A Georgia Demand Bond is a type of financial instrument that is issued by the state of Georgia and is designed to meet the financial needs of various projects undertaken by the government. It serves as a means of financing public infrastructure projects, such as highways, schools, hospitals, and other public facilities. The Georgia Demand Bond is generally a tax-exempt municipal bond, meaning that the interest income earned by investors is not subject to federal income tax. This feature makes it an attractive investment option for individuals looking for tax-efficient investments. There are different types of Georgia Demand Bonds, each serving a specific purpose: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the state of Georgia. They are usually used for general purposes and are secured by the state's taxing power. General Obligation Bonds are considered to be the safest type of bonds as they have a high credit rating. 2. Revenue Bonds: These bonds are issued to finance specific projects that generate revenue, such as toll roads, airports, or utilities. The interest and principal payments of Revenue Bonds are supported by the revenue generated by the project they are financing. 3. Transportation Bonds: Georgia Transportation Bonds are issued to fund transportation-related projects, including the construction and maintenance of highways, bridges, and other transportation infrastructure. These bonds are backed by dedicated transportation revenue sources, such as gasoline taxes or toll fees. 4. Education Bonds: Education Bonds are issued to finance projects related to education infrastructure, such as the construction or renovation of schools and colleges. The interest and principal payments of these bonds are typically supported by the state's education budget. Investing in Georgia Demand Bonds can provide investors with a stable income stream, while also supporting the development and improvement of public infrastructure in the state. Before investing, it is important to research the specific bond offering, assess the creditworthiness of the issuer, and evaluate the risks associated with the investment. It is recommended to consult with a financial advisor who can provide personalized advice based on individual financial goals and risk tolerance.

