Georgia Sample Letter regarding Notifying Client of Cancellation of Deed of Trust

Description

How to fill out Sample Letter Regarding Notifying Client Of Cancellation Of Deed Of Trust?

Have you ever found yourself in a situation where you require documents for both professional or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones isn't easy.

US Legal Forms offers thousands of form templates, such as the Georgia Sample Letter for Notifying Client of Cancellation of Deed of Trust, designed to meet federal and state regulations.

Once you obtain the correct form, click Get now.

Choose the payment plan you need, provide the necessary information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can get another copy of the Georgia Sample Letter for Notifying Client of Cancellation of Deed of Trust anytime, if needed. Just click the required form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Sample Letter for Notifying Client of Cancellation of Deed of Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

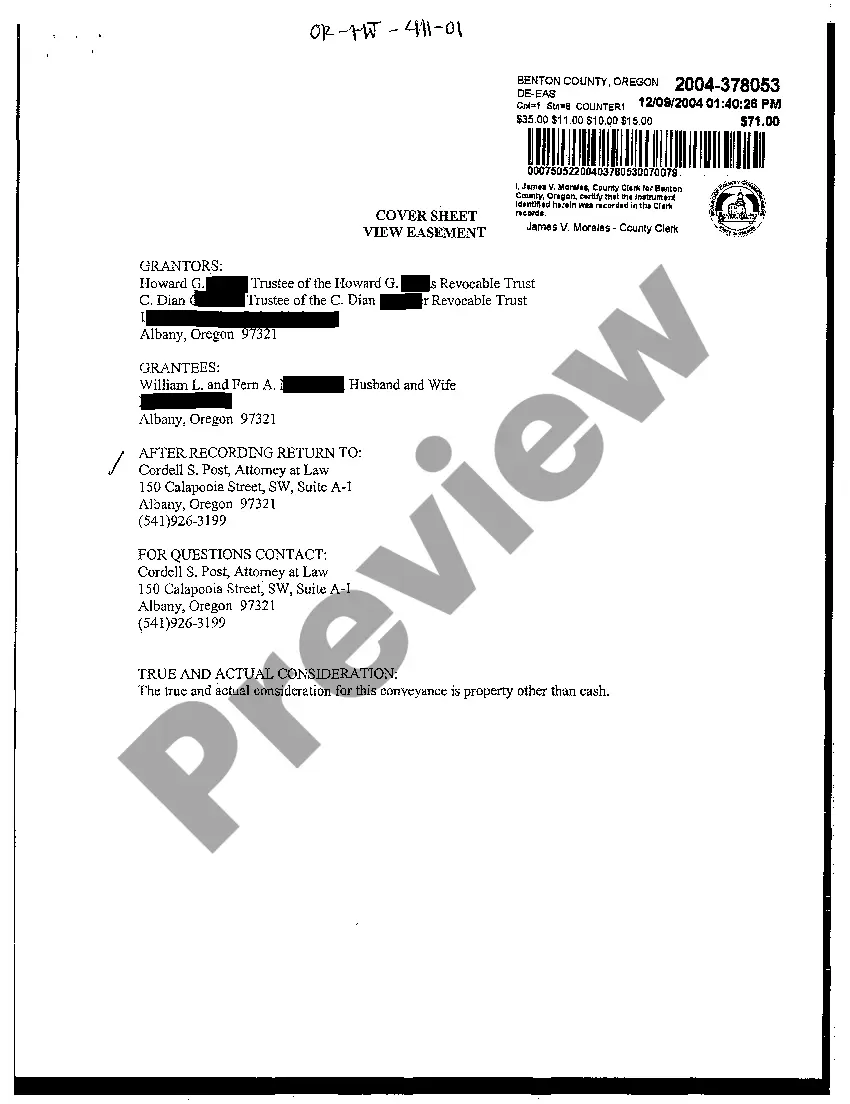

- Utilize the Review option to check the form.

- Read the description to confirm you have selected the right form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

Cancellation of sale deed refers to the revocation of the purchase and sale of property. A sale deed may be cancelled if any party involved is unsatisfied with the deal and makes a claim regarding the same in the court of law.

In Georgia, a security deed is the document that secures a loan on real estate. OCGA § 44-14-80 states that security deeds expire seven years after the maturity of the last installment date stated in the security deed.

Contrastingly, a Security Deed or mortgage only involves two parties, the borrower and the lender.

Georgia law provides that a security deed can be cancelled by the Clerk of Superior Court upon receipt of an affidavit from an attorney with specified attachments.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.