Georgia Option For Sale and Purchase of Real Estate — Commercial Building is a legal agreement that provides individuals or entities with the opportunity to acquire a commercial building through an option contract. This arrangement allows the potential buyer, also known as the option holder, to have the exclusive right to purchase the property at a predetermined price within a specific timeframe, while the seller agrees not to sell the property to any other buyer during the option period. The Georgia option for the sale and purchase of real estate is a flexible tool that offers both parties certain advantages. For the potential buyer, it provides the opportunity to secure a commercial building without the obligation to purchase, allowing them time to conduct due diligence, obtain necessary financing, and evaluate the property's suitability for their purposes. On the seller's side, this option arrangement ensures a potential sale without committing to a buyer immediately, granting them additional time to find alternative offers if needed. In Georgia, there are various types of options for the sale and purchase of commercial buildings. Some common variations include: 1. Lease Option: This type of option agreement combines both a lease and an option to purchase the commercial building. The potential buyer, in this case, becomes the tenant during the lease term and has the option to buy the property at a later date. 2. Call Option: A call option offers the buyer the right to purchase the commercial building at a predetermined price within a specified time frame. This type of option is commonly favored by investors or developers who wish to acquire a property for potential future development or appreciation. 3. Put Option: In a put option arrangement, the seller grants the potential buyer the right to sell the property back to them at a predetermined price. This option is frequently used in situations where the option holder may want to exit their investment or unload the property due to changing circumstances. 4. Right of First Refusal: This option gives the potential buyer the first opportunity to purchase the commercial building if the seller decides to sell it during the option period. If the seller receives an offer, they must present it to the option holder, who then has the right to match or exceed the offer before it can be accepted. 5. Conditional Option: A conditional option is based on specific conditions that must be met for the purchase to proceed. These conditions may include obtaining zoning approvals, securing necessary permits, or meeting other requirements essential to the buyer's intentions for the commercial building. In summary, Georgia Option For Sale and Purchase of Real Estate — Commercial Building is a versatile legal agreement that enables potential buyers and sellers to negotiate the acquisition of commercial properties under favorable terms. The various types of options available provide flexibility for both parties, offering opportunities for strategic investments, future developments, or secure exits from existing investments.

