Title: Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan Keywords: Georgia, letter agreement, known imposter, victim, repayment plan Description: This detailed description explains the concept of a Georgia Letter Agreement between a known imposter and a victim. It highlights the purpose and process of this agreement, its significance in resolving financial disputes, and the potential variations or types that may exist. 1. Understanding the Georgia Letter Agreement: A Georgia Letter Agreement between a known imposter and a victim is a legally binding document that aims to establish a fair and structured framework for the repayment of funds defrauded or otherwise obtained through fraudulent means. This agreement serves as a means for the victim to recover their financial losses while providing the imposter an opportunity to make amends and fulfill their repayment obligations. 2. Purpose of the Agreement: The primary purpose of this agreement is to outline the terms and conditions for repayment, ensuring that both parties are clear on their obligations and responsibilities. By entering into this agreement, the victim seeks to achieve financial redress, while the imposter aims to make restitution for their fraudulent actions. 3. Process of Negotiating the Agreement: The negotiation process typically involves the victim and the known imposter discussing the details of the fraudulent activity and the amount owed. The victim may provide evidence of the fraud to support their claim. Both parties then work together, possibly with the assistance of legal professionals or mediators, to draft an agreement that satisfies their respective interests. 4. Key Components of the Agreement: a. Repayment Terms: This includes specifying the total amount owed, the agreed-upon repayment schedule, the frequency of payments, and the method of payment (e.g., lump sum or installments). b. Interest or Penalty: The agreement may include provisions for interest or penalty charges if payments are delayed or not made according to the agreed schedule. c. Confidentiality: Parties may choose to include a clause ensuring the confidentiality of the agreement and any related discussions. d. Dispute Resolution: To handle potential conflicts or disagreements, a mechanism for dispute resolution, such as arbitration or mediation, may be included. e. Termination Provisions: The circumstances under which the agreement can be terminated must be defined, such as non-payment, breach of the agreement, or completion of repayment. Types of Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: 1. Personal Loan Fraud Repayment Agreement: When a known imposter fraudulently obtained a personal loan, this agreement outlines the terms and conditions for repayment. 2. Investment Fraud Repayment Agreement: In cases where an imposter defrauds a victim through an investment scheme, this agreement establishes a repayment plan while addressing any specifics related to investment terms. 3. Credit Card Fraud Repayment Agreement: This agreement focuses on fraudulent credit card transactions, specifying repayment terms and arrangements for clearing the debt owed by the imposter. 4. Mortgage Fraud Repayment Agreement: In instances where an imposter perpetrated mortgage fraud, this agreement stipulates the repayment plan, taking into account the specific circumstances of the fraud. Note: The variations of Georgia Letter Agreements mentioned above indicate the types of fraud and the corresponding repayment requirements.

Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

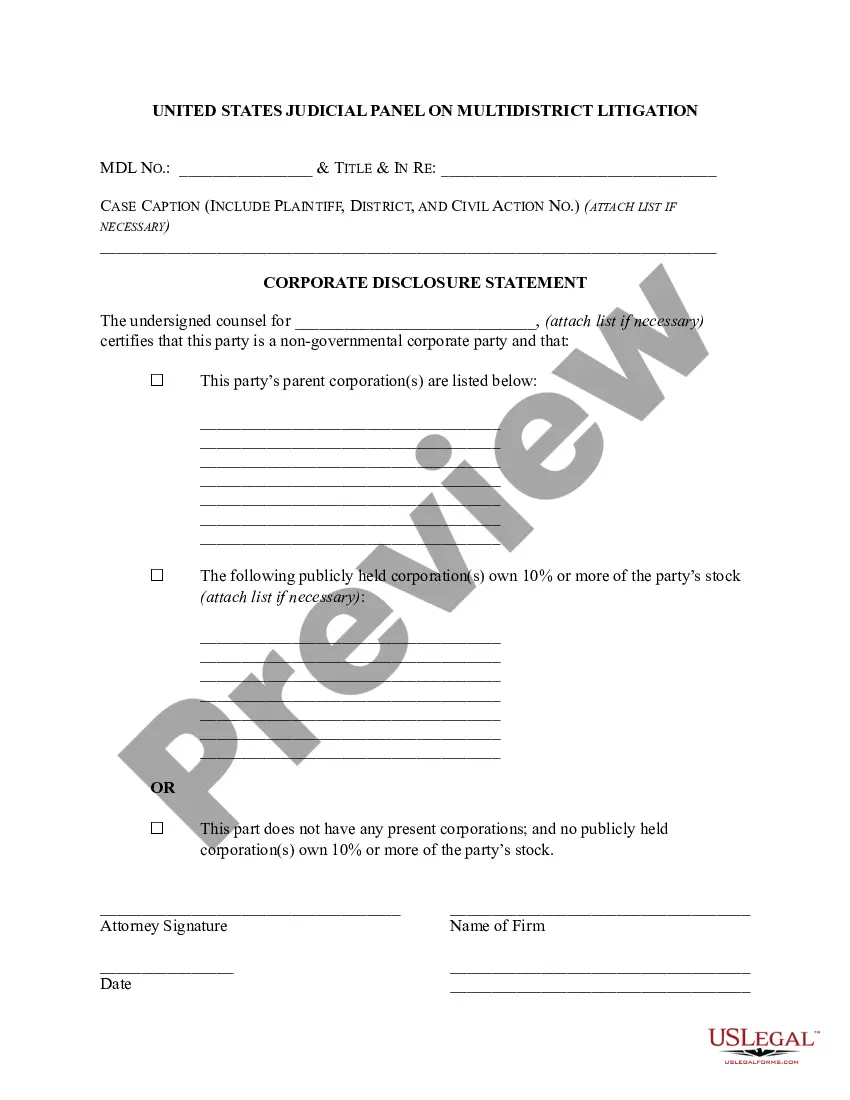

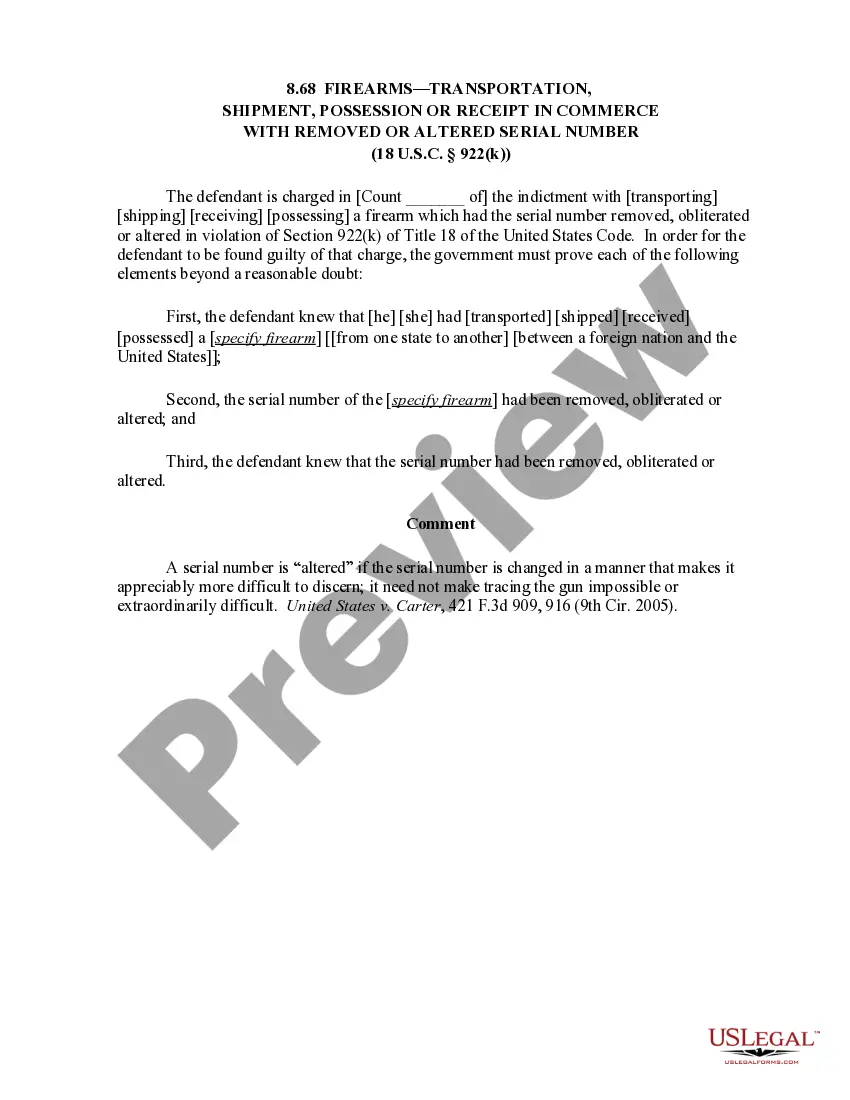

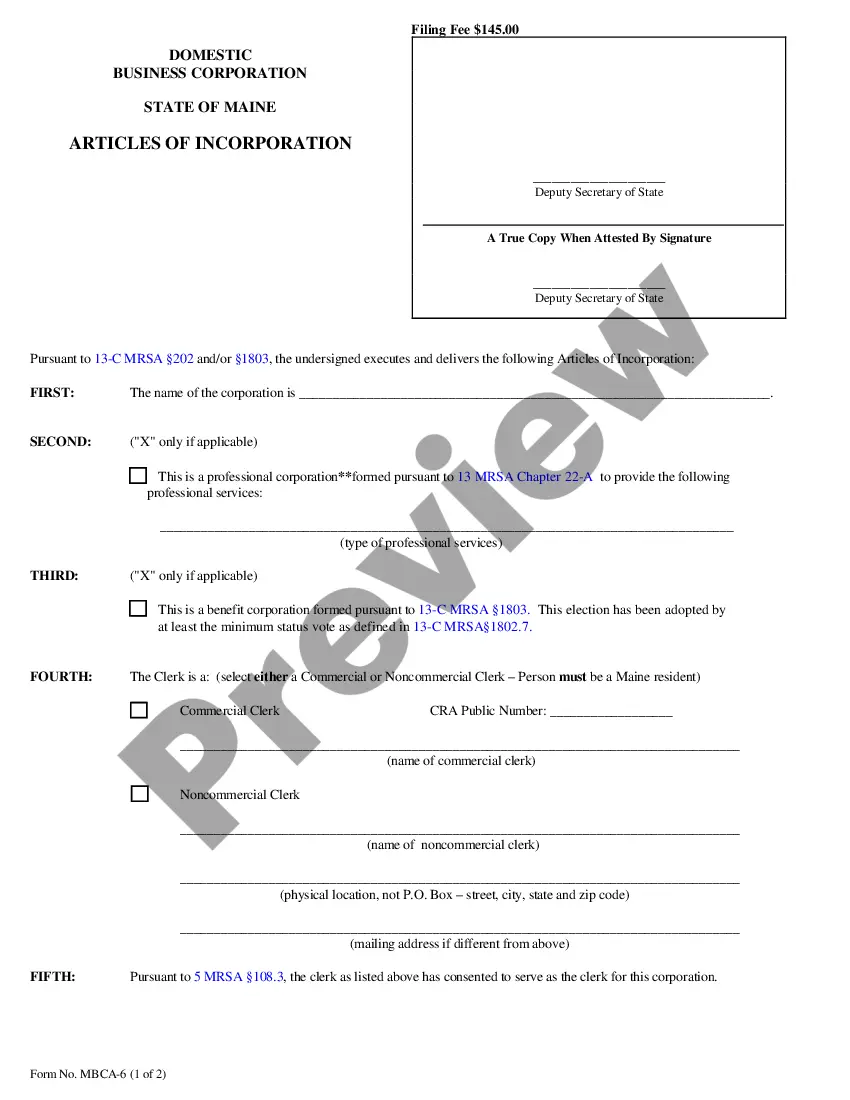

How to fill out Georgia Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

US Legal Forms - one of the greatest libraries of legitimate types in the United States - gives a wide range of legitimate document layouts you are able to acquire or print out. Making use of the website, you can get 1000s of types for business and person reasons, sorted by categories, states, or keywords.You will find the most up-to-date versions of types like the Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan in seconds.

If you already have a membership, log in and acquire Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan in the US Legal Forms local library. The Obtain switch will show up on every develop you see. You gain access to all formerly saved types inside the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed here are straightforward directions to help you get started off:

- Be sure to have selected the best develop for the city/area. Click on the Review switch to analyze the form`s articles. Browse the develop information to ensure that you have chosen the right develop.

- In case the develop does not match your requirements, take advantage of the Research discipline at the top of the display to obtain the one which does.

- Should you be pleased with the shape, confirm your selection by visiting the Acquire now switch. Then, pick the pricing plan you prefer and provide your references to register for the accounts.

- Procedure the transaction. Make use of bank card or PayPal accounts to accomplish the transaction.

- Choose the file format and acquire the shape on your own system.

- Make adjustments. Fill up, revise and print out and signal the saved Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan.

Every single format you included with your money lacks an expiry date and is also yours for a long time. So, if you want to acquire or print out one more duplicate, just visit the My Forms portion and then click about the develop you want.

