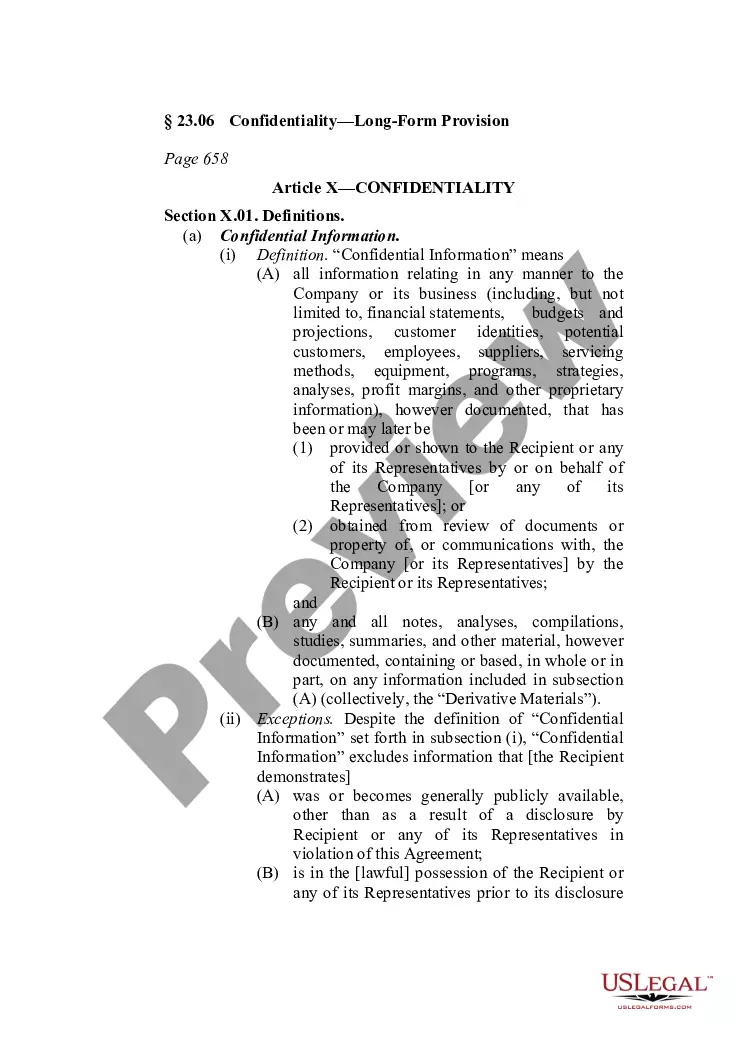

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Florida M&A Transaction Term Sheet Guideline

Description

How to fill out M&A Transaction Term Sheet Guideline?

Are you inside a situation that you will need documents for both enterprise or specific functions nearly every working day? There are tons of legal document layouts available on the Internet, but finding versions you can depend on isn`t simple. US Legal Forms provides a large number of form layouts, such as the Florida M&A Transaction Term Sheet Guideline, that are published to meet state and federal requirements.

If you are currently acquainted with US Legal Forms site and get your account, simply log in. Next, you can acquire the Florida M&A Transaction Term Sheet Guideline format.

Unless you offer an account and wish to begin using US Legal Forms, follow these steps:

- Obtain the form you require and make sure it is for your appropriate metropolis/state.

- Use the Review button to examine the form.

- Look at the outline to actually have selected the right form.

- In case the form isn`t what you`re seeking, take advantage of the Search area to discover the form that meets your needs and requirements.

- When you discover the appropriate form, just click Get now.

- Select the pricing prepare you would like, fill in the desired information to produce your bank account, and pay money for an order making use of your PayPal or bank card.

- Select a convenient paper structure and acquire your copy.

Discover every one of the document layouts you may have purchased in the My Forms menus. You may get a extra copy of Florida M&A Transaction Term Sheet Guideline any time, if possible. Just select the essential form to acquire or print out the document format.

Use US Legal Forms, by far the most substantial collection of legal forms, to conserve time as well as steer clear of faults. The service provides skillfully produced legal document layouts that you can use for an array of functions. Make your account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

3. Transfer students are required to be in good standing and eligible to return to the last postsecondary institution attended as a degree-seeking student and have a grade point average of at least 2.00 on a 4.00 scale on all college-level academic courses attempted.

Admission to FAMU is granted upon completing a minimum of 60 college transferable semester credits with an overall 2.00 GPA. Applicants who present a GED will also be considered for admission.

Finally FAMU: Reaching The University Level George W. Gore (1950-1968). The Florida legislature elevated the College to university status, and in 1953, Florida A&M College became Florida Agricultural and Mechanical University.

Florida A&M University, located in the hills of Tallahassee, is the only historically black institution in the State University System of Florida. The school's mission is to educate African-Americans, but it accepts students of every race, ethnic origin and nationality.

Cities in Florida that start with M Macclenny. Madeira Beach. Madison. Maitland. Malabar. Malone. Manalapan. Manasota Key.

In addition, you must have a GPA of at least 2.55-2.99. If you are applying for early entrance (skipping your senior year of HS and starting as a freshman at FAMU instead), your GPA must be at least 3.0.

Admissions Summary Florida Agricultural and Mechanical University is selective with an acceptance rate of 33%. Students that get into Florida Agricultural and Mechanical University have an SAT score between 1020?1135 or an ACT score of 19?23. Regular applications are due May 1.