Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest is a legal document that outlines the decision of a lessor in Florida to convert their royalty interest in a property to a working interest. This declaration signifies the lessor's choice to take an active role in the operations and decision-making process of the property, rather than simply receiving royalty payments. By converting their royalty interest to a working interest, the lessor becomes a co-owner of the property and shares both the benefits and responsibilities associated with it. This includes participating in drilling and development activities, making financial contributions towards operational costs, and sharing in the profits generated from the property's production. Keywords: Florida Declaration of Election, lessor, royalty interest, working interest, property, active role, operations, decision-making process, royalty payments, co-owner, benefits, responsibilities, drilling, development activities, financial contributions, operational costs, profits, production. There may be different types of Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, based on specific circumstances or requirements. Some potential variations may include: 1. Limited Working Interest Conversion Declaration: This type of declaration could specify certain limitations or conditions on the lessor's participation as a working interest owner, such as a cap on financial contributions or limited decision-making powers. 2. Complete Working Interest Conversion Declaration: In this case, the lessor is opting for a full conversion of their royalty interest to a working interest, assuming equal responsibilities and benefits as other working interest owners without any specific limitations. 3. Time-Bound Working Interest Conversion Declaration: This declaration may outline a temporary conversion of the royalty interest to working interest for a specific period, after which the lessor's interest reverts to a royalty interest again. 4. Partial Working Interest Conversion Declaration: Sometimes a lessor may choose to convert only a portion of their royalty interests to a working interest, allowing partial involvement in the property's operations and decision-making. It is important to consult legal professionals or qualified experts to understand the specific details, requirements, and implications of any particular type of Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, as they may vary based on individual circumstances and agreements.

Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Florida Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Are you currently inside a placement the place you will need documents for possibly business or personal purposes nearly every day? There are a lot of lawful papers layouts available on the net, but getting versions you can depend on isn`t easy. US Legal Forms offers thousands of kind layouts, such as the Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, that happen to be created to meet federal and state needs.

When you are currently acquainted with US Legal Forms web site and also have an account, merely log in. Afterward, you are able to download the Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest template.

Unless you provide an account and want to start using US Legal Forms, follow these steps:

- Obtain the kind you require and make sure it is for your appropriate metropolis/county.

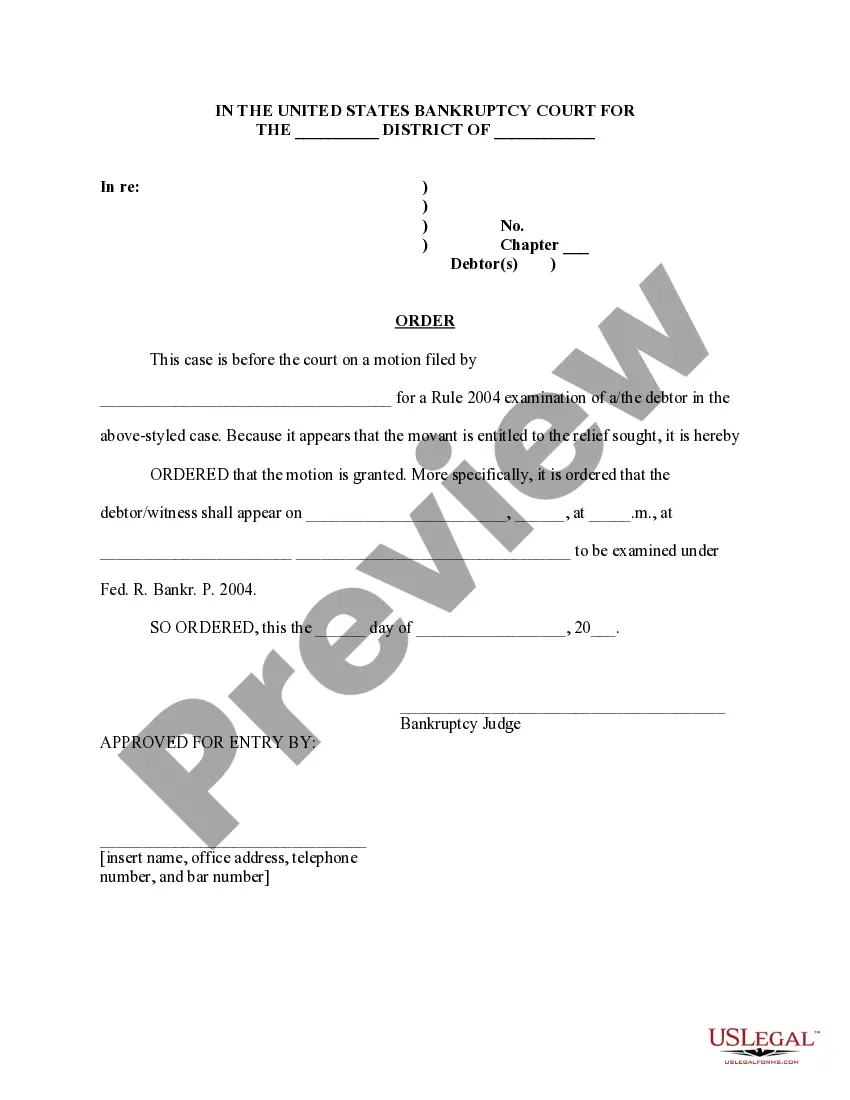

- Make use of the Preview key to analyze the form.

- Look at the information to ensure that you have selected the appropriate kind.

- In the event the kind isn`t what you are seeking, use the Research industry to discover the kind that suits you and needs.

- Once you discover the appropriate kind, just click Purchase now.

- Opt for the costs strategy you need, fill in the required information to produce your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Decide on a convenient file structure and download your backup.

Get all the papers layouts you might have purchased in the My Forms food selection. You can aquire a additional backup of Florida Declaration of Election by Lessor to Convert Royalty Interest to Working Interest whenever, if required. Just click on the required kind to download or print out the papers template.

Use US Legal Forms, one of the most extensive collection of lawful varieties, to save lots of some time and stay away from faults. The service offers professionally created lawful papers layouts that can be used for a variety of purposes. Create an account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.