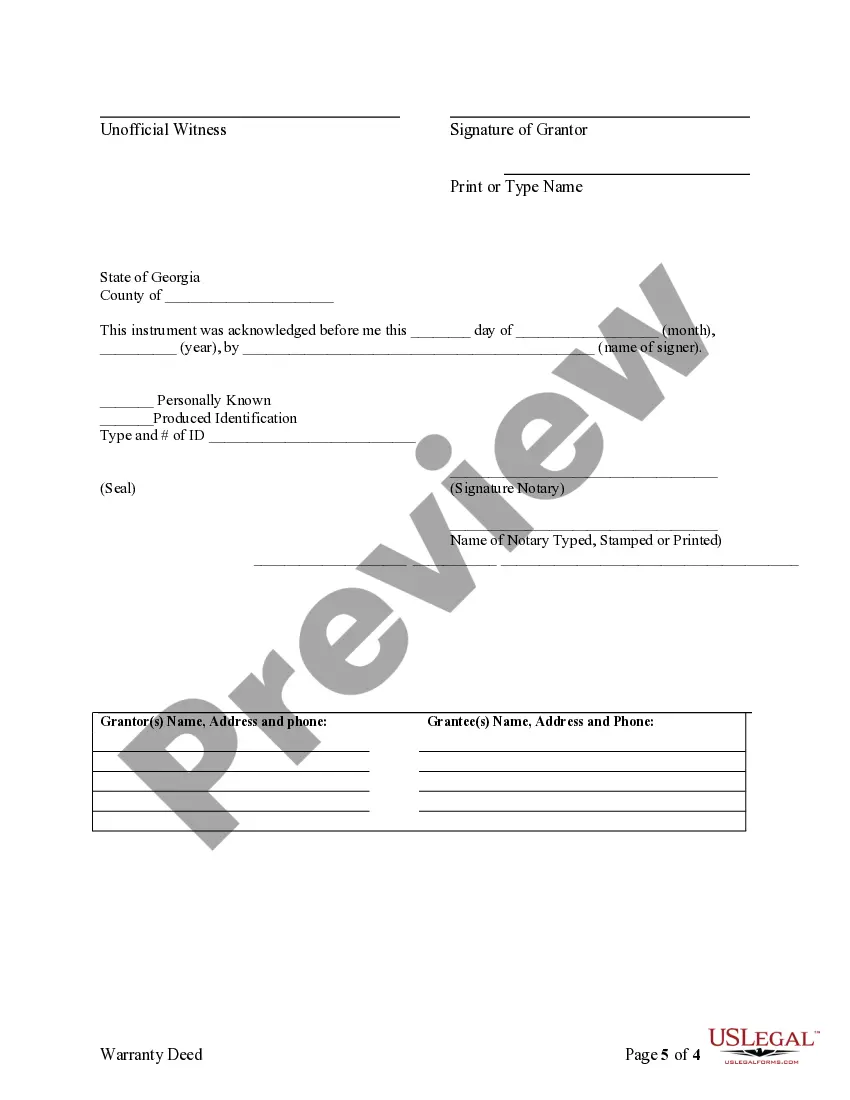

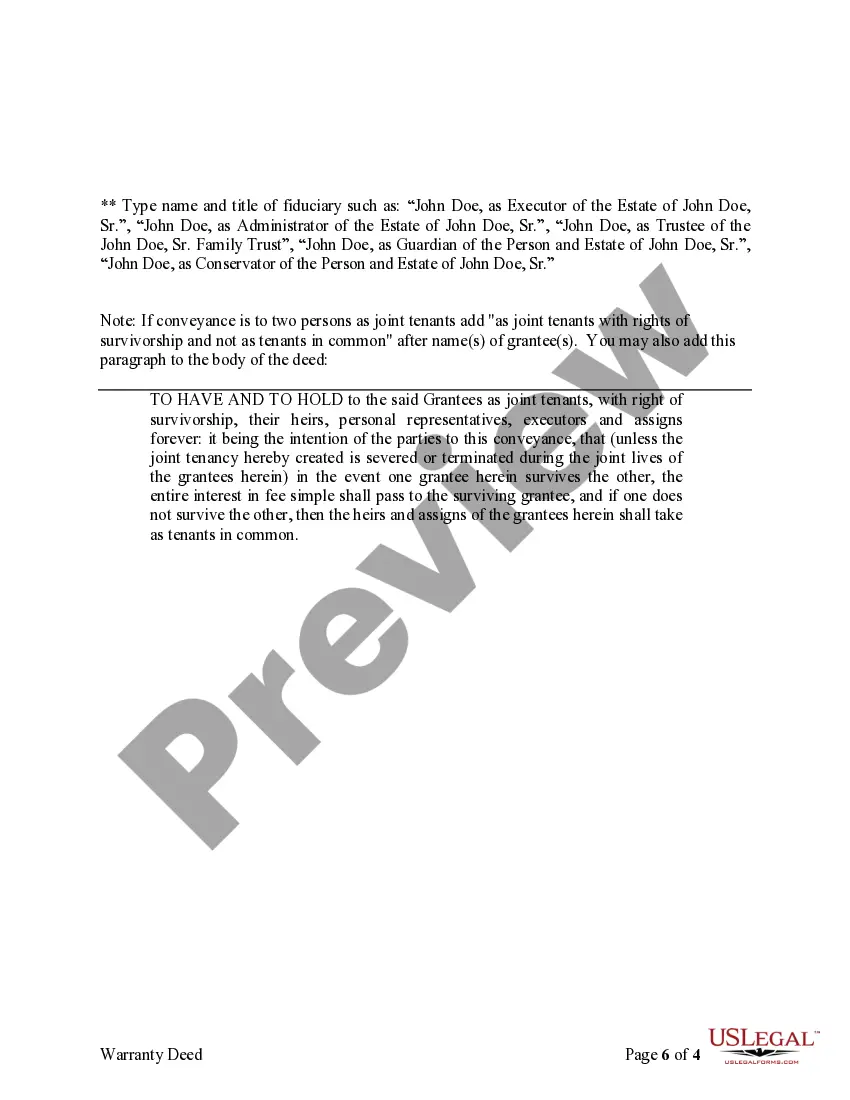

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Georgia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description Fiduciary Agreement Template

How to fill out Georgia Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among hundreds of free and paid templates that you’re able to find on the net, you can't be certain about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you need these to. Always keep relaxed and utilize US Legal Forms! Locate Georgia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries samples developed by skilled lawyers and get away from the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access your previously saved templates in the My Forms menu.

If you’re utilizing our service the first time, follow the guidelines listed below to get your Georgia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries with ease:

- Ensure that the document you find is valid where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another sample utilizing the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

When you’ve signed up and bought your subscription, you can utilize your Georgia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as often as you need or for as long as it continues to be valid where you live. Edit it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Trustors Deed Form popularity

