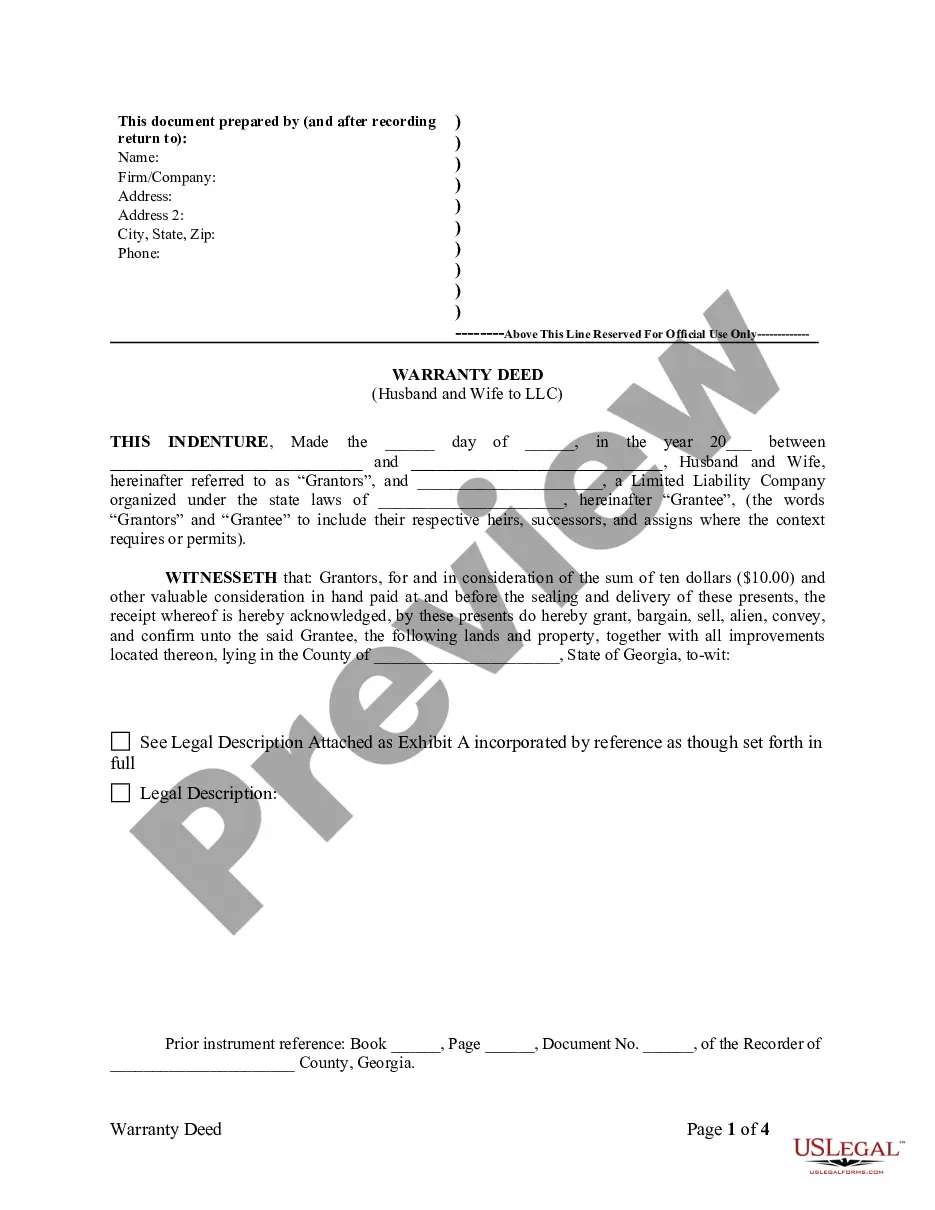

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

Georgia Warranty Deed from Husband and Wife to LLC

Description

How to fill out Georgia Warranty Deed From Husband And Wife To LLC?

Get the most expansive catalogue of legal forms. US Legal Forms is actually a platform where you can find any state-specific file in couple of clicks, including Georgia Warranty Deed from Husband and Wife to LLC templates. No reason to waste time of the time seeking a court-admissible example. Our qualified professionals make sure that you get updated examples every time.

To make use of the forms library, pick a subscription, and sign up your account. If you already created it, just log in and click on Download button. The Georgia Warranty Deed from Husband and Wife to LLC file will automatically get kept in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new account, follow the brief instructions listed below:

- If you're having to use a state-specific example, be sure you indicate the proper state.

- If it’s possible, review the description to learn all the ins and outs of the form.

- Utilize the Preview option if it’s accessible to check the document's information.

- If everything’s correct, click on Buy Now button.

- After choosing a pricing plan, create your account.

- Pay out by credit card or PayPal.

- Save the sample to your computer by clicking Download.

That's all! You need to complete the Georgia Warranty Deed from Husband and Wife to LLC template and check out it. To make certain that all things are precise, contact your local legal counsel for help. Join and easily find around 85,000 beneficial forms.

Form popularity

FAQ

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Creating an LLC for your rental property is a smart choice as a property owner. It reduces your liability risk, effectively separates your assets, and has the tax benefit of pass-through taxation.

Transferring property to an LLC is a simple way to reduce your personal liability for claims relating to the property. But a property title transfer should be only part of your strategy. It's also important to contact an insurance agent and obtain adequate liability insurance to cover any claims that might arise.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Does LLC ownership count as time used as a primary residence? For a single-member LLC, the answer is typically yes. For example, if the house is owned by an LLC. The Treasury Regulations allow for the capital gains exclusion when title is held by a single-member disregarded entity.

No you can't. A single member LLC is just you as far as the IRS is concerned. You're just living in your own property. You can't rent your own house to yourself.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Step 1: Form an LLC or Corporation. You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity. Step 2: Complete a Quitclaim Deed. Step 3: Record Your Quitclaim Deed.