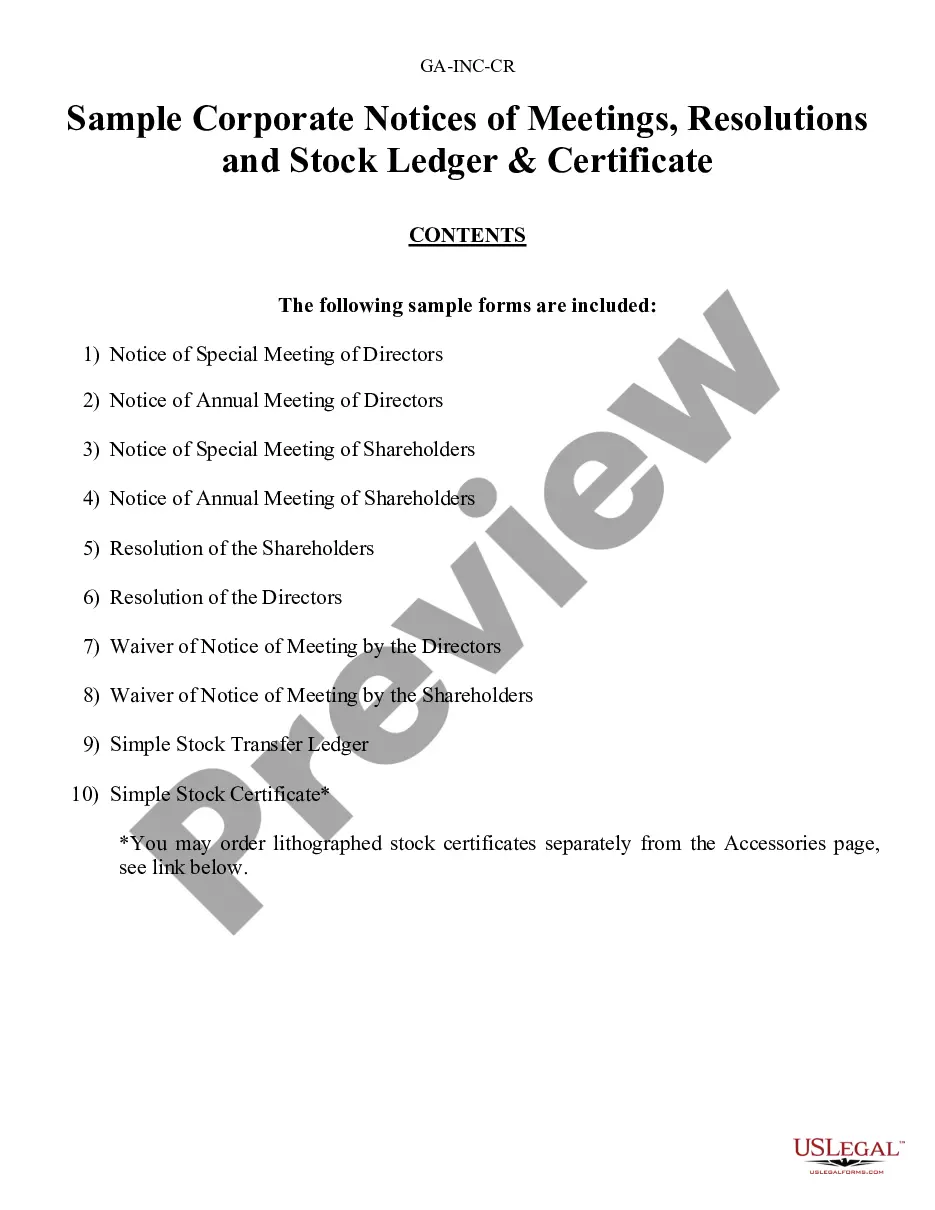

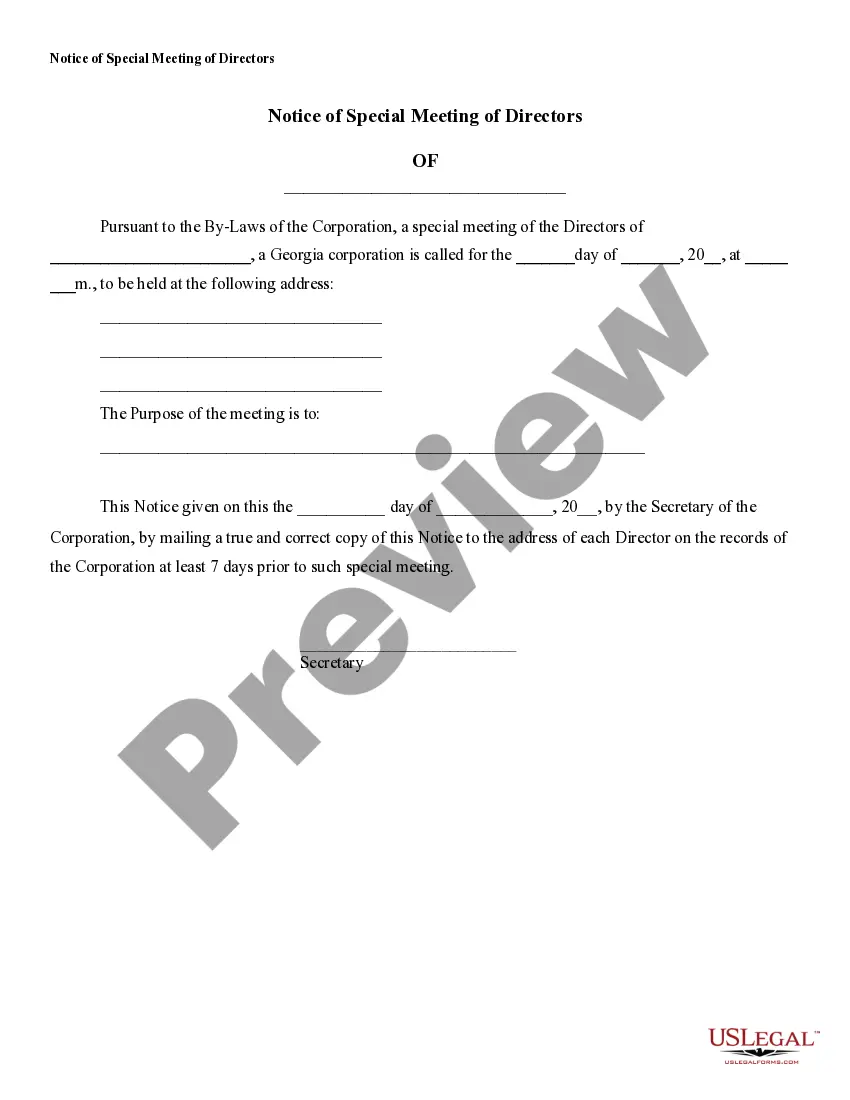

