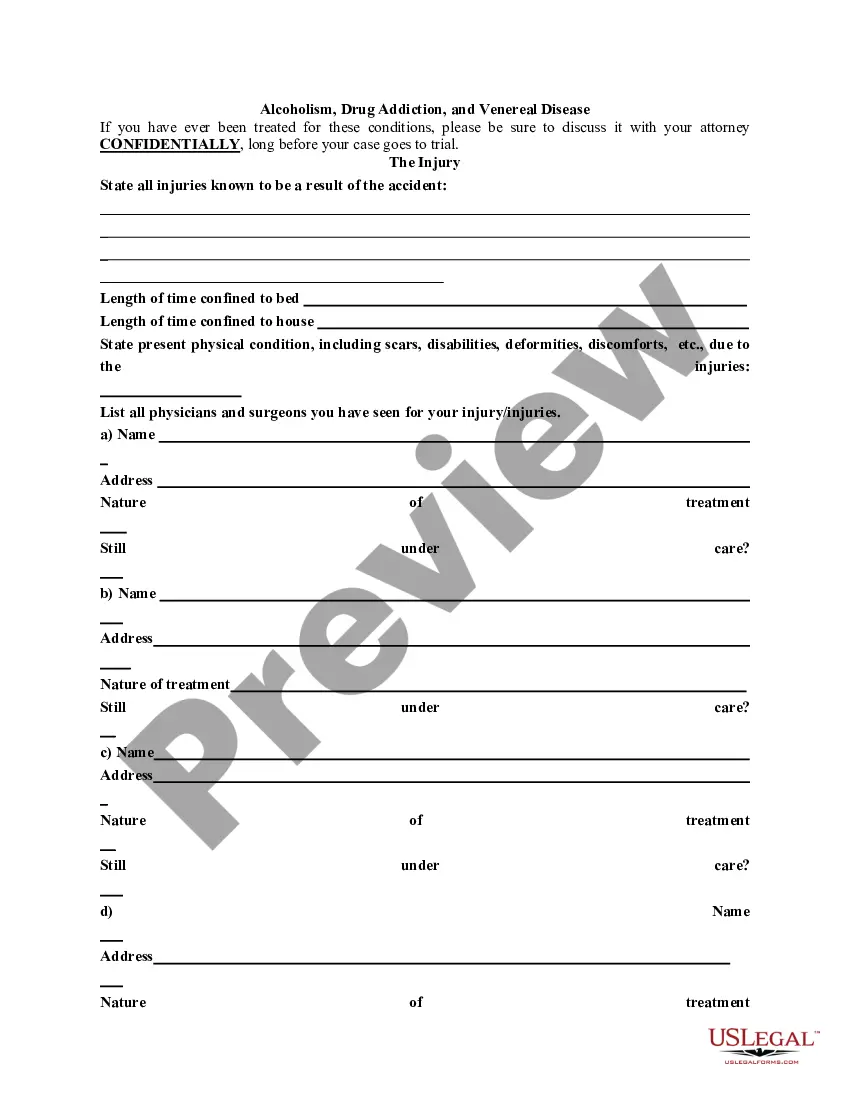

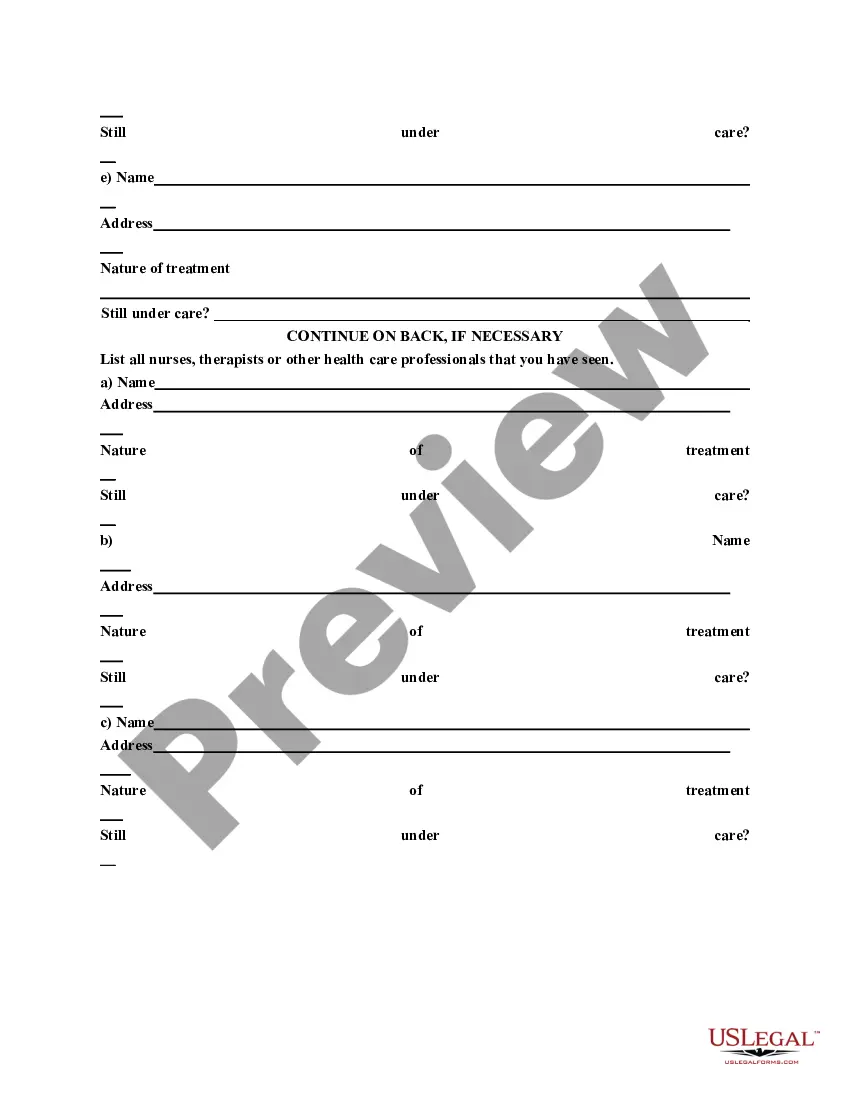

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Georgia General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the appropriate legal document template can be quite challenging. Naturally, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, including the Georgia General Information Questionnaire, that can be used for business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and then click the Download button to obtain the Georgia General Information Questionnaire. Use your account to search for the legal forms you have previously acquired. Visit the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and check the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain that the form is correct, select the Get now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your system. Complete, edit, print, and sign the downloaded Georgia General Information Questionnaire.

Leverage US Legal Forms to simplify your legal document needs with expert-reviewed templates that ensure compliance.

- US Legal Forms is the largest collection of legal forms where you can find numerous document templates.

- Utilize the service to acquire professionally crafted paperwork that comply with state regulations.

- The templates cater to both commercial and personal needs.

- All documentation is vetted by professionals.

- You can easily access your previously acquired forms.

- The platform ensures user-friendly navigation for new users.

Form popularity

FAQ

Note: Georgian citizen natural persons (including individual entrepreneurs) are assigned the same 11 digit tax identification number as the identification number that is assigned in the national identity card by registering body (Public registry).

To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process.

A Georgia EIN number is a federal tax ID number generated by the IRS. The Georgia Department of Revenue generates a Georgia tax ID number. You will need a Georgia state tax ID if your business pays sales tax, withholding tax for employees, Georgia corporate income tax, or other types of Georgia taxes.

The standard deduction for Georgia state tax increased in 2022. Single filers were able to deduct $5,400 and those married filing jointly could deduct $7,100. First-time Georgia tax filers, or those who haven't filed taxes in more than five years, receive their refund as a paper check.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances.

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first. ... Step 2: Gather Your Tax Documents. ... Step 3: Pick a Filing Status. ... Step 4: Choose Between the Standard Deduction or Itemizing. ... Step 5: Choose How to File. ... Step 6: File Your Taxes.

Form G-4 Employee Withholding Form (G4) is to be completed and submitted to your employer in order to have tax withheld from your wages.

Georgia withholding tax is the amount help from an employee's wages and paid directly by the employer. This includes tax withheld from wages, nonresident distributions, lottery winnings, pension/annuity payments and other sources of income.