Florida General Security Agreement granting secured party secured interest

Description

How to fill out General Security Agreement Granting Secured Party Secured Interest?

Are you currently in a situation that you need to have papers for either company or personal uses almost every working day? There are tons of authorized file themes available online, but finding kinds you can rely on isn`t simple. US Legal Forms offers thousands of develop themes, such as the Florida General Security Agreement granting secured party secured interest, that happen to be created to meet state and federal demands.

Should you be already informed about US Legal Forms web site and have a merchant account, merely log in. Afterward, you can download the Florida General Security Agreement granting secured party secured interest design.

Should you not have an accounts and want to begin using US Legal Forms, adopt these measures:

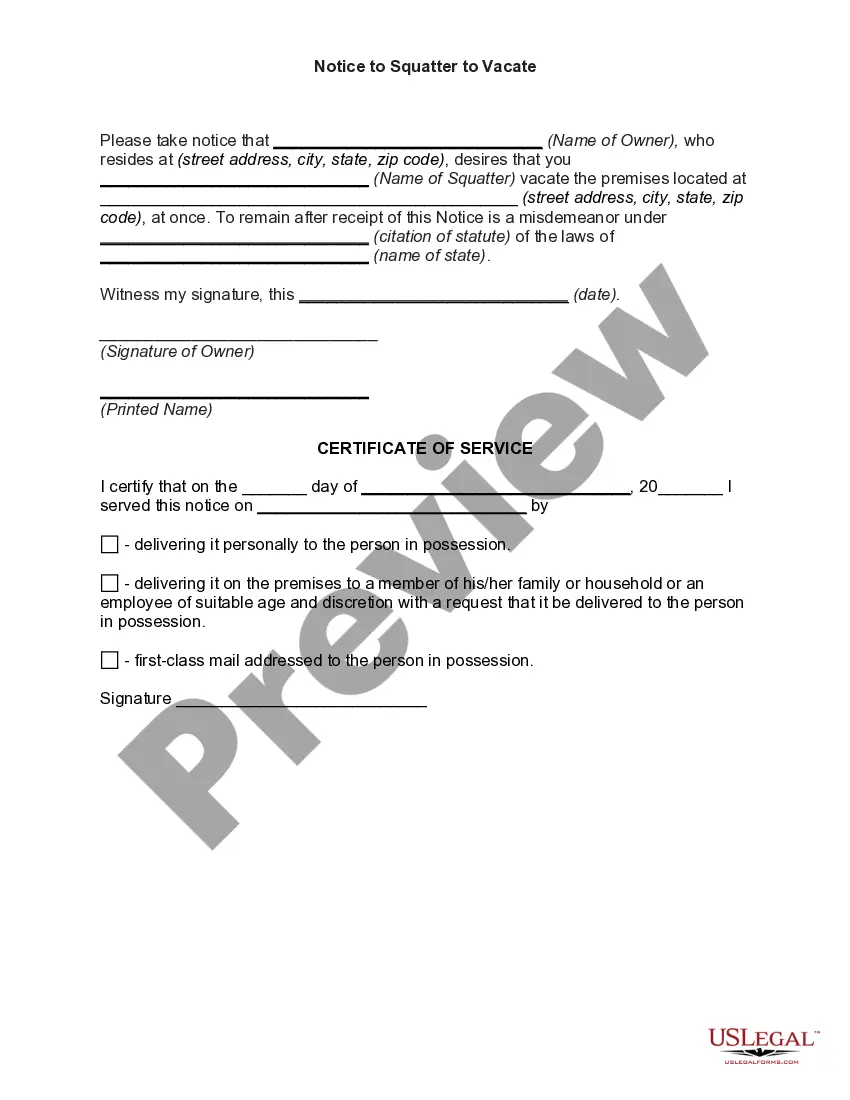

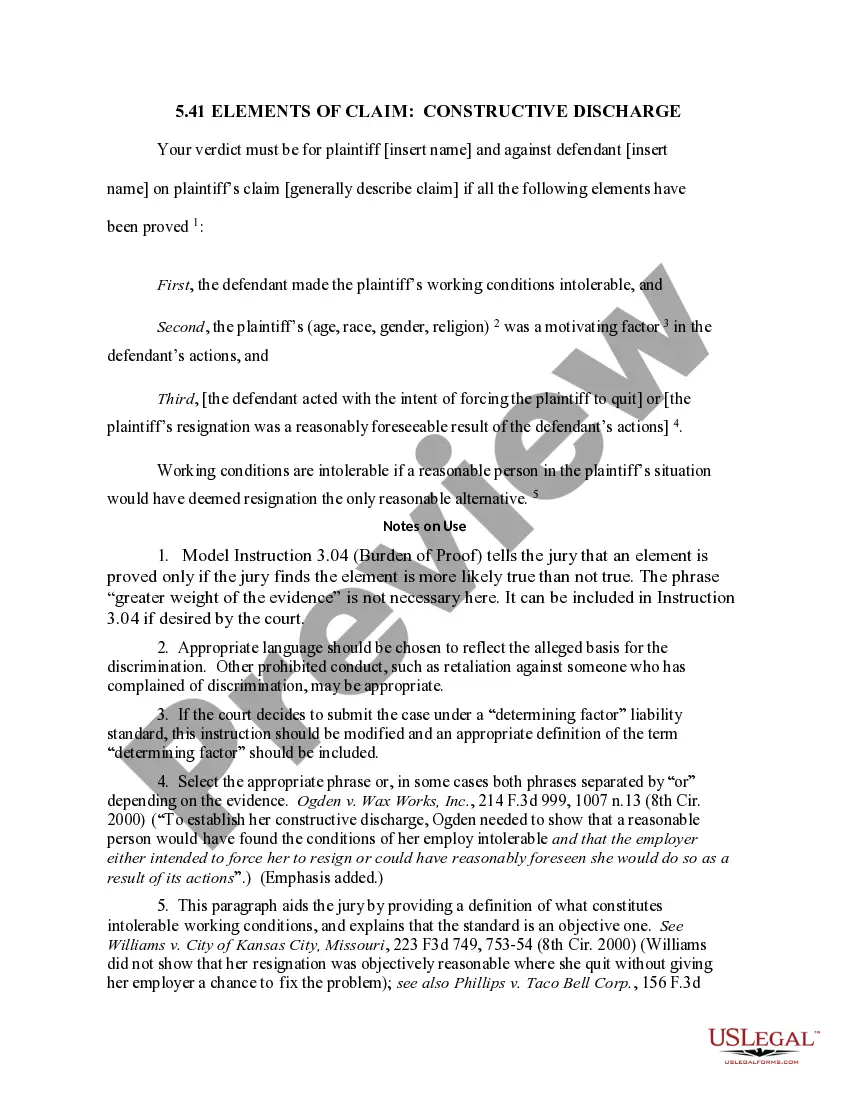

- Discover the develop you require and ensure it is for your proper city/state.

- Take advantage of the Preview button to examine the form.

- Read the description to ensure that you have chosen the proper develop.

- If the develop isn`t what you are looking for, take advantage of the Lookup industry to discover the develop that meets your needs and demands.

- Whenever you get the proper develop, click on Get now.

- Pick the pricing prepare you desire, fill in the specified information to create your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Select a practical data file structure and download your version.

Find every one of the file themes you have bought in the My Forms menu. You can aquire a more version of Florida General Security Agreement granting secured party secured interest anytime, if required. Just go through the required develop to download or print the file design.

Use US Legal Forms, by far the most extensive collection of authorized varieties, to save efforts and steer clear of blunders. The support offers professionally produced authorized file themes that you can use for an array of uses. Produce a merchant account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

