Georgia Revocable Living Trust for Unmarried Couples

Description

How to fill out Revocable Living Trust For Unmarried Couples?

US Legal Forms - among the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

Utilizing the website, you can discover thousands of forms for both business and personal needs, categorized by type, state, or keywords. You can access the latest editions of forms such as the Georgia Revocable Living Trust for Unmarried Couples within moments.

If you already possess a monthly subscription, Log In and retrieve the Georgia Revocable Living Trust for Unmarried Couples from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

Process the payment. Use a credit card or PayPal account to finalize your order.

Obtain the format and download the form onto your device. Edit. Fill out, modify, print, and sign the acquired Georgia Revocable Living Trust for Unmarried Couples. Every design you add to your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Gain access to the Georgia Revocable Living Trust for Unmarried Couples with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize numerous expert and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are straightforward steps to assist you in getting started.

- Ensure you have selected the correct form for your city/region.

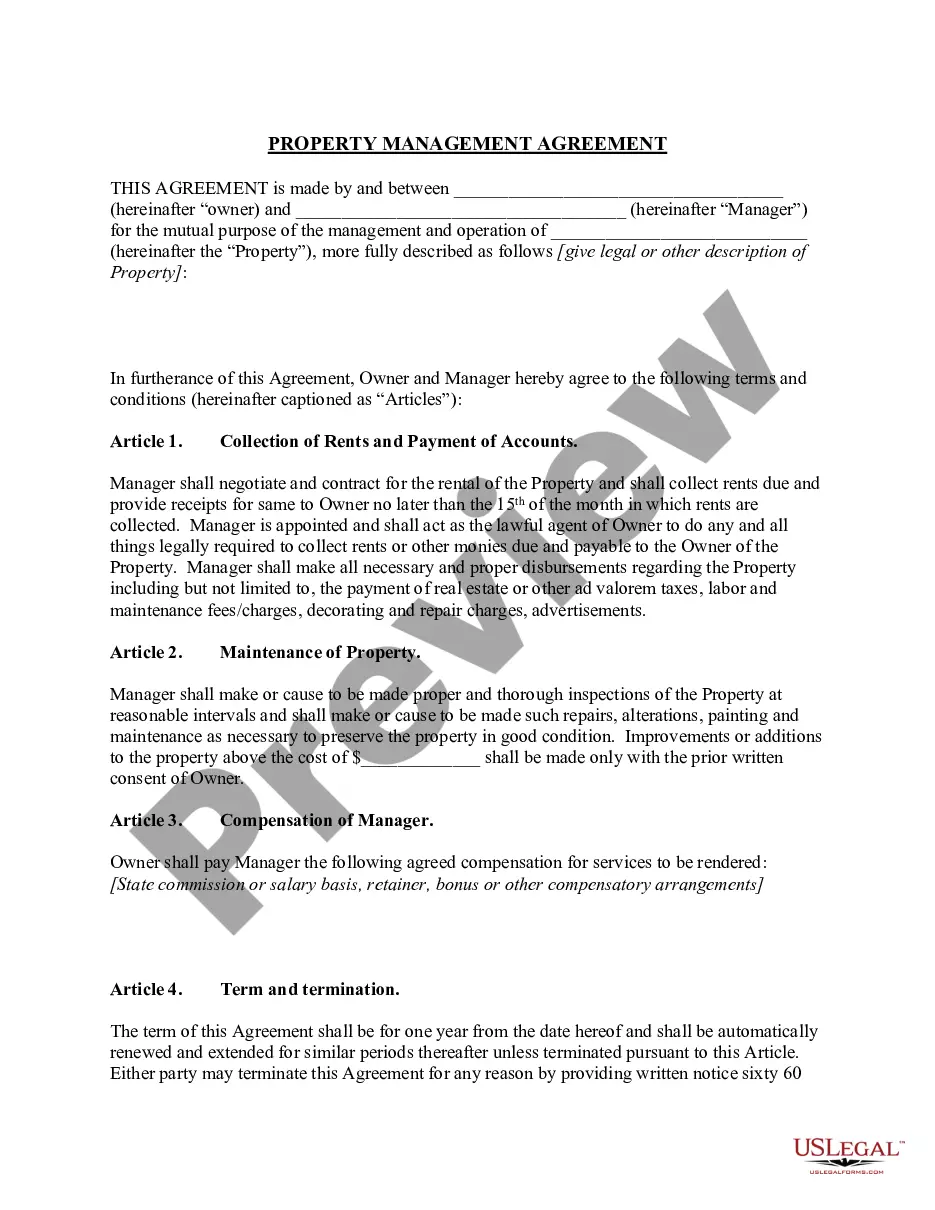

- Click on the Preview button to review the form's content.

- Examine the form description to ensure you have chosen the appropriate one.

- If the form does not satisfy your needs, utilize the Search section at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your details to register for the account.

Form popularity

FAQ

One downside of a living trust is that it may require more upfront costs compared to a simple will. Additionally, if you do not transfer all of your assets into the trust, those assets will still go through probate. It's essential to regularly review and update your Georgia Revocable Living Trust for Unmarried Couples to ensure it reflects your current wishes and circumstances. Ultimately, understanding these factors can help you make an informed decision.

To set up a Georgia Revocable Living Trust for Unmarried Couples, you should first define your assets and decide who will be the trustee. Next, create a trust document that outlines the terms and conditions of the trust. You can use platforms like US Legal Forms to facilitate the process, ensuring that you meet all legal requirements. Finally, transfer your assets into the trust to keep everything organized and secure.

While the focus here is on the Georgia Revocable Living Trust for Unmarried Couples, married couples often choose joint revocable living trusts to simplify asset management and estate planning. However, for unmarried couples, establishing separate but interrelated trusts can provide clarity and protection for each partner's assets. Always consider discussing your unique situations with a legal professional to determine the best options available for your specific circumstances.

