Florida Lease Agreement is a legally binding contract that outlines the terms and conditions for the lease of an office building between Ryan South bank II, LLC and Mind spring Enterprises, Inc. This agreement establishes the rights and obligations of both parties and ensures a smooth and mutually beneficial leasing process. The agreement typically includes key details such as the duration of the lease, rental payment terms, maintenance responsibilities, and any additional provisions agreed upon by both parties. In Florida, there are various types of lease agreements that can be tailored to suit specific requirements. Some common types of lease agreements applicable to the lease of an office building include: 1. Gross Lease: This type of lease agreement specifies a fixed rental amount for the entire duration of the lease, with the landlord responsible for all operating expenses, including maintenance, insurance, and property taxes. 2. Net Lease: A net lease agreement requires the tenant to pay a base rent amount along with a proportionate share of operating expenses. These expenses may include property taxes, insurance, and maintenance costs. There are three subcategories of net lease agreements: a. Single Net Lease: Tenant pays base rent plus a portion of property taxes. b. Double Net Lease: Tenant pays base rent plus a portion of property taxes and insurance costs. c. Triple Net Lease: Tenant pays base rent plus a portion of property taxes, insurance costs, and maintenance expenses. 3. Modified Gross Lease: In this type of lease agreement, the landlord covers some operating expenses, like maintenance and insurance, while the tenant is responsible for others, such as utilities. 4. Percentage Lease: A percentage lease is commonly used for retail spaces within an office building. The tenant pays a base rent plus a percentage of their business's sales revenue. 5. Sublease Agreement: This type of agreement allows a tenant (in this case, Mind spring Enterprises, Inc.) to lease a portion of or the entire office building to another party. Ryan South bank II, LLC must grant permission for such sublease arrangements. It is important for both parties involved to thoroughly review and understand the terms and conditions of the lease agreement before signing. Seeking legal advice is also recommended ensuring compliance with Florida's laws and regulations.

Florida Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc.

Description

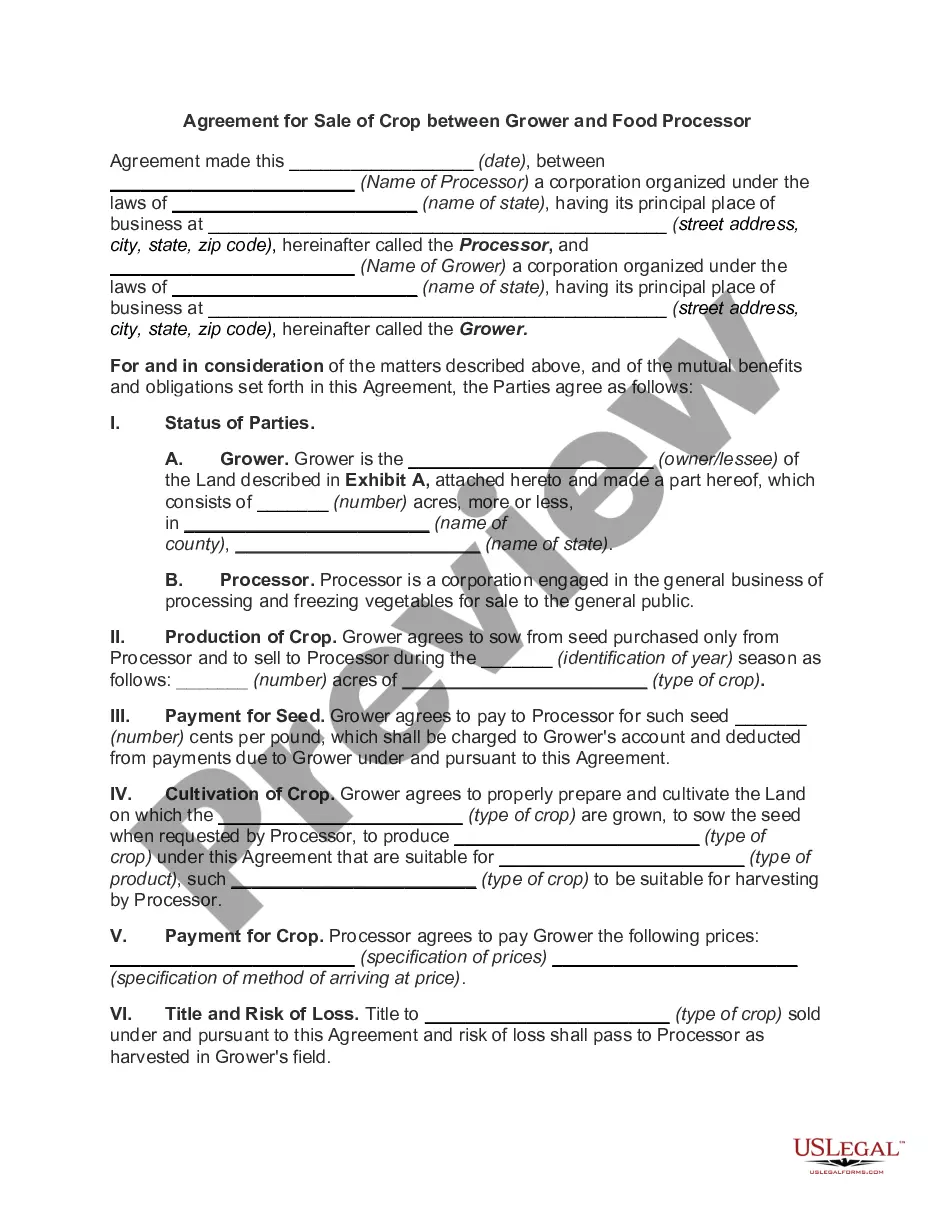

How to fill out Florida Lease Agreement Regarding Lease Of Office Building Between Ryan Southbank II, LLC And Mindspring Enterprises, Inc.?

If you wish to full, acquire, or print lawful record templates, use US Legal Forms, the most important selection of lawful forms, which can be found on the Internet. Take advantage of the site`s simple and hassle-free lookup to get the paperwork you require. Numerous templates for business and individual purposes are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to get the Florida Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. in a handful of clicks.

Should you be already a US Legal Forms consumer, log in to your bank account and click the Obtain key to have the Florida Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc.. You can also entry forms you formerly saved within the My Forms tab of the bank account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that correct area/country.

- Step 2. Take advantage of the Preview method to look over the form`s content material. Do not neglect to read the explanation.

- Step 3. Should you be not satisfied with the develop, take advantage of the Lookup industry at the top of the monitor to discover other versions of the lawful develop format.

- Step 4. Once you have identified the shape you require, click on the Get now key. Select the costs prepare you choose and put your credentials to sign up for an bank account.

- Step 5. Procedure the deal. You should use your credit card or PayPal bank account to complete the deal.

- Step 6. Pick the file format of the lawful develop and acquire it in your product.

- Step 7. Total, edit and print or indication the Florida Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc..

Every lawful record format you purchase is the one you have permanently. You possess acces to every develop you saved within your acccount. Click on the My Forms portion and choose a develop to print or acquire again.

Be competitive and acquire, and print the Florida Lease Agreement regarding lease of office building between Ryan Southbank II, LLC and Mindspring Enterprises, Inc. with US Legal Forms. There are millions of skilled and condition-particular forms you can utilize for the business or individual needs.