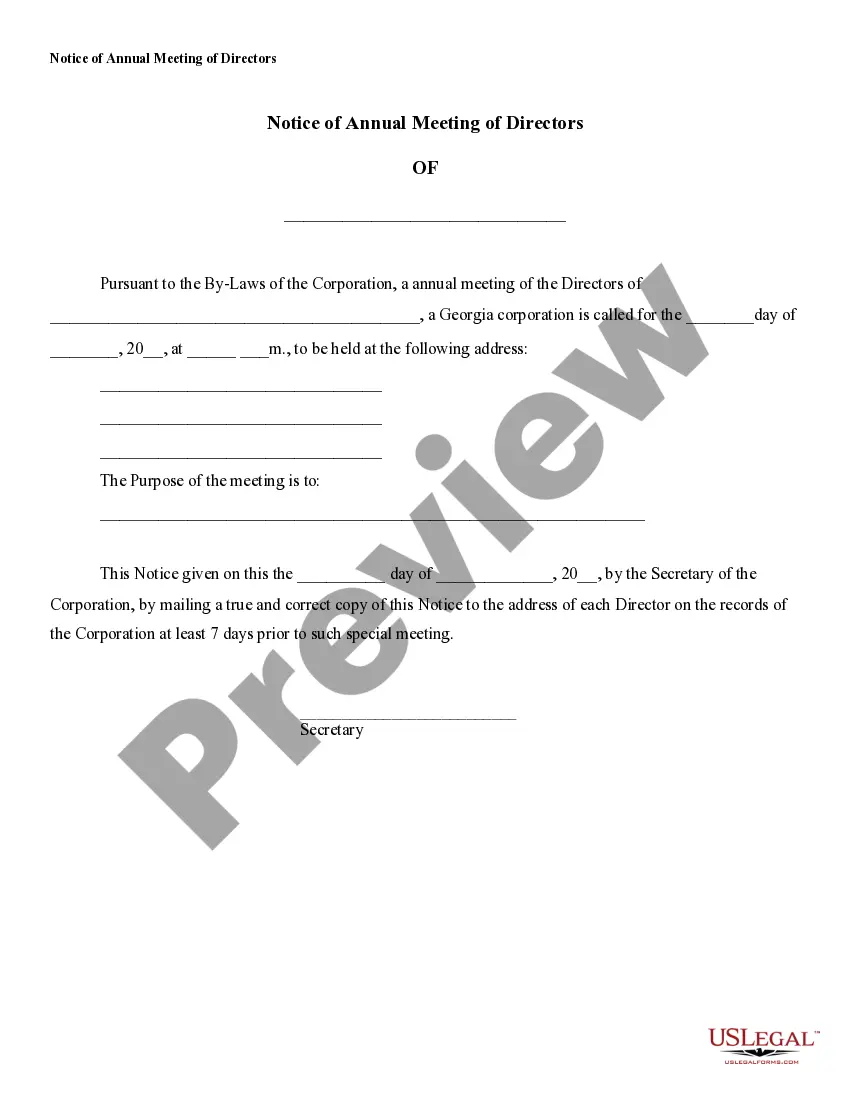

