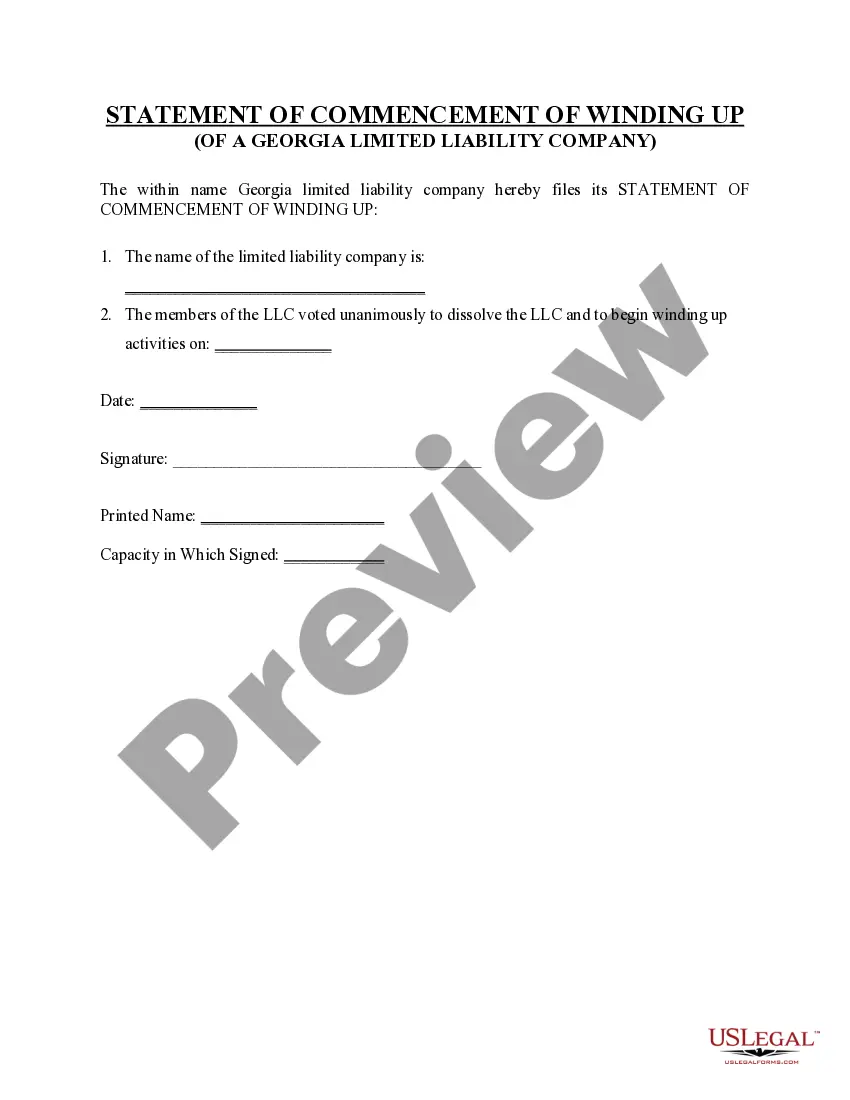

The dissolution package contains all forms to dissolve a LLC or PLLC in Georgia, step by step instructions, addresses, transmittal letters, and other information.

Georgia Dissolution Package to Dissolve Limited Liability Company LLC

Description Georgia Llc

How to fill out Ga Dissolution Dissolve?

Access one of the most extensive library of authorized forms. US Legal Forms is actually a platform where you can find any state-specific file in clicks, including Georgia Dissolution Package to Dissolve Limited Liability Company LLC templates. No need to spend time of the time trying to find a court-admissible sample. Our certified specialists ensure that you get up to date examples every time.

To leverage the forms library, pick a subscription, and sign-up an account. If you registered it, just log in and click on Download button. The Georgia Dissolution Package to Dissolve Limited Liability Company LLC template will immediately get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To register a new profile, follow the quick instructions below:

- If you're having to use a state-specific sample, be sure to indicate the appropriate state.