Georgia Demand Bond

Description

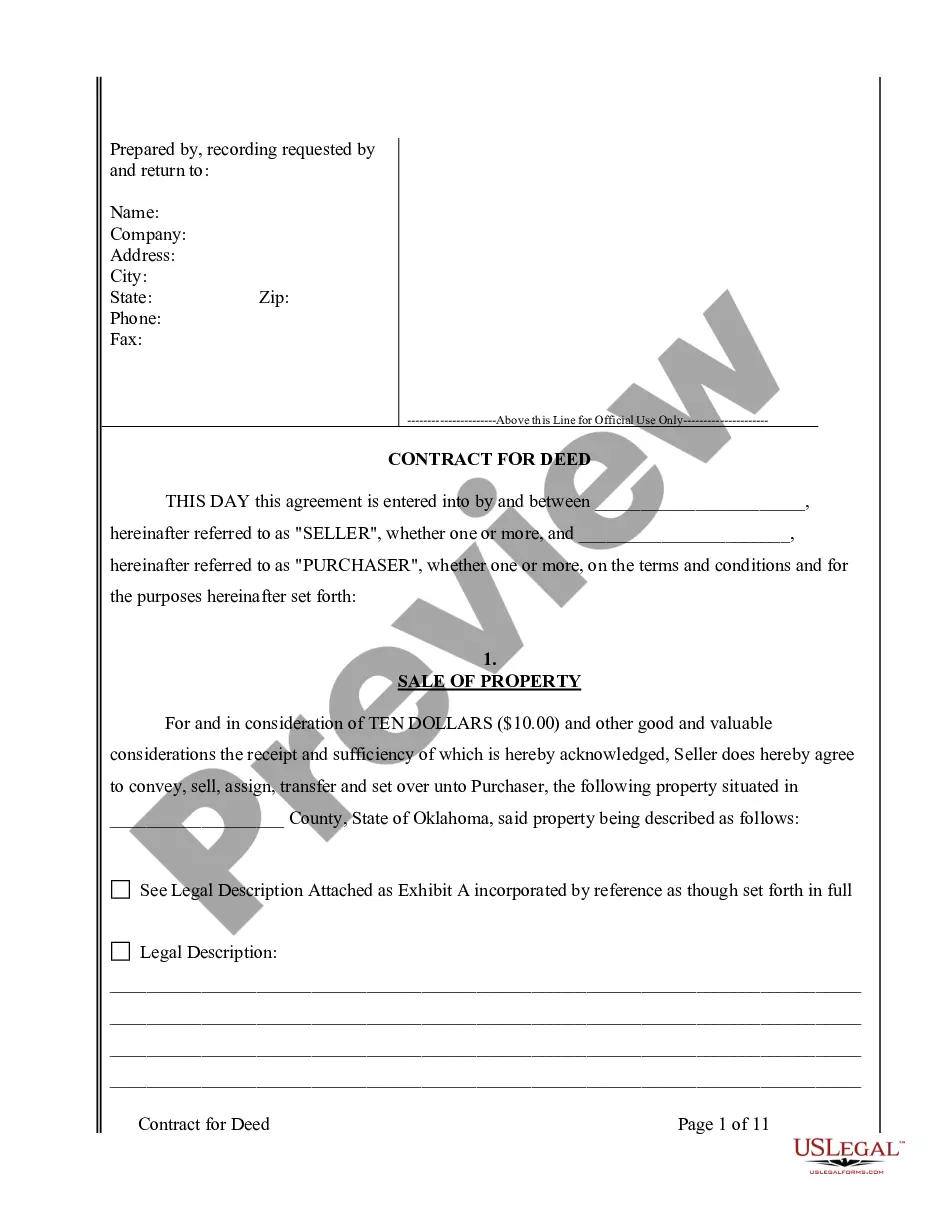

How to fill out Georgia Demand Bond?

You can invest hours on the Internet attempting to find the legitimate record format that suits the state and federal specifications you want. US Legal Forms gives a huge number of legitimate forms that are examined by professionals. You can actually download or produce the Georgia Demand Bond from my assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Down load button. Following that, you are able to total, modify, produce, or indication the Georgia Demand Bond. Every legitimate record format you purchase is your own property for a long time. To get one more version of the bought kind, proceed to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms site the first time, adhere to the basic instructions under:

- Initial, make certain you have selected the correct record format for that region/area of your liking. Read the kind explanation to ensure you have picked the proper kind. If available, use the Preview button to check with the record format too.

- In order to discover one more model from the kind, use the Search field to get the format that suits you and specifications.

- Upon having located the format you desire, click Purchase now to move forward.

- Pick the pricing plan you desire, enter your credentials, and sign up for a free account on US Legal Forms.

- Full the transaction. You can use your charge card or PayPal bank account to pay for the legitimate kind.

- Pick the structure from the record and download it to your device.

- Make alterations to your record if possible. You can total, modify and indication and produce Georgia Demand Bond.

Down load and produce a huge number of record themes while using US Legal Forms website, which provides the greatest variety of legitimate forms. Use expert and condition-particular themes to tackle your company or person demands.

Form popularity

FAQ

In Georgia, authorities can keep defendants in jail for up to seventy-two hours before they formally charge them with criminal violations. For warrantless arrests, the law only allows forty-eight hours. These times don't include weekends or legal holidays.

In Georgia, the court has 2 years to file an accusation in a misdemeanor case and 4 years to indict a felony but once accused or indicted, the statute of limitations does not apply. Constitutional speedy demand is based on case law and the 6th amendment.

Any person who is arrested for a crime and who is refused bail shall, within 90 days after the date of confinement, be entitled to have the charge against him or her heard by a grand jury having jurisdiction over the accused person; provided, however, that if the person is arrested for a crime for which the death ...

In Georgia, detained persons are entitled to a bond hearing within 72 hours of the arrest (not including weekends and holidays.) During the bond hearing, the judge decides if the defendant should be detained or released pending trial.

