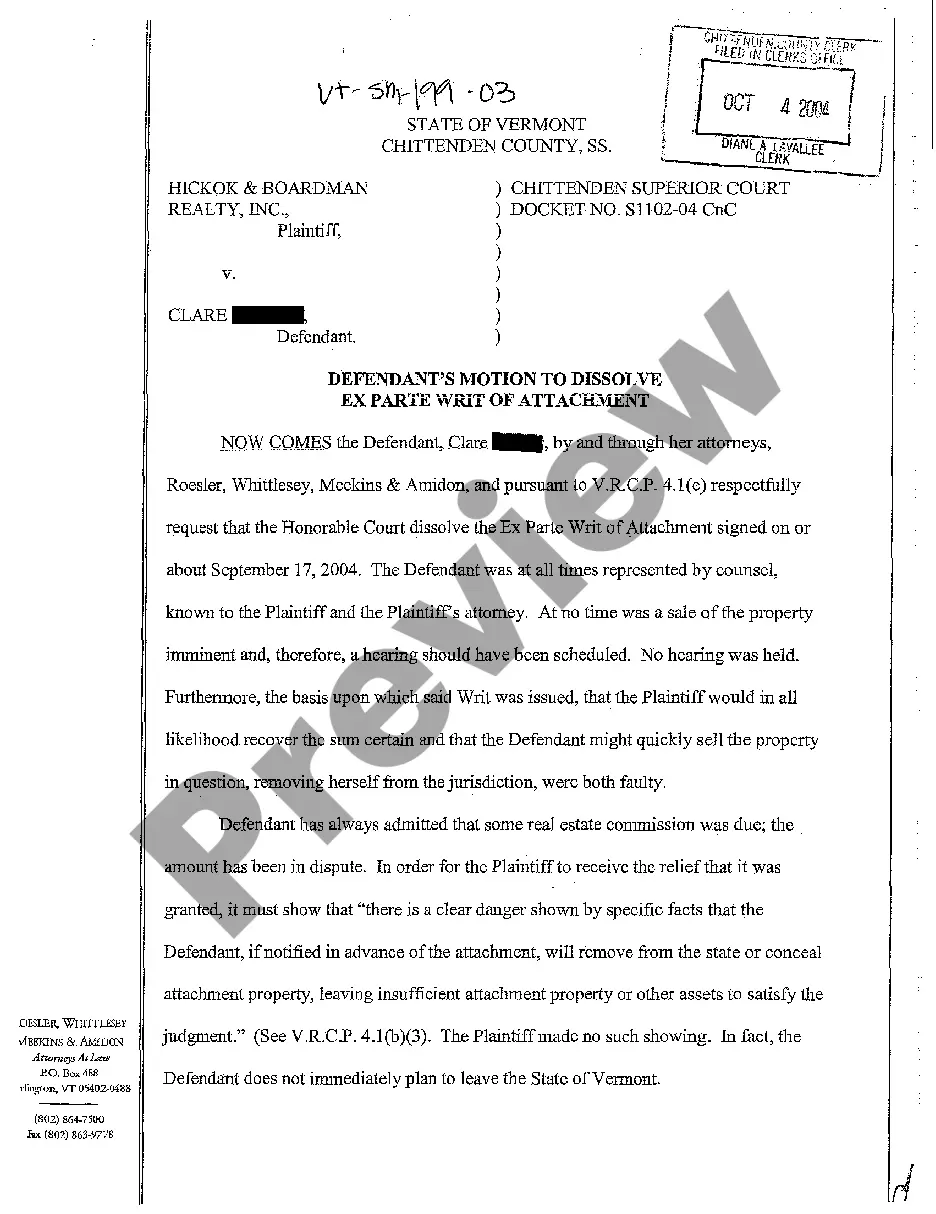

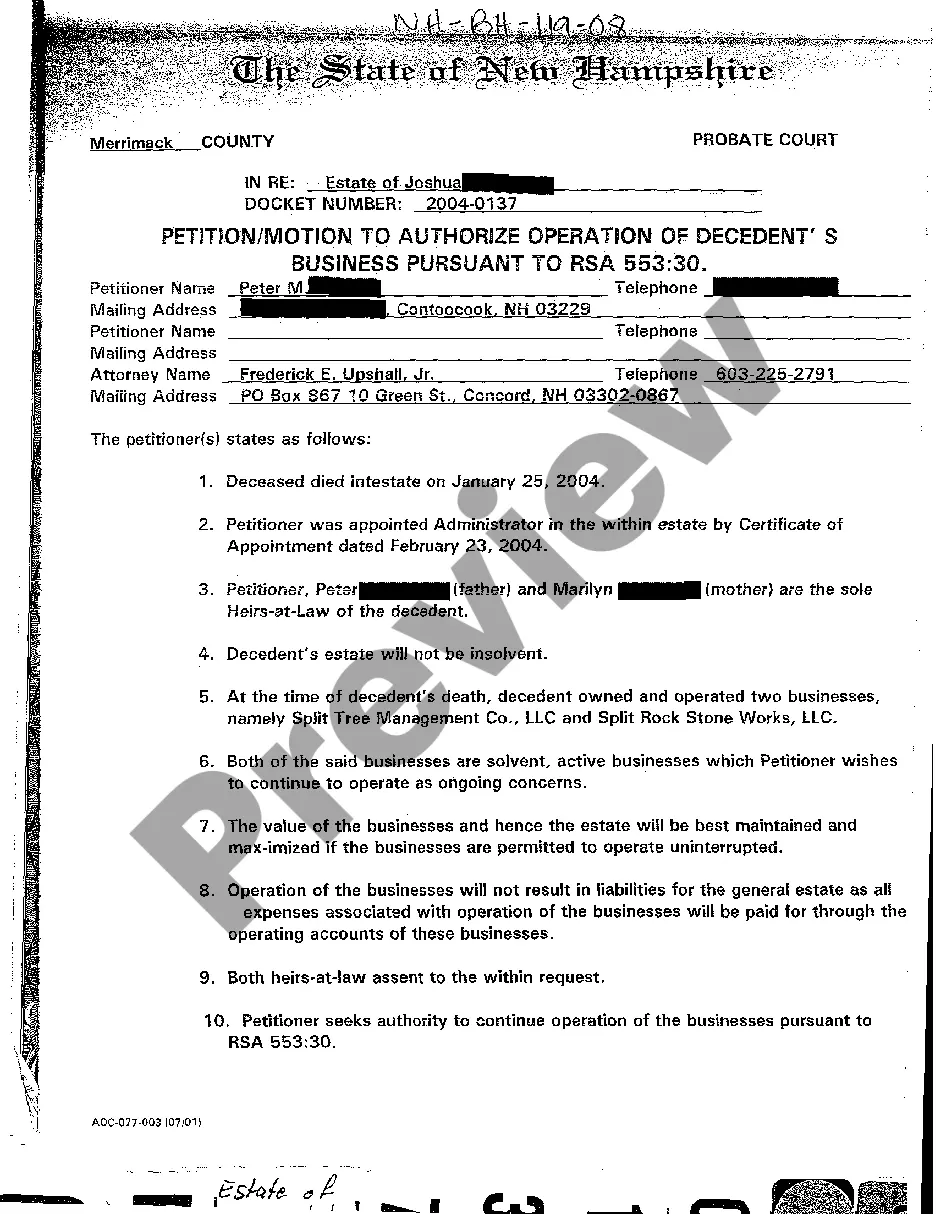

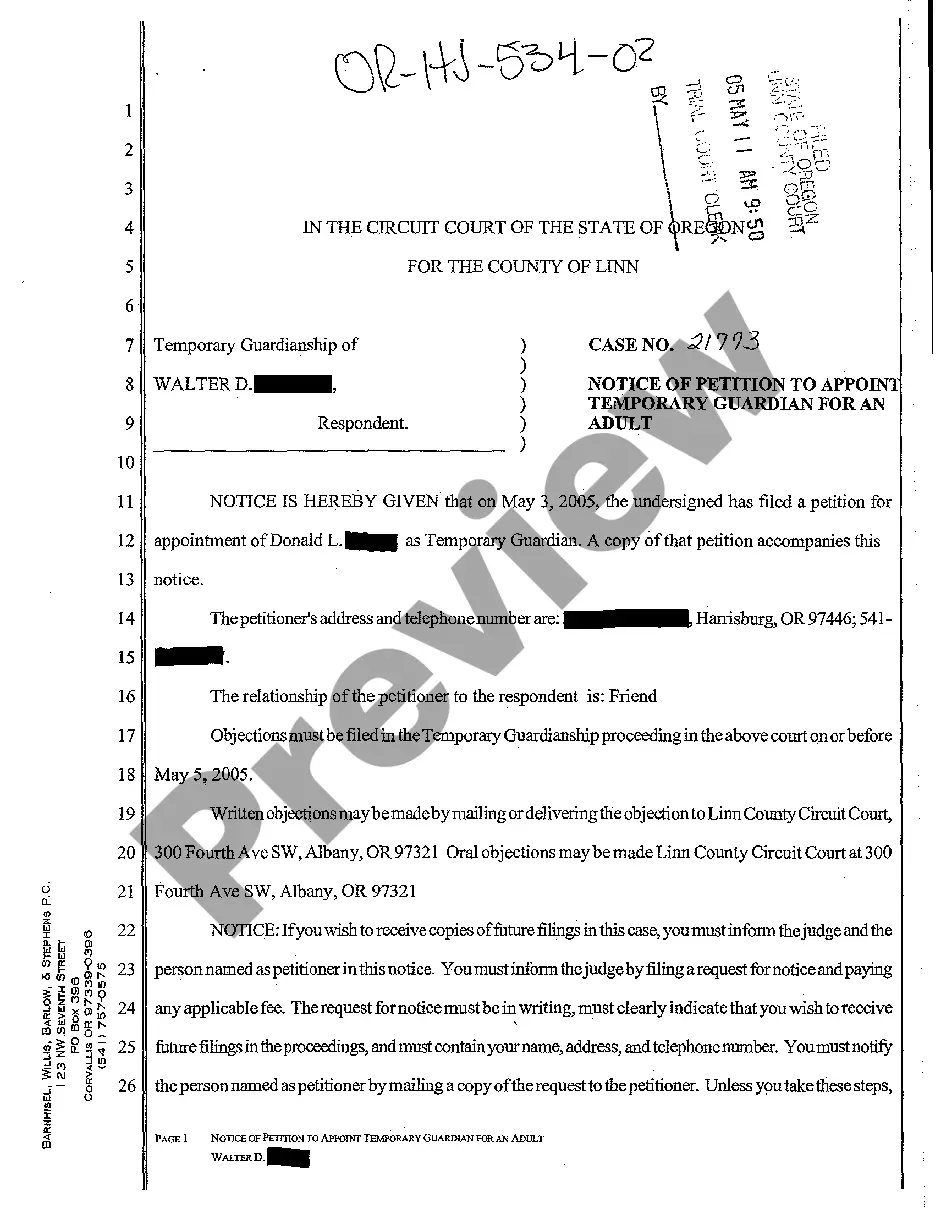

This form is for the posting of a bond with the court (when that is required) for administrators, guardians, executors, conservators, etc.

Georgia Bond of Administrators, Guardians, and Executors, etc.

Description

How to fill out Georgia Bond Of Administrators, Guardians, And Executors, Etc.?

Get access to one of the most extensive catalogue of legal forms. US Legal Forms is really a system to find any state-specific form in couple of clicks, even Georgia Bond of Administrators, Guardians, and Executors, etc. templates. No need to spend time of the time searching for a court-admissible sample. Our certified professionals ensure you get updated documents every time.

To benefit from the forms library, pick a subscription, and sign-up your account. If you did it, just log in and click Download. The Georgia Bond of Administrators, Guardians, and Executors, etc. file will immediately get saved in the My Forms tab (a tab for every form you save on US Legal Forms).

To create a new profile, look at short recommendations listed below:

- If you're going to use a state-specific documents, make sure you indicate the correct state.

