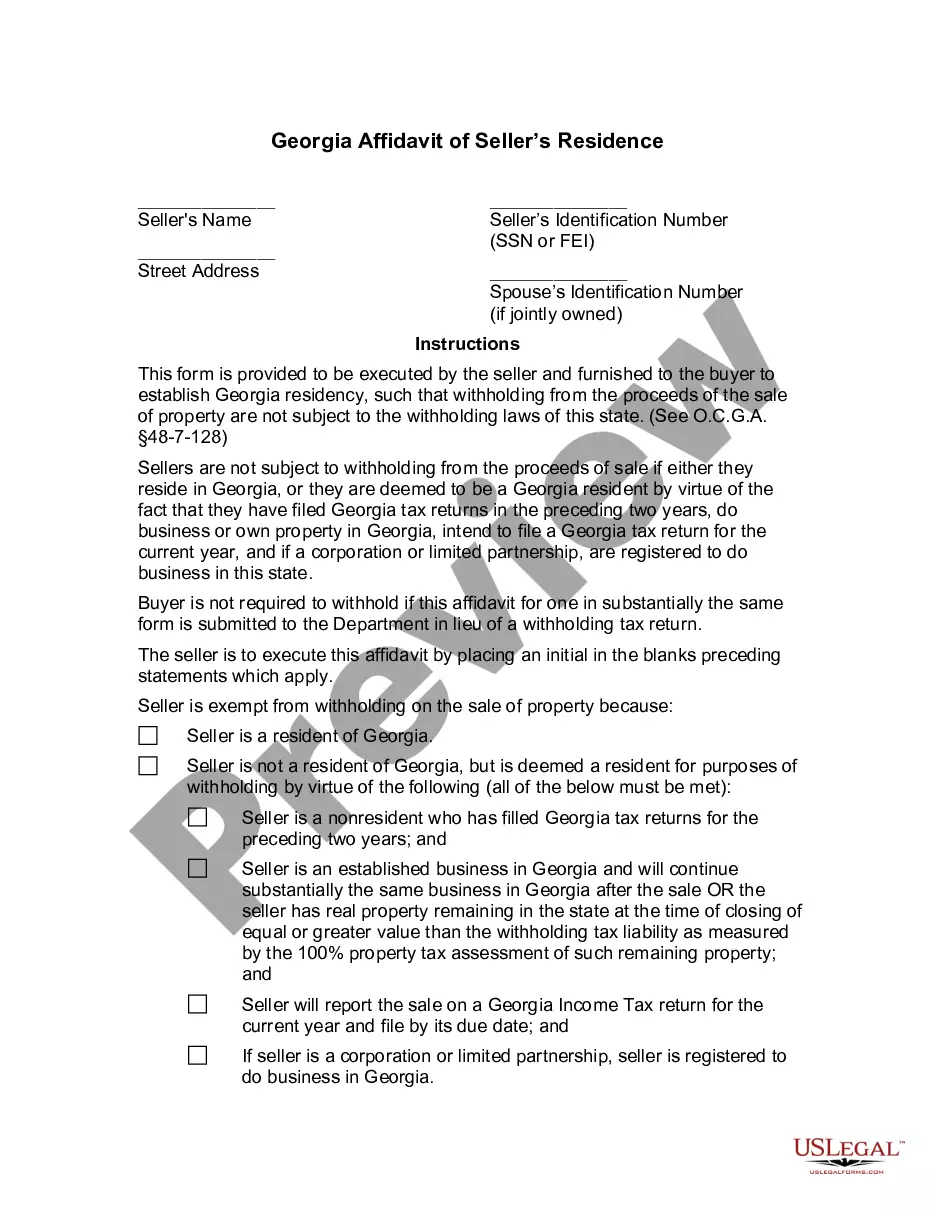

Georgia Affidavit of Seller's Residence

Description

How to fill out Georgia Affidavit Of Seller's Residence?

Handling legal documentation requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Georgia Affidavit of Seller's Residence template from our service, you can be certain it meets federal and state regulations.

Dealing with our service is easy and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to get your Georgia Affidavit of Seller's Residence within minutes:

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Georgia Affidavit of Seller's Residence in the format you prefer. If it’s your first time with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Georgia Affidavit of Seller's Residence you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Nonresidents who sell or transfer Georgia real property are subject to a 3% withholding tax. The withholding tax is to be computed by applying the 3% rate to the purchase price.

Am I a Georgia Nonresident. Nonresidents are individuals who are not residents of Georgia at any time during the year but have income subject to taxation in Georgia. In the residency status section of the Georgia individual tax return (Georgia Form 500), the taxpayer will indicate they are a Nonresident.

Withholding on Sales or Transfer of Real Property and Associated Tangible Personal Property by Nonresidents.

Out-of-state sellers must collect tax on all sales of tangible personal property made at a convention or trade show in this state. Additionally, these sellers must collect the tax on all sales made as the result of orders taken at a convention or trade show attended in this state.

Non-residents who work in Georgia or receive income from Georgia sources and are required to file a Federal income tax return are required to file a Georgia Form 500 Individual Income Tax Return.

What taxes do you pay when you sell your house in Georgia? The seller is typically responsible for paying real estate transfer taxes in Georgia, which are $1 for every $1,000 of the sale price. So, if you sell your home for $600,000, your tax bill for transferring ownership will be $6,000.

An affidavit of ownership to record in the real property records indicating that the remaining co-owner(s) of real property in Georgia hold the deceased co-owner's property interest due to a right of survivorship.

Georgia capital gains tax rates Tax rateSingleMarried filing separately2.00%$751 to $2,250$501 to $1,5003.00%$2,251 to $3,750$1,501 to $2,5004.00%$3,751 to $5,250$2,501 to $3,5005.00%$5,251 to $7,000$3,501 to $5,0002 more rows