Florida Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Employee Agreement Incentive Compensation And Stock Bonus?

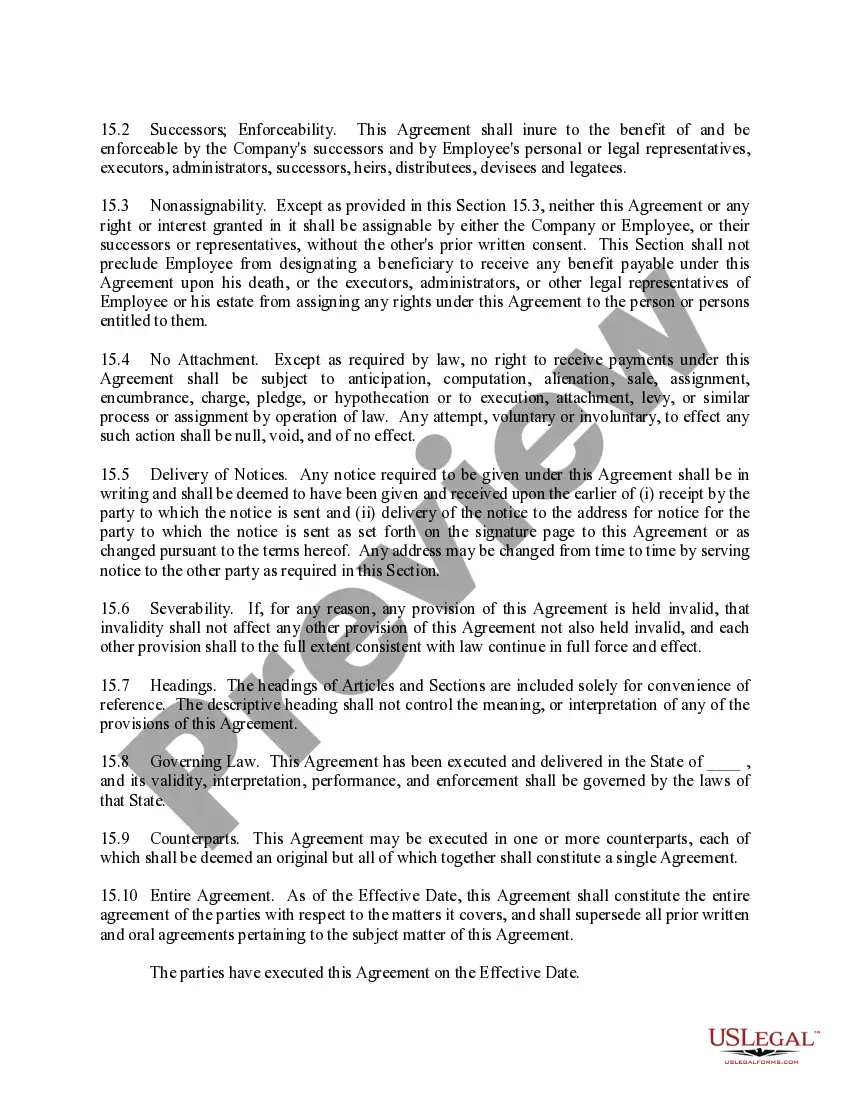

Are you currently in the place that you will need papers for either organization or person reasons virtually every time? There are a variety of lawful document web templates available on the net, but discovering types you can depend on isn`t straightforward. US Legal Forms gives a huge number of type web templates, such as the Florida Employee Agreement Incentive Compensation and Stock Bonus, that are composed in order to meet federal and state requirements.

In case you are currently informed about US Legal Forms site and also have a free account, basically log in. After that, you can down load the Florida Employee Agreement Incentive Compensation and Stock Bonus template.

Should you not offer an profile and need to begin to use US Legal Forms, abide by these steps:

- Find the type you require and make sure it is for your proper city/region.

- Take advantage of the Review switch to examine the shape.

- Look at the description to actually have selected the proper type.

- If the type isn`t what you`re trying to find, utilize the Search industry to get the type that meets your requirements and requirements.

- If you obtain the proper type, click Acquire now.

