Subject: Safeguarding Against Identity Theft: Georgia Sample Letter to Credit Reporting Bureau or Agency Dear [Credit Reporting Bureau or Agency's Name], I am writing to you today to address a critical concern that has emerged in these ever-evolving times — identity theft. As a responsible individual residing in the great state of Georgia, I wish to actively engage in preventive measures to safeguard my personal information and financial well-being. I kindly request your assistance in this matter by providing me with a standardized Georgia sample letter, specifically designed to combat identity theft risks. This letter aims to instigate necessary actions to ensure my credit report remains secure and unaffected. The contents of the letter should adhere to the guidelines provided by the Federal Trade Commission (FTC) and the Fair Credit Reporting Act (FCRA), while taking into account the state-specific regulations in Georgia. It should encompass the following essential elements: 1. Personal Information: Begin the letter by providing my legal name, current residential address, and contact information. It is vital to ensure accuracy and clarity in listing these details. 2. Suspected Identity Theft: Clearly state my concerns regarding potential identity theft and elaborate on the reasons that prompted my suspicion. It could include suspicious financial transactions, unauthorized access to personal accounts, or any instances where I believe my personal information was compromised. 3. Fraudulent Activities: Mention any fraudulent activities noticed in my credit report, such as unfamiliar accounts, unauthorized inquiries, or any inaccuracies detected. To assist you better, I shall attach supporting documentation, such as relevant receipts, bank statements, and any correspondence received from financial institutions. 4. Previous Actions Taken: State any prior measures I have implemented to mitigate the identity theft risks. This could include filing a police report, contacting other relevant bureaus, or freezing my credit reports. Provide supporting document copies (if applicable) to strengthen my case. 5. Request for Investigation: Formally request the credit reporting bureau or agency to initiate a comprehensive investigation into the suspected identity theft. Emphasize the urgency of the matter and request a prompt resolution to help restore my creditworthiness. 6. Notice to Furnish of Information: Please include any necessary statements addressing the requirements outlined in the FCRA regarding the responsibilities of the furnishes of information (credit card companies, banks, etc.). Seek their cooperation in correcting any erroneous information stemming from the suspected identity theft. 7. Communication and Follow-up: State whether I prefer updates and correspondence through mail or email, and provide accurate contact details for prompt communication during the investigation period. Request routine progress updates, including confirmation of account closures, removal of fraudulent entries, and any adjustments made to my credit report. As a proactive citizen of Georgia, I understand the magnitude of this issue and the importance of securing my financial reputation. By providing me with a thoughtfully crafted sample letter tailored to Georgia's regulations, you will enable me to take decisive action against identity theft. This initiative will not only protect me but also contribute to building public awareness about the seriousness of identity theft concerns. I eagerly await your prompt response and guidance to reinforce my efforts in resolving this matter efficiently. Thank you for your immediate attention to this critical issue. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address] Note: The above sample letter can be customized depending on the specific identity theft circumstances and concerns faced by the individual. Different variations or templates of Georgia sample letters for this purpose may exist based on the unique situation of the person seeking assistance.

