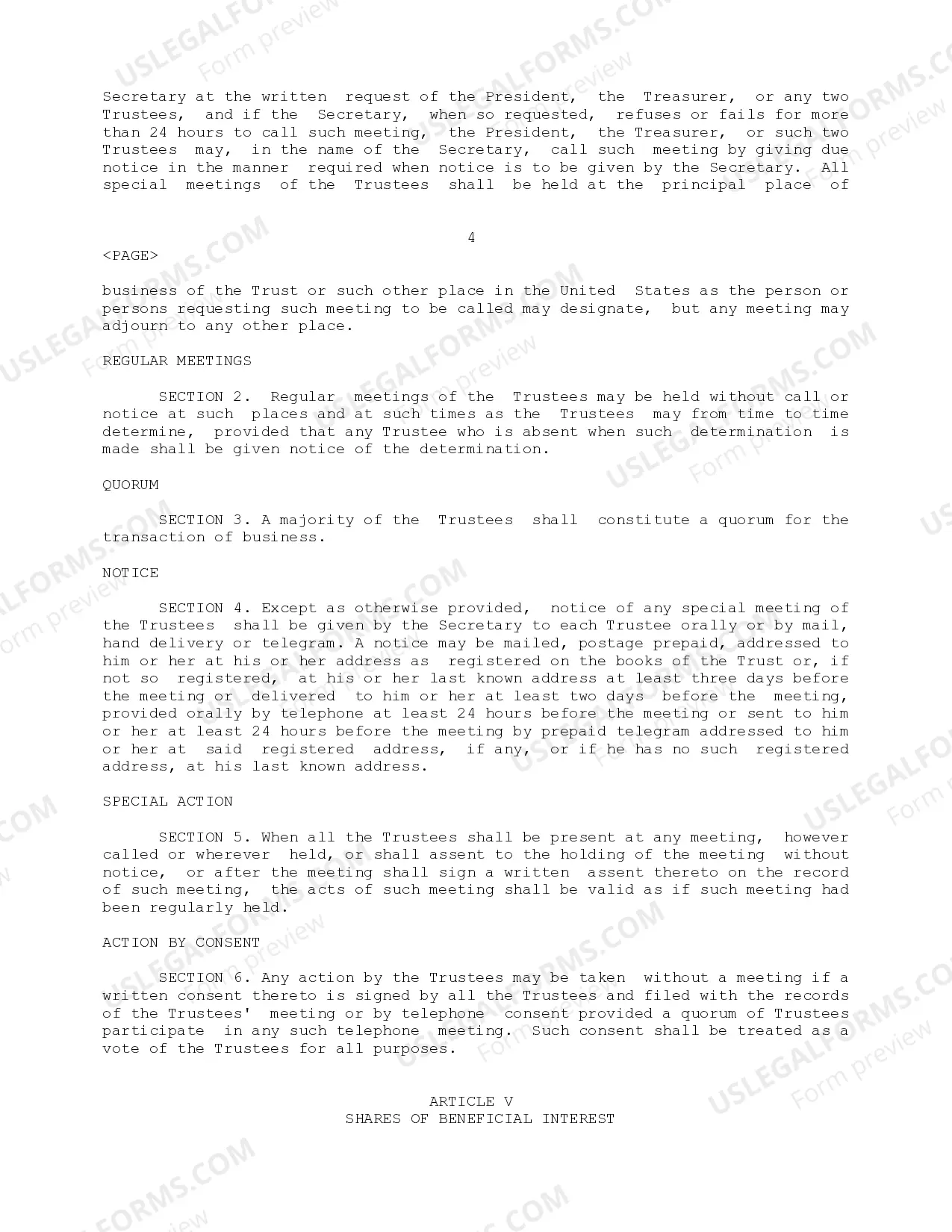

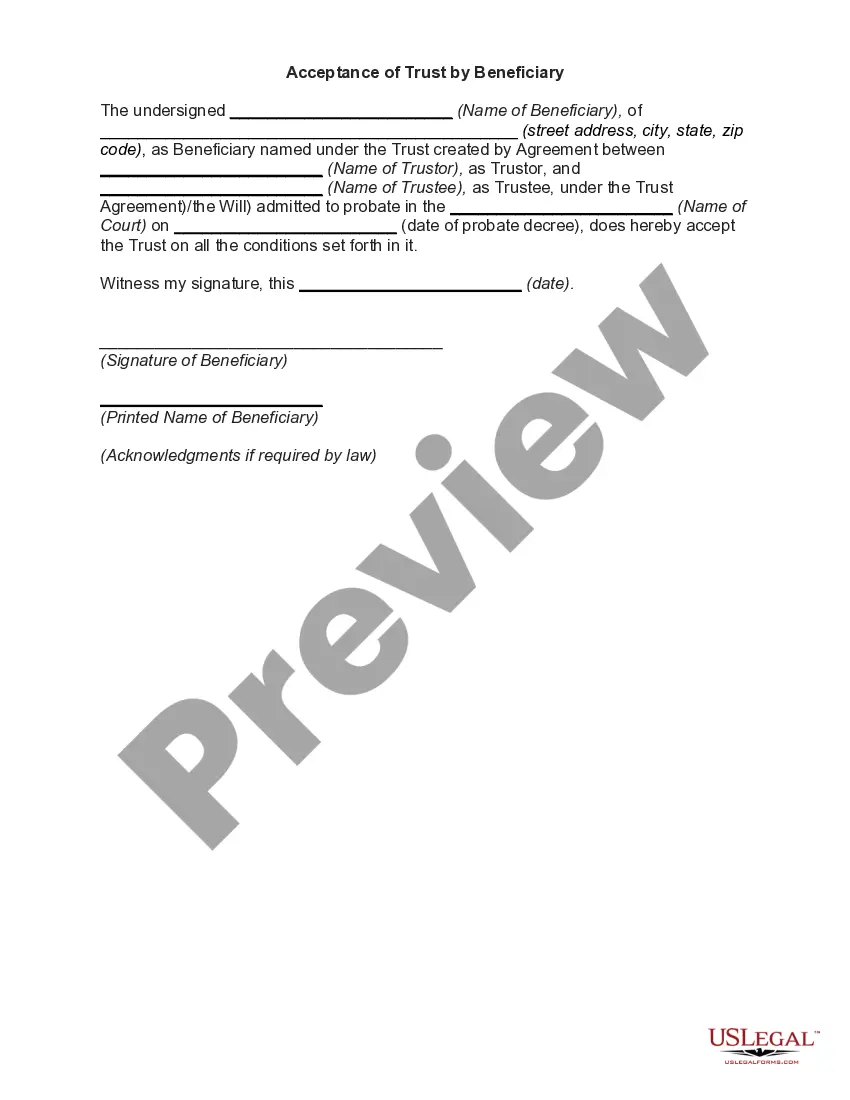

The Florida Bylaws of Potomac Insurance Trust is a crucial document that outline the rules and regulations governing the operation of the trust in the state of Florida. These bylaws serve as a guide for trustees and beneficiaries, ensuring transparency, accountability, and compliance with legal requirements. Key keywords: Florida Bylaws, Potomac Insurance Trust, rules and regulations, operation, trust, trustees, beneficiaries, transparency, accountability, legal requirements. The Florida Bylaws of Potomac Insurance Trust consist of comprehensive guidelines that cover various aspects of the trust's functioning. They define the powers and responsibilities of the trustees, establish rules for the distribution of assets, and outline the procedures for making investment decisions. These bylaws also highlight the rights and obligations of the beneficiaries, including the process for receiving payments, accessing information about the trust, and seeking remedies in case of disputes or breaches of fiduciary duty. One type of Florida Bylaws of Potomac Insurance Trust is the Trustee Appointment and Removal Bylaws. These bylaws outline the process for appointing and removing trustees, ensuring that only qualified individuals are entrusted with managing the affairs of the trust. Another type is the Distribution Bylaws, which provide detailed instructions on how assets are to be distributed among the beneficiaries. These bylaws aim to ensure a fair and efficient distribution process, taking into account any specific conditions or restrictions outlined in the trust agreement. Furthermore, the Florida Bylaws of Potomac Insurance Trust may include Investment Policy Bylaws, which detail the guidelines and limitations for investing the trust's assets. These bylaws are designed to protect the interests of the beneficiaries, promoting sound investment practices and minimizing risk. To guarantee transparency, the bylaws may incorporate Reporting and Disclosure Bylaws. These bylaws clarify the frequency and content of the reports that trustees must provide to beneficiaries, ensuring they are well-informed about the trust's financial activities and overall performance. Additionally, Conflict of Interest Bylaws may be included to regulate situations where trustees may have personal interests that conflict with their fiduciary duties. These bylaws establish procedures for disclosing potential conflicts and ensure