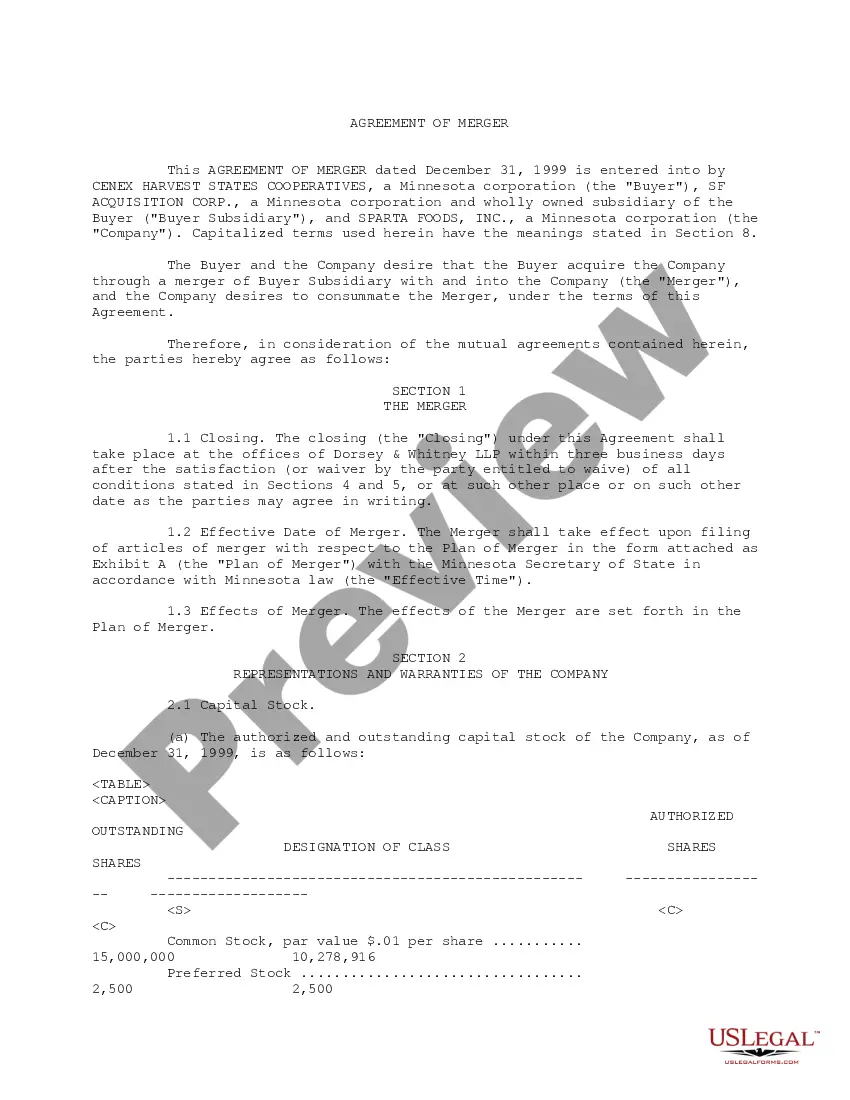

Florida Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.

Description

How to fill out Merger Agreement Between Cenex Harvest States Cooperative, SF Acquisition Corporation And Sparta Foods, Inc.?

Choosing the right authorized document format can be a battle. Needless to say, there are tons of templates available on the net, but how do you obtain the authorized form you require? Use the US Legal Forms site. The assistance provides thousands of templates, such as the Florida Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc., that you can use for business and private needs. Each of the kinds are checked by pros and satisfy state and federal specifications.

When you are currently listed, log in to your profile and then click the Download button to have the Florida Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc.. Make use of your profile to search through the authorized kinds you possess acquired in the past. Check out the My Forms tab of your own profile and have another copy from the document you require.

When you are a brand new consumer of US Legal Forms, allow me to share simple directions that you should adhere to:

- Initial, be sure you have selected the correct form for the area/county. You may look through the shape while using Review button and study the shape explanation to guarantee it is the best for you.

- If the form does not satisfy your preferences, utilize the Seach area to obtain the appropriate form.

- When you are certain the shape would work, go through the Acquire now button to have the form.

- Choose the rates prepare you would like and type in the needed information. Build your profile and pay money for an order utilizing your PayPal profile or credit card.

- Choose the data file structure and acquire the authorized document format to your product.

