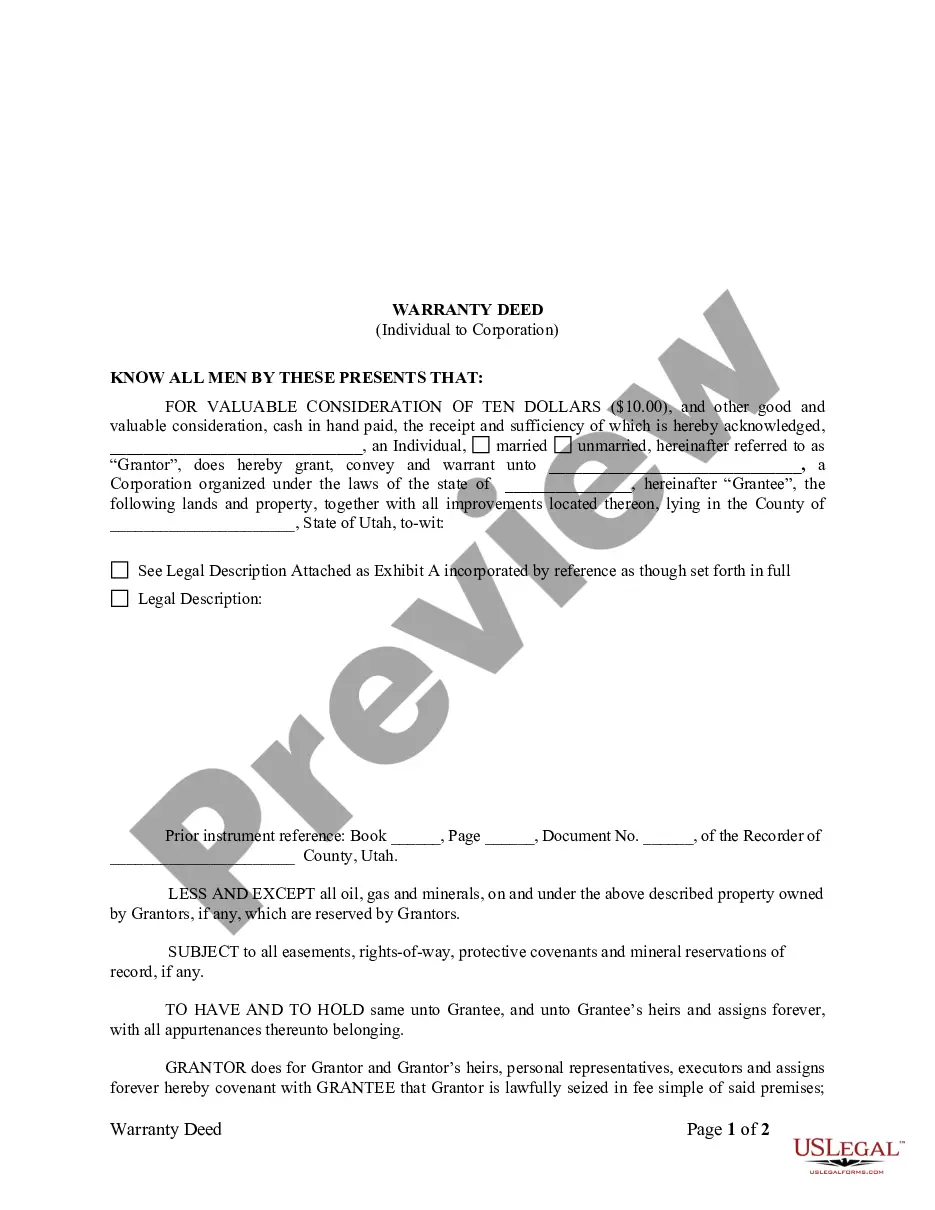

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantee is an Individual. Grantor conveys and quitclaims any interest Grantor might have in the described property to Grantee. This deed complies with all state statutory laws.

