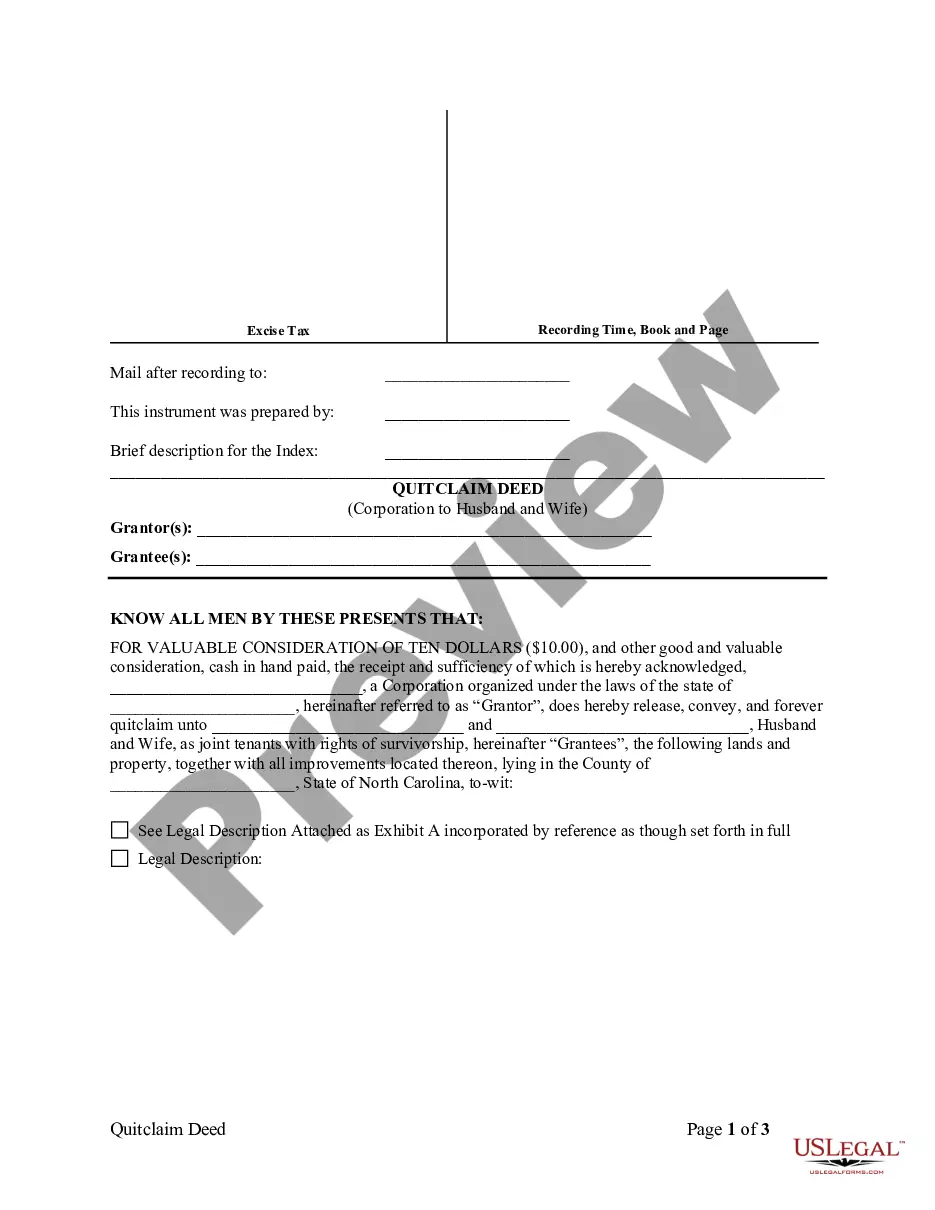

Georgia Administrator's Deed

Description Administrators Deed Estate Uslegal

What is an Administrator's Deed?

An Administrator's Deed is a legal document used in the context of probate law, where an administrator of an estate executes it to transfer property as part of estate management following the death of a property owner who did not leave a will.