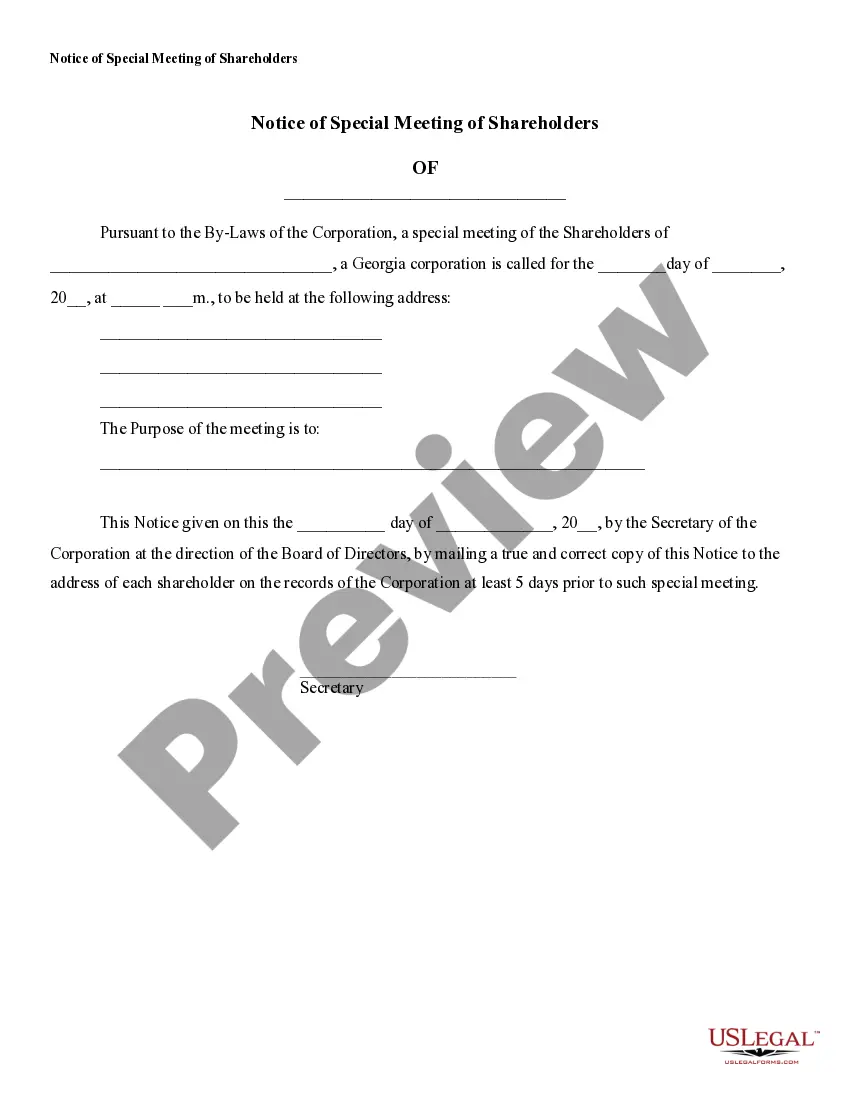

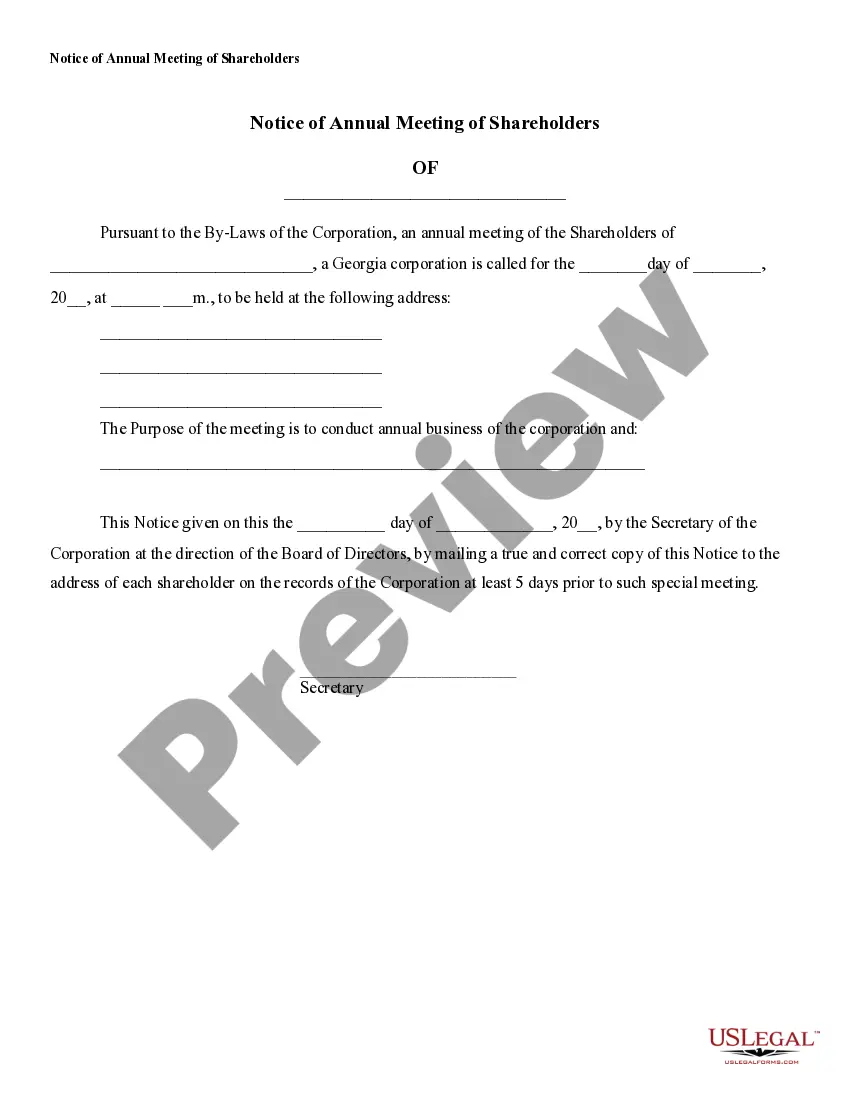