- If it’s possible, go over the description to learn all of the ins and outs of the form.

- Use the Preview option if it’s offered to check the document's content.

- If everything’s right, click Buy Now.

- After picking a pricing plan, make an account.

- Pay out by credit card or PayPal.

- Downoad the document to your computer by clicking on Download button.

That's all! You need to complete the Georgia Bond of Administrators, Guardians, and Executors, etc. form and double-check it. To make sure that things are precise, contact your local legal counsel for help. Register and simply find more than 85,000 useful templates.

Form popularity

FAQ

It is the executor's or the administrator's responsibility to collect and distribute the assets and to pay any death taxes and expenses of the decedent.

The difference between executor and administrator of estate in comes down to how the person came to be in charge of the estate. Someone who is appointed through the will of the person who died is called executor. Someone who is appointed because of any other reason is called administrator.

Administrators. If no living executors are named in the will, or if the executors named can't or don't wish to act, or there is no will, then one or more beneficiaries can apply to act as an administrator. A beneficiary is appointed an administrator once a 'grant of letters of administration with Will annexed' is given

In general, the responsibilities of an estate administrator are to collect all the decedent's assets, pay creditors and distribute the remaining assets to heirs or other beneficiaries.

Under California law, an executor or administrator of the estate can receive compensation for working on the estate.If an estate is valued at under $100,000, the executor may be paid an amount that is four percent of the value.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

Generally, the deceased person's estate is responsible for paying any unpaid debts. The estate's finances are handled by the personal representative, executor, or administrator. That person pays any debts from the money in the estate, not from their own money.

Appointment of Executor or Administrator In the absence of a will, the court appoints an administrator for the estate, typically the next of kin. Completion of the executor or administrator appointment takes about six to eight weeks once the executor files the petition or the court makes a selection.