- Complete, edit and printing and sign the acquired Florida Merger Agreement between Cenex Harvest States Cooperative, SF Acquisition Corporation and Sparta Foods, Inc..

US Legal Forms may be the most significant catalogue of authorized kinds where you can see a variety of document templates. Use the company to acquire professionally-produced documents that adhere to status specifications.

Form popularity

FAQ

An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

An integration clause?sometimes called a merger clause or an entire agreement clause?is a legal provision in Contract Law that states that the terms of a contract are the complete and final agreement between the parties.

Along with the press release, the public target will also file the definitive agreement (usually as an exhibit to the press release 8-K or sometimes as a separate 8-K). In a stock sale, the agreement is often called the merger agreement, while in an asset sale, it's often called an asset purchase agreement.

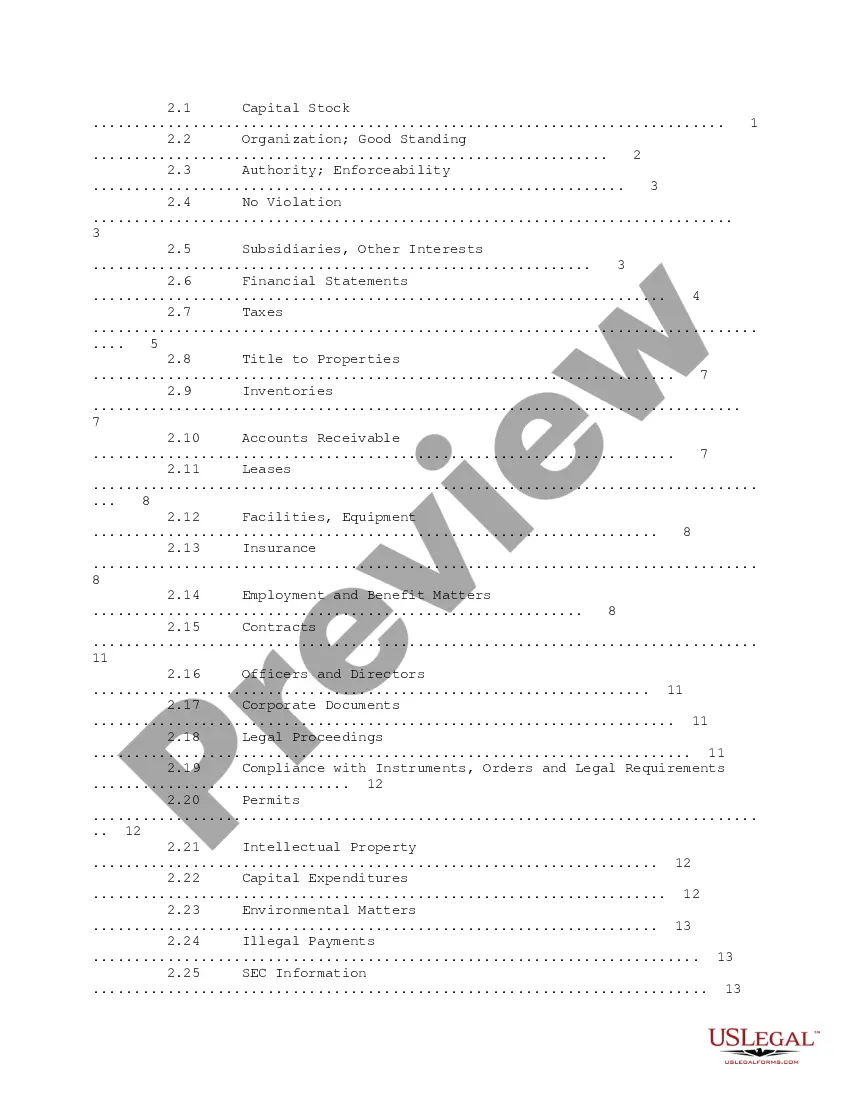

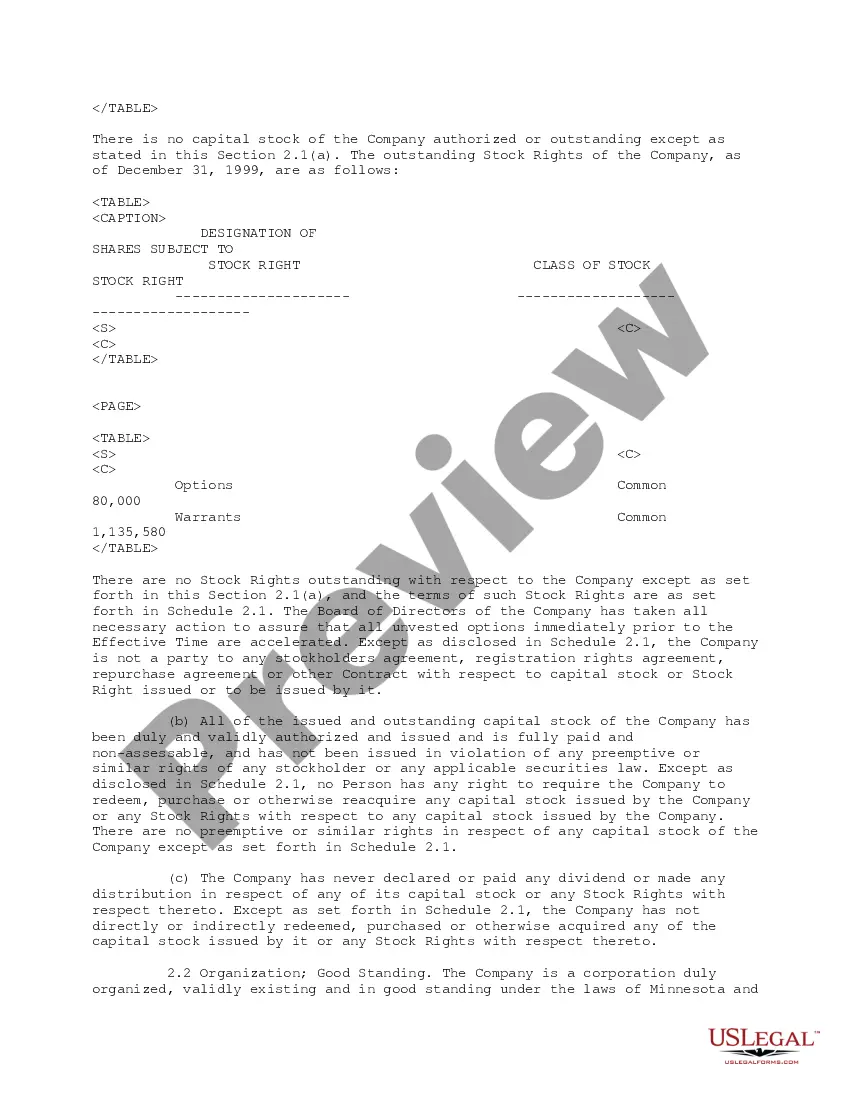

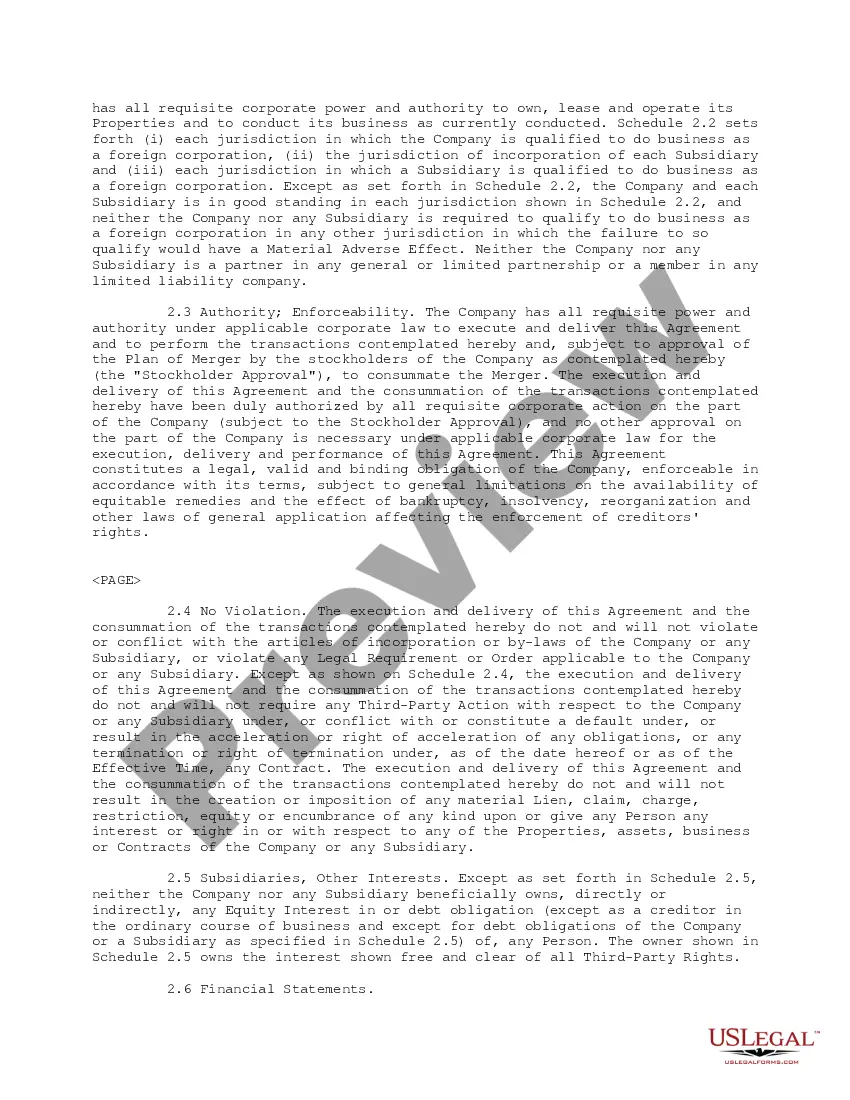

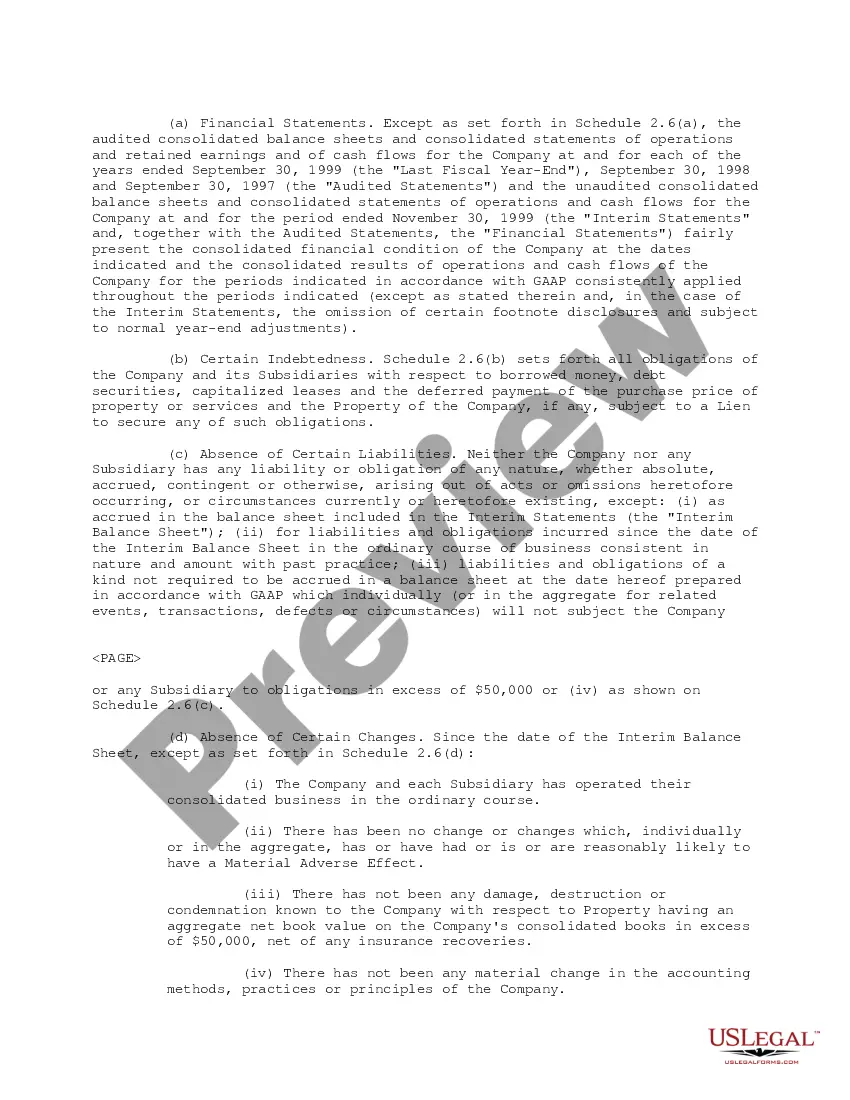

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

Mergers are most commonly done to gain market share, reduce costs of operations, expand to new territories, unite common products, grow revenues, and increase profits?all of which should benefit the firms' shareholders.