Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is a crucial document that individuals must be aware of in case of any unfortunate incidents involving their credit cards. This report is specifically designed to provide cardholders in Georgia with a means to report the loss or theft of their credit cards promptly, ensuring timely action to protect their financial assets. Prompt reporting of a lost or stolen credit card is crucial as it helps prevent unauthorized transactions and potential misuse by fraudulent individuals. The Georgia Credit Cardholder's Report emphasizes the importance of contacting the credit card company immediately after noticing the loss or theft through telephone communication. Once the credit card issuer is notified, they can take immediate action, such as blocking the card and initiating an investigation to identify any suspicious activities associated with the card. By facilitating this efficient reporting process, cardholders can minimize their liability for fraudulent charges and safeguard their financial well-being. It is essential to note that the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone may come in various forms or names, depending on the specific credit card issuer. Some commonly known variations include: 1. Georgia Credit Cardholder's Lost Card Report by Phone 2. Georgia Credit Cardholder's Stolen Card Notification by Telephone 3. Georgia Credit Cardholder's Telephone Report for Lost or Stolen Credit Cards Regardless of the specific name, the objective remains the same — ensuring that cardholders have a straightforward and efficient method to report the loss or theft of their credit cards after contacting their credit card company through phone communication. In conclusion, the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is a vital document that individuals should be familiar with to promptly report any unfortunate incidents involving their credit cards. By efficiently reporting the loss or theft, cardholders can protect themselves from potential financial losses and minimize the risk of fraudulent activities on their accounts.

Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

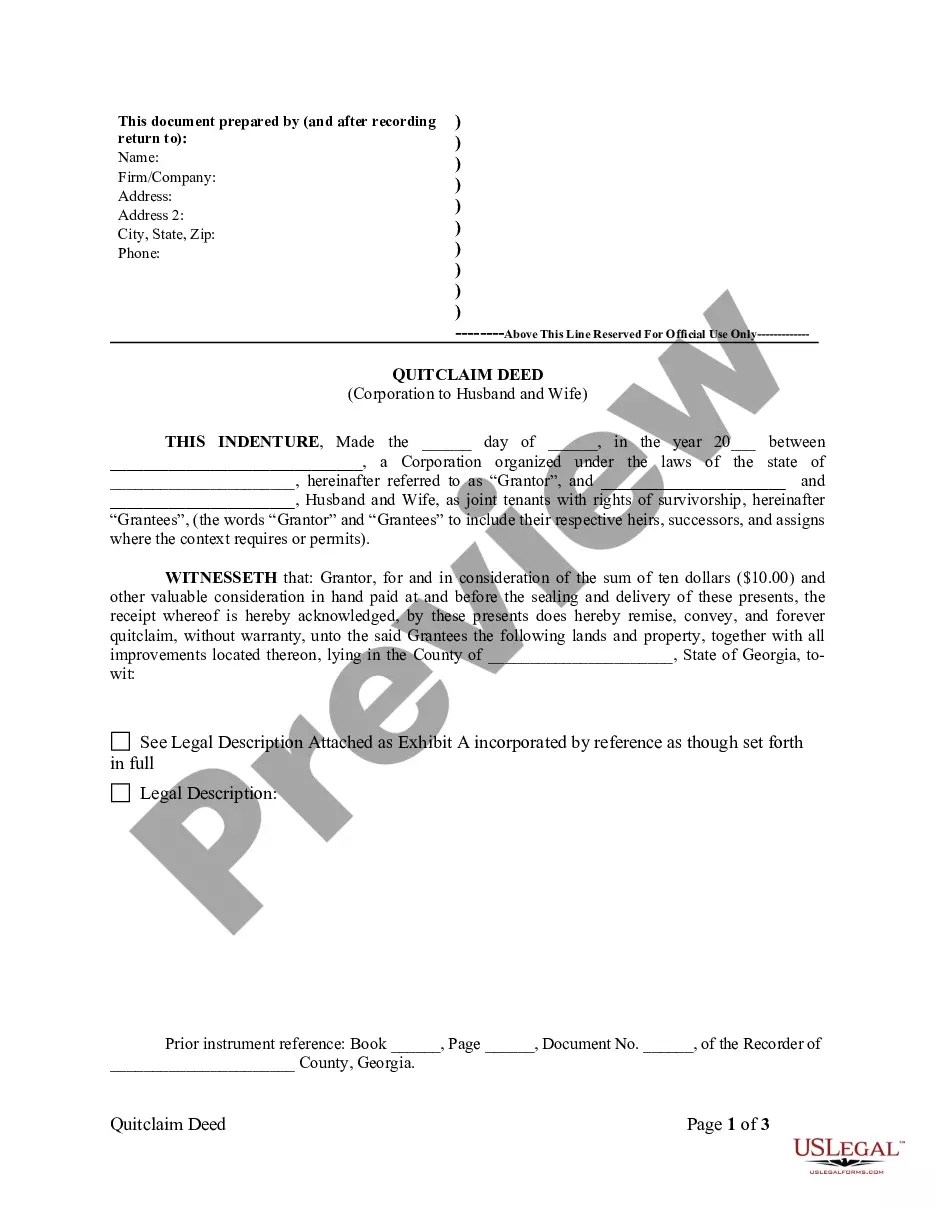

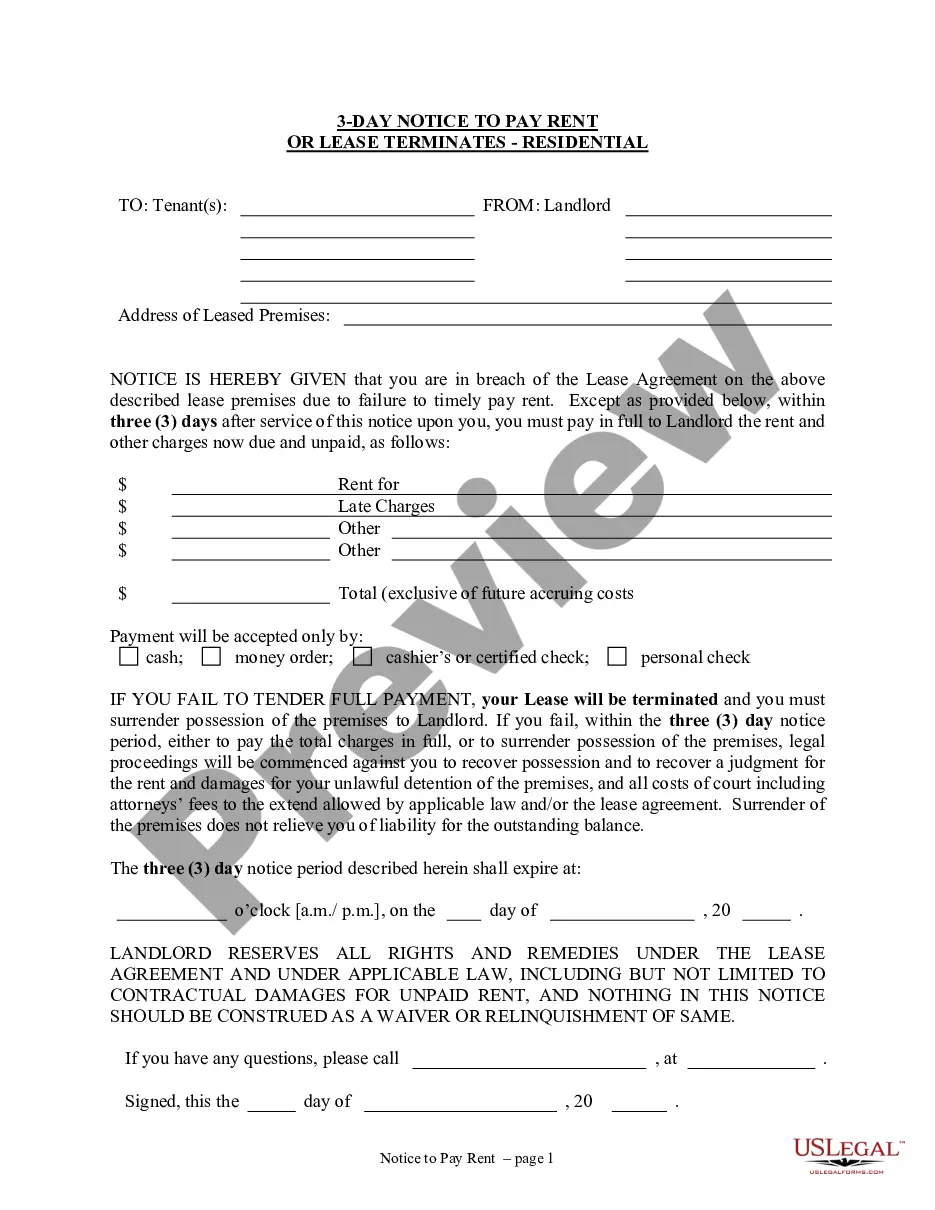

How to fill out Georgia Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

If you have to total, obtain, or produce authorized file web templates, use US Legal Forms, the most important variety of authorized kinds, that can be found online. Make use of the site`s basic and practical research to get the files you want. A variety of web templates for enterprise and specific uses are categorized by groups and says, or keywords. Use US Legal Forms to get the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone in a couple of click throughs.

Should you be presently a US Legal Forms customer, log in to the account and then click the Down load button to get the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone. You may also entry kinds you previously delivered electronically inside the My Forms tab of your account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the form for the correct metropolis/country.

- Step 2. Utilize the Preview choice to examine the form`s content material. Do not forget to learn the information.

- Step 3. Should you be not happy using the kind, make use of the Look for area near the top of the monitor to get other types from the authorized kind template.

- Step 4. When you have located the form you want, select the Buy now button. Pick the rates prepare you like and add your qualifications to sign up on an account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the structure from the authorized kind and obtain it on the product.

- Step 7. Complete, modify and produce or sign the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone.

Every authorized file template you get is your own permanently. You might have acces to each kind you delivered electronically inside your acccount. Go through the My Forms area and choose a kind to produce or obtain once more.

