Florida Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock

Description

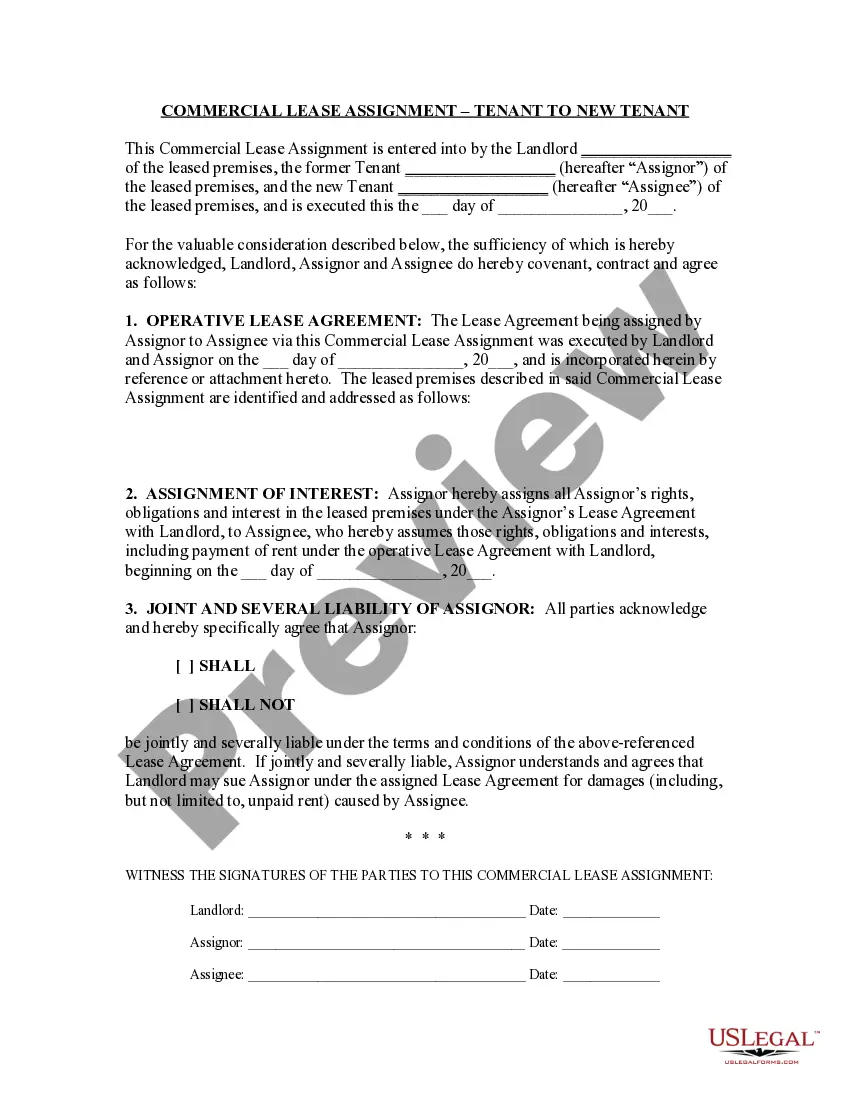

How to fill out Subscription Agreement - 6% Series G Convertible Preferred Stock - Between ObjectSoft Corp. And Investors Regarding Issuance And Sale Of Preferred Stock?

Have you been in a place where you require documents for both business or person reasons almost every working day? There are tons of legal file themes available online, but finding types you can rely isn`t effortless. US Legal Forms offers 1000s of kind themes, such as the Florida Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock, which can be composed to satisfy federal and state requirements.

Should you be currently informed about US Legal Forms website and possess a free account, just log in. Following that, it is possible to obtain the Florida Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock template.

Unless you provide an account and need to start using US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is for your right metropolis/region.

- Make use of the Preview key to review the form.

- Look at the explanation to ensure that you have selected the appropriate kind.

- If the kind isn`t what you are looking for, utilize the Lookup field to find the kind that meets your needs and requirements.

- Whenever you obtain the right kind, just click Get now.

- Opt for the pricing program you want, complete the specified information and facts to produce your account, and purchase an order making use of your PayPal or charge card.

- Choose a convenient document structure and obtain your copy.

Locate all the file themes you may have purchased in the My Forms food list. You can aquire a more copy of Florida Subscription Agreement - 6% Series G Convertible Preferred Stock - between ObjectSoft Corp. and Investors regarding issuance and sale of preferred stock anytime, if required. Just select the essential kind to obtain or print out the file template.

Use US Legal Forms, by far the most extensive selection of legal varieties, in order to save some time and steer clear of faults. The support offers professionally manufactured legal file themes which can be used for a variety of reasons. Generate a free account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Some disadvantages of convertible preferred stocks are that they are riskier and become less profitable when transformed into common stock. In addition, an issuer's control of the company diminishes upon the transformation to common stock since they have voting rights.

If the holders of that series of preferred stock (such as Series A preferred stockholders) vote for it, all of the outstanding preferred stock of that series (Series A) will convert to common stock. The voting threshold for this can be a majority or some super-majority, such as a 2/3 vote.

Some disadvantages of convertible preferred stocks are that they are riskier and become less profitable when transformed into common stock. In addition, an issuer's control of the company diminishes upon the transformation to common stock since they have voting rights.

What Are Convertible Preferred Shares? These shares are corporate fixed-income securities that the investor can choose to turn into a certain number of shares of the company's common stock after a predetermined time span or on a specific date.

The main disadvantage of owning preference shares is that the investors in these vehicles don't enjoy the same voting rights as common shareholders. 1 This means that the company is not beholden to preferred shareholders the way it is to traditional equity shareholders.

Risk and Returns There is a slightly higher risk that a company may default on preferred stocks, especially if the company has poor credit. Also, the price of preferred stock may drop when interest rates rise. On the other hand, the price may rise when interest rates fall.

Conversion price can be calculated by dividing the convertible preferred stock's par value by the stipulated conversion ratio. Conversion premium: The dollar amount by which the market price of the convertible preferred stock exceeds the current market value of the common shares into which it may be converted.

Convertible preferred stock offers the investor the benefits of both preferred stock and common stock. Investors get the stability, liquidation priority, and higher dividends of preferred stock, but they also have the option to convert their shares into common stock later if they believe that the price will go up.