Key Elements of an Administrator's Deed

- Grantor Information: The administrator of the estate acting as the seller of the property.

- Grantee Information: The recipient of the property, often an heir or a buyer.

- Legal Description: Detailed description of the property being transferred.

- Signatures: Must be signed by the administrator and typically notarized.

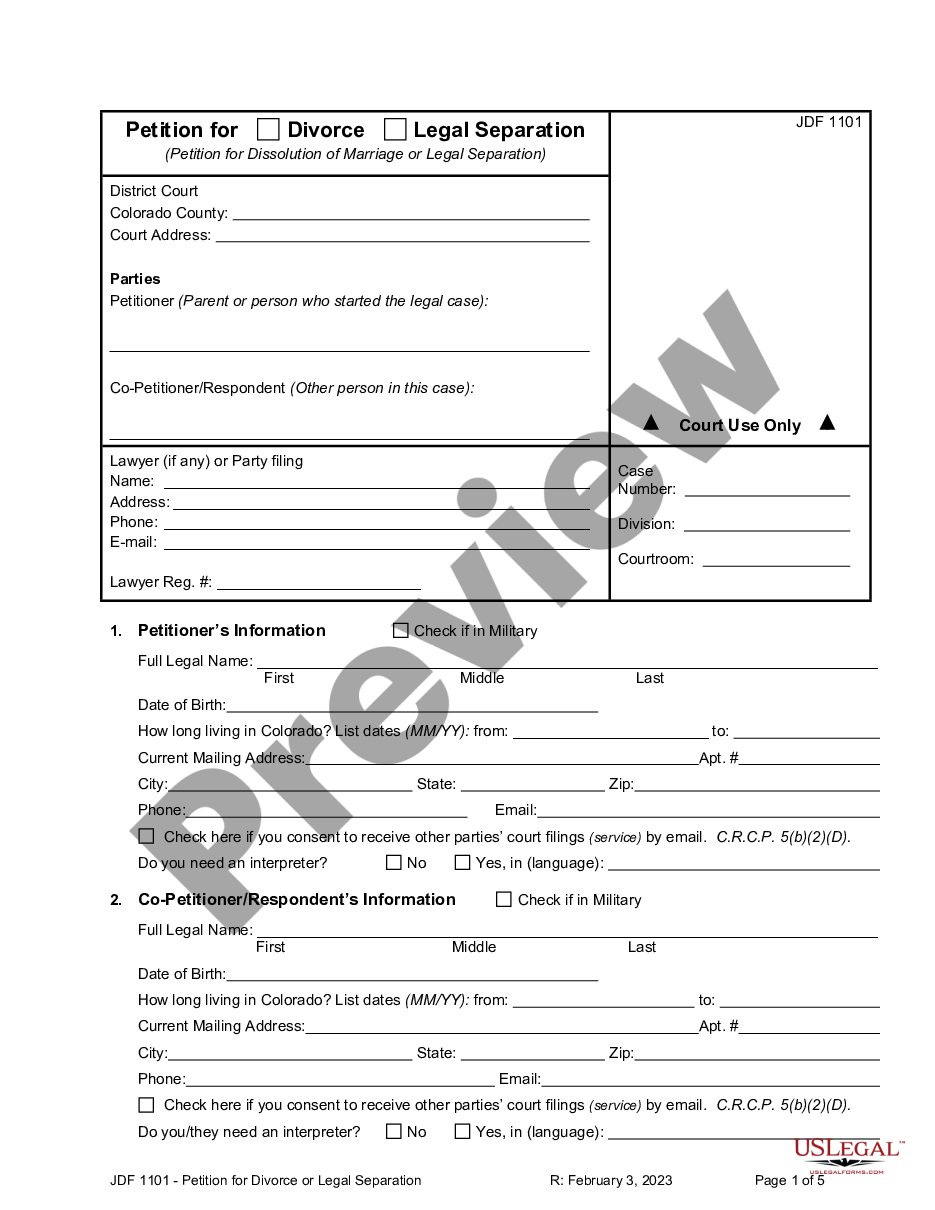

Step-by-Step Guide to Processing an Administrator's Deed

- Determine Authority: Verify the administrator has the authority to manage and dispose of assets.

