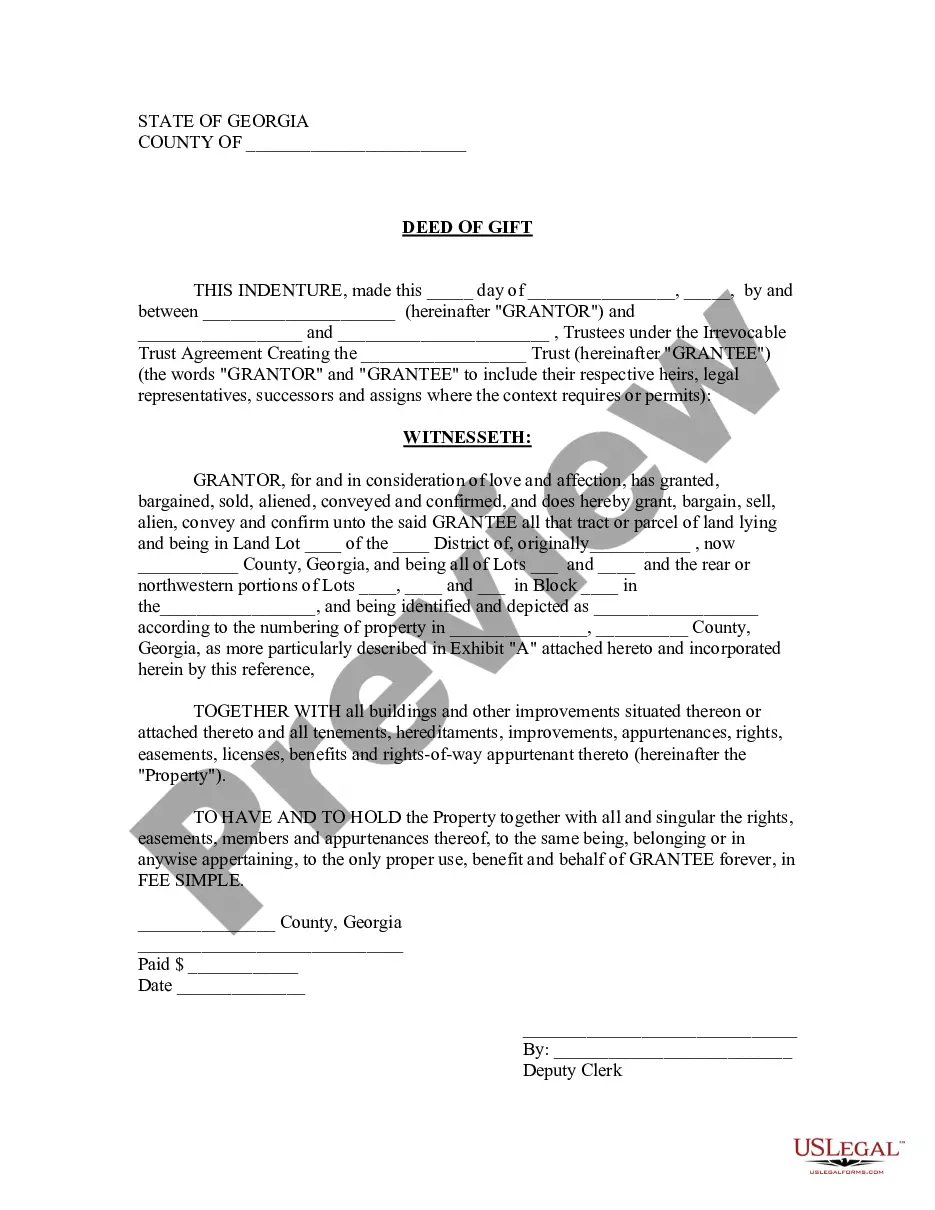

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed of Gift, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s). USLF control no. GA-8215

Georgia Deed of Gift

Description

How to fill out Georgia Deed Of Gift?

Obtain the most comprehensive collection of sanctioned forms.

US Legal Forms serves as a platform to locate any state-specific document in just a few clicks, like Georgia Deed of Gift samples.

There's no need to spend many hours searching for a court-acceptable form.

After selecting a pricing plan, set up your account. Make your payment via card or PayPal. Download the document to your computer by clicking Download. That's it! You should fill out the Georgia Deed of Gift template and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and easily access over 85,000 valuable samples.

- To access the forms library, select a subscription and create your account.

- If you have already done so, simply Log In and hit the Download button.

- The Georgia Deed of Gift example will be immediately saved in the My documents section (a section for each form you download from US Legal Forms).

- To create a new account, follow the quick instructions below.

- If you're planning to use a state-specific example, ensure you select the correct state.

- If possible, review the description to understand all the specifics of the form.

- Use the Preview feature if available to check the document's content.

- If everything looks good, click the Buy Now button.

Form popularity

FAQ

You should record a deed of gift in Georgia promptly after its execution. While there is no strict deadline, delaying the recording may expose your ownership to disputes or claims from other parties. Recording the deed quickly solidifies your ownership and protects you against potential problems. If you need guidance on how to complete and record your Georgia Deed of Gift effectively, US Legal Forms can provide the resources you need.

Yes, you should always keep a copy of your house deed, including your Georgia Deed of Gift, for your records. This document serves as proof of your property ownership and may be needed for various legal purposes, such as selling or refinancing your home. Having a copy readily available simplifies future transactions. Always store important documents securely to protect them from loss or damage.