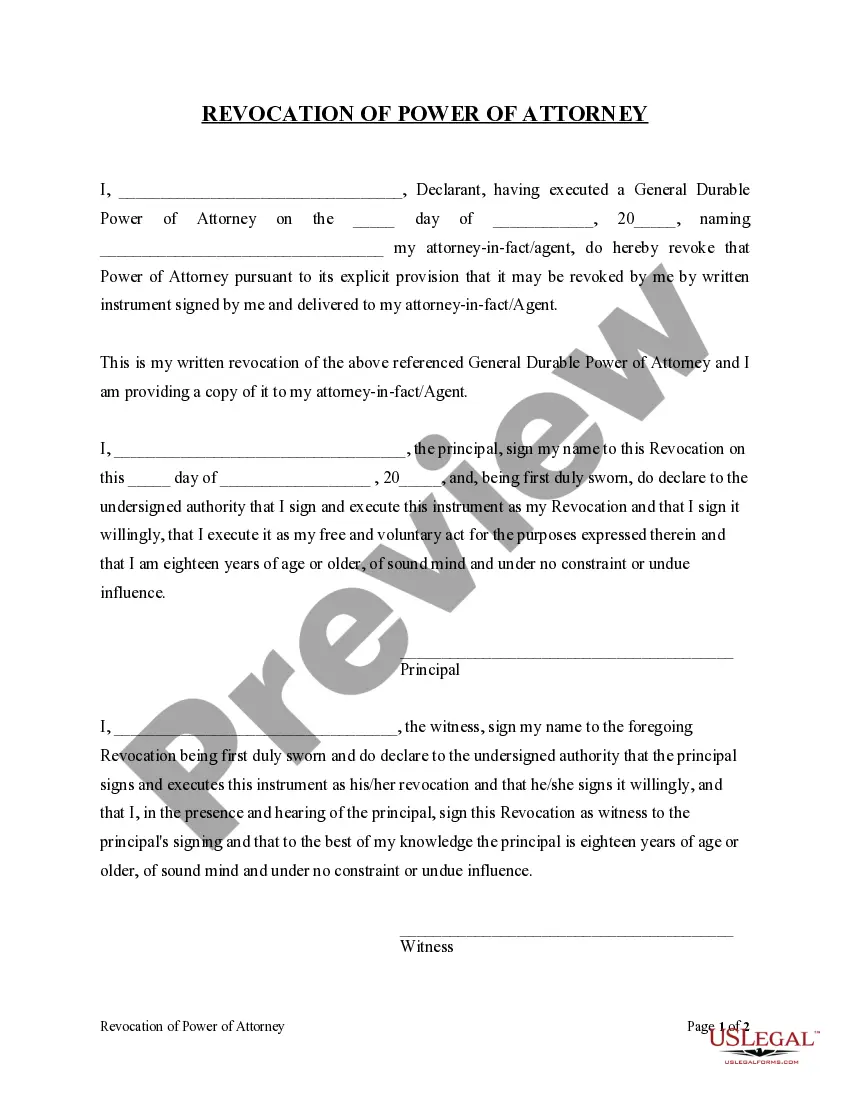

- If it’s possible, look at the description to learn all of the ins and outs of the form.

- Make use of the Preview option if it’s offered to take a look at the document's information.

- If everything’s right, click on Buy Now button.

- Right after choosing a pricing plan, make an account.

- Pay by card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You should submit the Georgia Dissolution Package to Dissolve Limited Liability Company LLC template and check out it. To ensure that things are correct, speak to your local legal counsel for assist. Join and easily look through above 85,000 helpful templates.