- Title Search: Conduct a title search to ensure the property can be legally transferred.

- Prepare the Deed: Draft the administrator's deed, including all required legal descriptions and terms.

- Sign and Notarize: The deed must be signed by the administrator and notarized.

- Record the Deed: File the deed with the appropriate county office to make the transfer official.

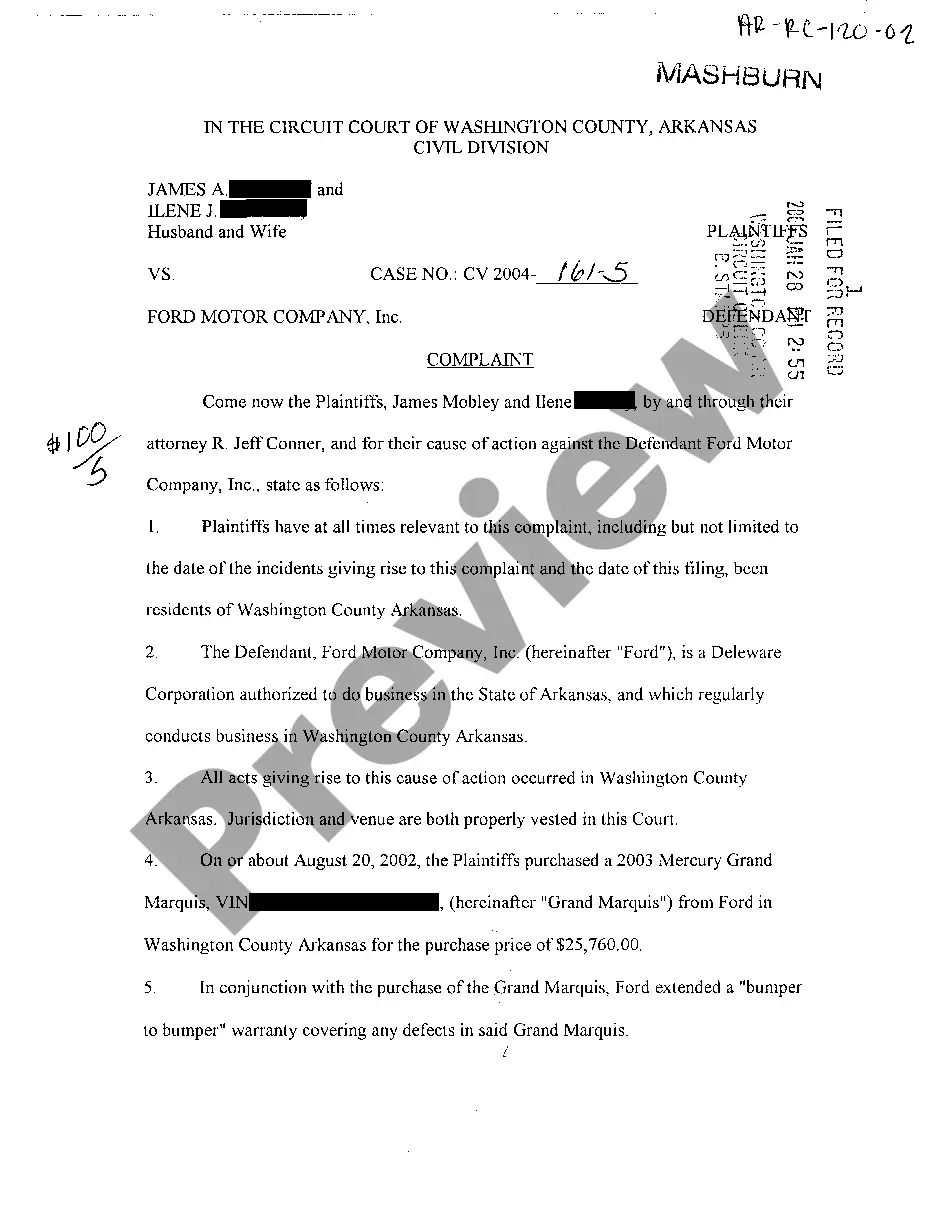

Risk Analysis of Administrator's Deeds

- Title Issues: Risks of undiscovered claims or liens against the property.

