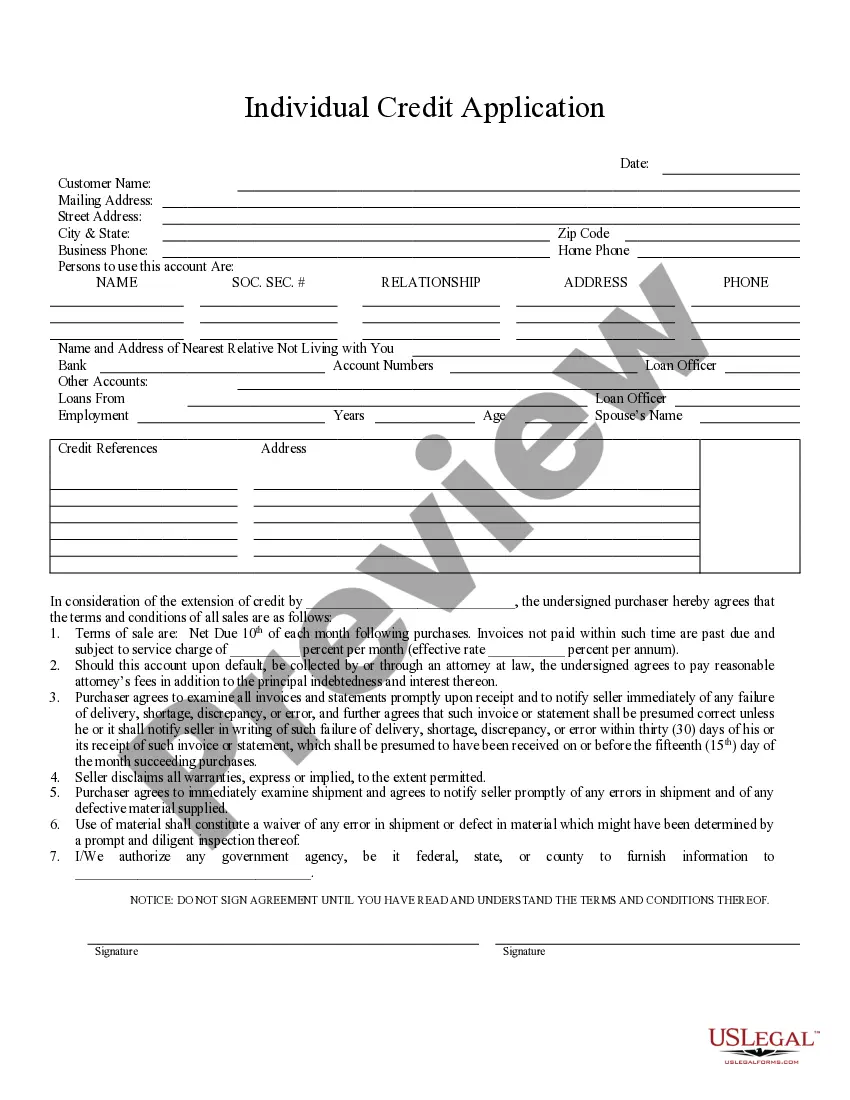

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Georgia Individual Credit Application

Description

How to fill out Georgia Individual Credit Application?

Get one of the most expansive catalogue of legal forms. US Legal Forms is actually a solution where you can find any state-specific document in clicks, such as Georgia Individual Credit Application samples. No reason to waste hrs of the time trying to find a court-admissible sample. Our licensed pros ensure that you receive updated documents every time.

To take advantage of the forms library, pick a subscription, and register an account. If you created it, just log in and then click Download. The Georgia Individual Credit Application sample will automatically get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new profile, look at short guidelines below:

- If you're proceeding to utilize a state-specific sample, be sure to indicate the correct state.

- If it’s possible, go over the description to learn all of the ins and outs of the document.

- Make use of the Preview option if it’s accessible to look for the document's information.

- If everything’s appropriate, click Buy Now.

- Right after picking a pricing plan, make your account.

- Pay out by card or PayPal.

- Downoad the sample to your computer by clicking on Download button.

That's all! You need to submit the Georgia Individual Credit Application template and check out it. To be sure that everything is accurate, contact your local legal counsel for support. Register and easily look through above 85,000 useful samples.

Form popularity

FAQ

YOU MAY USE FORM 500EZ IF: You are not 65 or over, or blind. Your filing status is single or married filing joint and you do not claim any exemptions other than yourself or yourself and your spouse.

A state can refund the amount of a credit at a discounted rate; Limited partnerships or a syndication structure can be used to transfer the credit; or. The state taxing authority can issue a tax credit certificate which can be sold to a third party.

Georgia's Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend $500,000 or more on production and post-production in Georgia, either in a single production or on multiple projects.

On average, $1 of Georgia Film Tax credit can be purchased for $0.87 to $0.90. Taxpayers have the ability to purchase these credits retroactively for up to three years; however, the purchase price can vary depending on the timing of the purchase and the tax year in which the credit will be applied.

Designed to streamline the filing process, form 500 EZ is for residents who have made less than $100,000 in a year and are not over the age of 65. Residents can also use the form if they do not have any dependents and are a full-time resident of the state of Georgia.

Reduce the amount of income tax owed by low- and middle-income families. The Georgia Work Credit would reduce tax bills for families that work but struggle to make ends meet because of low-wage jobs. A young married couple with a new child and $29,000 of annual income could see a state tax cut of $250.

The idea behind a film tax credit is pretty simple: by moving production to a state, you'll be able to save money on taxes owed, or get some other perks in exchange for shooting on location there. Of course you may have to use a certain amount of local vendors to qualify, but every offer is different.

The series 100 credits are a group of credits that can be claimed on Schedule 2 and Schedule 2B of your Georgia income tax return.The Georgia Department of Revenue requires electronic filing for income tax returns in which series 100 credits are generated, allocated, claimed, utilized, or included in any manner.

How Can an Individual Benefit from the Georgia Film Tax Credit?The broadening of this legislation permits a Georgia corporate, fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. On average, $1 of Georgia Film Tax credit can be purchased for $0.87 to $0.90.