Title: Georgia Employment Contract of Consultant with Nonprofit Corporation: A Comprehensive Guide Introduction: In the state of Georgia, nonprofit corporations often hire consultants to provide specialized skills, expertise, and guidance. To ensure a productive and mutually beneficial working relationship, a detailed employment contract is necessary. This article aims to provide a comprehensive description of the Georgia Employment Contract of Consultant with Nonprofit Corporation, highlighting its importance and various types available. 1. Importance of the Employment Contract: The Georgia Employment Contract of Consultant with Nonprofit Corporation serves as a legal document that outlines the terms and conditions of employment between the nonprofit corporation and the consultant. It helps establish clarity, expectations, and the rights and responsibilities of both parties. This contract emphasizes the importance of maintaining confidentiality, intellectual property, and compliance with state and federal laws. 2. Essential Components of the Employment Contract: — Identification of Parties: Clearly state the names and contact information of the nonprofit corporation and the consultant. — Engagement Details: Specify the contract start and end dates, project scope, and any deliverables. — Compensation and Payment Terms: Describe the consultant's fee structure, reimbursement policies, and payment schedule. — Confidentiality and Non-Disclosure: Define the confidential information that the consultant will have access to and outline restrictions on disclosure. — Intellectual Property Rights: Address ownership and usage rights of any intellectual property created or utilized during the contract. — Termination Clause: Describe the conditions under which either party can terminate the contract, including notice periods. — Indemnification: Determine the extent to which the nonprofit corporation will protect the consultant from legal claims arising from their work. — Governing Law: Specify that the employment contract will be governed by the laws of Georgia. Types of Georgia Employment Contracts of Consultant with Nonprofit Corporation: 1. Short-term Contract: A contract designed for consultants hired to complete specific projects within a defined period. 2. Continuous Contract: A long-term contract for consultants hired to provide ongoing services or support for an extended duration. 3. Renewal Contract: A contract tailored for consultants whose employment is subject to renewal or extension upon successful completion of the initial contract period. 4. Fixed-Term Contract: A contract with a predetermined end date, which may be suitable for consultants brought in to oversee limited-duration initiatives. Conclusion: In Georgia, nonprofits and consultants rely on well-drafted employment contracts to establish a mutually beneficial working relationship. By encompassing various vital clauses tailored to specific needs, the Georgia Employment Contract of Consultant with Nonprofit Corporation ensures transparency, legal compliance, and a clear understanding of expectations. Whether it is a short-term, continuous, renewal, or fixed-term contract, consultants and nonprofit corporations can utilize these contracts to foster cooperation, protect intellectual property, and establish a solid foundation for successful collaborations.

Georgia Employment Contract of Consultant with Nonprofit Corporation

Description

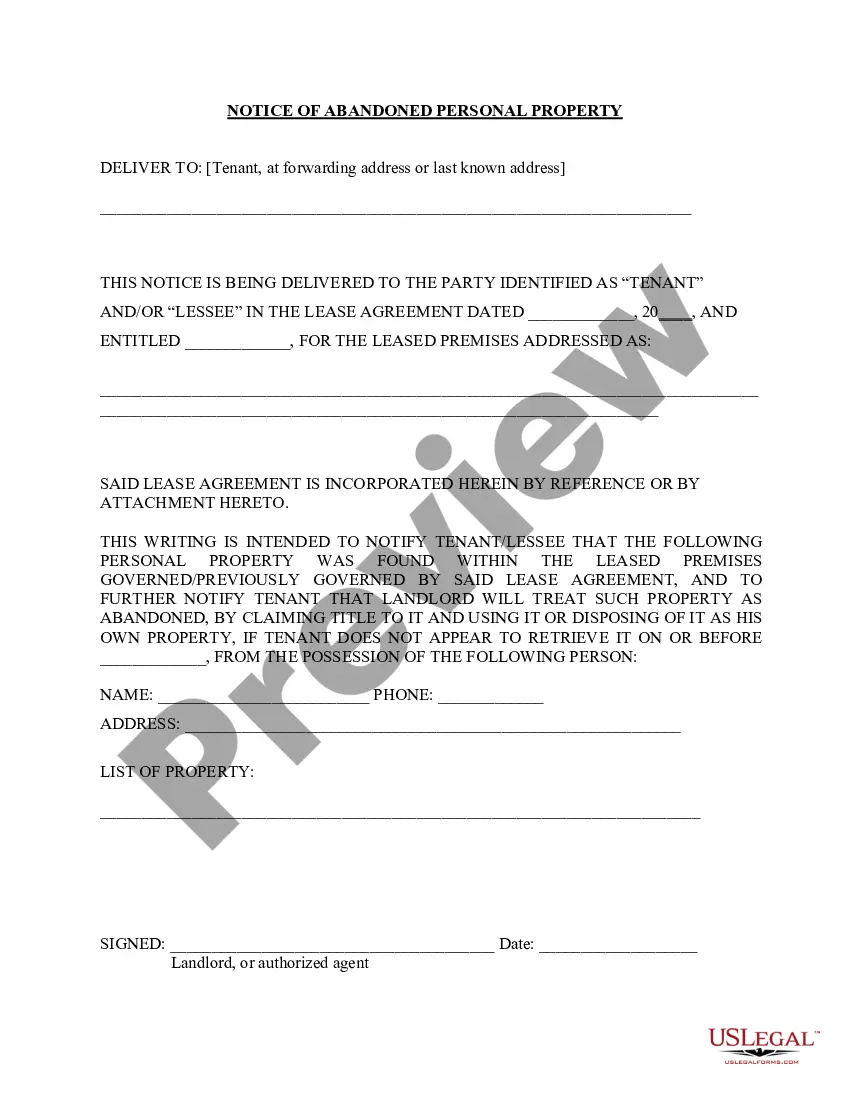

How to fill out Georgia Employment Contract Of Consultant With Nonprofit Corporation?

If you have to full, obtain, or produce authorized record themes, use US Legal Forms, the greatest assortment of authorized varieties, which can be found on the Internet. Make use of the site`s basic and handy look for to get the documents you require. A variety of themes for company and specific uses are sorted by categories and says, or search phrases. Use US Legal Forms to get the Georgia Employment Contract of Consultant with Nonprofit Corporation in just a few click throughs.

Should you be presently a US Legal Forms customer, log in for your bank account and click on the Down load option to have the Georgia Employment Contract of Consultant with Nonprofit Corporation. Also you can gain access to varieties you formerly downloaded from the My Forms tab of your own bank account.

Should you use US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the form for the right city/region.

- Step 2. Use the Preview solution to look over the form`s information. Never neglect to learn the outline.

- Step 3. Should you be not happy with the type, take advantage of the Look for industry towards the top of the display screen to get other models from the authorized type format.

- Step 4. When you have located the form you require, click on the Purchase now option. Choose the rates strategy you like and include your credentials to register on an bank account.

- Step 5. Method the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Select the structure from the authorized type and obtain it on your own system.

- Step 7. Complete, revise and produce or signal the Georgia Employment Contract of Consultant with Nonprofit Corporation.

Every authorized record format you buy is the one you have eternally. You have acces to every single type you downloaded with your acccount. Click on the My Forms segment and decide on a type to produce or obtain once again.

Be competitive and obtain, and produce the Georgia Employment Contract of Consultant with Nonprofit Corporation with US Legal Forms. There are thousands of specialist and state-certain varieties you can utilize for your company or specific requirements.