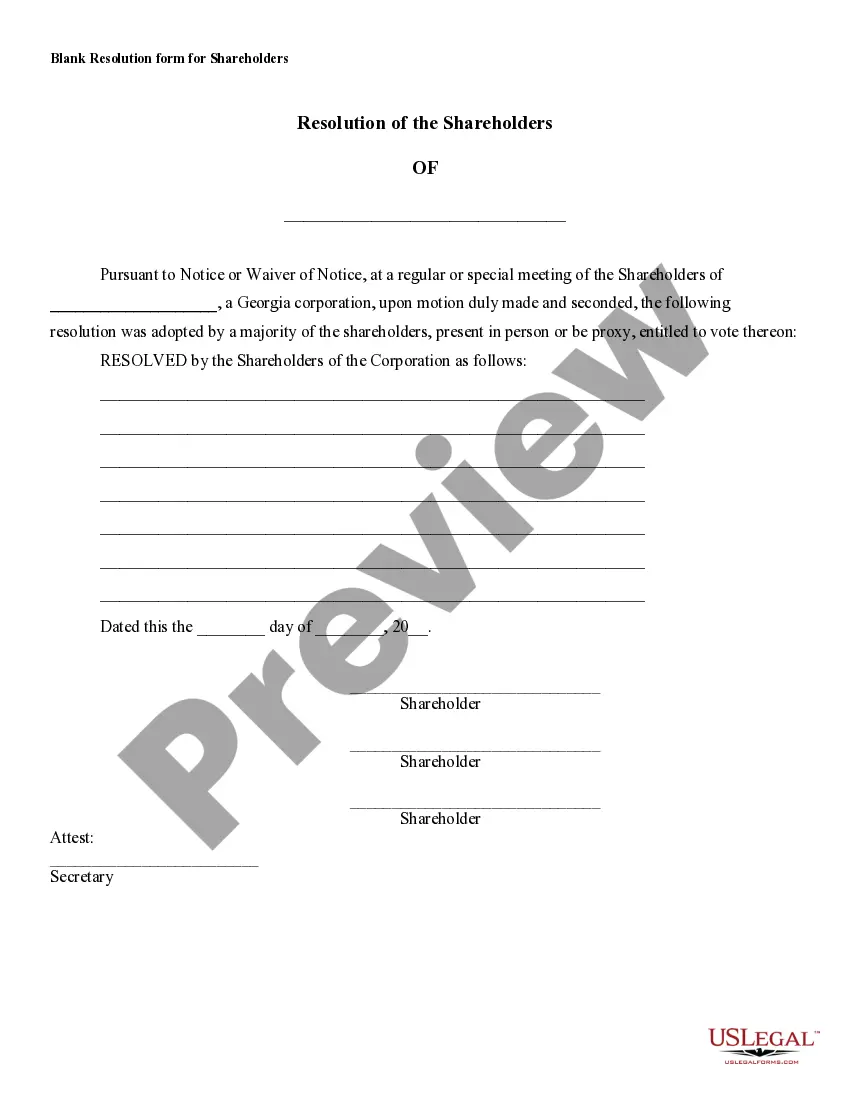

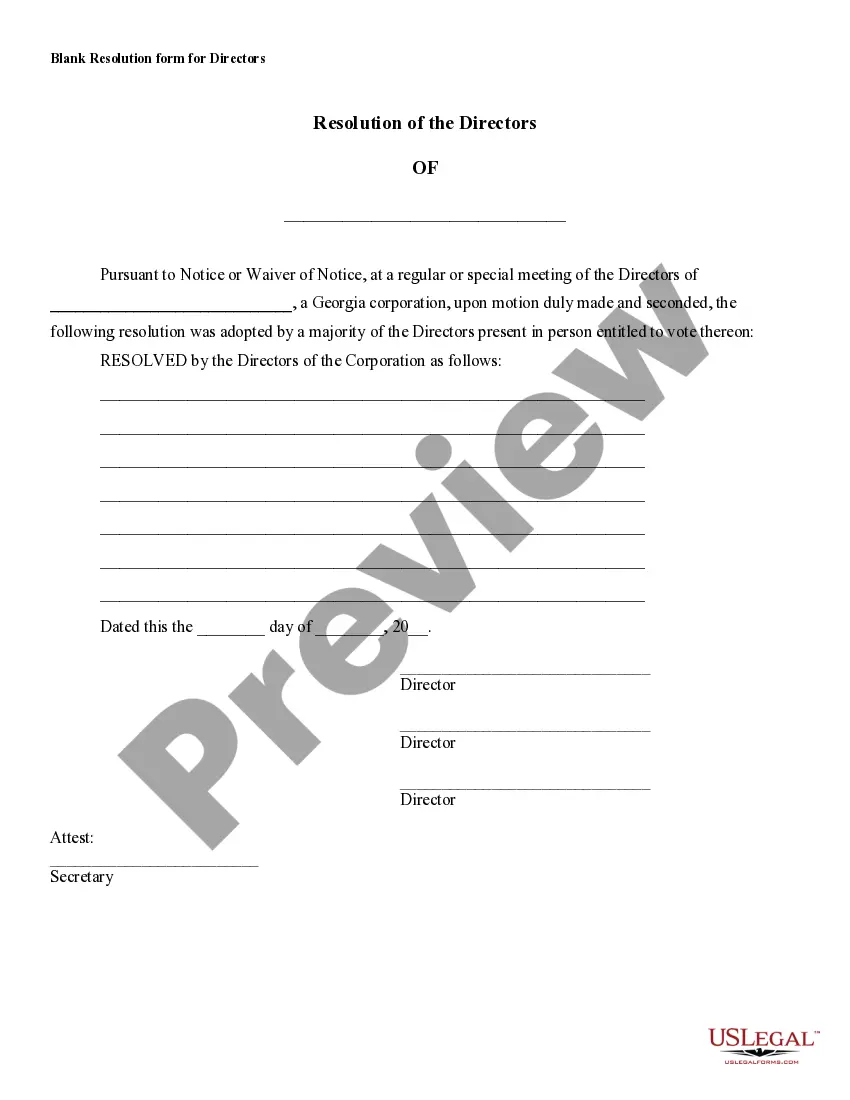