Dissolve Company Form popularity

Dissolve Company Online Other Form Names

State Georgia Llc FAQ

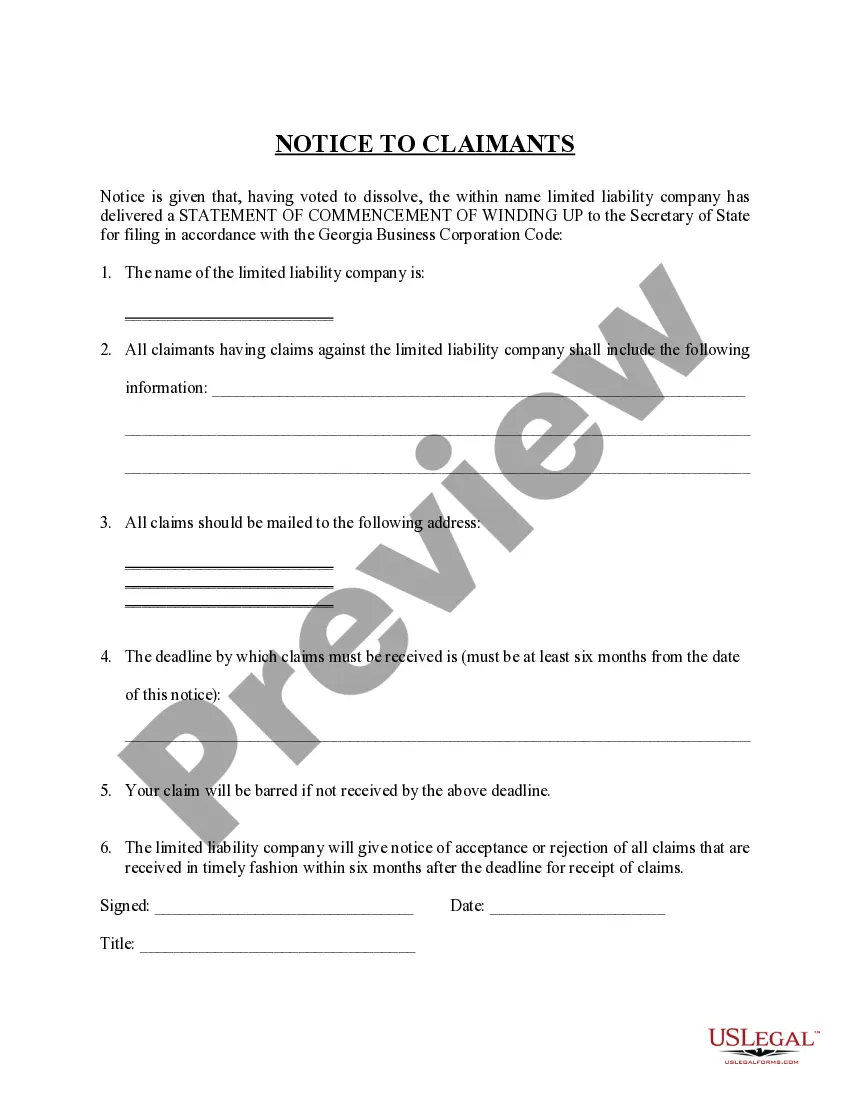

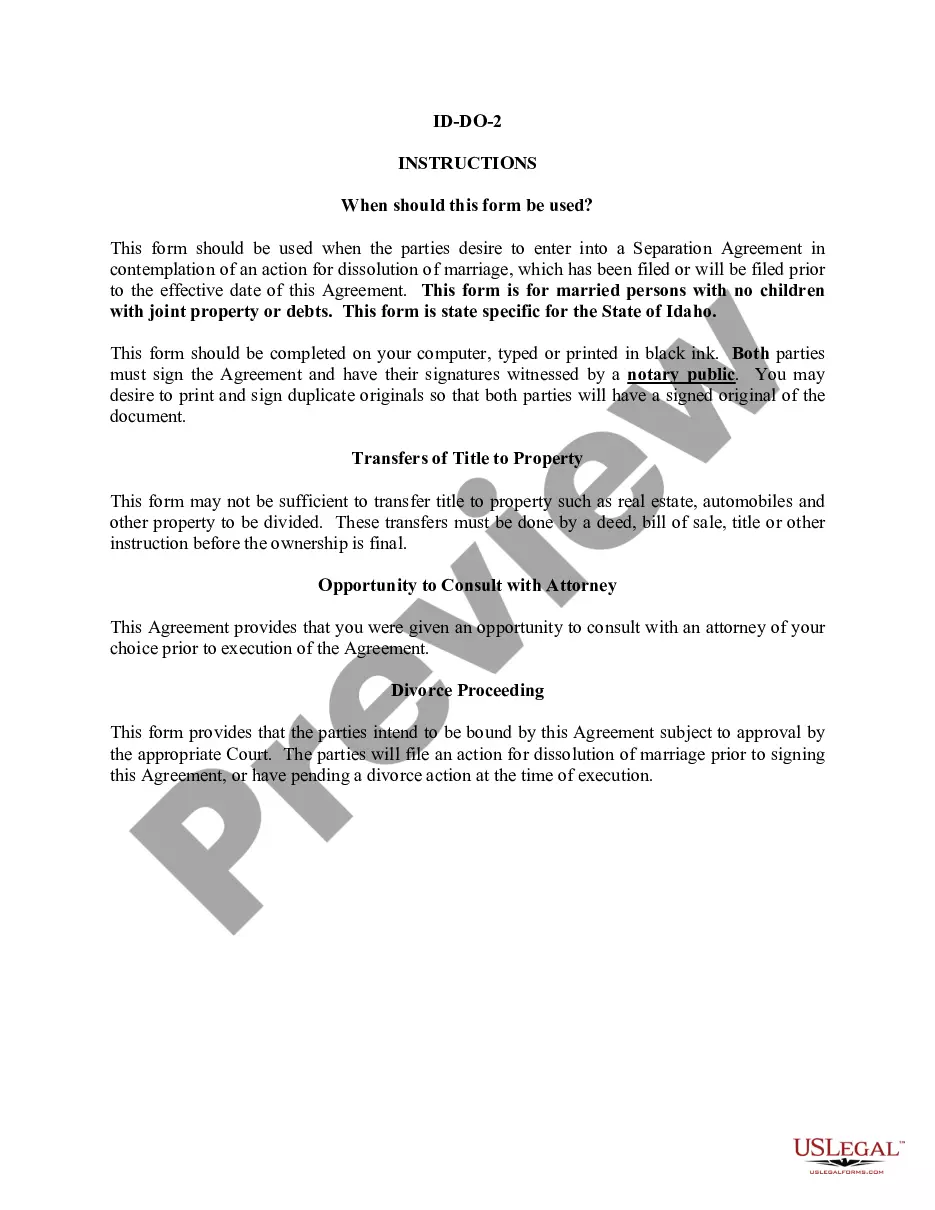

Verify that the LLC's status with the state is active and current. Prepare a certificate of termination. 4. Mail required documentation to the Secretary of State's office. Watch for the state to issue your confirmed certificate of termination.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