What Is A Fiduciary Deed Other Form Names

FAQ

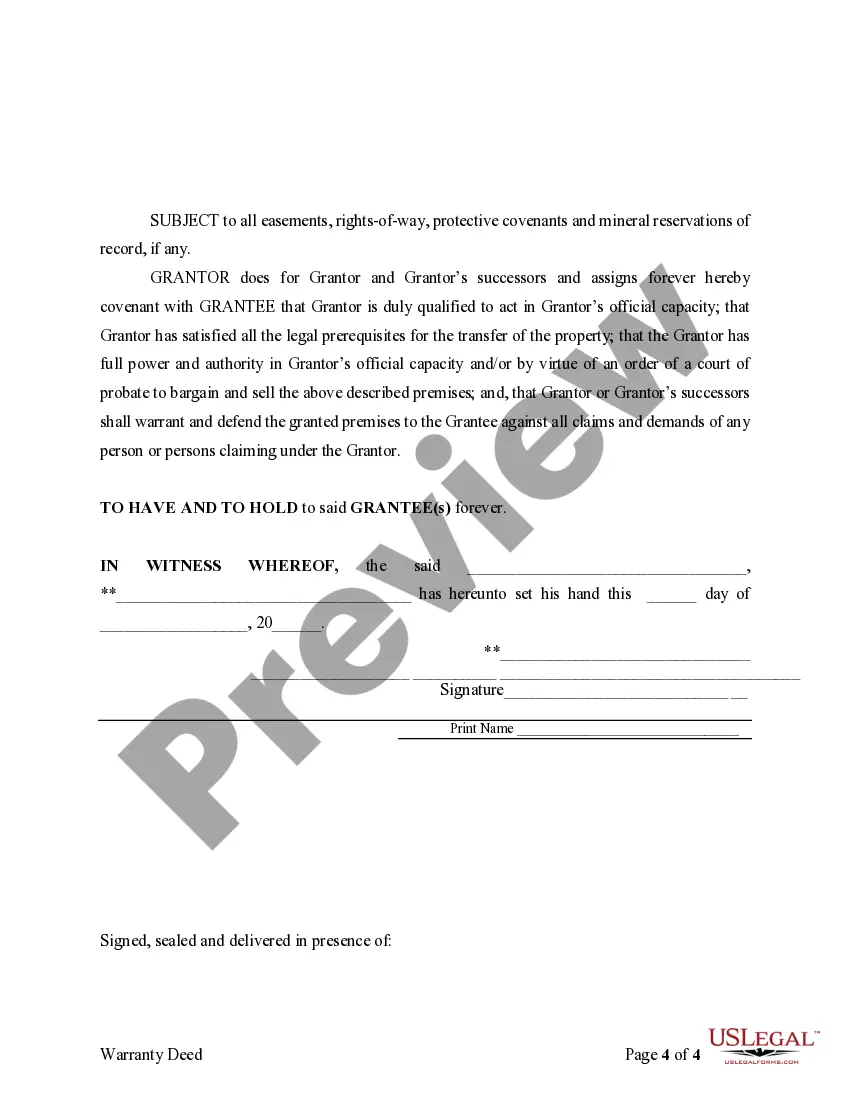

Trustees must follow the terms of the trust and are accountable to the beneficiaries for their actions. They may be held personally liable if they: Are found to be self-dealing, or using trust assets for their own benefit. Cause damage to a third party to the same extent as if the property was their own.