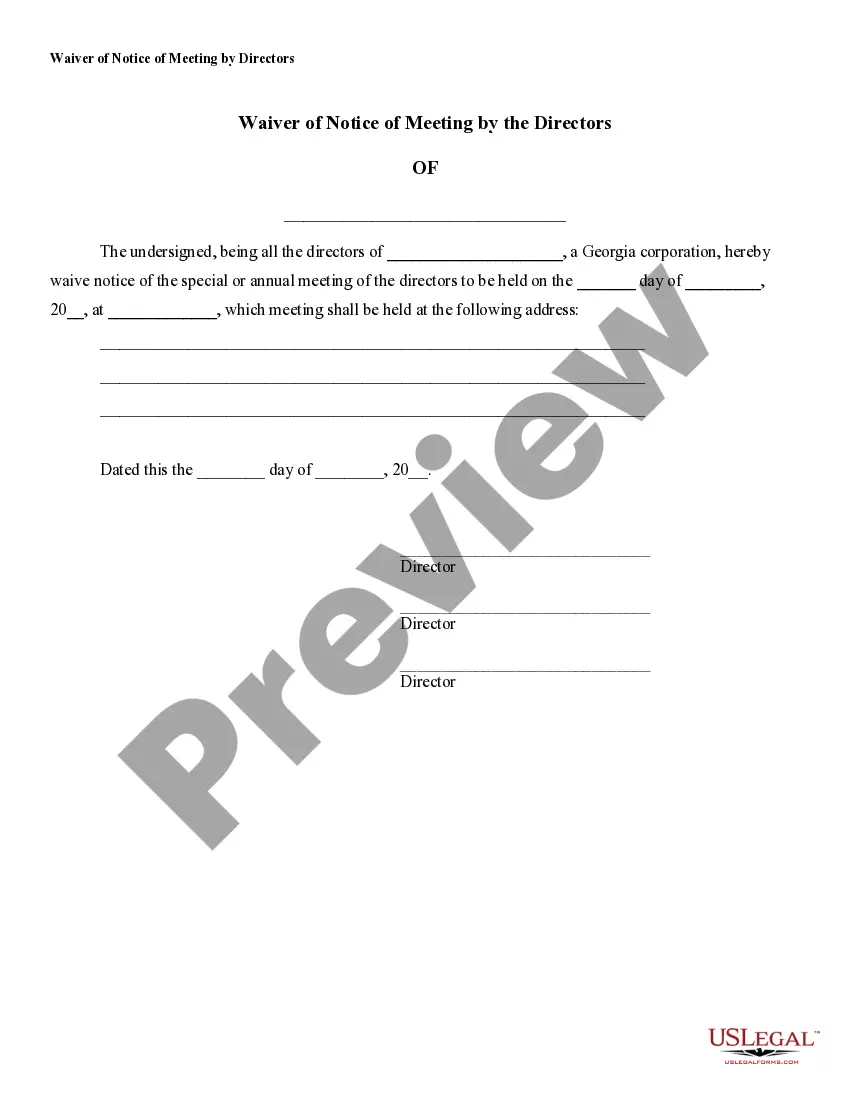

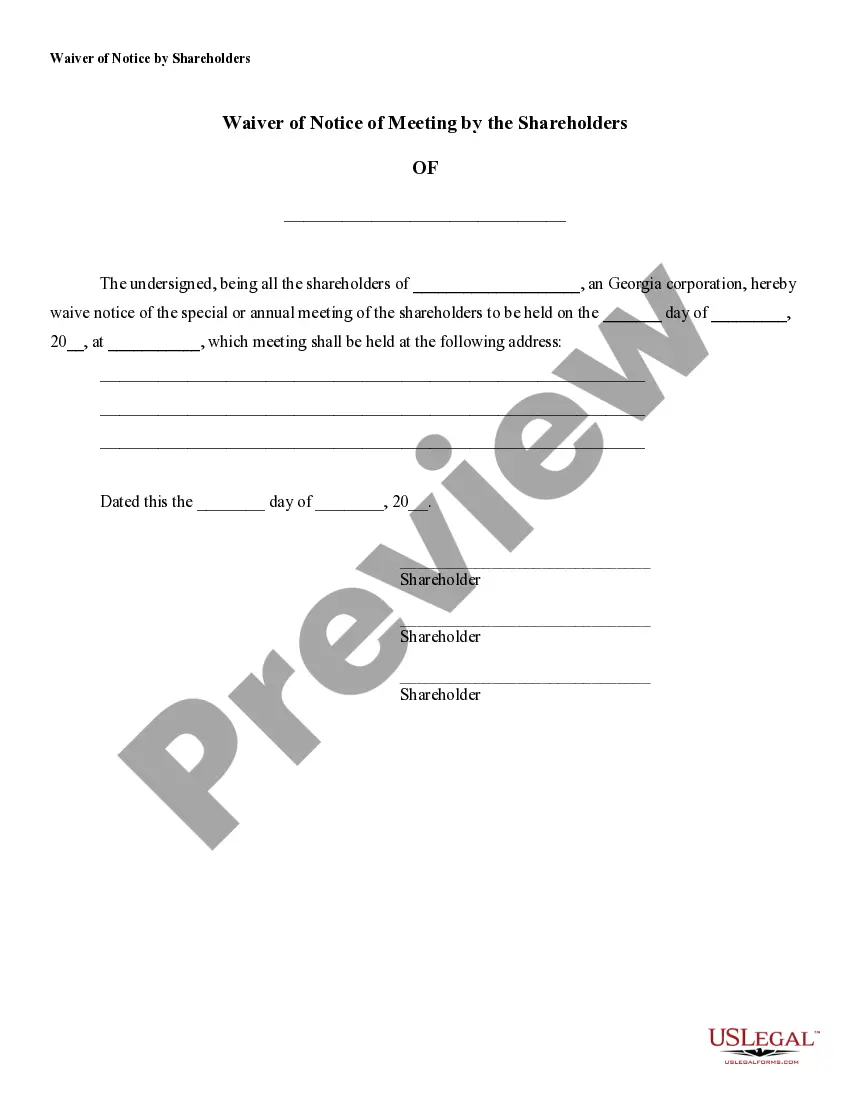

This is a group of forms that includes Notices of Meetings, Corporate Resolutions, a Stock Ledger, and a sample Stock Certificate.

