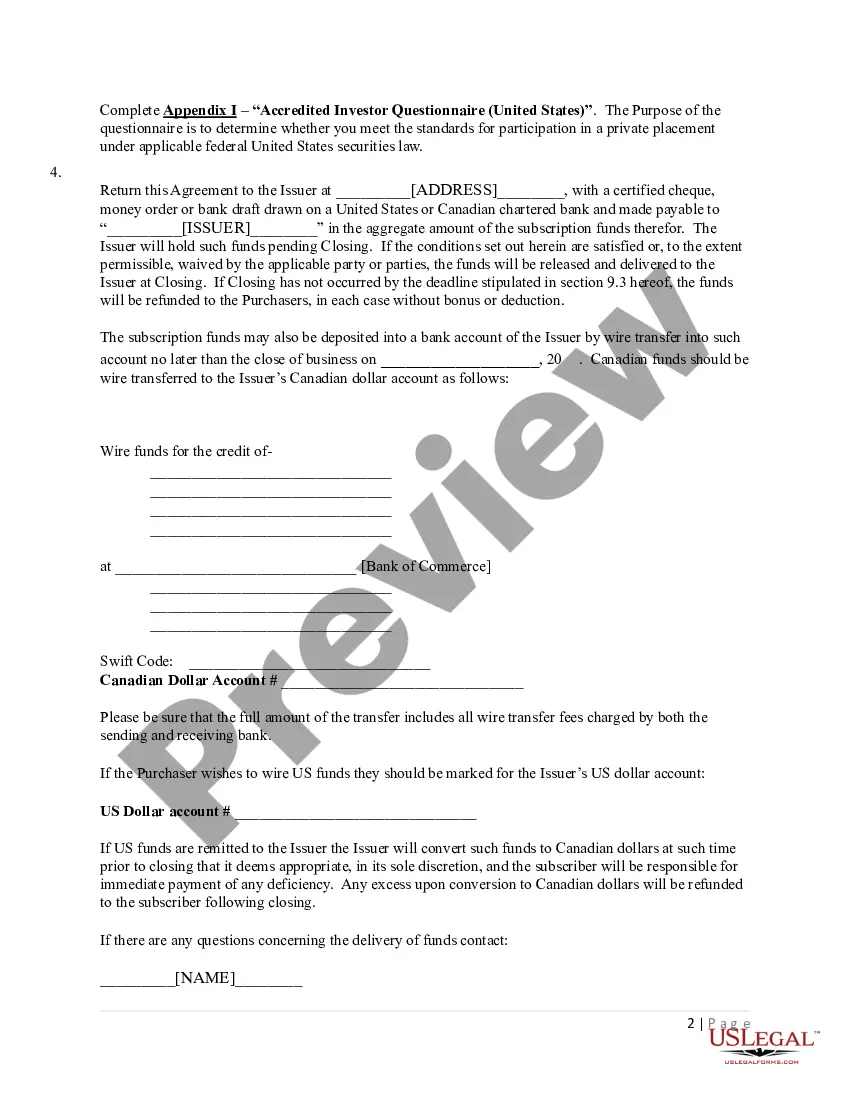

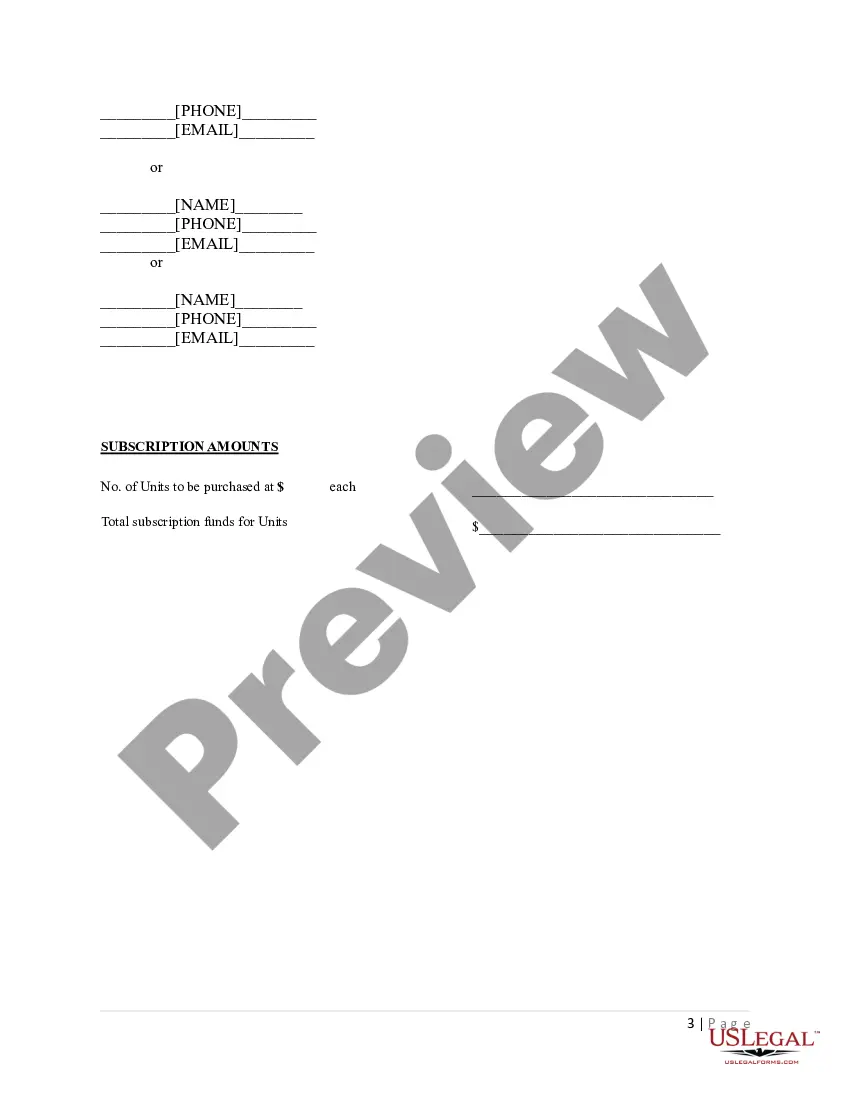

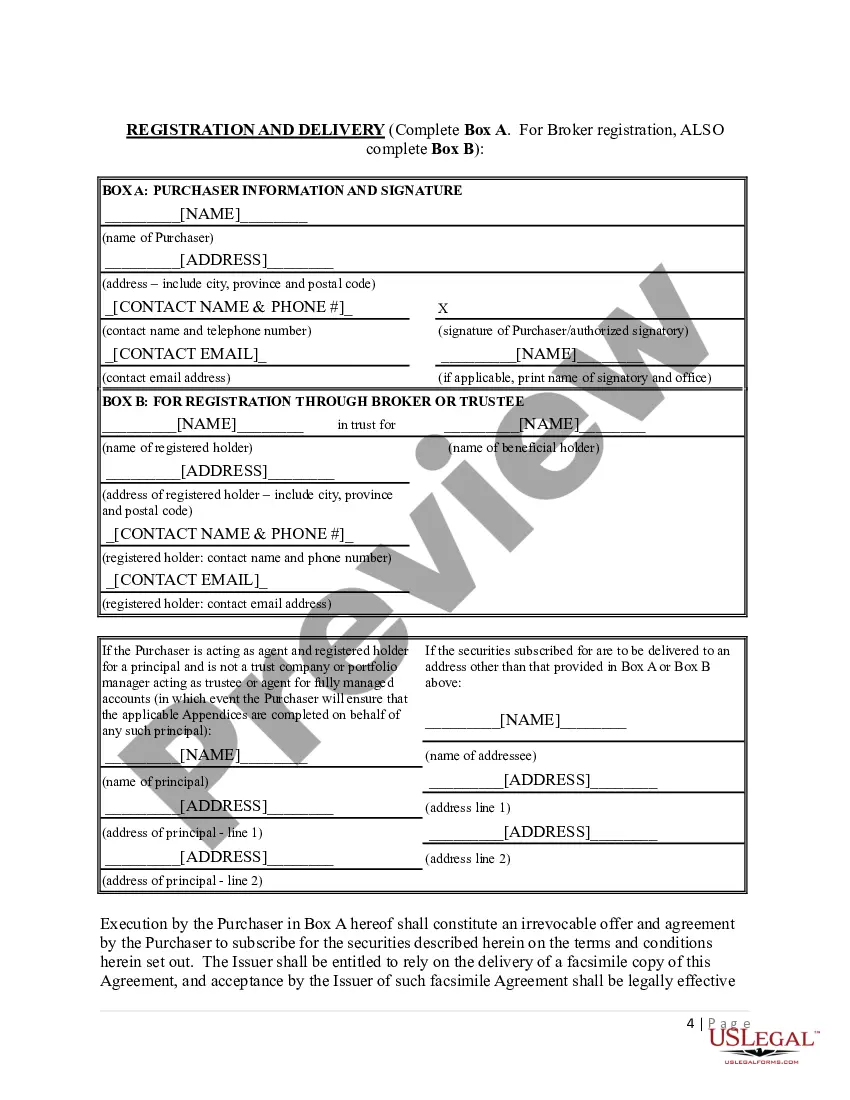

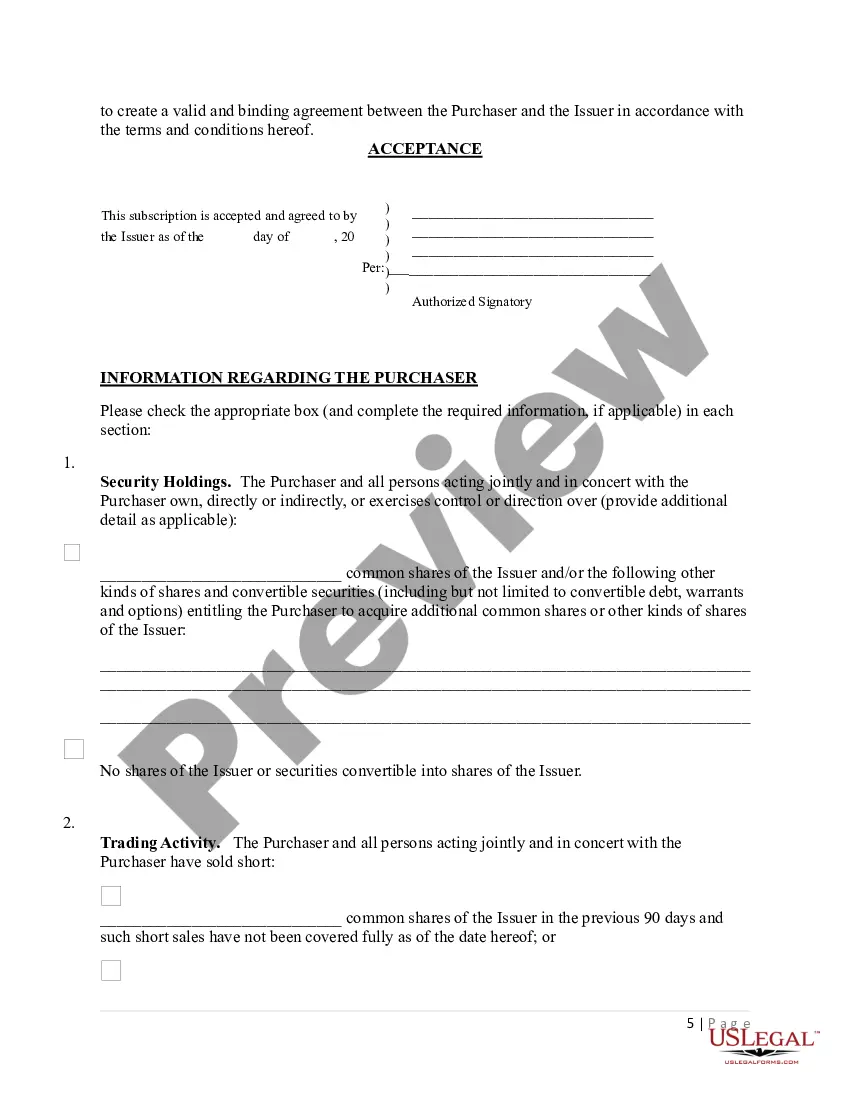

The Florida Subscription Agreement is a legal document that outlines the terms and conditions for individuals or entities subscribing to purchase or invest in securities, such as stocks, bonds, or limited partnership interests, within the state of Florida. This agreement serves as a contract between the issuer of the securities, often a company or partnership, and the subscriber. The Florida Subscription Agreement typically contains various key components, including but not limited to: 1. Subscription Details: This section entails the subscriber's name, address, and contact information, along with the type and quantity of securities being subscribed to. It may also include the purchase price or investment amount. 2. Representations and Warranties: This section requires the subscriber to make certain representations and warranties, ensuring that they meet specific criteria or qualifications necessary to invest in the securities. It typically addresses the subscriber's financial status, investment experience, and risk tolerance. 3. Subscription Procedure: This component outlines the steps required to complete the subscription, including the submission of funds, necessary documents, and any applicable filing fees. It may also mention the conditions precedent, such as receiving regulatory approvals or a minimum subscription threshold. 