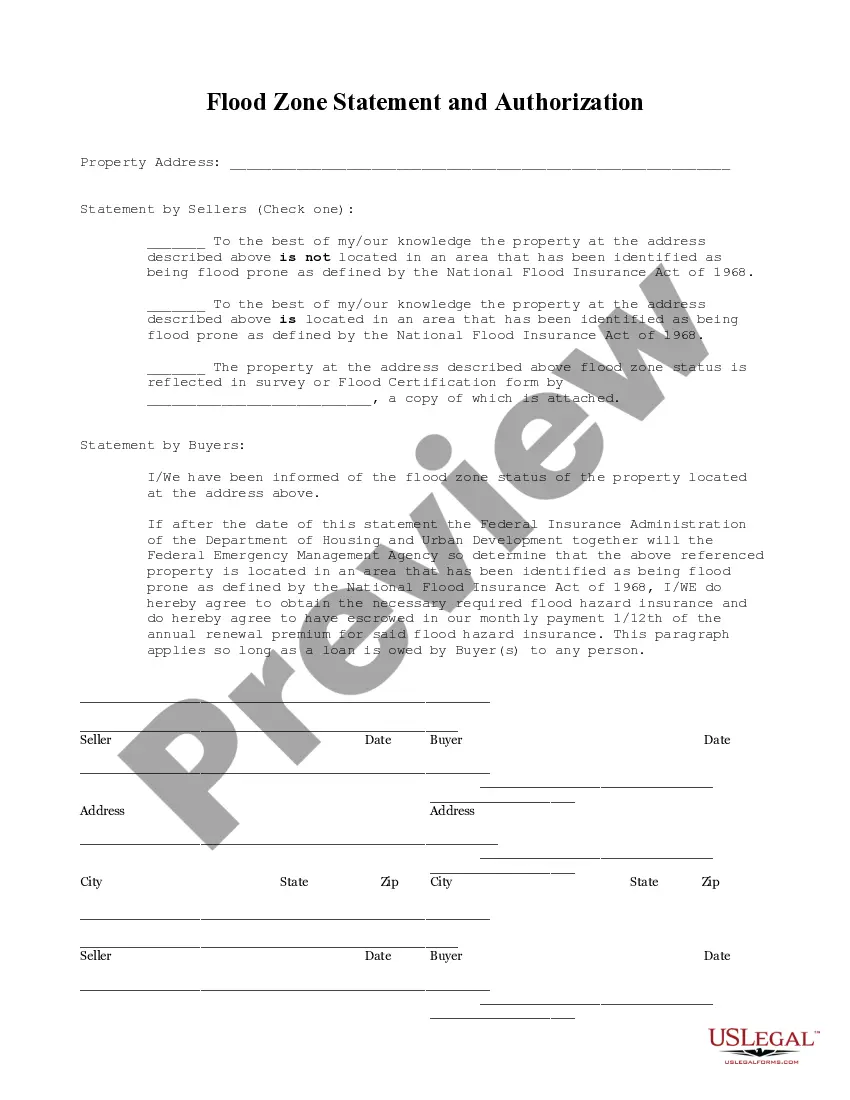

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

Georgia Flood Zone Statement and Authorization

Description

How to fill out Georgia Flood Zone Statement And Authorization?

Get access to one of the most holistic catalogue of legal forms. US Legal Forms is really a system where you can find any state-specific form in a few clicks, including Georgia Flood Zone Statement and Authorization templates. No requirement to spend hrs of the time searching for a court-admissible sample. Our qualified professionals make sure that you receive updated examples every time.

To benefit from the forms library, pick a subscription, and sign up your account. If you created it, just log in and then click Download. The Georgia Flood Zone Statement and Authorization template will quickly get stored in the My Forms tab (a tab for all forms you download on US Legal Forms).

To create a new profile, look at simple guidelines below:

- If you're having to utilize a state-specific documents, make sure you indicate the proper state.

- If it’s possible, go over the description to know all of the ins and outs of the form.

- Use the Preview option if it’s offered to check the document's content.

- If everything’s appropriate, click on Buy Now button.

- After selecting a pricing plan, create an account.

- Pay out by credit card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You should submit the Georgia Flood Zone Statement and Authorization template and check out it. To ensure that everything is accurate, call your local legal counsel for help. Sign up and easily find around 85,000 valuable samples.

Form popularity

FAQ

You're only obligated to get flood insurance if your mortgage lender requires it and if your property is located in a high-risk flood zone.

Maintain your current flood insurance coverage. Contact a surveyor to perform an elevation certificate on your home. Submit an application for a Letter of Map Amendment to FEMA once you have received an elevation certificate showing your home to be above the flood plain. Wait for FEMA to evaluate your application.

Your local floodplain manager: Your local floodplain manager may already have a certificate on file. The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.

AE. Areas with a 1% annual chance of flooding and a 26% chance of flooding over the life of a 30 year. mortgage.

AE. Areas with a 1% annual chance of flooding and a 26% chance of flooding over the life of a 30 year. mortgage.

1Your local floodplain manager: Your local floodplain manager may already have a certificate on file.2The seller of your property: If you're buying a property, the sellers may already have the certificate, and you can ask them for it before purchasing.What Is An Elevation Certificate for Flood Insurance? - ValuePenguin\nwww.valuepenguin.com > elevation-certificate-flood-insurance

Evidence of flood insurance Completed and executed NFIP Flood Insurance Application PLUS a copy of the Borrower's premium check or agent's paid receipt.

Zone A. Zone A is the flood insurance rate zone that corresponds to the I-percent annual chance floodplains that are determined in the Flood Insurance Study by approximate methods of analysis.

The designation AE indicates areas at high risk for flooding and provides the base flood elevations (BFEs) for them. The AE designation replaced the old designations of A1 to A30, known as the numbered A zones.