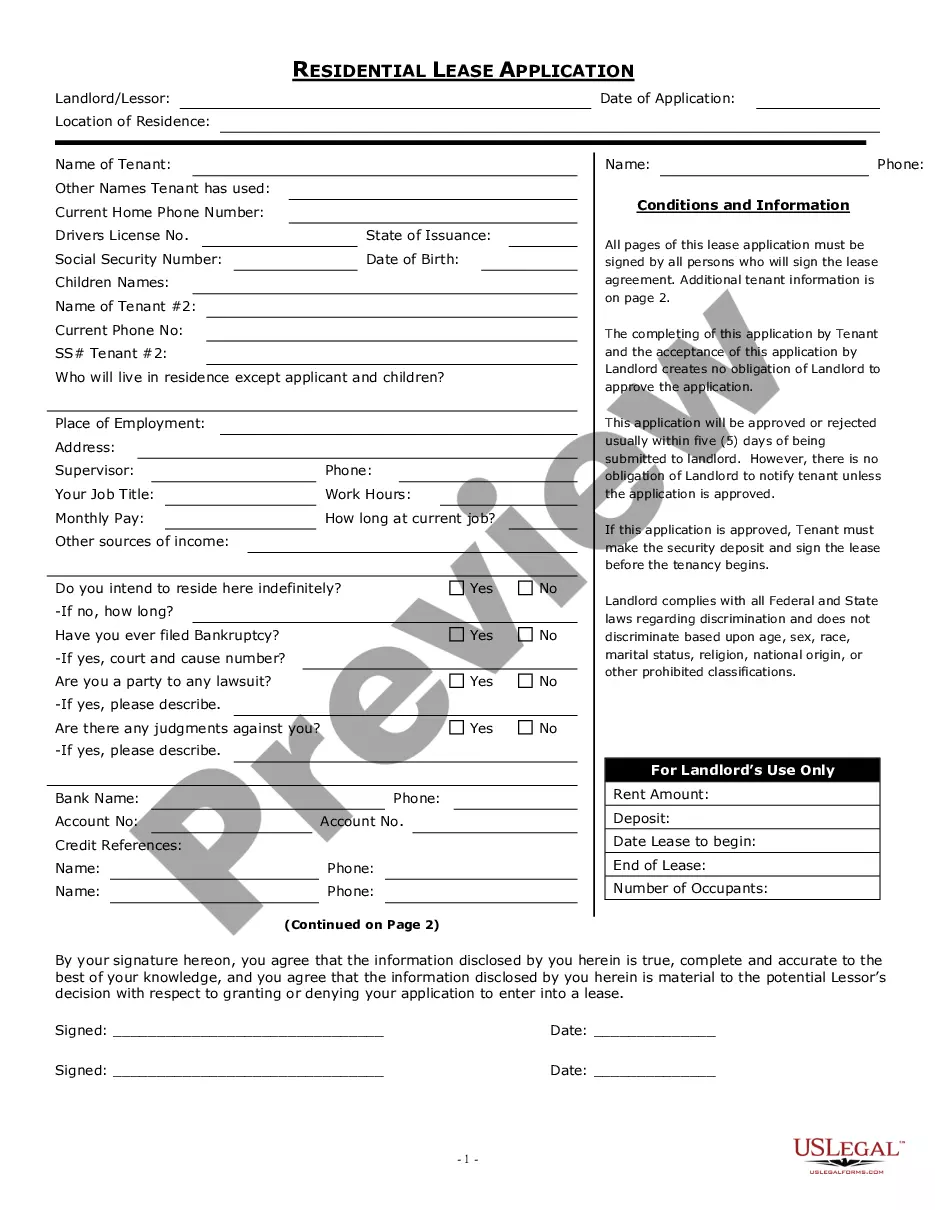

How much does a Georgia contractor bond cost? TermBond AmountCost* (Annual Premium)1 Year$25,000$1252 Years$25,000$2503 Years$25,000$375

? Georgia law says defendants held in custody must be indicted within 90 days. If they aren't, they're automatically owed bond. But in cases involving charges ranging from drug trafficking to aggravated assault, Fulton County prosecutors have repeatedly missed that deadline.

You should be able to receive a bond almost immediately. If you're charged with a felony in Georgia, it may take a little longer because some of those charges, those bonds have to be set by a superior court judge.

Surety bonds basically have a statute of repose, or expiration date. For misdemeanors, this is one year; and for felonies, it is two years. If the charges are not tried within that time period, then any judgment on the bond is not enforceable and the surety is released from liability.