Georgia State Continuing Garnishment Form Package

Description

How to fill out Georgia State Continuing Garnishment Form Package?

How much time and resources do you normally spend on composing official paperwork? There’s a greater option to get such forms than hiring legal experts or wasting hours browsing the web for an appropriate blank. US Legal Forms is the premier online library that offers professionally drafted and verified state-specific legal documents for any purpose, such as the Georgia State Continuing Garnishment Form Package.

To acquire and complete a suitable Georgia State Continuing Garnishment Form Package blank, adhere to these easy steps:

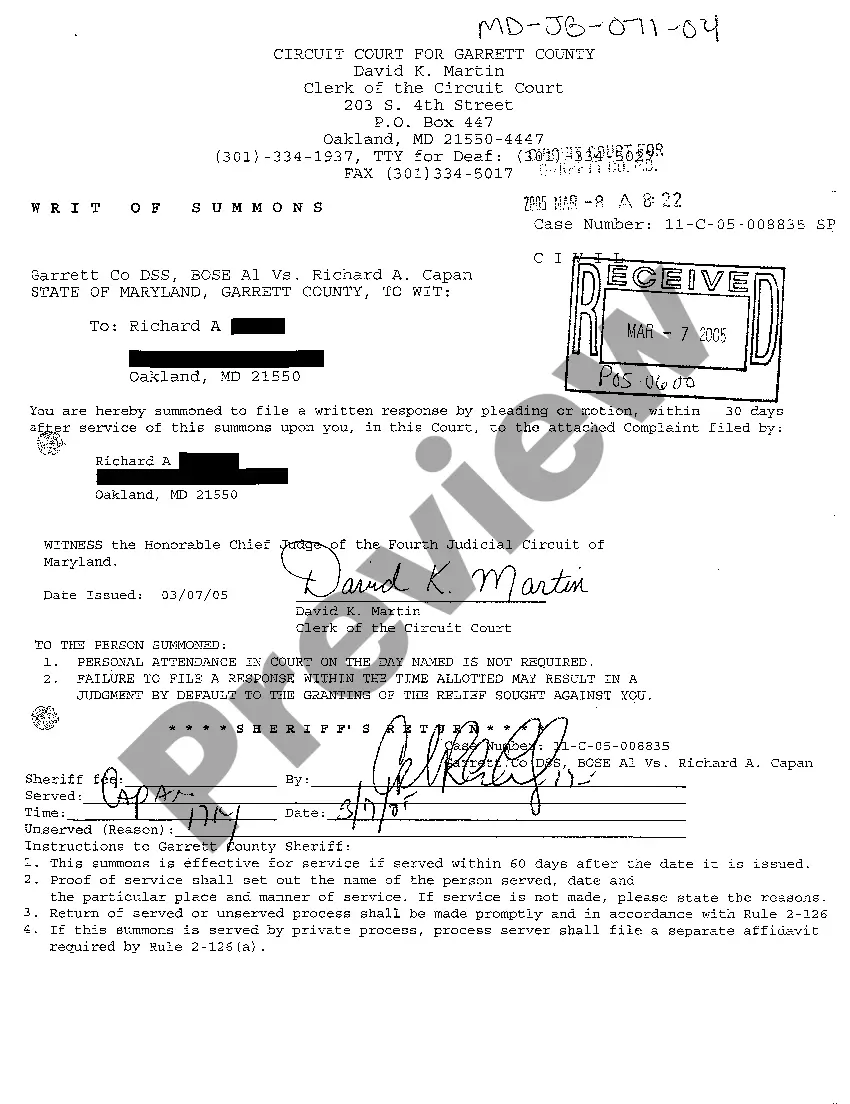

- Examine the form content to make sure it meets your state laws. To do so, check the form description or use the Preview option.

- If your legal template doesn’t satisfy your needs, locate a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the Georgia State Continuing Garnishment Form Package. Otherwise, proceed to the next steps.

- Click Buy now once you find the right document. Select the subscription plan that suits you best to access our library’s full opportunities.

- Register for an account and pay for your subscription. You can make a payment with your credit card or via PayPal - our service is absolutely secure for that.

- Download your Georgia State Continuing Garnishment Form Package on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trusted web services. Sign up for us today!

Form popularity

FAQ

Answer. A business which has been served with a garnishment affidavit has forty-five (45) days to file an answer. If an answer is not filed within forty-five (45) days, the garnishee (employer or bank) will be in default.

Affidavit for continuing garnishment is a sworn statement by a plaintiff or his/her attorney or agent requesting the issuance of a summons of continuing garnishment as the defendant is indebted to the plaintiff on a judgment from a particular court and the plaintiff believes that the garnishee is or may be an employer

The creditor files garnishment paperwork with the court and serves your employer. Once a creditor has a judgment it's called a judgment creditor. The judgment creditor then files an Affidavit of Continuing Garnishment for Wages with a Georgia court and serves this paperwork on your employer ? called the garnishee.

In Georgia, a creditor can garnish the lesser of 25% of your disposable income or the amount by which your disposable earnings exceed 30% of federal minimum wage. If your disposable income is less than 30 times minimum wage, it cannot be garnished at all.

You can quickly and legally stop creditors from garnishing your earnings by filing for bankruptcy. As soon as you file a petition for Chapter 7 or Chapter 13 bankruptcy, the court will order your creditors to immediately stop all collection activities.

There are two types of garnishment: Continuing garnishment - The employer will deduct from the defendant's wages for approximately 179 days (or six months) provided the defendant makes wages which are subject to garnishment. garnishment deductions are based on the employee's net pay.