- Legal Challenges: Potential disputes over the legitimacy of the administrator's authority or the deed's execution.

- Financial Implications: Costs involved in clearing title or defending against disputes.

Comparison Table: Administrator's Deed vs Executor's Deed

| Criteria | Administrator's Deed | Executor's Deed |

|---|---|---|

| Authority Basis | No will, court appointed | Executor named in will |

| Function | Transfers property in intestate cases | Transfers property according to the will's instructions |

| Legal Requirements | Must be court authorized | Typically follows the directives of the will |

Best Practices for Handling Administrator's Deeds

- Verify Details: Double-check all property and administrative details for accuracy.

- Consult Legal Help: Engage with a probate attorney to ensure all processes comply with state laws.

- Maintain Transparency: Keep all beneficiaries informed throughout the process to prevent disputes.

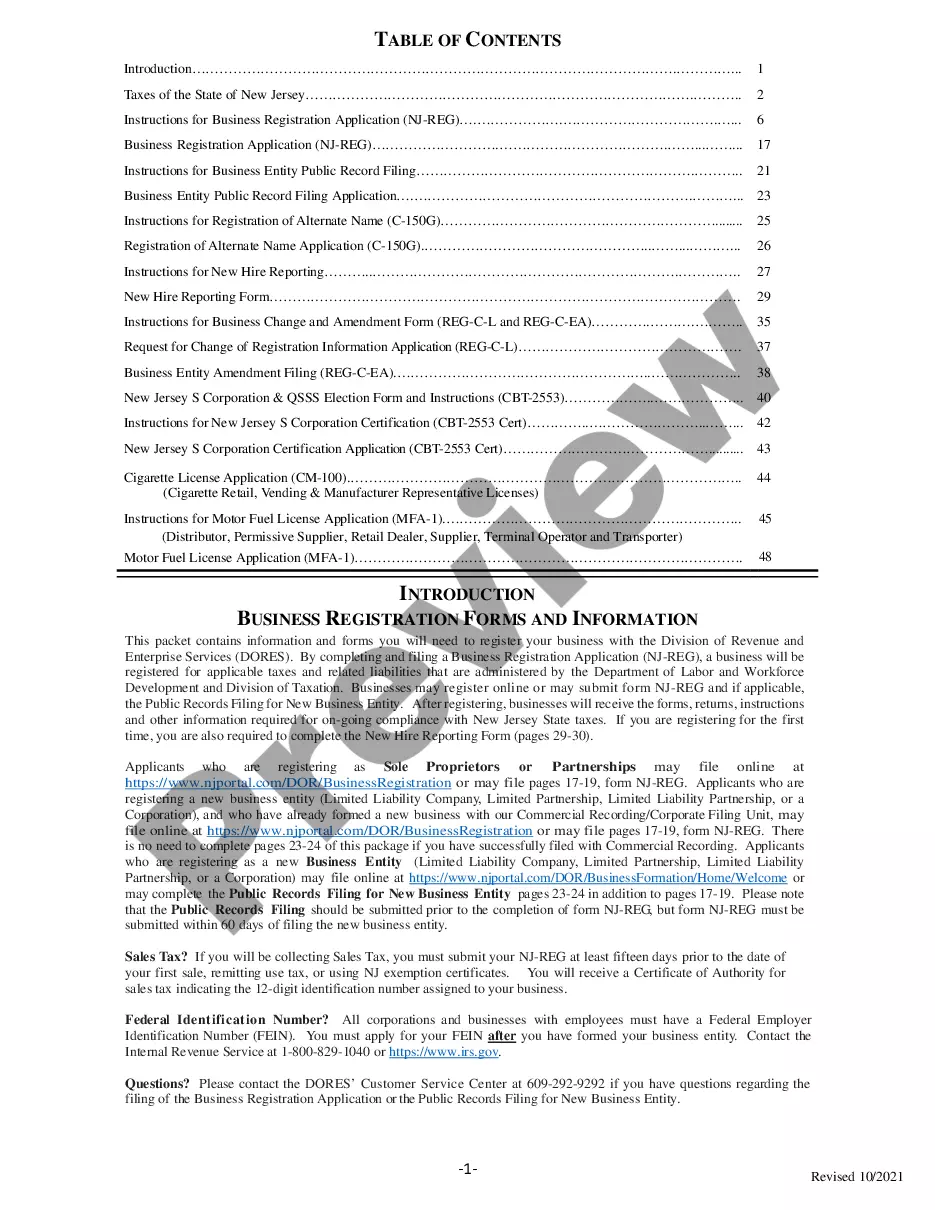

How to fill out Ga Deed Form Warranty Uslegal?

Get one of the most comprehensive catalogue of legal forms. US Legal Forms is really a platform to find any state-specific file in couple of clicks, such as Georgia Administrator's Deed samples. No reason to waste time of your time searching for a court-admissible example. Our accredited specialists ensure you receive up to date examples all the time.

To leverage the forms library, choose a subscription, and sign up your account. If you registered it, just log in and click on Download button. The Georgia Administrator's Deed sample will automatically get saved in the My Forms tab (a tab for all forms you save on US Legal Forms).

To register a new account, follow the quick recommendations listed below:

- If you're going to utilize a state-specific sample, ensure you indicate the correct state.

- If it’s possible, go over the description to learn all the nuances of the document.

- Utilize the Preview option if it’s accessible to check the document's content.

- If everything’s right, click Buy Now.

- Right after choosing a pricing plan, make your account.

- Pay out by credit card or PayPal.

- Downoad the document to your device by clicking on Download button.