4. Securities Offering Terms: Here, the essential terms of the securities being subscribed to are described. This includes details such as the number of shares, the offering price or valuation, the type of security (common stock, preferred stock, etc.), any restrictions on transferability, and voting rights associated with the securities. 5. Governing Law and Dispute Resolution: This section states the jurisdiction and laws that will govern the agreement, typically specifying Florida state law. It may also outline the mechanisms for resolving disputes, such as mediation, arbitration, or litigation. Different types of Florida Subscription Agreements may exist based on the specific securities being offered or the type of offering entity. Some common variations include: 1. Stock Subscription Agreement: This agreement relates to the purchase or subscription of shares of a company's stock. 2. Bond Subscription Agreement: This type of agreement pertains to the acquisition of bonds, representing debt instruments through which the issuer borrows funds from investors. 3. Partnership Interest Subscription Agreement: In the case of a limited partnership, this agreement governs the subscription for ownership interests in the partnership. 4. Convertible Note Subscription Agreement: This variation applies when investors subscribe to convertible notes, which are debt instruments that can be converted into equity at a later date. In summary, the Florida Subscription Agreement is a crucial legal document that outlines the terms and conditions for individuals or entities subscribing to purchase securities within the state of Florida. By defining the rights, obligations, and expectations of both the issuer and the subscriber, this agreement helps ensure transparency, compliance, and fairness in the investment process.

Florida Subscription Agreement

Description

How to fill out Florida Subscription Agreement?

US Legal Forms - one of many largest libraries of lawful types in America - delivers an array of lawful file web templates you can acquire or print out. Utilizing the internet site, you can get a large number of types for enterprise and specific uses, categorized by categories, states, or key phrases.You will find the latest models of types just like the Florida Subscription Agreement in seconds.

If you currently have a subscription, log in and acquire Florida Subscription Agreement from your US Legal Forms collection. The Acquire key will appear on every single develop you look at. You have accessibility to all earlier acquired types inside the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed below are straightforward guidelines to obtain began:

- Be sure you have selected the correct develop to your town/area. Select the Preview key to review the form`s articles. Read the develop explanation to ensure that you have chosen the correct develop.

- In the event the develop doesn`t fit your requirements, take advantage of the Lookup area near the top of the monitor to discover the one which does.

- When you are content with the shape, verify your choice by clicking on the Acquire now key. Then, choose the costs program you prefer and supply your credentials to sign up for the accounts.

- Approach the deal. Make use of your charge card or PayPal accounts to accomplish the deal.

- Find the format and acquire the shape on the gadget.

- Make changes. Complete, edit and print out and signal the acquired Florida Subscription Agreement.

Each and every design you added to your money does not have an expiry particular date and is also your own property eternally. So, if you would like acquire or print out an additional duplicate, just proceed to the My Forms area and click on the develop you will need.

Get access to the Florida Subscription Agreement with US Legal Forms, the most comprehensive collection of lawful file web templates. Use a large number of skilled and condition-distinct web templates that meet up with your organization or specific requirements and requirements.