Georgia Option For the Sale and Purchase of Real Estate - Commercial Building

Description

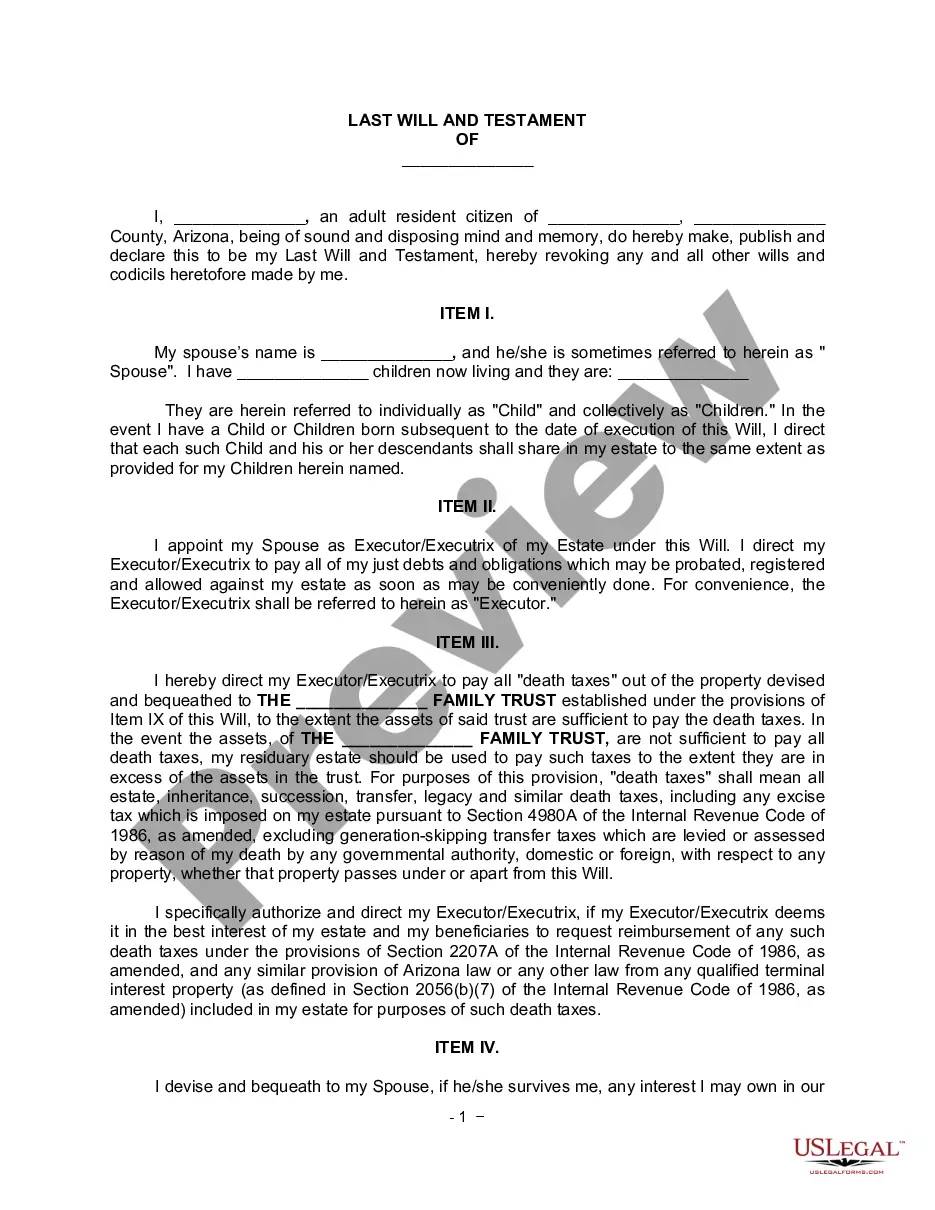

How to fill out Georgia Option For The Sale And Purchase Of Real Estate - Commercial Building?

You have the capability to dedicate time online searching for the legal document template that fulfills the state and federal criteria you desire.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You are able to download or print the Georgia Option For the Sale and Purchase of Real Estate - Commercial Building from your service.

If available, utilize the Preview option to view the document template as well. If you wish to find another version of your document, use the Search field to locate the template that aligns with your needs and preferences. Once you find the template you require, click Acquire now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make adjustments to your document if possible. You can complete, edit, sign, and print the Georgia Option For the Sale and Purchase of Real Estate - Commercial Building. Download and print a multitude of document templates from the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal requirements.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- Afterward, you can complete, edit, print, or sign the Georgia Option For the Sale and Purchase of Real Estate - Commercial Building.

- Every legal document template you obtain is permanently yours.

- To acquire an additional copy of the purchased document, navigate to the My documents tab and select the applicable option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the document description to confirm that you have chosen the right document.

Form popularity

FAQ

Yes, there is a significant difference between commercial and residential real estate licenses in Texas. A commercial real estate license focuses on transactions involving business properties, such as office buildings and retail spaces. In contrast, a residential license pertains to homes and other living spaces, which are governed by different regulations and requirements.

Commercial property includes office buildings, medical centers, hotels, malls, retail stores, multifamily housing buildings, farm land, warehouses, and garages. In many states, residential property containing more than a certain number of units qualifies as commercial property for borrowing and tax purposes.

The rule in Georgia is Caveat Emptor (let the buyer beware). This is a common law doctrine which serves as the general rule regarding the purchase of realty.

1) Due Diligence Period During the Due Diligence Period, you can terminate the contract for ANY REASON here in Georgia.

Commercial property is real estate that is owned or used by businesses. Most states, including Georgia, enforce a number of laws that deal specifically with commercial property issues. Commercial real estate law establishes legal standards for commercial leases and for the purchase and sale of commercial real estate.

In Georgia, due diligence is the period when you are given an amount of time to get out of a purchase and sale agreement and still obtain your earnest money deposit back. This allows a buyer to carry out all the inspections of the home and the surroundings before coming to any conclusions.

When does due diligence start? It starts the moment the contract is signed. The following day is Day 1.

The due diligence period ends at a.m. on the last business day after the day following the day the contract is signed.

Commercial property is real estate that is used for business activities. Commercial property usually refers to buildings that house businesses, but can also refer to land used to generate a profit, as well as large residential rental properties.

In Georgia, it has become customary over the years to include an all encompassing due diligence period commonly lasting 10 to 14 days. Buyers are advised to use the period to inspect every single element of the purchase transaction, since objections which are raised later could result in forfeiture of earnest money.