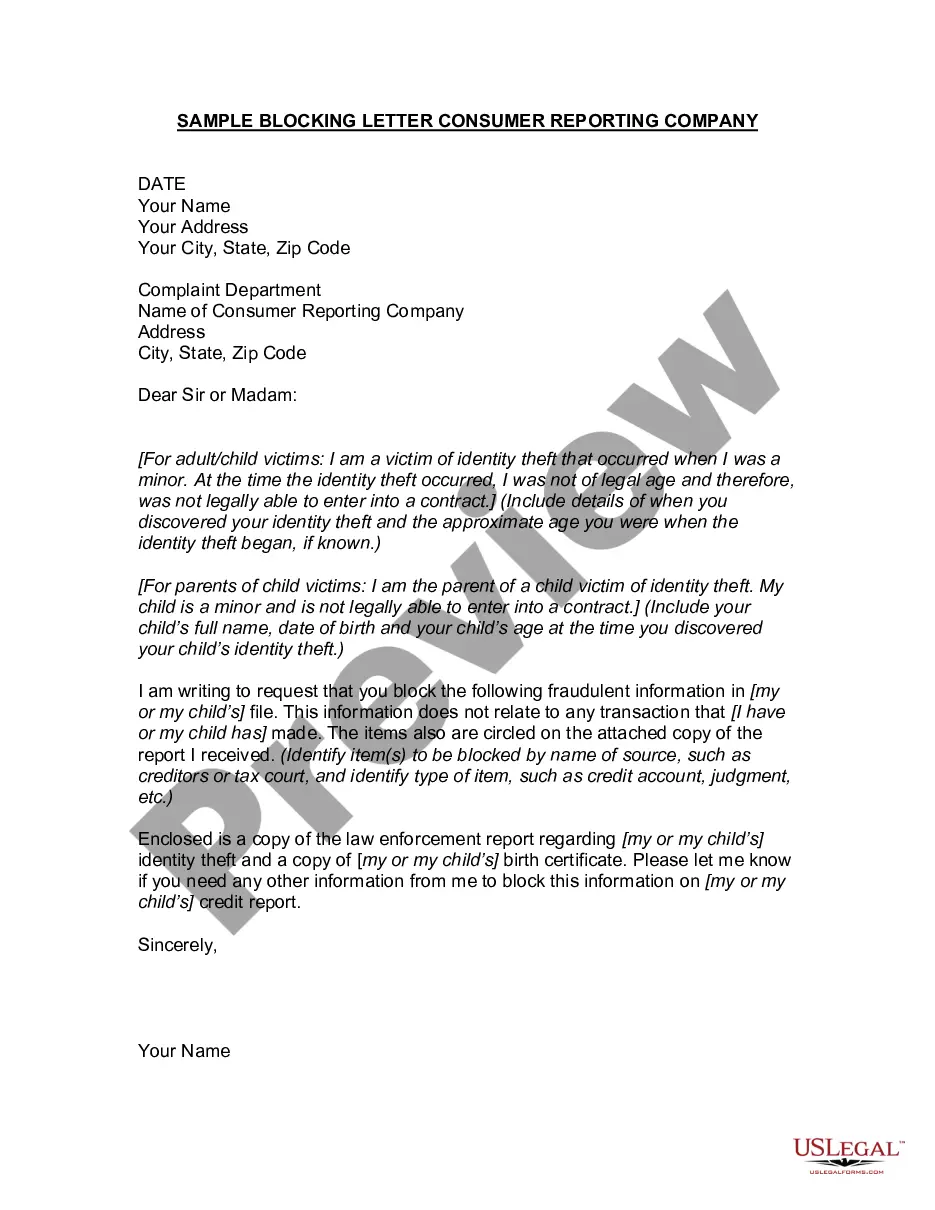

Description: A Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor is a formal written communication addressed to a credit reporting agency or bureau in the state of Georgia, specifically concerning the case of identity theft involving a minor. This letter serves as a crucial tool for parents or legal guardians to protect their child's financial reputation and address any fraudulent activities that may have occurred. Keywords: Georgia, Letter, Credit Reporting Company, Bureau, Identity Theft, Minor Different types of Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor could include: 1. Initial Notification Letter: This type of letter is sent to the credit reporting company or bureau as soon as the parent or legal guardian becomes aware of the identity theft. It provides detailed information about the minor, including their name, date of birth, and any relevant account numbers associated with the fraud. The letter also explains the circumstances of the identity theft and requests immediate action to rectify the situation. 2. Request for Credit Freeze Letter: A credit freeze is a security measure that restricts access to a minor's credit information, making it difficult for identity thieves to open new accounts in the child's name. This type of letter is used to inform the credit reporting company or bureau about the identity theft and request a credit freeze on the minor's file. It may also include supporting documents such as a police report or an identity theft affidavit. 3. Dispute Letter: If the credit reporting company or bureau fails to take appropriate action or correct errors on the minor's credit report after being notified about the identity theft, a dispute letter can be sent. This letter outlines the inaccuracies present in the credit report and demands a thorough investigation to resolve the issue. It is essential to provide supporting evidence, such as the police report, identity theft affidavit, and any other relevant documentation. 4. Follow-up or Status Request Letter: In case of delayed response or inadequate resolution from the credit reporting company or bureau, a follow-up or status request letter can be used. This letter expresses concern over the lack of progress in investigating and resolving the identity theft case. It emphasizes the urgency and the parent or guardian's expectation of a timely resolution. 5. Letter to Creditors or Collection Agencies: If fraudulent accounts or debts have been opened or incurred in the minor's name, a letter to the respective creditors or collection agencies can be sent. This letter notifies them about the identity theft and requests immediate cessation of any collection activities related to those fraudulent accounts. It may also include a copy of the initial notification letter sent to the credit reporting company or bureau for reference. In conclusion, a Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor is a critical document for addressing and rectifying identity theft cases involving children. By utilizing different types of letters tailored to specific situations, parents or guardians can protect their child's financial well-being and ensure that their credit report remains accurate and untarnished.

Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor

Description

How to fill out Georgia Letter To Credit Reporting Company Or Bureau Regarding Identity Theft Of Minor?

Choosing the best lawful record template can be a have difficulties. Naturally, there are plenty of templates available on the Internet, but how would you find the lawful kind you require? Utilize the US Legal Forms website. The services provides 1000s of templates, including the Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor, that you can use for enterprise and private requires. Every one of the kinds are inspected by professionals and fulfill state and federal needs.

When you are already authorized, log in to your accounts and click on the Download key to have the Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor. Make use of accounts to check from the lawful kinds you possess ordered earlier. Go to the My Forms tab of your accounts and get an additional backup in the record you require.

When you are a whole new user of US Legal Forms, here are straightforward guidelines that you can comply with:

- Initial, make certain you have selected the appropriate kind for your personal town/region. You may look over the shape using the Review key and read the shape explanation to guarantee it is the right one for you.

- If the kind fails to fulfill your preferences, utilize the Seach industry to find the right kind.

- Once you are certain the shape would work, select the Purchase now key to have the kind.

- Pick the rates strategy you want and enter in the required info. Make your accounts and pay money for an order with your PayPal accounts or charge card.

- Select the document format and download the lawful record template to your gadget.

- Complete, edit and printing and sign the acquired Georgia Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor.

US Legal Forms may be the most significant local library of lawful kinds for which you will find numerous record templates. Utilize the service to download skillfully-made files that comply with state needs.