Georgia Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

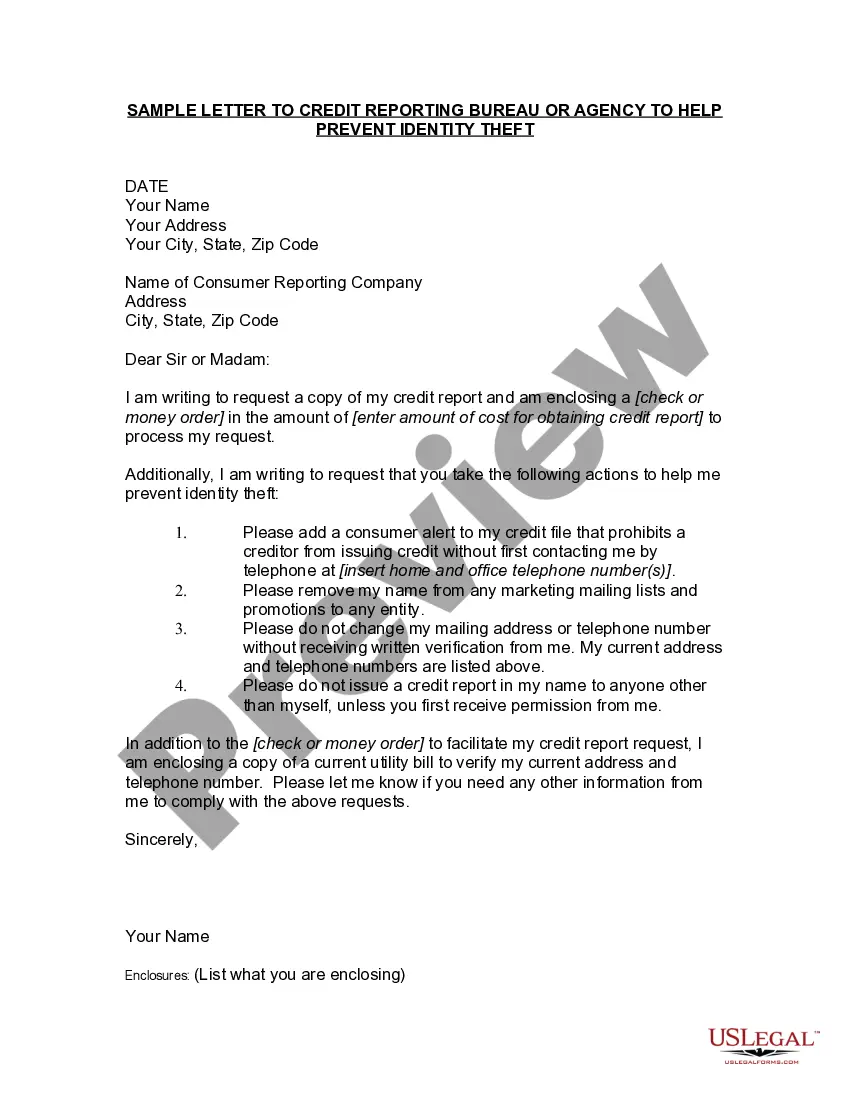

How to fill out Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

If you have to comprehensive, obtain, or print out lawful file web templates, use US Legal Forms, the most important variety of lawful forms, which can be found on the Internet. Utilize the site`s basic and handy research to discover the files you want. Various web templates for enterprise and specific functions are sorted by classes and says, or search phrases. Use US Legal Forms to discover the Georgia Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with a few clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and click on the Acquire key to find the Georgia Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft. You can also gain access to forms you in the past delivered electronically from the My Forms tab of the profile.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the correct area/land.

- Step 2. Take advantage of the Preview method to look over the form`s content material. Don`t overlook to read the description.

- Step 3. Should you be unsatisfied using the develop, utilize the Search area on top of the screen to find other versions of your lawful develop template.

- Step 4. Once you have identified the shape you want, select the Buy now key. Choose the pricing prepare you like and include your credentials to register for the profile.

- Step 5. Approach the transaction. You can use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the structure of your lawful develop and obtain it on the device.

- Step 7. Full, change and print out or sign the Georgia Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft.

Each lawful file template you purchase is the one you have for a long time. You may have acces to every develop you delivered electronically with your acccount. Select the My Forms area and decide on a develop to print out or obtain once again.

Be competitive and obtain, and print out the Georgia Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with US Legal Forms. There are thousands of professional and status-particular forms you may use for your personal enterprise or specific needs.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

How can we help? Call Us. Consumer Complaints: (404) 651-8600. Toll-free in Georgia: (800) 869-1123. Other Issues: (404) 458-3800. Online Complaint Form. File a Complaint. Visit. 2 Martin Luther King Jr. Hours. Monday to Friday, a.m. - p.m. Eastern Time Zone.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.