Florida Permission For Deputy or Agent To Access Safe Deposit Box

Description

How to fill out Florida Permission For Deputy Or Agent To Access Safe Deposit Box?

Discovering the right legal document web template can be a have difficulties. Of course, there are plenty of templates available online, but how will you discover the legal develop you will need? Use the US Legal Forms website. The support delivers a huge number of templates, including the Florida Permission For Deputy or Agent To Access Safe Deposit Box, that you can use for organization and personal needs. All of the forms are inspected by pros and fulfill state and federal requirements.

In case you are currently registered, log in to the account and then click the Down load option to obtain the Florida Permission For Deputy or Agent To Access Safe Deposit Box. Make use of account to appear from the legal forms you possess bought formerly. Visit the My Forms tab of your account and acquire another copy of the document you will need.

In case you are a new end user of US Legal Forms, here are easy recommendations so that you can follow:

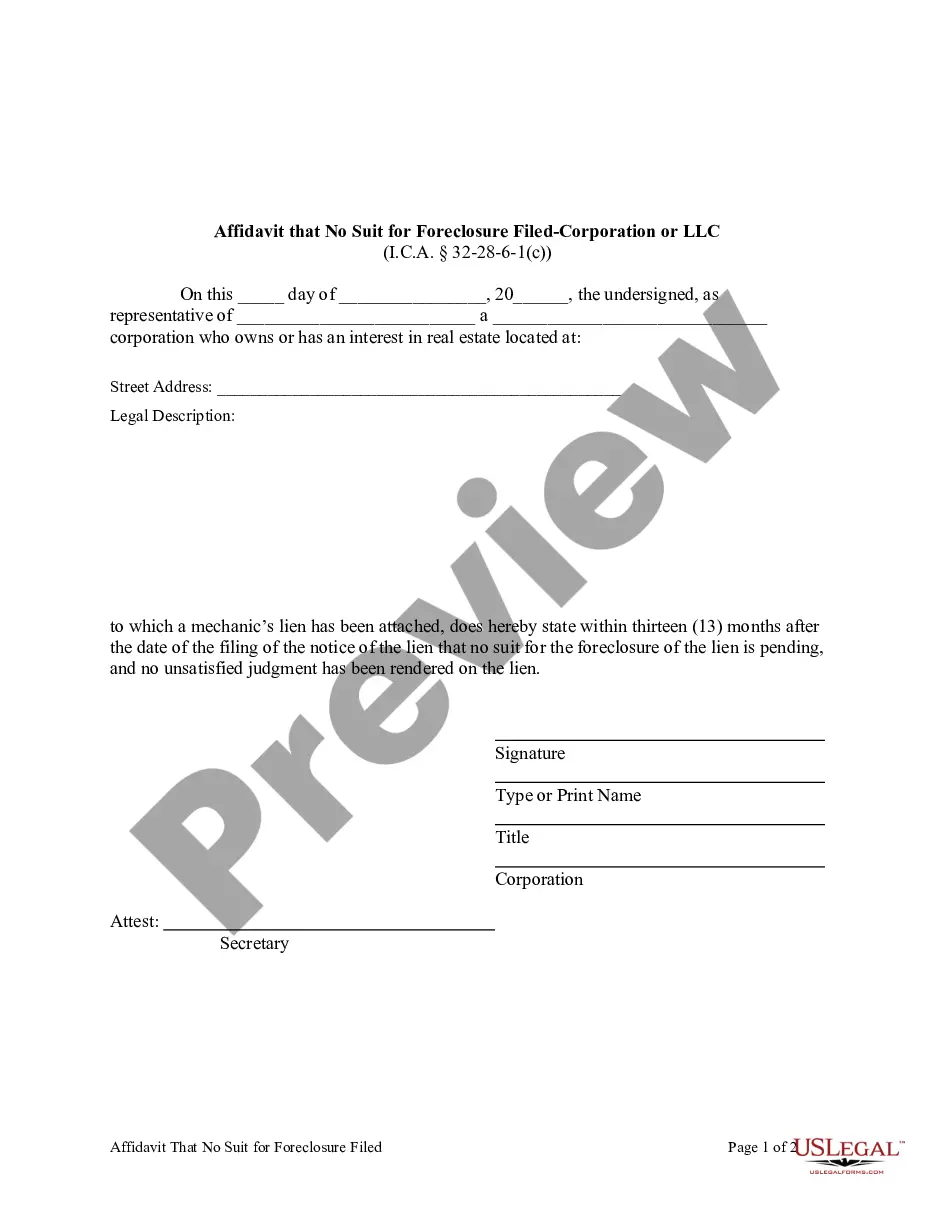

- Very first, ensure you have chosen the correct develop to your city/county. It is possible to look over the shape while using Preview option and look at the shape description to make certain it is the right one for you.

- When the develop does not fulfill your expectations, take advantage of the Seach field to discover the correct develop.

- Once you are certain the shape would work, select the Acquire now option to obtain the develop.

- Choose the rates prepare you want and enter the essential information. Design your account and purchase the transaction with your PayPal account or Visa or Mastercard.

- Opt for the file format and obtain the legal document web template to the product.

- Total, edit and printing and indicator the received Florida Permission For Deputy or Agent To Access Safe Deposit Box.

US Legal Forms will be the greatest library of legal forms where you can see numerous document templates. Use the company to obtain appropriately-produced documents that follow express requirements.

Form popularity

FAQ

Florida law differs from other states in that the safe-deposit box is not sealed upon death, as the state does not have a revenue interest in the box's contents. The estate's personal representative must account for all of the decedent's assets, including the safe-deposit box.

A dual key system protects safe deposit boxes. The bank provides you with two keys of your own, and the bank has a 'guard' key. Without the combination of one of your keys and the bank's guard key, the box cannot be opened.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

Dual control: Two peopleusually a bank employee and the renterare required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.

Section 45ZE of banking regulation act 1949 When the locker is hired jointly and can be operated jointly only if one of the locker hirer dies than the nominee and the surviving joint hirer can access the locker and may remove its contents also.

Specifically, two people must be present when the box is opened. The first is an employee of the institution where the box is located (usually a bank). The second person can either be the estate's personal representative or his or her attorney.

Concerned About Theft by Bank Employees Its contents are guarded by the bank with a "triple-redundant" security system. First, the safe deposit box is in a secure area, in the bank vault. Bank customers are not allowed open access to this area. You must sign in with bank security staff to enter the vault.

You'd think that an executor, spouse, family member of the deceased, or anyone with a key can walk into the bank and open a safe deposit box. But, that's not the way it works. In most states, safe deposit boxes are sealed and cannot be accessed when the original renter passes away.

Come to the bank with your safe deposit box key. You will need to sign an admission slip to get access to the Safe Deposit area of the vault. A Safe Deposit Area attendant will take you to the vault. With the bank's Guard Key and your key, open your Safe Deposit Box slot.

You may think it is unfair that the bank has the right to break open your locker, but at times things like explosives or illegal substances have been found in the locker, especially the inoperational ones. Thus, the banks have the right to break it open and rent it out to someone else.