Florida Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Florida Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

US Legal Forms - among the greatest libraries of authorized kinds in the States - delivers a variety of authorized file templates you can obtain or produce. Making use of the internet site, you can find thousands of kinds for enterprise and personal uses, sorted by groups, suggests, or search phrases.You will discover the most up-to-date versions of kinds much like the Florida Irrevocable Power of Attorney for Transfer of Stock by Executor within minutes.

If you currently have a membership, log in and obtain Florida Irrevocable Power of Attorney for Transfer of Stock by Executor from your US Legal Forms collection. The Down load option will appear on every single form you see. You gain access to all formerly delivered electronically kinds within the My Forms tab of your respective bank account.

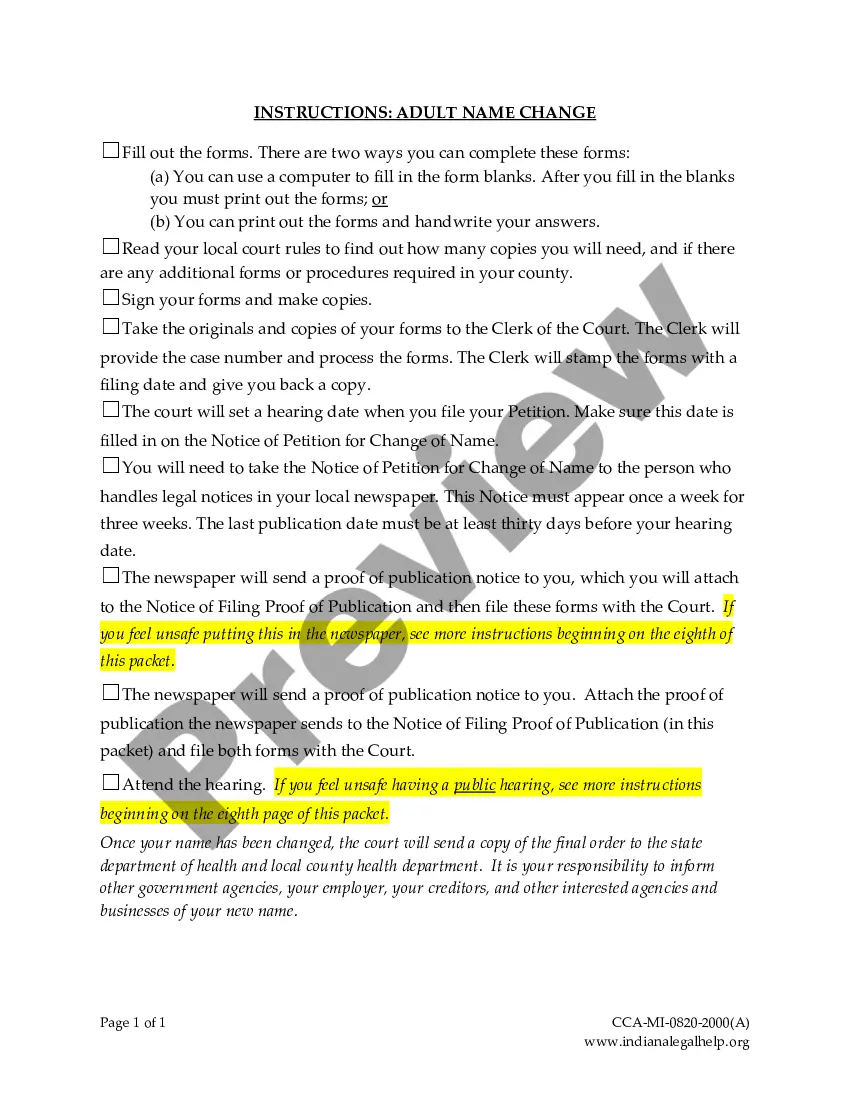

If you would like use US Legal Forms the first time, here are simple recommendations to help you started off:

