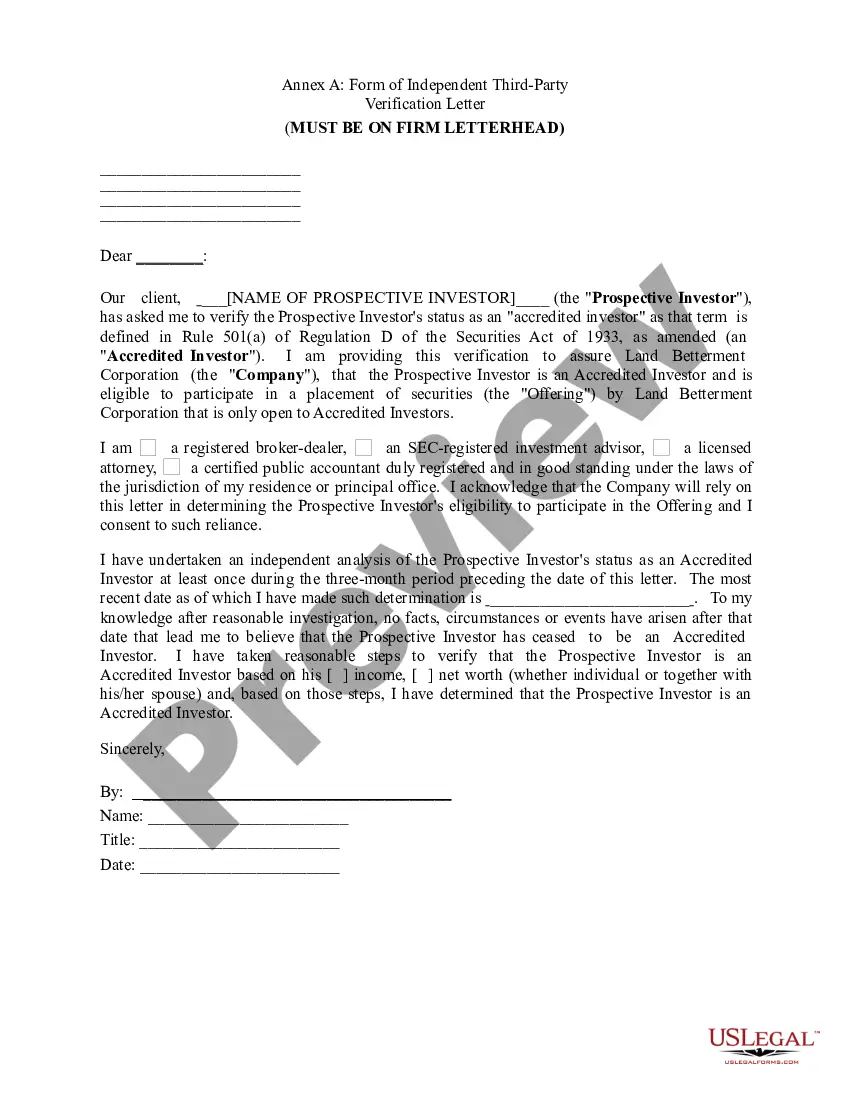

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

The Florida Accredited Investor Certification Letter is an official document that certifies an individual's status as an accredited investor under the regulations set forth by the Florida Office of Financial Regulation (OF). This certification is crucial for individuals who wish to participate in certain investment opportunities that are only available to accredited investors. To understand the significance of the Florida Accredited Investor Certification Letter, it is important to grasp the concept of an accredited investor. In the United States, accredited investors are individuals or entities that meet specific income or net worth requirements, as defined by the Securities and Exchange Commission (SEC). The purpose of these criteria is to ensure that only sophisticated and financially capable investors can participate in high-risk investments, such as private equity placements, hedge funds, and venture capital funds. The Florida Accredited Investor Certification Letter serves as a proof or verification that an individual meets the accredited investor standards set forth in Rule 120-3-1.02 of the Florida Administrative Code. It is typically required by securities issuers and investment firms to comply with state regulations and protect investors from potentially risky investments. By obtaining this certified status, individuals gain access to a wider range of investment opportunities that may offer potentially higher returns. There are various types of Florida Accredited Investor Certification Letters that cater to different groups of investors. These include: 1. Individual Accredited Investor Certification Letter: This type of certification is issued to individuals who meet the income or net worth requirements outlined in the OF regulations. The individual must provide relevant documentation and complete the necessary forms to obtain this letter. 2. Entity Accredited Investor Certification Letter: This certification is issued to entities, such as corporations, partnerships, limited liability companies (LCS), or trusts, that meet specific criteria to be considered accredited investors. The entity must submit supporting documents and comply with the OF's guidelines to receive this certification. 3. Spousal Accredited Investor Certification Letter: In cases where a married couple wishes to invest jointly in certain opportunities, the Florida OF allows for a spousal certification. This allows the spouse of an accredited investor to be included in the accredited status, even if they do not individually meet the income or net worth requirements. The couple must provide the required documentation and meet certain qualifications to receive this certification. Obtaining a Florida Accredited Investor Certification Letter is a crucial step for those seeking to engage in private investment opportunities within the state. It ensures compliance with the OF regulations and grants individuals access to potentially lucrative investment prospects typically unavailable to non-accredited investors.