- Select the prices program you need, submit the required information to create your account, and purchase an order making use of your PayPal or credit card.

- Decide on a practical paper file format and down load your duplicate.

Get each of the document web templates you possess bought in the My Forms menu. You may get a additional duplicate of Florida Employee Agreement Incentive Compensation and Stock Bonus any time, if needed. Just click on the essential type to down load or print the document template.

Use US Legal Forms, probably the most considerable collection of lawful varieties, in order to save some time and stay away from blunders. The services gives appropriately made lawful document web templates which you can use for an array of reasons. Make a free account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

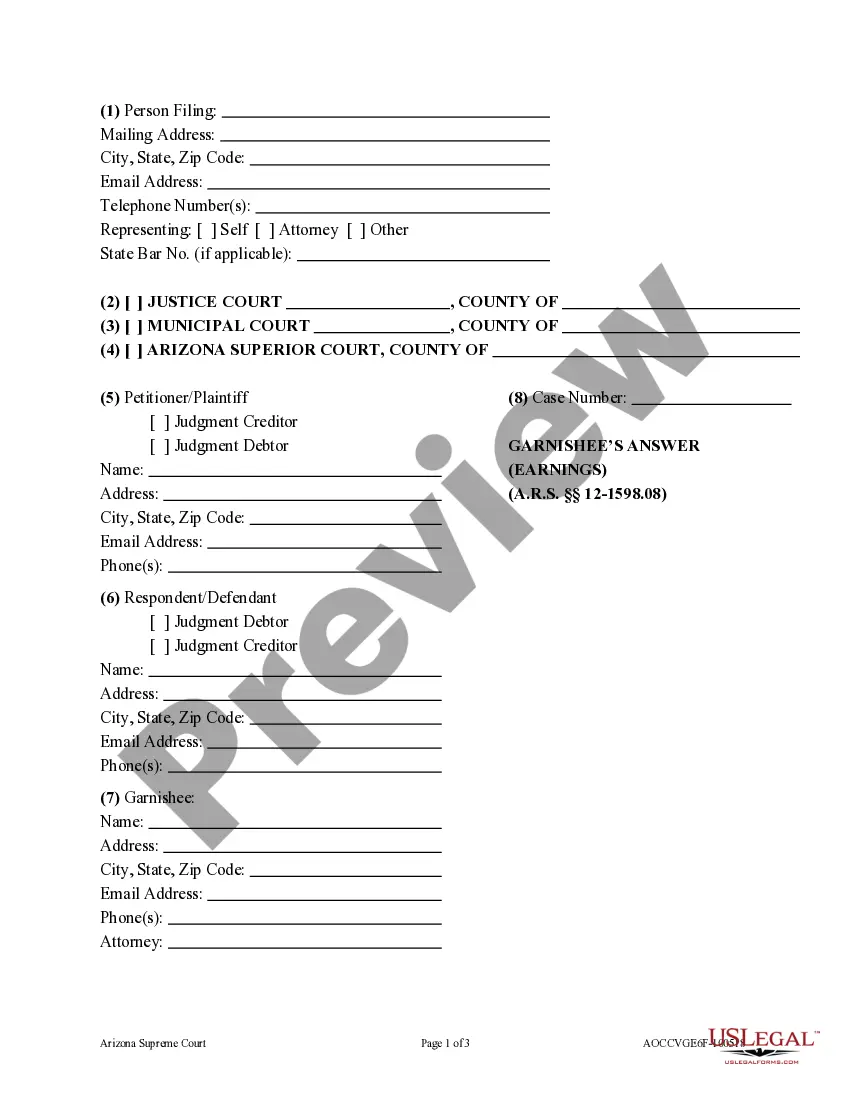

California Labor Laws and Bonuses All earned bonuses are treated as wages under California Labor Code Section 200. These bonuses are ?earned? as part of an employment contract, work performance policy, obligation, or an understanding between the employer and employees.

It is not uncommon for an employer to express an employee's capacity to earn a bonus in the employment contract. There might be language disclosing the employer's wish to retain maximum discretion regarding bonuses, such as the amount, date of payment, and associated conditions.

