A Georgia Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legal document that outlines the terms and conditions under which an individual, usually working on a commission basis, will be engaged to carry out work for a company in Georgia. This type of agreement is unique to self-employed individuals who generate income based on sales they make. The agreement typically includes various essential elements to protect both the contractor and the employer. Here are some significant points covered in a Georgia Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor: 1. Contractor Information: The agreement begins by identifying the parties involved, including the contractor's name, address, and contact details, as well as the employer's name and address. 2. Scope of Work: This section details the specific services or products the contractor will be responsible for selling, promoting, or distributing. It may include details about the territory or target markets the contractor will cover. 3. Payment Terms: Since this agreement revolves around a percentage-based compensation system, the payment terms are crucial. It outlines how the sales commissions will be calculated, when the payments will be made, and any additional expenses or reimbursements the contractor may be entitled to. 4. Non-Exclusive Arrangement: This clause clarifies that the contractor is not exclusively working for the employer and may engage in similar activities for other companies or clients simultaneously. 5. Obligations and Duties: The agreement outlines the expectations and responsibilities of the contractor. It may include meeting sales targets, maintaining appropriate records, providing regular reports, attending training sessions, and adhering to any specific company policies or guidelines. 6. Independent Contractor Status: This clause declares that the contractor is an independent entity, not an employee of the company. It clarifies that the contractor is responsible for their own taxes, insurance, and other legal obligations. It also confirms that the contractor is not entitled to employee benefits such as health insurance or paid leave. 7. Termination: This section explains the circumstances under which either party can terminate the agreement. It may include provisions for immediate termination due to breach of contract, poor performance, or violation of any terms of the agreement. Different types or variations of the Georgia Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor may exist based on specific industries, such as real estate, insurance, or direct sales. These agreements would incorporate industry-specific terms or regulations, in addition to the general clauses mentioned above. By utilizing a Georgia Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor, both the contractor and employer can establish clarity, build trust, and protect their individual rights and obligations in a business relationship supported by sales commission structure.

Georgia Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Georgia Employment Agreement - Percentage Of Sales - Self-Employed Independent Contractor?

If you wish to collect, download, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require. Various templates for business and personal needs are organized by categories and states, or keywords.

Make use of US Legal Forms to find the Georgia Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor with just a few clicks.

Every legal document template you purchase is yours indefinitely.

You can access every form you downloaded in your account. Select the My documents section and choose a form to print or download again. Be proactive and download, and print the Georgia Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and state-specific forms available for your personal business or individual requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Georgia Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

- You can also access forms you have previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct area/state.