The decision to establish one trust or two in a Georgia Revocable Living Trust for Unmarried Couples often depends on your specific situation and goals. Having one trust may simplify management and distribution of assets, while two separate trusts can provide clearer boundaries for each person's assets. It's essential to consult with an expert to evaluate which approach best meets your needs and ensures that your wishes are effectively represented.

In a Georgia Revocable Living Trust for Unmarried Couples, it's advisable not to place retirement accounts or life insurance policies directly into the trust. Instead, consider naming the trust as the beneficiary to manage these assets appropriately. Additionally, avoid including personal items that may need to be liquidated or distributed manually, as this can complicate the trust administration process.

When one person in a Georgia Revocable Living Trust for Unmarried Couples dies, the assets in the trust typically transfer to the surviving member or beneficiaries as outlined in the trust agreement. This process generally avoids probate, making it simpler and faster for loved ones to access the assets. It's crucial to have a clear plan in place within the trust to ensure that your wishes are honored.

You can place your bank accounts in your Georgia Revocable Living Trust for Unmarried Couples, but it isn’t always necessary for every account. It’s often wise to keep a few accounts outside of the trust for easy access and daily transactions. However, transferring your primary or significant accounts can simplify estate management and ensure a smooth transition for your beneficiaries. US Legal Forms provides valuable insights on how to properly manage these transfers.

Assets such as personal injury settlements and certain government benefits are generally not suitable for inclusion in a revocable trust. It's important to remember that anything with a designated beneficiary—like life insurance and retirement accounts—should also be kept separate. When you consider a Georgia Revocable Living Trust for Unmarried Couples, it is wise to evaluate your asset portfolio to determine the best approach.

To set up a Georgia Revocable Living Trust for Unmarried Couples, start by drafting a trust document that outlines your wishes and asset distribution. You can create this document independently or consult a professional. Once you have your trust established, transfer your assets into the trust to ensure they are managed according to your guidelines. Platforms like US Legal Forms can assist you in drafting and understanding your options.

Typically, retirement accounts, life insurance policies, and certain types of assets require special handling and should not be included in a revocable trust. Additionally, assets with designated beneficiaries may pass outside of the trust. For those exploring a Georgia Revocable Living Trust for Unmarried Couples, it's crucial to understand these exceptions to ensure your desired outcomes.