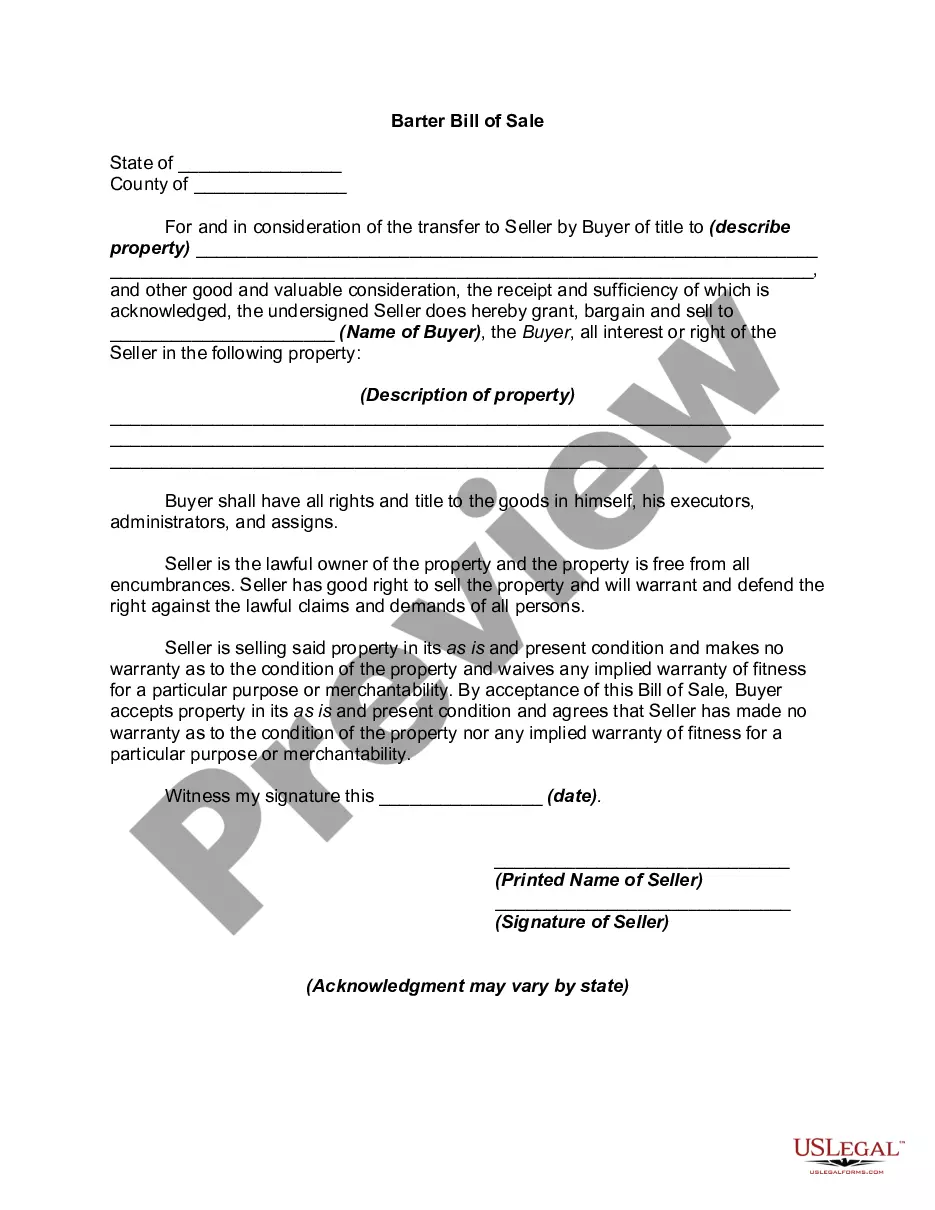

A bonus agreement is an arrangement between two or more parties where one party agrees to pay another a sum of money, usually determined by the revenue generated. The agreement sets out how long it will take to make the payment and any conditions that need to be met before the bonus is issued.

If the bonus is contractual, the employer must make these payments if the employee meets the required criteria. For example, if you set clear performance targets and the employee meets them, you will need to pay out the bonus.

