deal.

- Select the formatting and download the shape on your own product.

- Make changes. Fill up, edit and print out and indicator the acquired Florida Master Agreement between Credit Suisse Financial Products and Bank One National Association.

Each format you added to your bank account lacks an expiration date and it is the one you have permanently. So, if you want to download or print out yet another duplicate, just visit the My Forms section and click in the develop you need.

Gain access to the Florida Master Agreement between Credit Suisse Financial Products and Bank One National Association with US Legal Forms, probably the most considerable library of legitimate file layouts. Use 1000s of expert and condition-specific layouts that fulfill your business or personal requires and needs.

Form popularity

FAQ

Credit Suisse Group AG (French pronunciation: [k?e. di s?is], lit. 'Swiss Credit') is a global investment bank and financial services firm founded and based in Switzerland.

Credit Suisse Group AG has now been acquired by UBS Group AG, creating a new consolidated banking group. This marks a historic moment for UBS, Credit Suisse and the entire banking industry, and the beginning of a promising future together.

Credit Suisse and UBS: a common future On 31 August 2023, we announced the future direction for Credit Suisse's Swiss business and that we will integrate it into UBS. We believe it is important to present our thoughts on the matter.

The Americas region comprises Credit Suisse's operations in the US, Canada, the Caribbean and Latin America. Our three divisions are strongly represented across the region. With offices in 44 cities spanning 14 countries, we offer our clients local access to our global resources in their home markets.

Following several years of scandals, Switzerland's Credit Suisse bank collapsed in March 2023. It was purchased by Swiss rival UBS for about $3.3 billion in a deal approved by Swiss regulators without shareholder approval.

?As of the opening of trading on June 12, 2023, the Credit Suisse ADSs currently listed on the NYSE are expected to be suspended from trading on the NYSE, will be delisted from the NYSE on the same day and will thereafter be deregistered under the U.S. Exchange Act.

Credit Suisse is fully integrated into UBS. However, the ?Credit Suisse? brand or name will remain for the moment and perhaps in the future.

One Bank Collaboration (OBC) is all about having an established network of colleagues who have the trust in each other to execute and deliver the right solutions to the bank's clients. Through this strategy, Credit Suisse generates creative solutions and enables stronger client relationships.