The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Georgia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor

Description

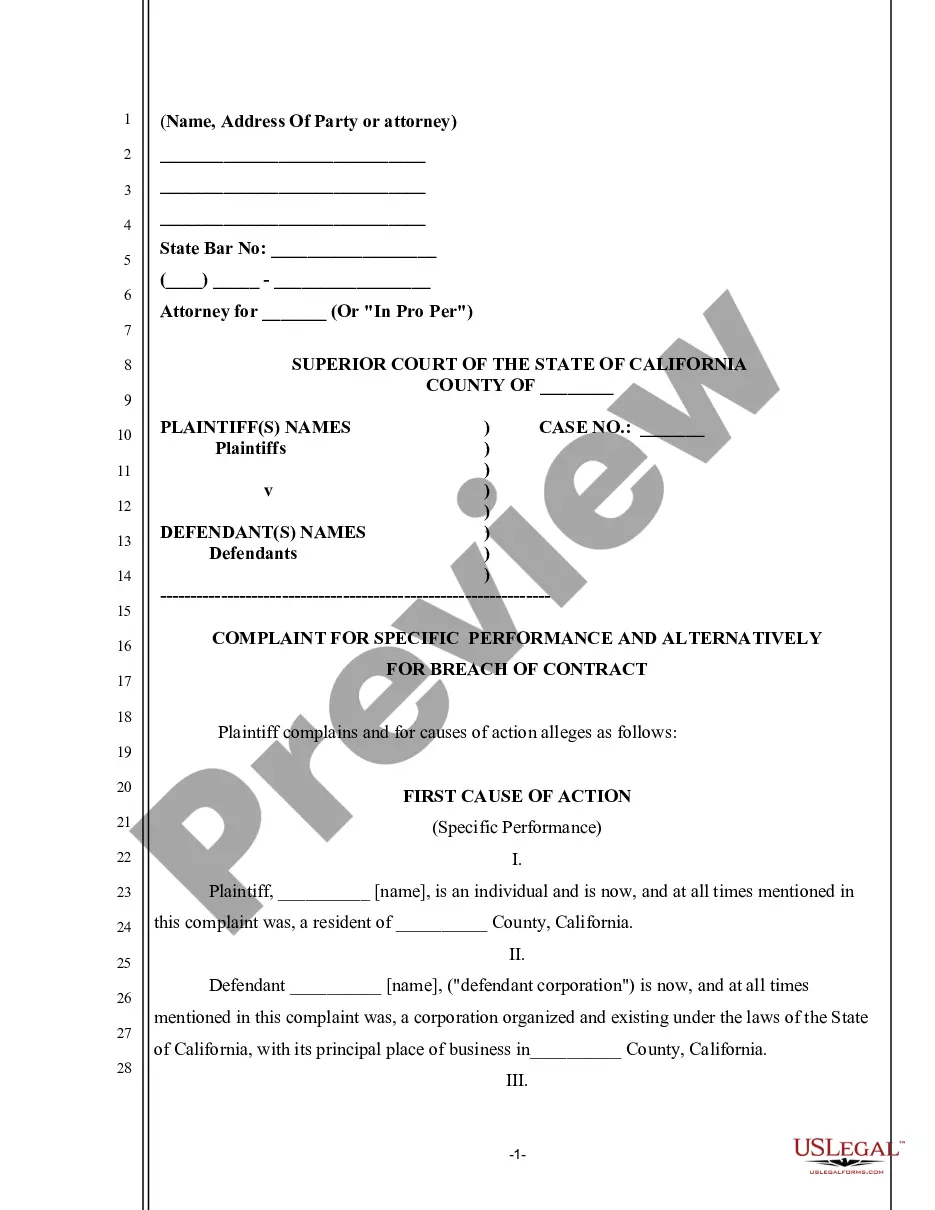

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Due To False Oath Or Account Of Debtor?

US Legal Forms - among the biggest libraries of lawful forms in the United States - offers a variety of lawful document themes it is possible to download or print. Using the site, you may get a huge number of forms for enterprise and individual uses, sorted by types, claims, or search phrases.You will discover the newest variations of forms much like the Georgia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor in seconds.

If you already have a monthly subscription, log in and download Georgia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor from the US Legal Forms collection. The Download option can look on every type you see. You gain access to all previously delivered electronically forms from the My Forms tab of your respective account.

If you wish to use US Legal Forms the first time, allow me to share simple directions to help you began:

- Be sure to have chosen the best type for your metropolis/state. Go through the Preview option to check the form`s content. Read the type information to actually have selected the appropriate type.

- When the type does not match your needs, take advantage of the Look for industry near the top of the display screen to get the one which does.

- In case you are content with the form, validate your selection by clicking on the Buy now option. Then, pick the prices prepare you want and offer your references to sign up to have an account.

- Procedure the financial transaction. Use your credit card or PayPal account to complete the financial transaction.

- Select the file format and download the form on your device.

- Make changes. Load, edit and print and indication the delivered electronically Georgia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor.

Every single design you added to your money lacks an expiration date and is the one you have permanently. So, if you want to download or print yet another backup, just check out the My Forms segment and click on around the type you need.

Gain access to the Georgia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor with US Legal Forms, the most extensive collection of lawful document themes. Use a huge number of expert and express-particular themes that satisfy your small business or individual requires and needs.

Form popularity

FAQ

P. 4005. Secured creditors may retain some rights to seize property securing an underlying debt even after a discharge is granted. Depending on individual circumstances, if a debtor wishes to keep certain secured property (such as an automobile), he or she may decide to "reaffirm" the debt.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Reaffirmation agreements are a special feature of Chapter 7 bankruptcy. They give your creditors a chance to get you back on the hook for debt you would have otherwise discharged in the bankruptcy by allowing you to reaffirm, or re-sign, liability for a specific debt.

In bankruptcy, a reaffirmation is an agreement that a debtor and a creditor enter into after a debtor has filed for bankruptcy, in which the debtor agrees to repay all or part of an existing debt after the bankruptcy proceedings are over and the property subject to the reaffirmation is not subject to partition in the ...

The answer is yes, creditors benefit from a certain degree of protection under the bankruptcy law and they are allowed to require debtors to file for bankruptcy. Nonetheless, the circumstances in which one would be forced by creditors to file for involuntary bankruptcy are limited.

What is a discharge in bankruptcy? A bankruptcy discharge releases the debtor from personal liability for certain specified types of debts. In other words, the debtor is no longer legally required to pay any debts that are discharged.

Secured creditors may retain some rights to seize property securing an underlying debt even after a discharge is granted. Depending on individual circumstances, if a debtor wishes to keep certain secured property (such as an automobile), he or she may decide to "reaffirm" the debt.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.