Florida Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

It is possible to commit hours on-line looking for the legal document design that meets the state and federal demands you will need. US Legal Forms supplies 1000s of legal forms which are reviewed by experts. It is possible to down load or printing the Florida Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company from your services.

If you currently have a US Legal Forms bank account, you may log in and click the Down load button. Next, you may total, edit, printing, or sign the Florida Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company. Each legal document design you buy is yours for a long time. To obtain an additional copy associated with a obtained form, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms web site initially, adhere to the basic guidelines below:

- First, make certain you have chosen the correct document design to the county/town of your choosing. Read the form explanation to make sure you have selected the right form. If available, use the Preview button to search through the document design also.

- If you want to get an additional version from the form, use the Lookup area to obtain the design that meets your needs and demands.

- Once you have located the design you would like, click Purchase now to carry on.

- Pick the pricing prepare you would like, type your qualifications, and register for an account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal bank account to purchase the legal form.

- Pick the format from the document and down load it in your product.

- Make adjustments in your document if needed. It is possible to total, edit and sign and printing Florida Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Down load and printing 1000s of document web templates while using US Legal Forms site, that offers the most important assortment of legal forms. Use professional and status-certain web templates to deal with your organization or specific demands.

Form popularity

FAQ

To put simply, the deed is the legal document that proves who holds title to a property, while a mortgage is an agreement between a financial lender and borrower to repay the amount borrowed to purchase a home.

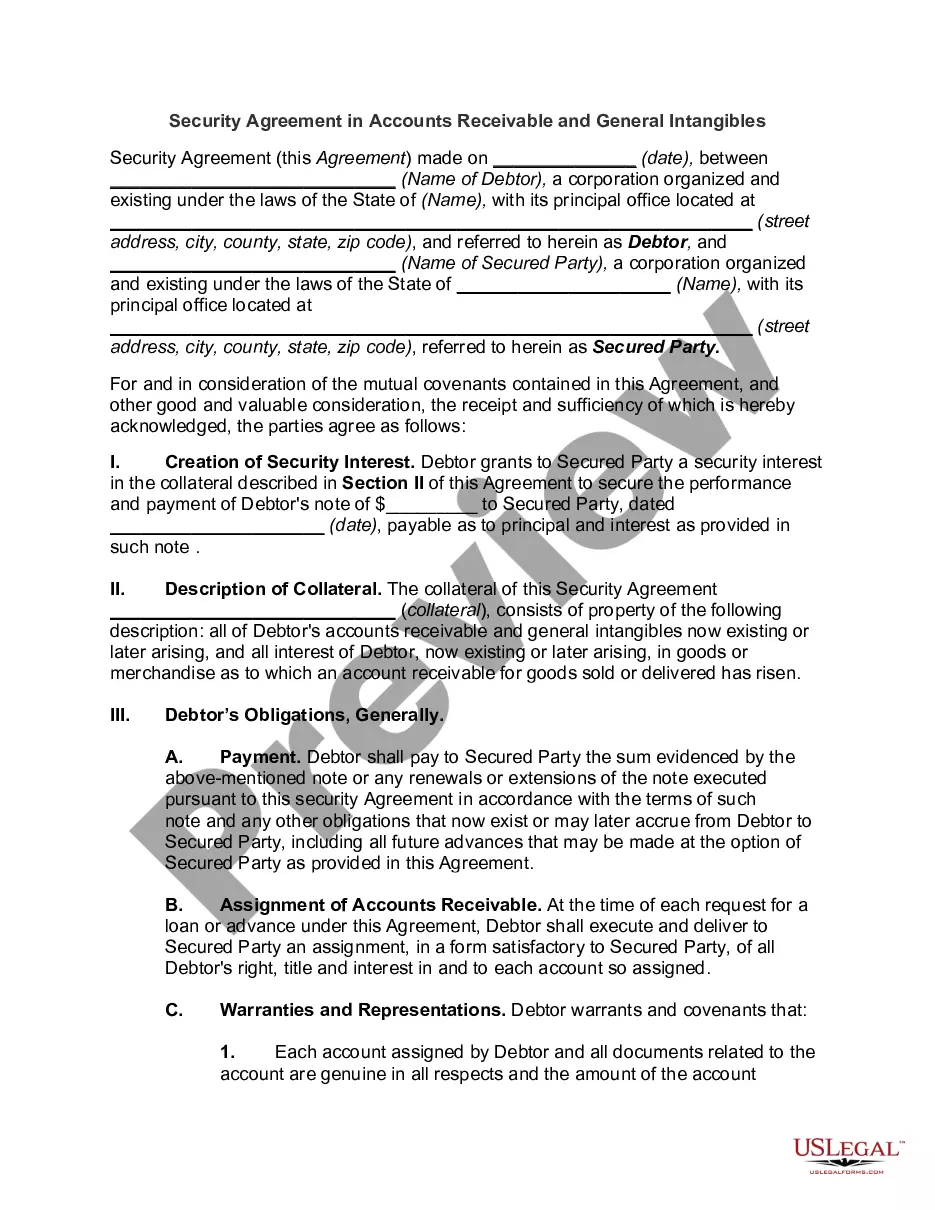

A Pooling and Servicing Agreement (PSA) is a legal document that contains all of the rights and responsibilities of a servicer, a trustee, and any others presiding over a pool of mortgage loans.

A loan servicing agreement is a legal agreement between a lender and a third party, the servicer, that outlines the terms and conditions for which that third party will provide loan servicing services.

While "mortgage-backed security" is a broad term describing asset-backed securities, a collateralized mortgage obligation is a more specific class of mortgage-backed security. A CMO is one type of MBS that is divided into categories based on risk and maturity dates.

A mortgage pool is a form of alternative investment that provides mortgages to those who may not be approved through usual methods. Essentially, a group of investors pool their money together and invest in projects that range from commercial to residential property.

Mortgage securitization is the process of bundling many mortgages into a pool, and then selling shares of that pool as bonds.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

What is the advantage of a deed of trust over a mortgage? A deed of trust has a crucial advantage over a mortgage from the lender's point of view. If the borrower defaults on the loan, then the trustee has the power to foreclose on the property on behalf of the beneficiary.

Once a lender completes a mortgage transaction, it usually sells the mortgage to another entity, such as Fannie Mae or Freddie Mac. Those entities then package the mortgages together into a mortgage pool and the mortgage pool then acts as collateral for a mortgage-backed security. 1.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.