Title: Florida Stock Transfer Agreement: A Comprehensive Overview Introduction: The Florida Stock Transfer Agreement plays a critical role in facilitating the transfer of shares between EMC Corp., Eagle Merger Corp., and their respective shareholders. This legally binding contract outlines the terms and conditions under which the shares are to be transferred, ensuring a smooth transition of ownership. In this article, we delve into the details of this agreement, exploring its various types and highlighting the key elements to provide a comprehensive understanding. Key Elements of Florida Stock Transfer Agreement: 1. Parties Involved: The agreement primarily involves three parties: EMC Corp., Eagle Merger Corp., and the shareholders. EMC Corp. represents the selling company, Eagle Merger Corp. serves as the acquiring entity, and the shareholders are individuals or entities holding shares in EMC Corp. 2. Transfer Terms: The agreement outlines the terms and conditions governing the transfer of shares. It determines the number and type of shares to be transferred, the price per share, the payment method, and any additional considerations agreed upon by all parties. 3. Representations and Warranties: The agreement contains representations and warranties provided by both parties to ensure the validity and legality of the transfer. These may include confirming ownership of shares, absence of liens or encumbrances, compliance with legal requirements, and the accuracy of provided information. 4. Closing Conditions: The agreement specifies the conditions that must be met for the transfer to be considered complete. It may include shareholder approval, regulatory compliance, the absence of disputes, and the fulfillment of any necessary documentation or registrations. 5. Confidentiality and Non-Disclosure: In some cases, Florida Stock Transfer Agreements may include clauses emphasizing confidentiality and non-disclosure obligations. This ensures that sensitive business information shared during the negotiation and execution of the agreement remains confidential. Types of Florida Stock Transfer Agreement: 1. Stock Purchase Agreement: This agreement typically involves the sale of shares between EMC Corp. and Eagle Merger Corp., wherein Eagle Merger Corp. acquires a significant portion or entirety of EMC Corp.'s shares. 2. Stock Subscription Agreement: This agreement allows shareholders, often new investors or employees, to subscribe to newly issued shares by EMC Corp. or Eagle Merger Corp. It defines the terms of subscribing to additional shares and may outline specific conditions associated with this process. 3. Stock Assignment Agreement: This agreement enables shareholders to assign their shares to another party, who may or may not be Eagle Merger Corp. In this scenario, ownership rights are transferred without directly involving EMC Corp. Conclusion: The Florida Stock Transfer Agreement is a pivotal legal document that governs the transfer of shares between EMC Corp., Eagle Merger Corp., and their respective shareholders. Understanding its key elements, including transfer terms, representations and warranties, closing conditions, and confidentiality, ensures a transparent and secure stock transfer process. Additionally, acknowledging the different types of agreements, such as Stock Purchase, Stock Subscription, and Stock Assignment Agreements, highlights the versatility and applicability of this legal framework.

Florida Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders

Description

How to fill out Florida Stock Transfer Agreement Between EMC Corp., Eagle Merger Corp., And Shareholders?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - gives a wide range of legitimate file templates you are able to obtain or print out. Making use of the website, you can get 1000s of forms for organization and person functions, sorted by types, claims, or search phrases.You can get the most recent models of forms just like the Florida Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders within minutes.

If you already have a subscription, log in and obtain Florida Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders from your US Legal Forms library. The Acquire option will appear on every kind you see. You get access to all previously delivered electronically forms from the My Forms tab of your respective profile.

If you wish to use US Legal Forms for the first time, here are basic directions to help you started out:

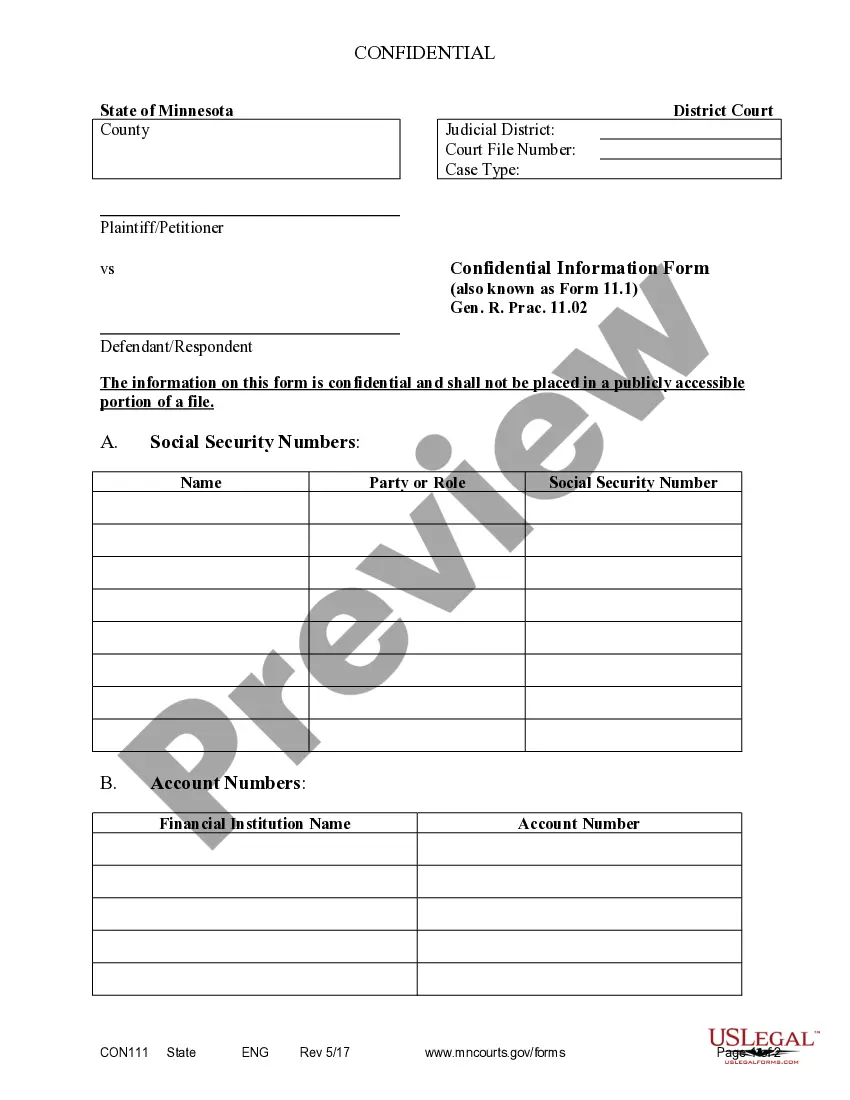

- Be sure you have chosen the correct kind for the town/area. Click on the Preview option to review the form`s content. Look at the kind description to actually have selected the correct kind.

- If the kind does not match your requirements, take advantage of the Look for field near the top of the screen to obtain the one which does.

- Should you be happy with the shape, validate your selection by visiting the Buy now option. Then, choose the prices program you want and provide your credentials to register for the profile.

- Process the financial transaction. Use your bank card or PayPal profile to complete the financial transaction.

- Select the formatting and obtain the shape on your device.

- Make modifications. Load, revise and print out and indication the delivered electronically Florida Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders.

Each design you put into your money lacks an expiry time and is the one you have forever. So, if you want to obtain or print out one more copy, just proceed to the My Forms area and click on on the kind you want.

Get access to the Florida Stock Transfer Agreement between EMC Corp., Eagle Merger Corp., and Shareholders with US Legal Forms, by far the most considerable library of legitimate file templates. Use 1000s of professional and express-distinct templates that meet your business or person requirements and requirements.