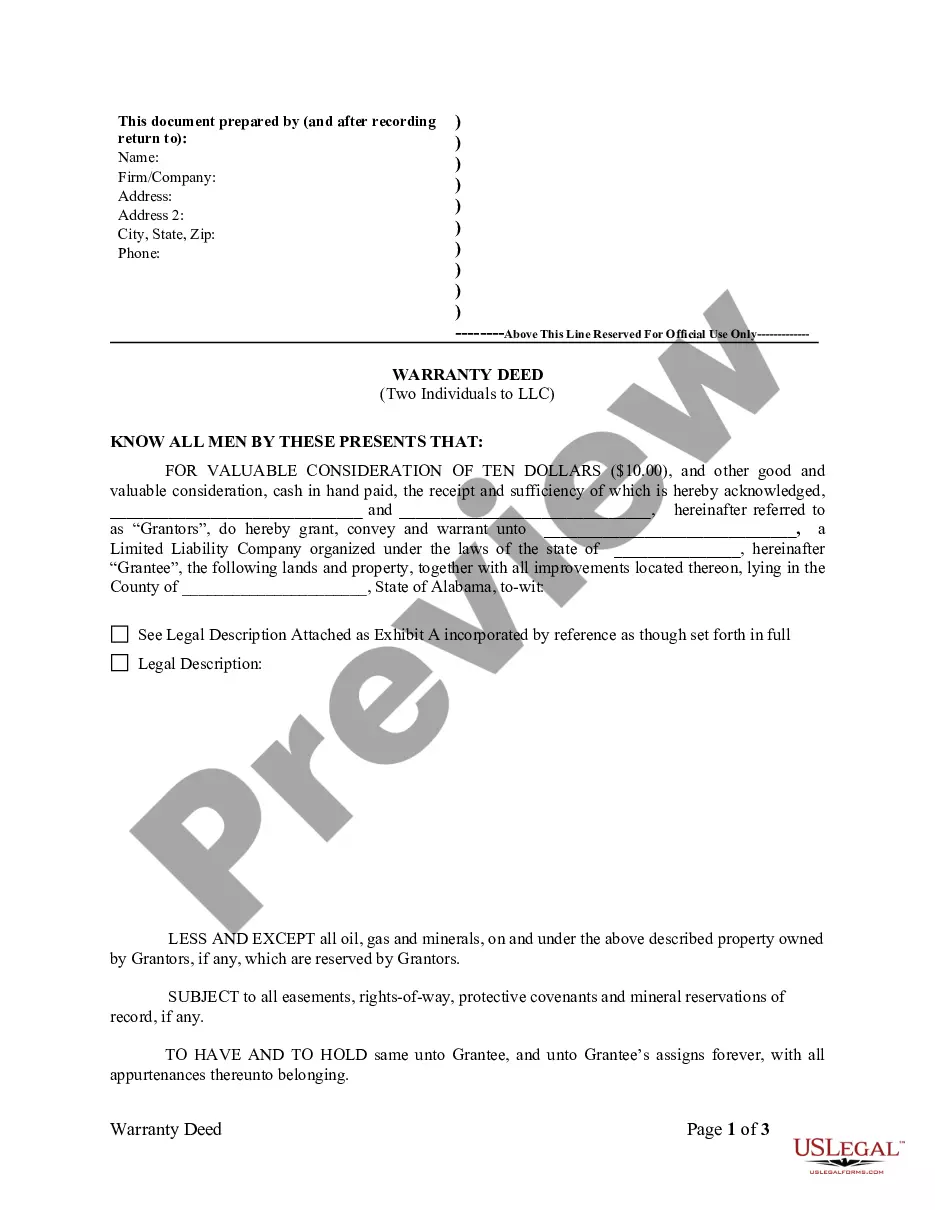

- Be sure you have picked the best form for your town/area. Go through the Review option to analyze the form`s content. Look at the form description to ensure that you have chosen the proper form.

- If the form does not satisfy your needs, take advantage of the Lookup industry on top of the screen to discover the one which does.

- Should you be content with the form, verify your decision by clicking the Get now option. Then, choose the prices strategy you want and give your accreditations to register on an bank account.

- Procedure the purchase. Make use of Visa or Mastercard or PayPal bank account to complete the purchase.

- Select the structure and obtain the form on the system.

- Make adjustments. Load, change and produce and signal the delivered electronically Florida Irrevocable Power of Attorney for Transfer of Stock by Executor.

Each design you included with your bank account lacks an expiry date and is also yours eternally. So, if you want to obtain or produce yet another version, just proceed to the My Forms segment and click on around the form you need.

Obtain access to the Florida Irrevocable Power of Attorney for Transfer of Stock by Executor with US Legal Forms, one of the most extensive collection of authorized file templates. Use thousands of specialist and status-particular templates that meet your small business or personal requires and needs.

Form popularity

FAQ

A power of attorney can be made irrevocable if it is given with due consideration and if it specifically mentions that it is irrevocable. Such a power of attorney would operate beyond the life of the granter, says Joshi.

An executor can appoint an attorney to act in their place even if they have intermeddled in the estate, so as long as the grant of probate has not been applied for.

A Florida durable power of attorney form represents a way in which an individual, or principal, can have someone act for them with regard to their finances and other areas of life. The durable type of POA stays in effect even if the principal ends up in a situation where he or she cannot think or act or communicate.

A Power of Attorney, like a Trust, does not need to be registered or recorded in the public records in order to be effective. It does have to be in writing, signed, witnessed and notarized.

How to Fill Out a Florida DPOA FormStep 1: Designate an agent. First, choose someone you trust to be your agent.Step 2: Grant authority. Then, mark on the form which areas of your life you want to give the agent legal power over.Step 3: Ensure your form is durable.Step 4: Sign and date the form.

According to Section 709.2105, in order for the power of attorney to be valid, you must sign the Florida power of attorney in the physical presence of two (2) witnesses and must be acknowledged by a notary.

You cannot give an attorney the power to: act in a way or make a decision that you cannot normally do yourself for example, anything outside the law. consent to a deprivation of liberty being imposed on you, without a court order.

If you create a medical POA, you need to sign the form in the presence of two witnesses, who must also sign. If you create any other type of POA, you need two witness signatures plus the acknowledgement and signature of a notary public.