Georgia Deed to Secure Debt

Description

How to fill out Georgia Deed To Secure Debt?

Access the most comprehensive collection of legal documents.

US Legal Forms is a service where you can discover any state-specific file in just a few clicks, including Georgia Deed to Secure Debt templates.

No need to squander hours searching for a court-admissible template. Our certified experts ensure that you receive updated samples at all times.

After selecting a pricing plan, create your account. Pay via card or PayPal. Download the document to your device by clicking the Download button. That's it! You need to complete the Georgia Deed to Secure Debt template and finalize it. To ensure that everything is accurate, consult your local legal advisor for assistance. Sign up and easily find over 85,000 valuable samples.

- To utilize the forms library, choose a subscription and create your account.

- If you have already registered, simply Log In and then click Download.

- The Georgia Deed to Secure Debt template will be instantly saved in the My documents tab (a section for each form you acquire on US Legal Forms).

- To set up a new account, review the brief instructions below.

- If you plan to use a state-specific example, ensure you select the correct state.

- If available, review the description to grasp all the specifics of the document.

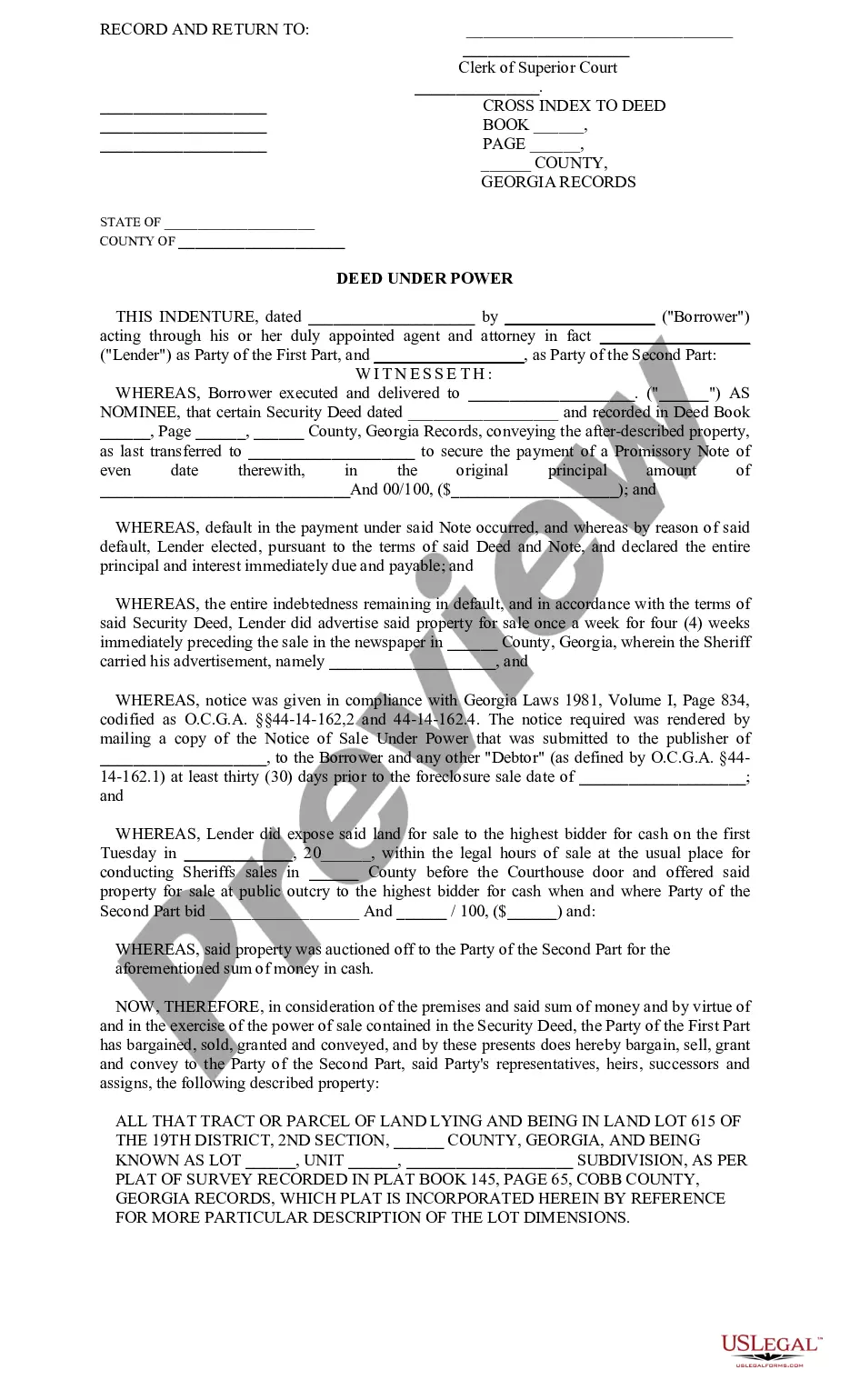

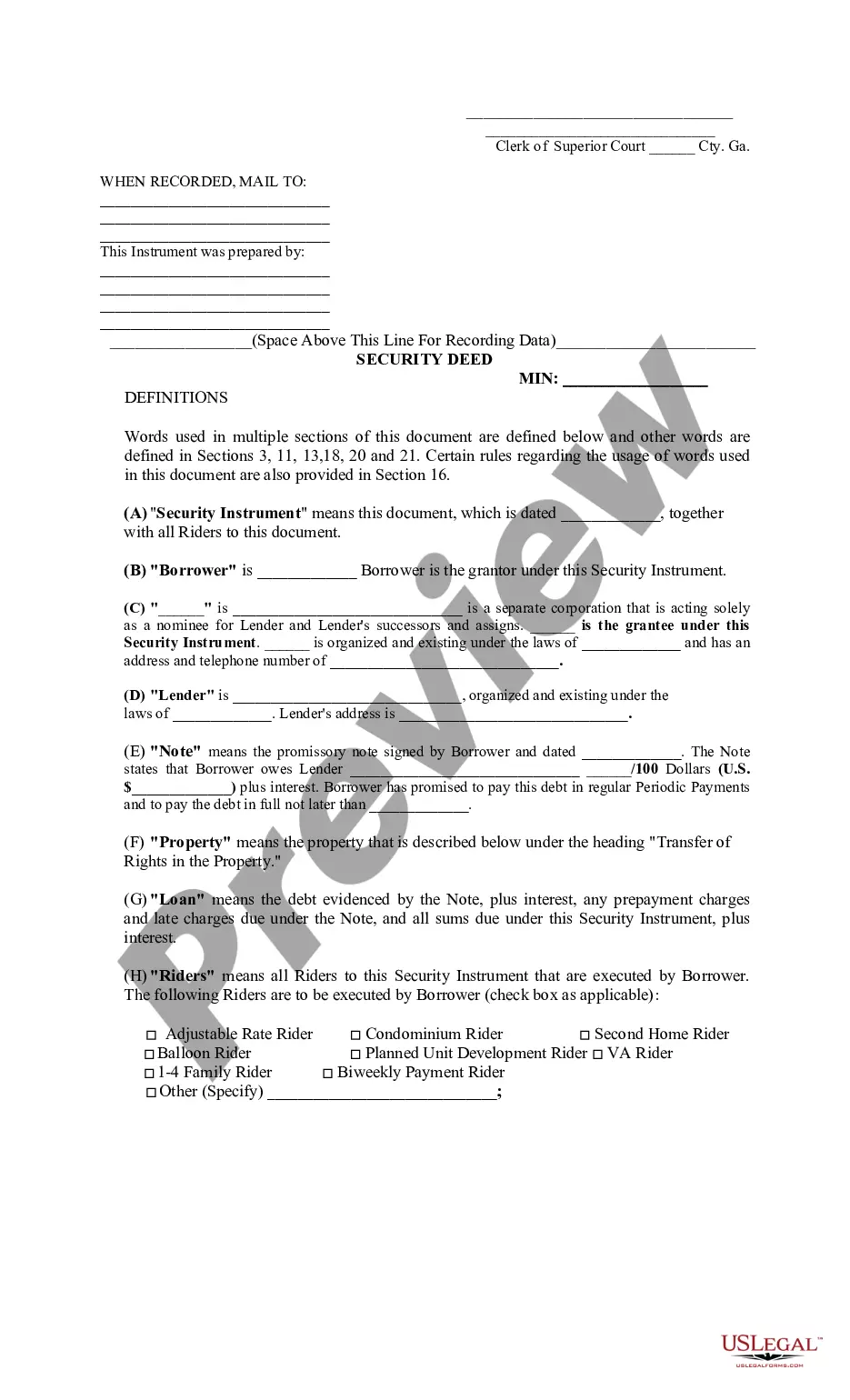

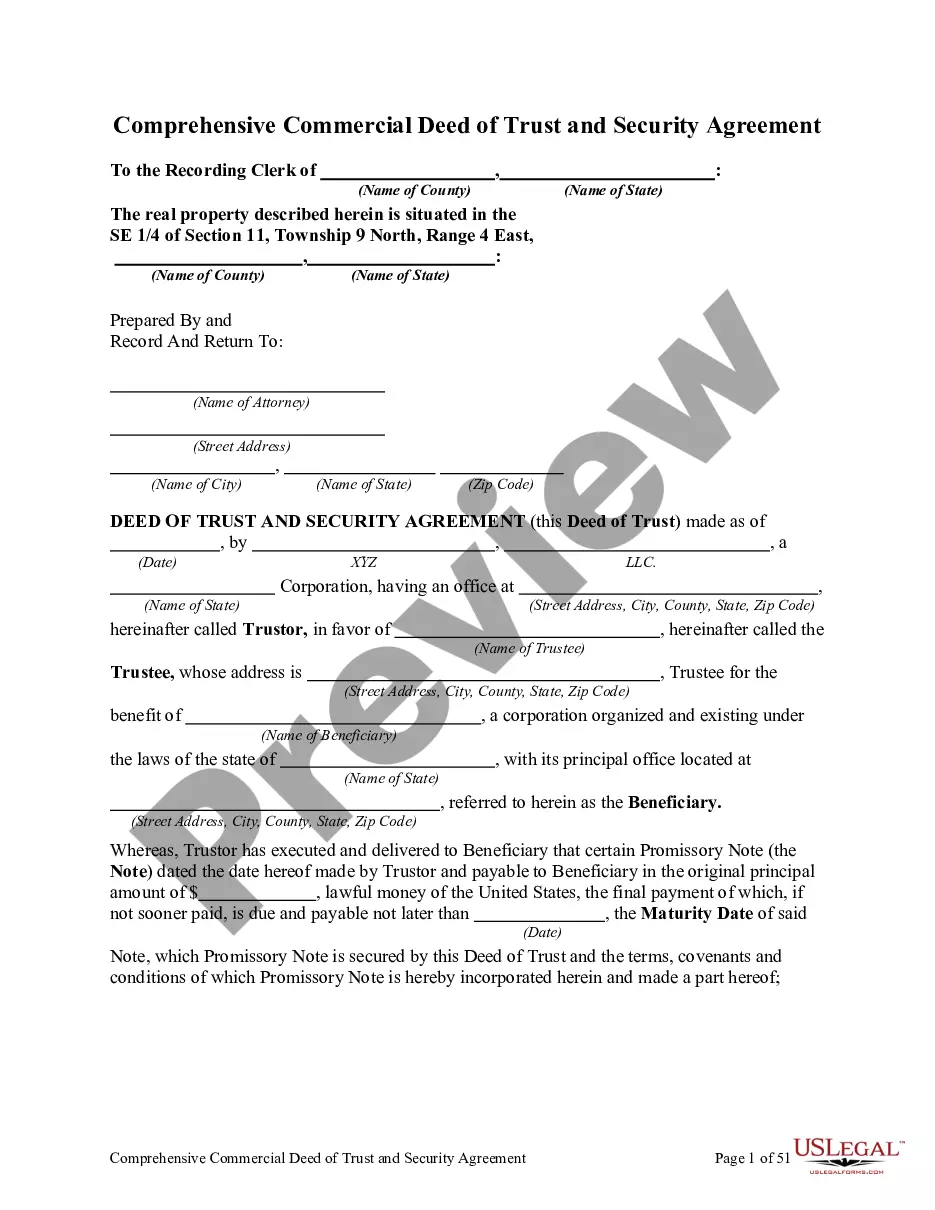

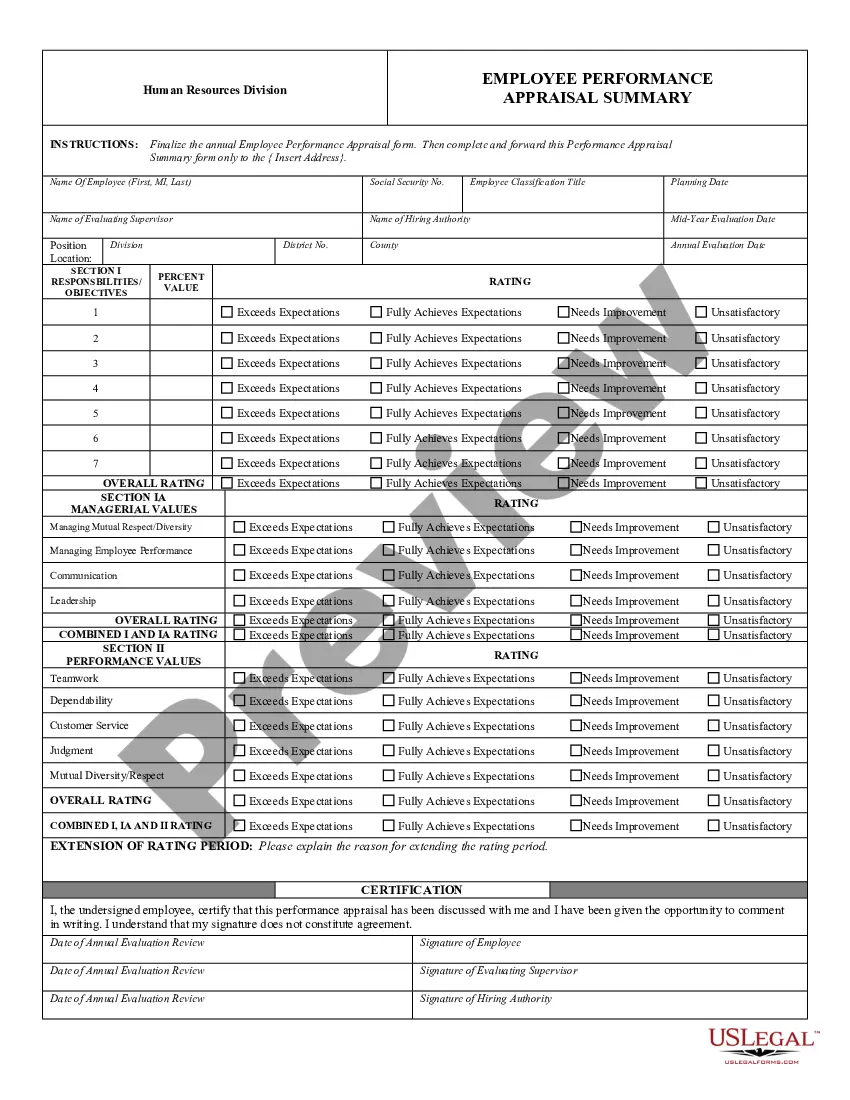

- Use the Preview feature if it is available to examine the document's content.

- If everything appears to be correct, click Buy Now.

Form popularity

FAQ

In Georgia, recording a deed requires specific information to be included. The document must have the names of the parties involved, a clear legal description of the property, and it should be signed before a notary public. Furthermore, a Georgia Deed to Secure Debt must be filed in the appropriate county's land records for it to be legally recognized. Making sure these requirements are met ensures the security of your debts against the property.

In Georgia, owner financing operates by allowing the buyer to make payments directly to the seller instead of a traditional mortgage lender. The seller uses a Georgia Deed to Secure Debt to formalize the agreement and protect their interests. This approach can streamline the purchasing process while providing flexibility for both parties.