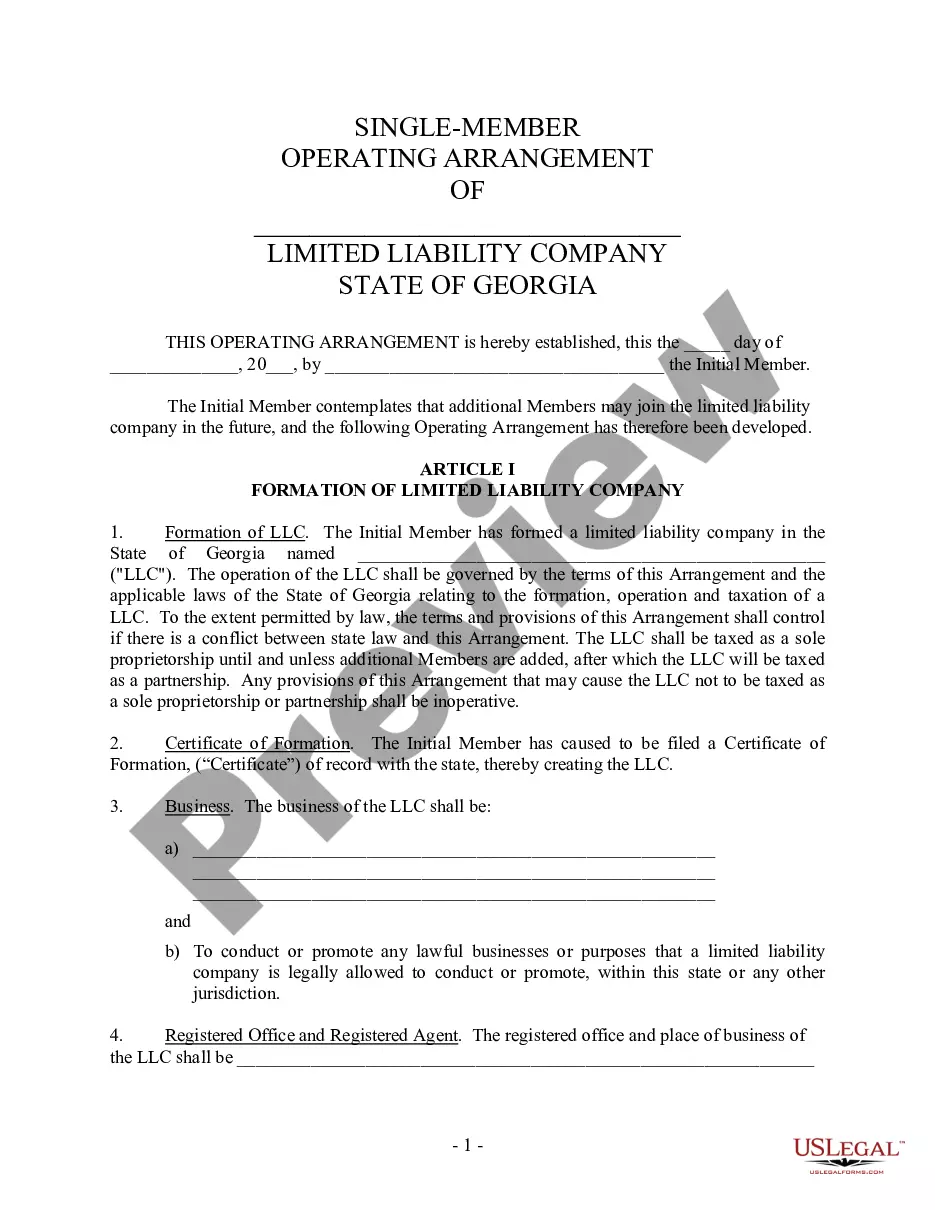

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

The maximum penalty is for the LLC to be administratively dissolved or terminated. This means that the LLC's right to conduct business is ended and the only action the LLC can lawfully take is to wind up its affairs, pay its remaining debts and distribute the remaining assets to the owners.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.

The name of the corporation; The date on which the notice of intent to dissolve was filed and a statement that the notice has not been revoked;

There is no fee to file the California dissolution forms. To speed up the process, you can pay for expedited service and preclearance.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.