Compete and obtain, and produce the Georgia Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone with US Legal Forms. There are millions of skilled and express-distinct kinds you may use for your enterprise or specific requires.

Form popularity

FAQ

Also, if an unauthorized charge to your ATM is reported to your bank statement, you are liable for the full amount unless you report the charge within 60 days of the date the statement is sent to you. In other words, report the loss/theft of your ATM card immediately.

Notify your bank or credit union. As soon as you're reasonably certain you won't find your card, contact your bank or credit union and request a replacement. Typically, you can do this by phone or by visiting a branch location. Your lost card will be canceled, and it may take up to seven days to receive a new one.

If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Depending on timing, they may instruct you to destroy and dispose of the card and begin using the replacement card that they've arranged to be sent to your address.

A person convicted of financial transaction card theft in Georgia will be charged with a felony. The consequences include a fine up to $5,000.00 and a prison term between one and five years, or both.

In most instances, a credit card reported as lost is completely deactivated and a new one is issued. Some issuers allow cardholders to lock the card, either online or by requesting it through customer service. This option ensures that the card isn't usable if someone finds it, but can be reactivated it if you find it.

If you can see what bank the card is through, then drop it off at one of those branches, and the will get it to the owner. Or you can drop it off at the police station. You could cut it up and throw it away as another option.

Contact your credit card issuer When you speak to a representative, tell them that your account was compromised and list the fraudulent transactions. The bank will cancel the card (this doesn't mean your account is closed) and mail you a new card with a new account number, expiration date and security code.

Got some time to spare? Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.