Florida's clauses relating to venture IPO are provisions that pertain to Initial Public Offerings (IPOs) of startup companies in the state of Florida. These clauses outline specific conditions and regulations that govern the process of taking a startup public and provide legal framework for investors, founders, and other stakeholders involved in venture capital funding. Some different types of Florida clauses relating to venture IPO include: 1. Securities Laws Compliance: Florida clauses ensure that the startup complies with state and federal securities laws during the IPO process. This includes providing proper disclosures, registration statements, and filing relevant documents with the Florida Division of Securities. 2. Registration Requirements: Florida clauses specify the registration requirements for startups looking to go public. They outline the process for submitting the IPO registration documents and the necessary fees involved. 3. Investor Protection: These clauses focus on protecting the interests of investors by ensuring that the company's IPO meets certain transparency and disclosure standards. They may require the startup to provide information about its financial condition, business operations, risks, and any conflicts of interest. 4. Preemption Rights: These clauses determine whether existing shareholders, such as venture capital firms or angel investors, have the right to participate in the IPO. They outline the conditions under which these shareholders can purchase additional shares to maintain their ownership percentage in the company. 5. Lock-up Agreements: Lock-up agreements are clauses that prevent certain shareholders, typically founders and early investors, from selling their shares for a specified period after the IPO. These clauses aim to stabilize post-IPO share prices and prevent any sudden sell-offs that could negatively impact the company's stock value. 6. Escrow Requirements: Escrow clauses outline the conditions under which funds raised from the IPO are held in a third-party escrow account until certain milestones or obligations are met. They provide protection for investors and may include provisions for the release of funds in stages as the company achieves predetermined performance targets. 7. Anti-dilution Rights: These clauses protect early investors from dilution of their ownership percentage in the event of additional financing rounds or stock issuance. They may include full-ratchet or weighted-average anti-dilution provisions to adjust the conversion price of the investor's shares. 8. Reporting Obligations: Florida IPO clauses may include requirements for the company to file periodic reports and financial statements with the Florida Division of Securities. These provisions ensure ongoing transparency and disclosure to protect investors. Overall, Florida clauses relating to venture IPO plays a vital role in regulating the IPO process, protecting investors, and ensuring compliance with securities laws. It is crucial for startups and their legal teams to carefully consider and understand these clauses to facilitate a successful and legally sound IPO in the state of Florida.

Florida Clauses Relating to Venture IPO

Description

How to fill out Florida Clauses Relating To Venture IPO?

You may spend hrs on-line trying to find the authorized papers format that meets the federal and state demands you will need. US Legal Forms offers 1000s of authorized forms that are examined by professionals. It is possible to down load or printing the Florida Clauses Relating to Venture IPO from our services.

If you have a US Legal Forms bank account, it is possible to log in and then click the Down load option. Following that, it is possible to full, edit, printing, or sign the Florida Clauses Relating to Venture IPO. Every authorized papers format you get is your own eternally. To get yet another backup associated with a acquired kind, visit the My Forms tab and then click the corresponding option.

Should you use the US Legal Forms web site initially, follow the basic directions under:

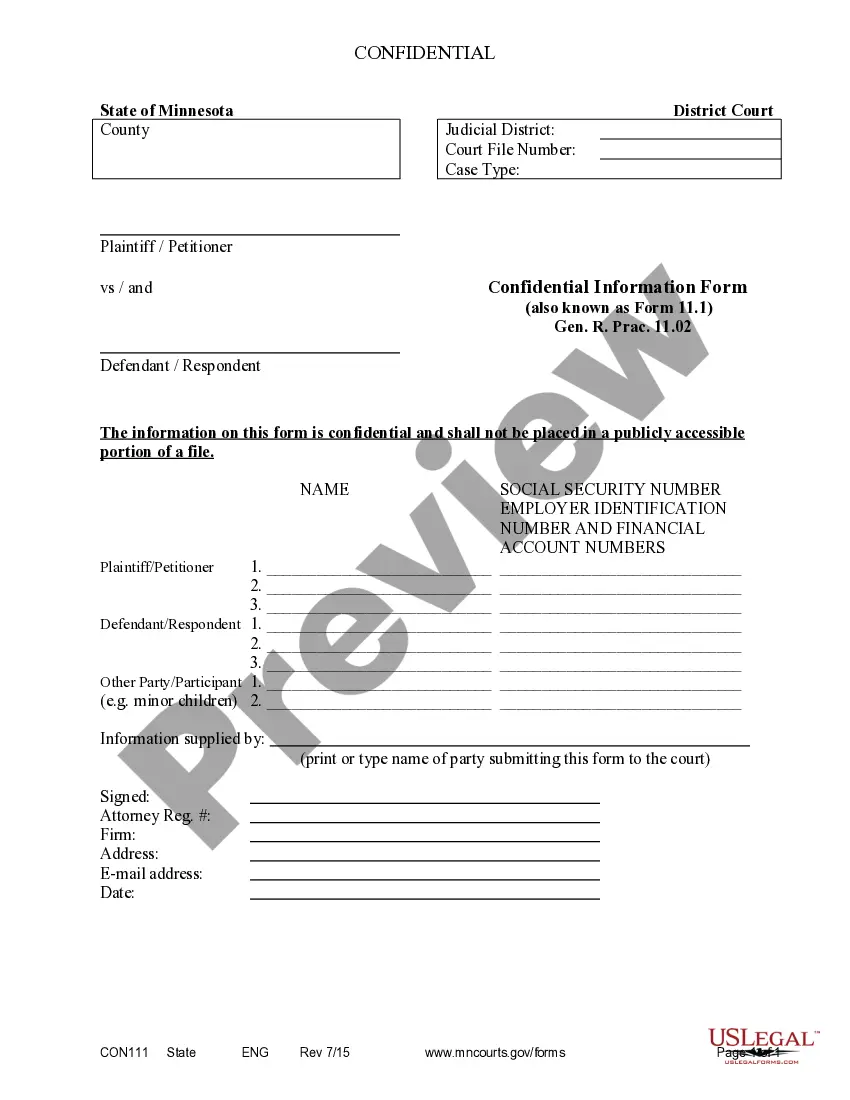

- Initial, make sure that you have selected the proper papers format for the region/city of your choosing. See the kind explanation to ensure you have picked the right kind. If offered, utilize the Preview option to look through the papers format as well.

- If you wish to discover yet another variation of the kind, utilize the Look for industry to discover the format that meets your requirements and demands.

- When you have located the format you need, click Acquire now to carry on.

- Find the prices plan you need, type your references, and sign up for a free account on US Legal Forms.

- Total the purchase. You can use your bank card or PayPal bank account to fund the authorized kind.

- Find the formatting of the papers and down load it for your device.

- Make modifications for your papers if necessary. You may full, edit and sign and printing Florida Clauses Relating to Venture IPO.

Down load and printing 1000s of papers layouts while using US Legal Forms web site, that provides the greatest assortment of authorized forms. Use professional and state-certain layouts to handle your small business or specific requires.