Georgia Commercial Partnership Agreement in the Form of a Bill of Sale

Description

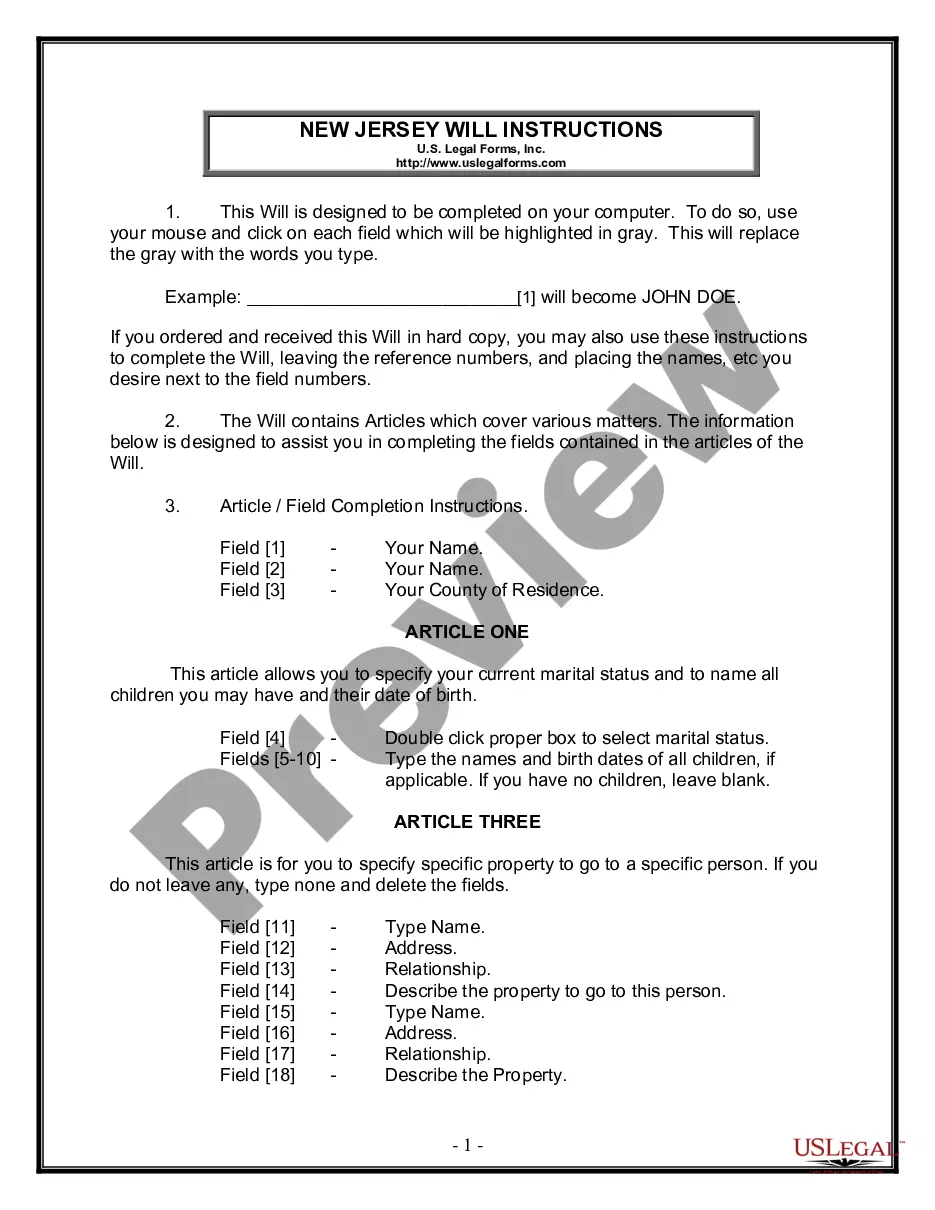

How to fill out Commercial Partnership Agreement In The Form Of A Bill Of Sale?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide selection of legal document templates that you can download or print.

By utilizing the website, you will find thousands of forms for both business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest editions of forms such as the Georgia Commercial Partnership Agreement in the Format of a Bill of Sale within moments.

If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

If you are satisfied with the form, confirm your choice by clicking the Get now button.

- If you have a subscription, Log In and retrieve the Georgia Commercial Partnership Agreement in the Format of a Bill of Sale from your US Legal Forms account.

- The Download button will appear on each form you view.

- You can access all previously saved forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are straightforward steps to get started.

- Make sure you have selected the correct form for your city/state.

- Click the Review button to check the content of the form.

Form popularity

FAQ

Setting up a 50/50 partnership involves equal distribution of profits, responsibilities, and decision-making between partners. Begin with open discussions about goals, contributions, and expectations to foster mutual understanding. Draft a formal agreement that explicitly outlines each partner's role and processes for resolving conflicts. Utilizing a Georgia Commercial Partnership Agreement in the Form of a Bill of Sale can streamline this process and guarantee clarity.

To form a partnership agreement, start by determining your partnership's objectives and the structure you desire. Next, gather the necessary information from each partner concerning contributions and obligations. Draft the agreement, making sure to cover essential elements such as profit distribution and dispute resolution. Consider using a Georgia Commercial Partnership Agreement in the Form of a Bill of Sale for a straightforward and legally binding document.

A partnership agreement is made through negotiation and mutual consent among the partners involved. All parties should discuss their expectations, contributions, and terms upfront. Once agreed upon, these details are documented, often benefiting from legal guidance. A Georgia Commercial Partnership Agreement in the Form of a Bill of Sale can serve as a helpful template.

In Georgia, Form 700 must be filed by partnerships that operate within the state and intend to report income for tax purposes. This includes both general partnerships and limited partnerships. If you are unsure about your specific requirements, seeking guidance from a tax professional can ensure compliance. The Georgia Commercial Partnership Agreement in the Form of a Bill of Sale can also aid in this process.

To create a simple partnership agreement, you start by outlining the roles and responsibilities of each partner. Clearly define the profit-sharing structure, decision-making process, and procedures for resolving disputes. It’s essential to include details on terminating the partnership. Utilizing the Georgia Commercial Partnership Agreement in the Form of a Bill of Sale can simplify this process.

An example of a partnership agreement could be a document outlining the terms for two photographers sharing a studio. It would define profit sharing, client responsibilities, and decision-making processes. Using the framework provided by uslegalforms can streamline the creation of such an agreement, ensuring it remains thorough and legally compliant.

The three types of partnership agreements include general partnership agreements, limited partnership agreements, and limited liability partnership agreements. Each agreement type caters to different levels of liability and involvement among partners. When considering a Georgia Commercial Partnership Agreement in the Form of a Bill of Sale, it is essential to choose the right type to reflect your business arrangement.

Three examples of partnerships include a restaurant co-owned by two chefs, a law firm comprised of several attorneys, and a joint venture between two technology companies for a new software product. Each partnership exemplifies how individuals or entities collaborate to achieve mutual goals. A well-documented partnership agreement can ensure each party understands their obligations and benefits.

The four types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has different implications for liability and management. Understanding these distinctions helps in crafting a Georgia Commercial Partnership Agreement in the Form of a Bill of Sale that fits your business needs.

The four important contents of a partnership agreement typically include the partner's information, the duration of the partnership, the roles of each partner, and profit-sharing arrangements. This ensures clarity around each partner's contributions and expectations. Consider looking into a Georgia Commercial Partnership Agreement in the Form of a Bill of Sale for comprehensive guidelines on these elements.