A lender can perfect a lien on a borrower's deposit account only by obtaining "control" over the account, which requires one of the following arrangements: (1) the borrower maintains its deposit account directly with the lender; (2) the lender becomes the actual owner of the borrower's deposit accounts with the ...

If at any time any Grantor shall take a security interest in any property of an Account Debtor or any other Person to secure payment and performance of an Account in an amount in excess of $250,000, such Grantor shall promptly assign such security interest to the Collateral Agent for the benefit of the Secured Parties.

Filing a Financing Statement to Perfect the Security Interest. Security interests for most types of collateral are usually perfected by filing a document simply called a "financing statement." You'll usually file this form with the secretary of state or other public office.

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

(1) A security interest in chattel paper or negotiable documents may be perfected by filing. A security interest in the right to proceeds of a written letter of credit can be perfected only by the secured party's taking possession of the letter of credit.

File a financing statement: To perfect most security interests, the borrower must file a financing statement (e.g., a UCC-1) with the Florida Department of State. A mortgage must be recorded ing to Florida Statutes Chapter 695.

A security interest generally is created with a security agreement, which is a contract governed by Uniform Commercial Code (UCC) Article 9, as well as other state laws governing contracts.

Creating a security agreement Some key provisions in a security agreement include: Describing the collateral as accurately and as detailed as possible, so both the borrower and the lender agree upon the secured property. How to determine whether and when the borrower is in default under the loan.