Georgia Notices, Resolutions, Simple Stock Ledger and Certificate

Description What Is A Stock Ledger

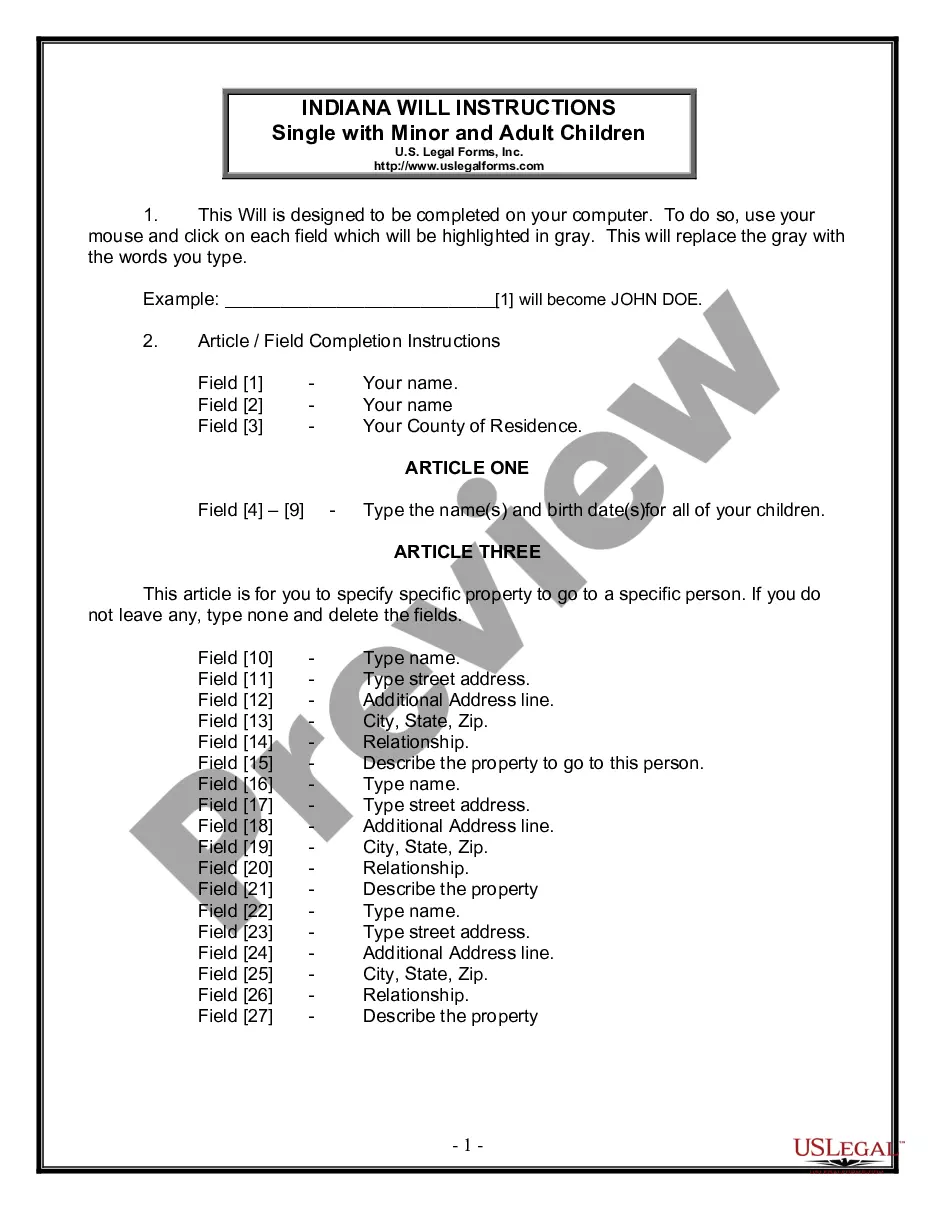

How to fill out Georgia Notices, Resolutions, Simple Stock Ledger And Certificate?

Access one of the most holistic library of authorized forms. US Legal Forms is really a system to find any state-specific document in couple of clicks, including Georgia Notices, Resolutions, Simple Stock Ledger and Certificate examples. No reason to spend hours of your time trying to find a court-admissible sample. Our qualified pros ensure you receive updated documents every time.

To make use of the documents library, pick a subscription, and sign-up an account. If you already did it, just log in and click on Download button. The Georgia Notices, Resolutions, Simple Stock Ledger and Certificate file will quickly get kept in the My Forms tab (a tab for all forms you save on US Legal Forms).

To create a new profile, look at short instructions below:

- If you're having to use a state-specific example, be sure you indicate the right state.

- If it’s possible, look at the description to learn all the nuances of the form.

- Take advantage of the Preview option if it’s offered to look for the document's information.

- If everything’s proper, click on Buy Now button.

- Right after picking a pricing plan, make an account.

- Pay by card or PayPal.

- Save the document to your computer by clicking Download.

That's all! You ought to submit the Georgia Notices, Resolutions, Simple Stock Ledger and Certificate form and double-check it. To make certain that everything is correct, contact your local legal counsel for help. Register and simply find around 85,000 useful templates.

Stock Ledger Certificate Form popularity

FAQ

This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares. Waif for the transfer agent to cancel your old certificate.

The stock ledger holds financial data that allows you to monitor your company's performance. It incorporates financial transactions related to merchandising activities, including sales, purchases, transfers, and markdowns; and is calculated weekly or monthly.

Name of the shareholder; Complete mailing address of the stock shareholder including contact number; Stock certificate number; The total number of shares outstanding; The date the shares were purchased;

Be sure the purchaser is eligible. Being taxed as an S corp. Review the shareholders' agreement and bylaws. You can find your company's restrictions on stock transfers in its shareholders' agreement or bylaws. Determine the stock's value. Prepare and execute a stock transfer agreement. Update corporate records.