Florida Plan of Merger is a legal agreement that outlines the terms and conditions for the merger between Cowling Ban corporation, Cowling Bank, and Northern Bank of Commerce in the state of Florida. This plan is a crucial document that details the specific steps and procedures involved in merging the entities, ensuring a smooth transition and consolidation of resources. The Florida Plan of Merger aims to combine the strengths and resources of each entity involved to create a more robust and competitive financial institution. It outlines the terms of the merger, including the exchange ratio of shares, the composition of the board of directors, and the allocation of assets and liabilities. The plan typically includes provisions for the integration of the banks' staff, operational systems, and customer accounts. It also addresses any regulatory requirements and applicable laws governing mergers in the state of Florida. There may be different types of Florida Plans of Merger, each with its own specific provisions and considerations. Some possible variations include: 1. Restructuring Merger: This type of merger involves a complete reorganization of the entities involved, resulting in a new corporate structure and possibly a new name for the merged entity. 2. Consolidation Merger: In this type of merger, two or more entities combine to form a new entity, pooling their assets, liabilities, and operations. 3. Subsidiary Merger: A subsidiary merger occurs when a parent company merges with one of its subsidiaries, absorbing its operations and assets. 4. Reverse Merger: In a reverse merger scenario, a smaller entity acquires a larger entity, allowing the smaller company to gain a public listing. 5. Conglomerate Merger: This type of merger involves entities from unrelated industries or sectors merging to diversify their operations and enhance their competitive advantage. The Florida Plan of Merger serves as a blueprint for the merger process, ensuring legal compliance, protecting the interests of shareholders, and outlining the strategic objectives for the merged entity. It is a vital document that requires careful consideration, negotiation, and approval by the boards of directors, shareholders, and regulatory authorities.

Florida Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce

Description

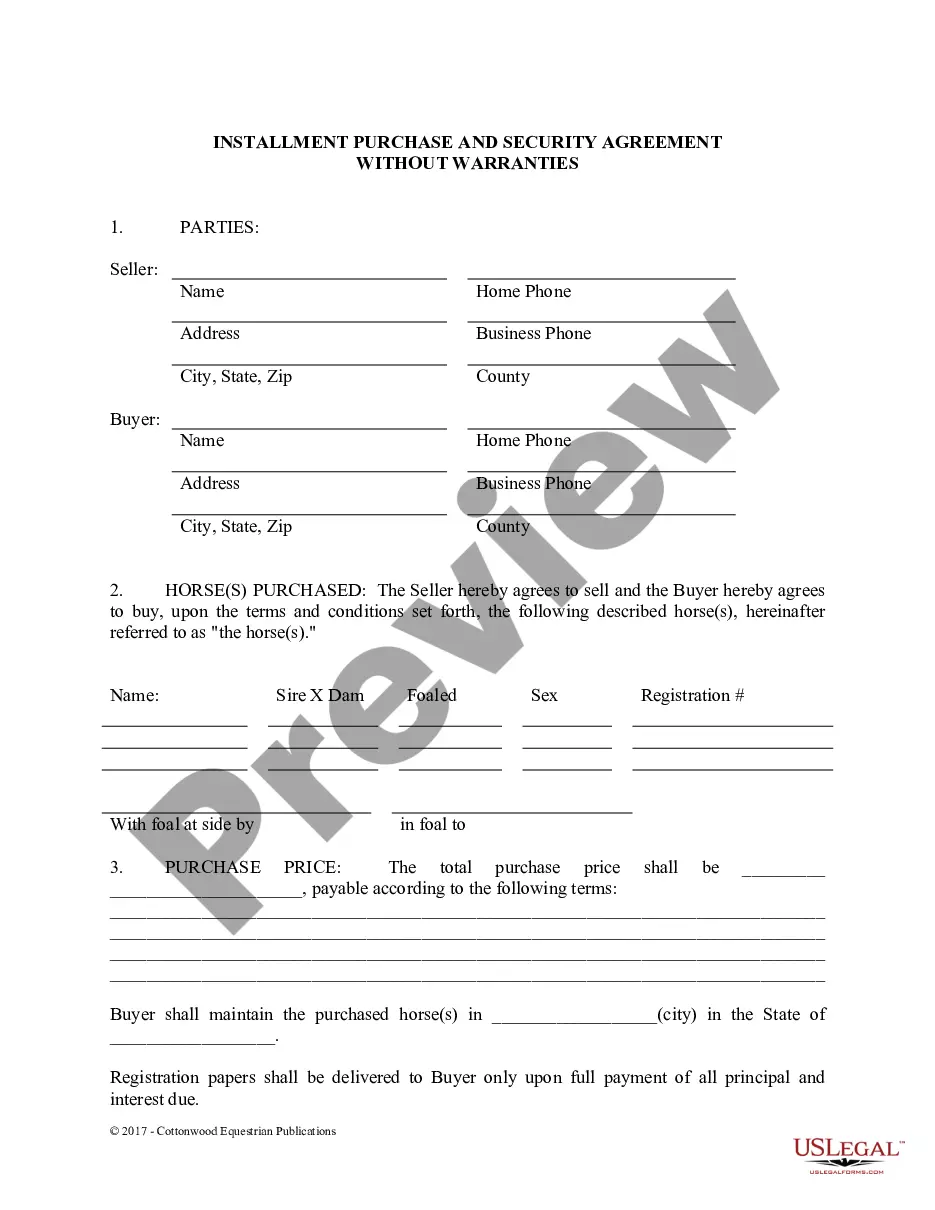

How to fill out Plan Of Merger Between Cowlitz Bancorporation, Cowlitz Bank And Northern Bank Of Commerce?

If you have to comprehensive, obtain, or print out authorized record themes, use US Legal Forms, the largest selection of authorized varieties, which can be found on the Internet. Utilize the site`s basic and hassle-free look for to find the paperwork you want. Various themes for company and specific purposes are sorted by categories and states, or keywords and phrases. Use US Legal Forms to find the Florida Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce within a few clicks.

If you are already a US Legal Forms client, log in in your accounts and then click the Download button to have the Florida Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce. Also you can access varieties you earlier delivered electronically within the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape to the appropriate town/nation.

- Step 2. Use the Preview solution to look over the form`s information. Don`t neglect to read through the information.

- Step 3. If you are unhappy with all the form, take advantage of the Lookup field at the top of the monitor to locate other types of your authorized form design.

- Step 4. After you have found the shape you want, click the Get now button. Pick the costs strategy you favor and add your references to register for the accounts.

- Step 5. Approach the deal. You may use your Мisa or Ьastercard or PayPal accounts to accomplish the deal.

- Step 6. Find the structure of your authorized form and obtain it on your gadget.

- Step 7. Comprehensive, revise and print out or signal the Florida Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce.

Every single authorized record design you buy is your own property eternally. You have acces to every form you delivered electronically in your acccount. Click the My Forms portion and decide on a form to print out or obtain again.

Be competitive and obtain, and print out the Florida Plan of Merger between Cowlitz Bancorporation, Cowlitz Bank and Northern Bank of Commerce with US Legal Forms. There are thousands of specialist and express-particular varieties you may use for your company or specific demands.