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

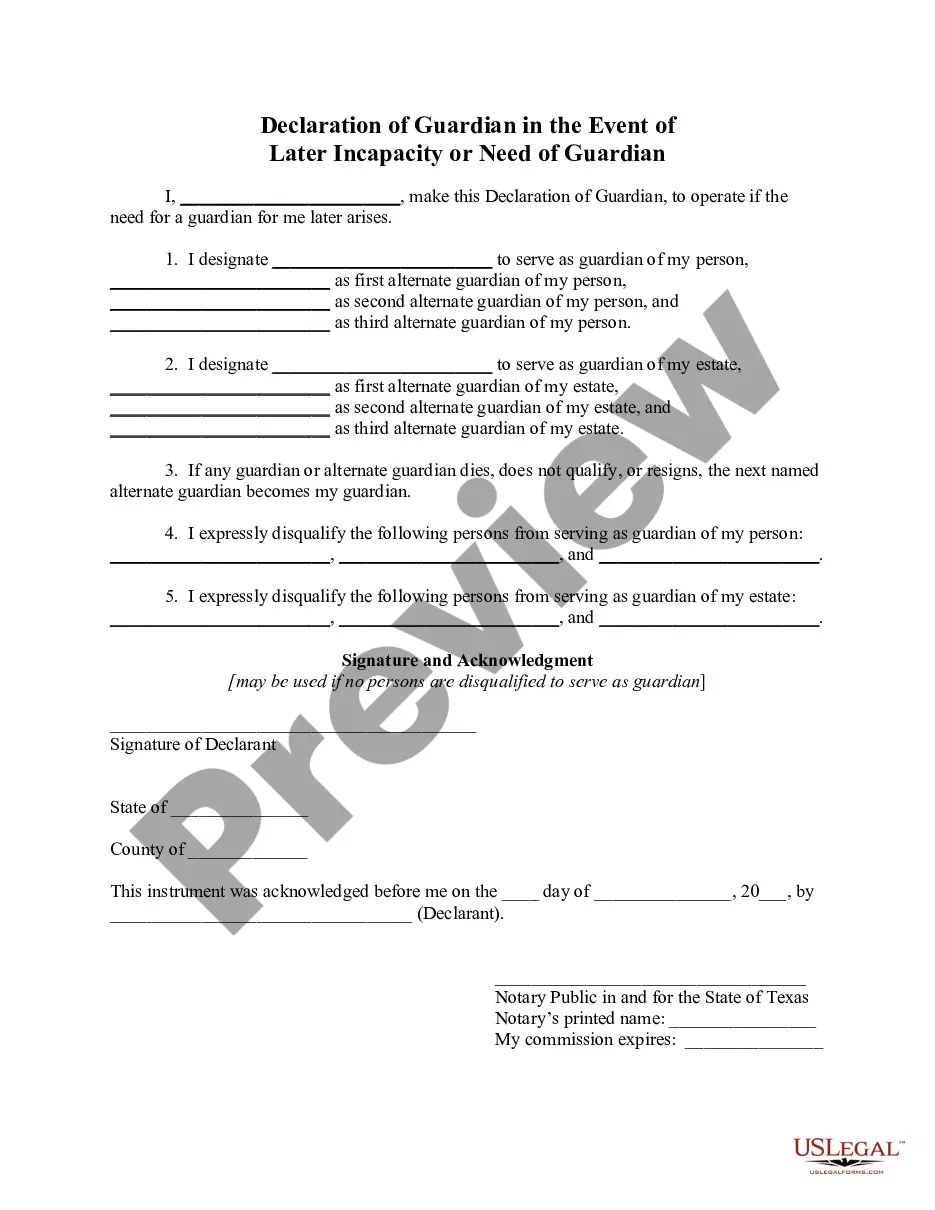

Trustees, executors, administrators and other types of personal representatives are all fiduciaries.Executor - (Also called personal representative; a woman is sometimes called an executrix) An individual or trust company that settles the estate of a testator according to the terms of the will.

Yes an estate can have 2 administrators but it is not likely. If a names co-executors the Court may allow this, but if two people want to serve as co-administrators most Courts say "No" to the future conflicts between adminsitrators.

Trusteeship is a serious legal responsibility, and a fiduciary duty is a fundamental duty of care owed by thetrustees to the trust's beneficiaries. Fiduciary duties are owed by all trustees by reason of their position, which imposes a duty of undivided loyalty and good faith towards the beneficiaries.

A trustee is personally liable for a breach of his or her fiduciary duties. The trustee's fiduciary duties include a duty of loyalty, a duty of prudence, and subsidiary duties.The trustee will always have duties, or the trust will become passive and legal title will pass to the beneficiaries.

A Trustee owes a duty of honesty, integrity, loyalty and good faith to the beneficiaries of the trust. A trustee must at all times act exclusively in the best interests of the trust and be actively involved in any decisions.

The Executor is responsible for wrapping up the deceased person's affairs and distributing the assets to, or for the benefit of, the persons named in the will (beneficiaries). An Administrator is the person in charge of the estate when my someone dies without a Last Will and Testament.

In most situations, it's not a good idea to name co-executors. When you're making your will, a big decision is who you choose to be your executorthe person who will oversee the probate of your estate. Many people name their spouse or adult child. You can, however, name more than one person to serve as executor.