That's all! You ought to complete the Georgia Administrator's Deed template and double-check it. To ensure that all things are accurate, contact your local legal counsel for help. Register and easily browse more than 85,000 valuable samples.

Georgia Administrators File Form popularity

Administrator's Deed Ga Other Form Names

Georgia Decedent Wit FAQ

An administrator's deed is a legal document that transfers the property of an intestate individual, who is a person who passes away without a will. In such cases, the property is transferred to descendents or next-of-kin with the use of an administrator's deed since the deceased individual did not have a will.

Step 1: Download the GA quitclaim deed form. Step 2: Fill out the form. Step 3: Write the delivery address. Step 4: Write the preparer's contact information. Step 5: Get the necessary signatures. Step 6: Pay the deed transfer tax.

California mainly uses two types of deeds: the grant deed and the quitclaim deed. Most other deeds you will see, such as the common interspousal transfer deed, are versions of grant or quitclaim deeds customized for specific circumstances.

When you own a home, you own both the deed and title for that property. In real estate, title means you have ownership and a right to use the property.The deed is the physical legal document that transfers ownership. It shows who you bought your house from, and when you sell it, it shows who you sold it to.

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

The Quit Claim Deed form uses the terms of Grantor (Seller or Owner of said property) and Grantee (Buyer of said property) for the two parties involved. First, the parties must fill in the date. Then, write in the name of the county and state in which the property is located.

The simplest way to add a spouse to a deed is through a quitclaim deed. This type of deed transfers whatever ownership rights you have so that you and your spouse now become joint owners. No title search or complex transaction is necessary. The deed will list you as the grantor and you and your spouse as grantees.

The named personal representative uses an executor's deed to transfer real property from a testate estate. The executor's deed contains all the information required for a standard conveyance, such as a quitclaim or warranty deed, but also includes relevant details about the decedent and the probate case.

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.