Georgia Quitclaim Deed from a Trust to an Individual

Description Georgia Deed Estate

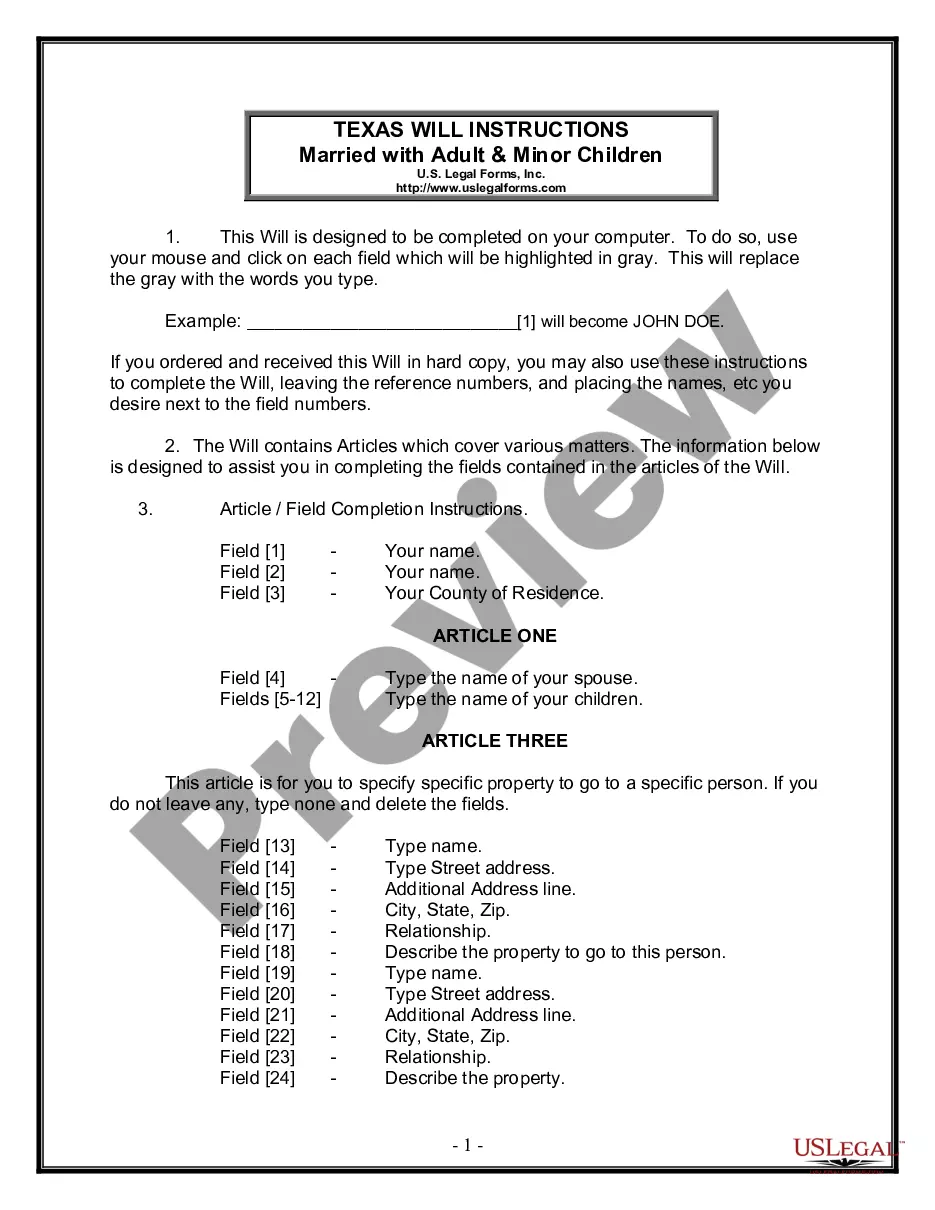

How to fill out Georgia Quitclaim Deed Online?

Get access to the most comprehensive catalogue of legal forms. US Legal Forms is really a system to find any state-specific document in a few clicks, such as Georgia Quitclaim Deed from a Trust to an Individual examples. No requirement to waste hrs of the time seeking a court-admissible form. Our certified specialists ensure you get up to date examples every time.

To benefit from the documents library, choose a subscription, and register an account. If you created it, just log in and then click Download. The Georgia Quitclaim Deed from a Trust to an Individual template will automatically get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, look at brief recommendations listed below:

- If you're having to utilize a state-specific example, be sure to indicate the proper state.

- If it’s possible, review the description to know all the ins and outs of the document.

- Utilize the Preview function if it’s accessible to take a look at the document's information.

- If everything’s correct, click Buy Now.

- After choosing a pricing plan, make an account.

- Pay by credit card or PayPal.

- Downoad the sample to your device by clicking Download.

That's all! You ought to submit the Georgia Quitclaim Deed from a Trust to an Individual form and double-check it. To be sure that things are exact, call your local legal counsel for help. Join and simply browse more than 85,000 beneficial forms.

Real Estate Form Form popularity

Deed Real Estate Printable Other Form Names

Quitclaim Deed Form Purchase FAQ

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed is quick and easy because it transfers all of one person's interest in the property to another.The deed transfers all claims the seller has to the property, if any. If the seller has no interest in the real estate, no interest is transferred.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

A quitclaim deed is a deed (proof of ownership) that is passed from a grantor (the existing property owner) to a grantee (the new property owner) that does not have a warranty.A quitclaim deed has no guarantees for the grantor or grantee.