Get access to the Georgia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan with US Legal Forms, one of the most substantial local library of legitimate document layouts. Use 1000s of professional and state-specific layouts that satisfy your company or person demands and requirements.

Form popularity

FAQ

Most taxpayers qualify for an IRS payment plan (or installment agreement) and can use the Online Payment Agreement (OPA) to set it up to pay off an outstanding balance over time. Once taxpayers complete the online application, they receive immediate notification of whether the IRS has approved their payment plan.

If you owe a tax debt to the Georgia Department of Revenue and cannot afford to pay it all at once, you can request an installment payment agreement to settle your debt over time. Payment plans may not be for longer than 60 months and the minimum monthly payment is $25.

Visit the IRS Web site, .irs.gov, to use the ?Where's My Refund?? interactive tool to determine if they are really getting a refund, rather than responding to the e-mail message. Forward the suspicious e-mail or url address to the IRS mailbox phishing@irs.gov, then delete the e-mail from their inbox.

Georgia Individual Income Tax returns must be received or postmarked by the April 18, 2023 due date.

Once the DOR files a tax lien, they have ten years from that date to collect the unpaid taxes. The 10-year time clock may be tolled (paused) under certain circumstances. For example, when the taxpayer is in a Payment Agreement with the DOR or when the taxpayer has filed bankruptcy.

Installment payment agreements can be requested online through the Georgia Tax Center. Read Installment Payment Agreement for more information on setting up payment plans and to see if you qualify. Is there a fee to setup an installment payment agreement? Yes, the fee is $50 for IPA's that are electronically drafted.

Installment payment agreements can be requested online through the Georgia Tax Center. Read Installment Payment Agreement for more information on setting up payment plans and to see if you qualify. Is there a fee to setup an installment payment agreement? Yes, the fee is $50 for IPA's that are electronically drafted.