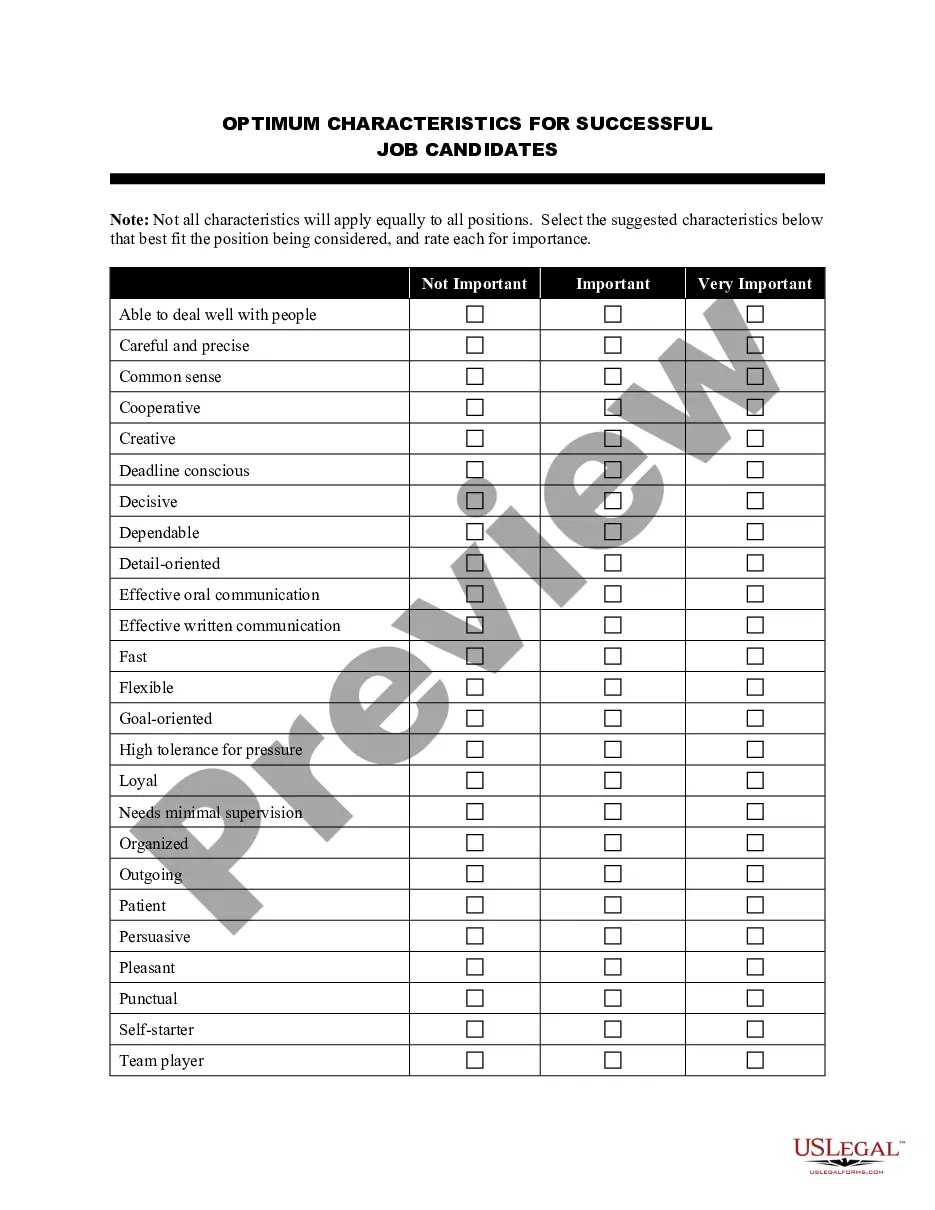

An employee bonus plan provides compensation beyond annual salary to employees as an incentive or reward for reaching certain predetermined individual or team goals. The purpose of bonus plans is to provide recognition for employees who go above and beyond normal work obligations.

This is against the law, but many employees do not realize that this is the case. Even if you ended the employment contract, in most cases, the amount that you earned in bonus and commission will need to be paid to you once your former employer has it in hand.