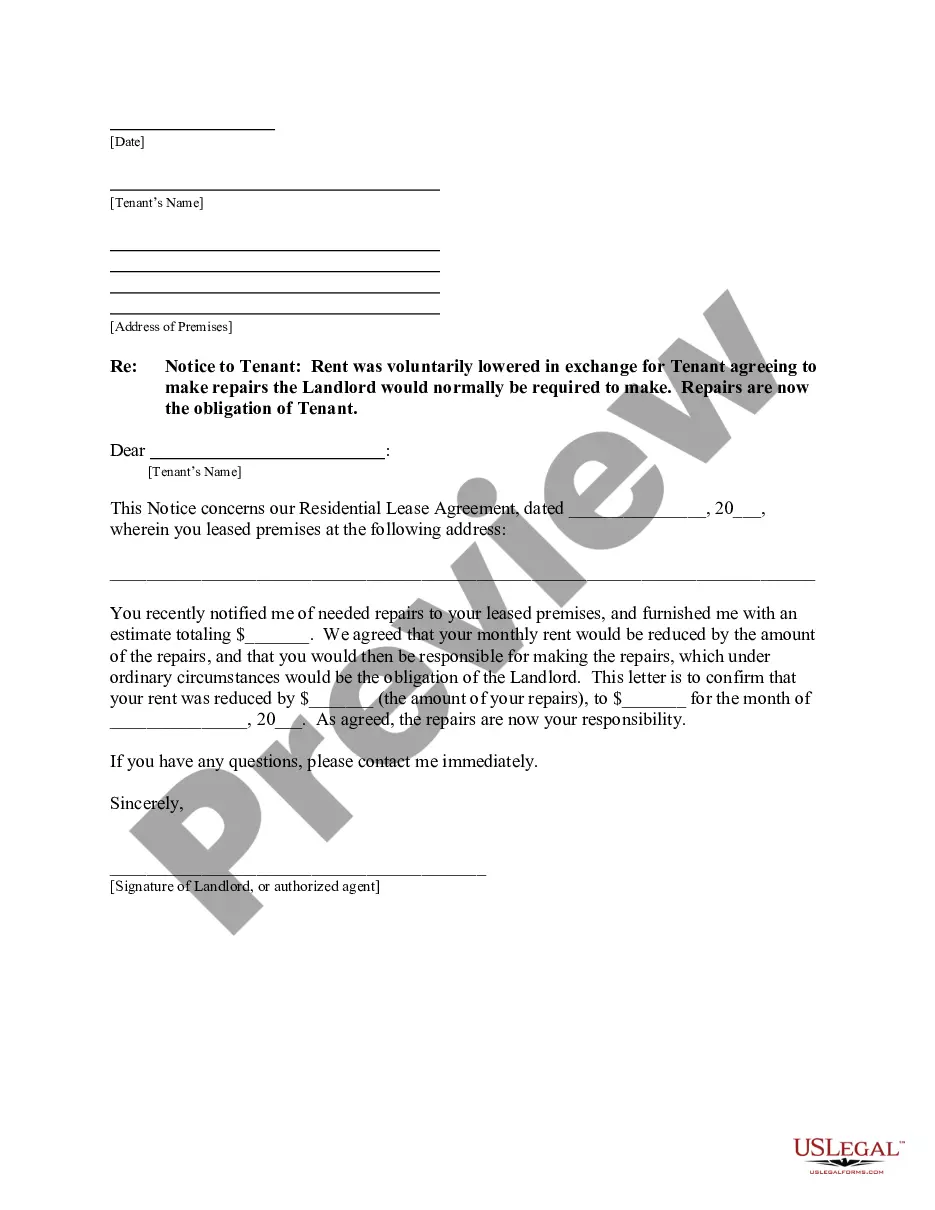

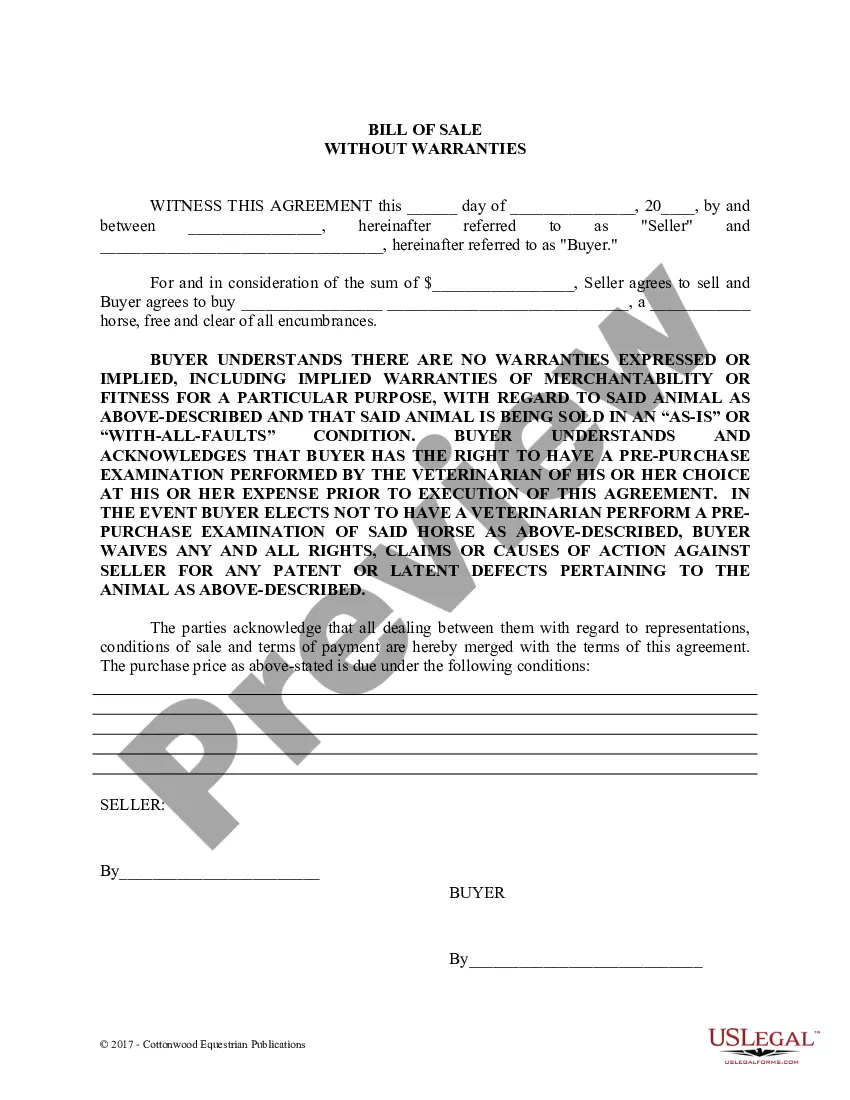

- Step 2. Use the Review option to examine the form's details. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Georgia Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

Form popularity

FAQ

Employees in South Africa are entitled to certain minimum employment benefits, while independent contractors are not. Subject to some exclusions, all employees are entitled to a number of statutory minimum entitlements and basic conditions of employment.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

If you're self-employed, you do not have a contract of employment with an employer. You're more likely to be contracted to provide services over a certain period of time for a fee and be in business in your own right. You'll also pay your own tax and National Insurance Contributions.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

A person is required to come into an agreement (known as Independent Contractor Agreement and/or ICA) if he is appointed as an independent contractor with the company, being the other party. This ICA recognises the rights, duties, obligations, services of the contractor, etc.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Often Independent Contractors are completely unaware that they are not Employees as defined in South African labour legislation and therefore unprotected by labour legislation.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Interesting Questions

More info

Our employee contract template is free and simple; the template is fully customizable, so you can tailor it to meet your company's needs. Just choose a template, fill in your information and then select the templates. You can change the template size, font or content to fit your needs. We even offer templates in both Word and Excel formats, so you can easily edit the forms whenever necessary. The free template was designed to make creating an acceptable and professional employee employment agreement a cinch. The template allows you to: • Review any changes that you would like to make, including adding or removing clauses.