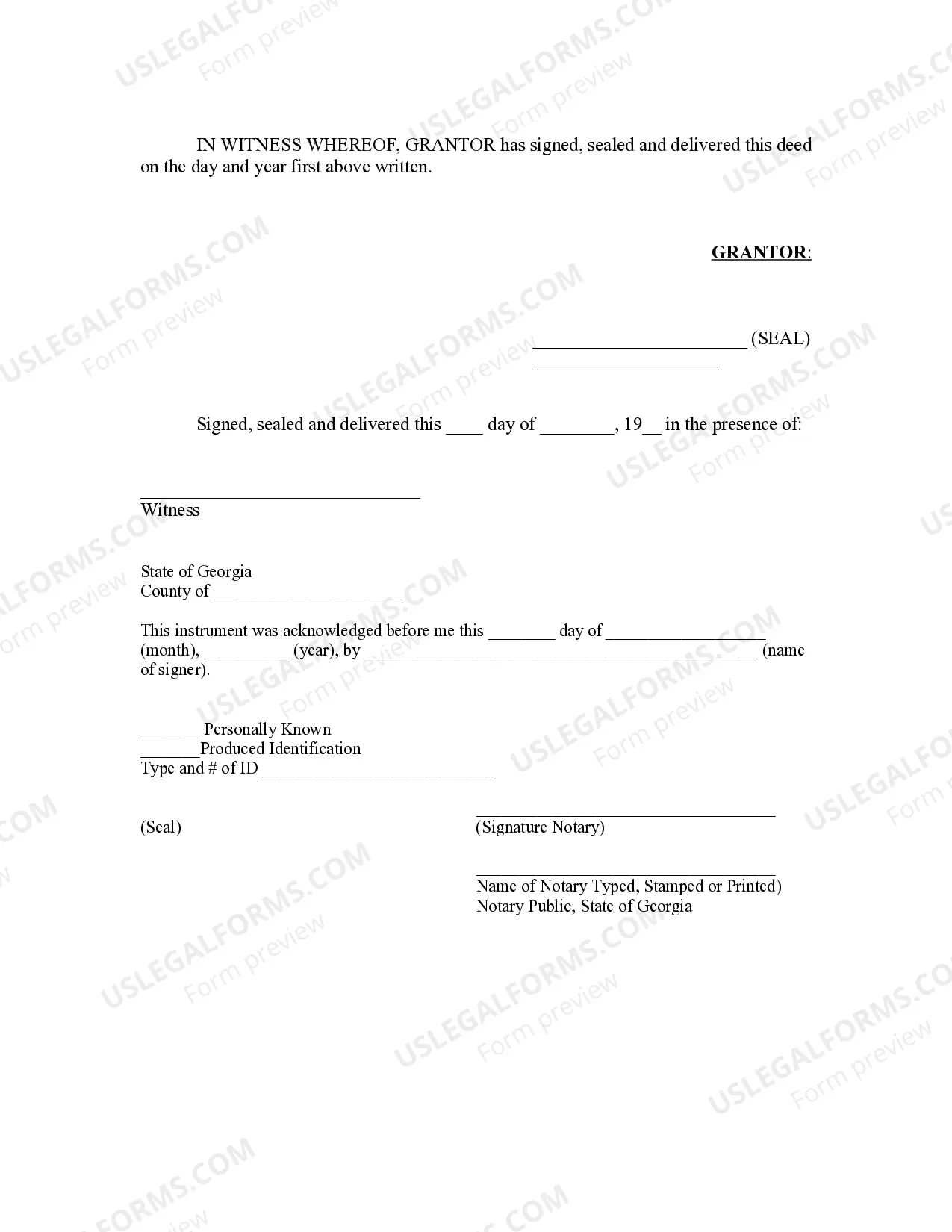

To record a deed in Georgia, you need to first prepare the deed document, such as a Georgia Deed of Gift, ensuring it is properly signed and notarized. Afterward, visit the appropriate County Clerk's office and submit your deed along with any required fees. The clerk will then record your deed in the public records, making your ownership official. For comprehensive assistance with the recording process, consider using US Legal Forms.

In Georgia, a deed, including a Georgia Deed of Gift, must be recorded in the county where the property is located. Recording the deed at the County Clerk's office ensures the transfer of property is public and protects your rights as the new owner. This step is crucial for establishing ownership. By recording your deed, you help avoid future disputes regarding property ownership.

In Georgia, while it is not a strict requirement for an attorney to prepare a Georgia Deed of Gift, it is highly advisable. A knowledgeable attorney can ensure that the deed meets all legal standards and includes necessary provisions. By consulting a legal expert, you can avoid potential issues related to title transfer and ensure the document is properly executed. Ultimately, having professional assistance can provide peace of mind during the gifting process.

The primary purpose of a Georgia Deed of Gift is to formally document the voluntary transfer of property from one individual to another. It acts as a legal declaration that makes the transfer unquestionable and binding. Utilizing a deed of gift is particularly helpful for estate planning, allowing for smooth transitions of assets during a person's lifetime.

Yes, a Georgia Deed of Gift typically supersedes a will regarding the property that has been gifted. When you execute a gift deed, the transfer is immediate and legally binding. Thus, any mention of that property in your will will not hold if you have already effectively gifted it to someone.

Gifting a house using a Georgia Deed of Gift can provide immediate benefits, such as eliminating probate, but it also means you lose the property rights. Conversely, inheriting a house can come with a step-up in property basis, which can reduce tax liabilities. Weighing emotional and financial factors is critical in deciding whether to gift or inherit property.

Using a Georgia Deed of Gift allows you to transfer property during your lifetime, which can help avoid probate. However, the potential downside includes losing control of the property once the gift is made. In contrast, a will keeps the property within your control until your passing, but it requires probate, which can be time-consuming and costly.

A quitclaim deed transfers ownership from one party to another without any guarantees. In contrast, a Georgia Deed of Gift serves a specific purpose, where one person gives property to another without expecting payment in return. The primary distinction lies in the intent: a quitclaim deed conveys rights, while a gift deed conveys ownership as an outright gift.