Whether it is better to be on the mortgage or the deed depends on your goals. Holding the mortgage allows you to receive payments and act in a lending role, while holding the deed provides you with ownership rights. Ultimately, working with a Georgia Deed to Secure Debt can offer protection and security, regardless of your position.

In Georgia, during an owner financing transaction, the seller typically retains the Georgia Deed to Secure Debt. This deed serves as a legal instrument that secures the seller’s interest until the buyer complete their repayment. Such an arrangement guarantees that the seller has recourse should the buyer default on their financial obligations.

In owner financing arrangements near you, the seller generally holds the Georgia Deed to Secure Debt. They keep this deed as collateral until the buyer fulfills the payment obligations agreed upon in the financing agreement. This protects the seller's investment and ensures the buyer adheres to the terms.

In owner financing, the buyer typically holds the title to the property while the seller retains the Georgia Deed to Secure Debt as a security interest. This arrangement allows the buyer to enjoy the benefits of ownership, including the ability to occupy and improve the property. The seller maintains a legal claim until the debt is satisfied.

The most common reason for using a quitclaim deed is to transfer property between family members or in situations where the transfer of ownership is straightforward. This type of deed allows the grantor to release any claim they have to the property, simplifying the legal process. While it doesn't guarantee that the title is clear, it can be a quick way to handle ownership changes. US Legal Forms can provide helpful templates to streamline this task.

To fill out a quitclaim deed yourself, start by obtaining the appropriate form from a reliable source, like US Legal Forms, which offers templates for Georgia deeds. Fill in the necessary details, including the names of both parties, the property's legal description, and any relevant terms. After completing the deed, get it signed in front of a notary to finalize the process. This straightforward approach allows you to handle property transfers without needing a lawyer.

Filling out a quit claim deed in Georgia involves selecting the correct form and entering the property's legal description accurately. You need to include the names of both the grantor and the grantee, and ensure that all information is completed clearly without any errors. Once completed, the deed must be signed in the presence of a notary public, who will validate the document. This helps ensure a smooth transfer of property ownership.