that trustees make decisions solely in the best interests of the trust and its beneficiaries. In summary, the Florida Bylaws of Potomac Insurance Trust is a set of rules and regulations that govern the operations, responsibilities, and rights of trustees and beneficiaries within the trust. They provide a framework for transparent and accountable management, ensuring compliance with legal requirements and safeguarding the interests of all parties involved.

Florida Bylaws of Potomac Insurance Trust

Description

How to fill out Florida Bylaws Of Potomac Insurance Trust?

If you wish to full, down load, or print authorized file themes, use US Legal Forms, the biggest variety of authorized varieties, that can be found on-line. Make use of the site`s simple and handy research to discover the files you will need. A variety of themes for business and specific purposes are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Florida Bylaws of Potomac Insurance Trust within a handful of click throughs.

In case you are already a US Legal Forms client, log in to the profile and then click the Obtain switch to find the Florida Bylaws of Potomac Insurance Trust. You can even gain access to varieties you in the past saved from the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form for that right metropolis/nation.

- Step 2. Make use of the Preview solution to check out the form`s content material. Don`t neglect to read the outline.

- Step 3. In case you are unsatisfied with the type, use the Lookup area on top of the display screen to locate other types in the authorized type design.

- Step 4. After you have located the form you will need, click on the Get now switch. Select the pricing prepare you prefer and include your qualifications to register on an profile.

- Step 5. Method the purchase. You may use your bank card or PayPal profile to complete the purchase.

- Step 6. Find the file format in the authorized type and down load it on your product.

- Step 7. Full, revise and print or signal the Florida Bylaws of Potomac Insurance Trust.

Each authorized file design you purchase is your own property for a long time. You have acces to every single type you saved with your acccount. Go through the My Forms area and choose a type to print or down load again.

Contend and down load, and print the Florida Bylaws of Potomac Insurance Trust with US Legal Forms. There are millions of skilled and express-particular varieties you may use for your personal business or specific requires.