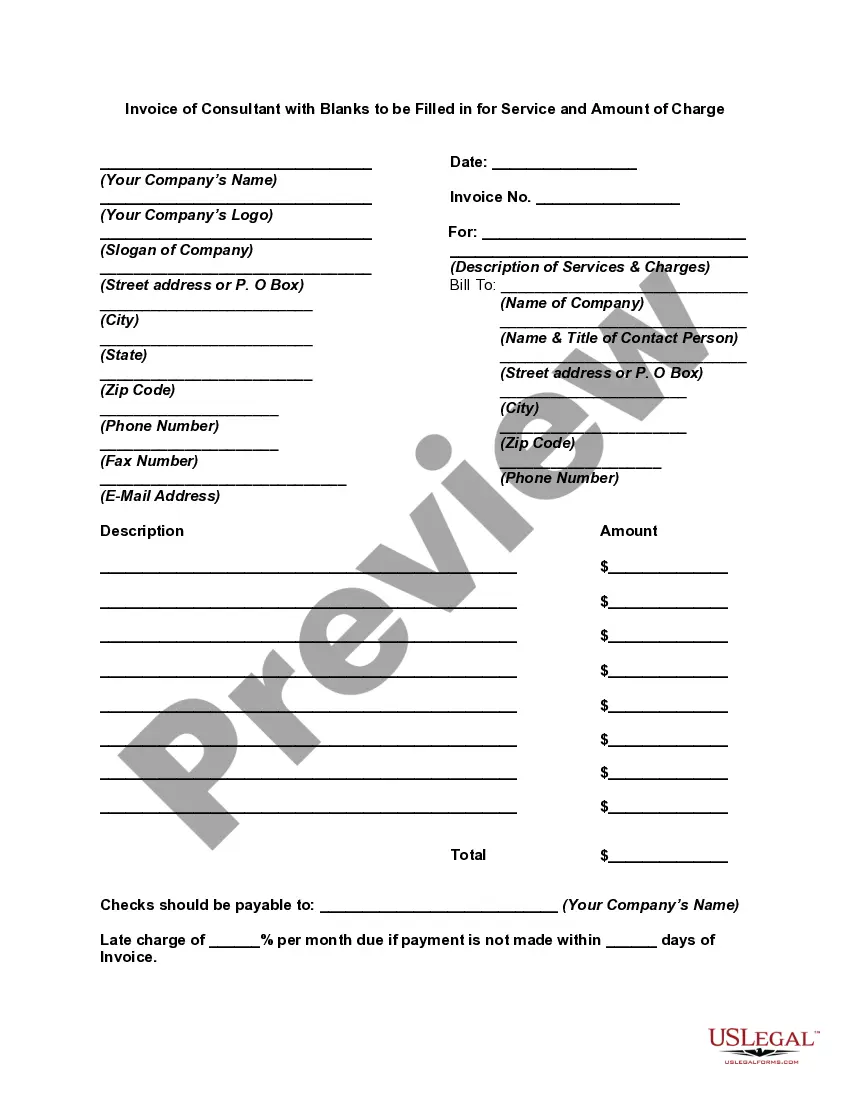

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Georgia Invoice of Consultant is a crucial document that outlines the service provided by a consultant along with the corresponding amount charged for their expertise. This invoice serves as a legally-binding agreement between the consultant and the client, ensuring transparency and accountability in the billing process. The Georgia Invoice of Consultant includes various blanks that need to be filled in accurately to reflect the specific details of the service and charges. These blanks facilitate customization and flexibility based on the uniqueness of each consulting engagement. The primary blanks include: 1. Consultant Information: Here, the consultant's complete name, address, phone number, and email address need to be entered. This ensures that the invoice is correctly attributed to the consultant responsible for the services rendered. 2. Client Information: This section requires the client's name, address, phone number, and email address. Filling in this information helps identify the recipient of the invoice and ensures it reaches the appropriate party. 3. Invoice Number: A unique invoice number should be assigned to each invoice. The consultant can determine their numbering system to track invoices efficiently and avoid confusion. 4. Invoice Date: It is crucial to mention the date when the invoice is created. This ensures clarity regarding the billing timeline and helps both parties maintain accurate financial records. 5. Service Description: A detailed description of the consulting services provided must be included in this section. The consultant should specify the nature, extent, and duration of the service rendered to justify the amount charged. 6. Hourly Rate/Service Rate: The amount charged per hour or the set rate for the service should be mentioned clearly. This rate should be in accordance with the agreement between the consultant and client. 7. Quantity/Hours Worked: The number of hours worked or the quantity of service provided should be accurately recorded. This helps the client understand the basis for calculating the charge. 8. Total Amount: The total amount due should be calculated, taking into account the quantity of service and the agreed-upon rate. Any applicable taxes or additional fees should be added to arrive at the final payable amount. 9. Payment Terms and Due Date: The terms of payment, such as the due date and acceptable payment methods, need to be clearly stated. This avoids any misunderstandings or delays in payment. It's worth mentioning that the Georgia Invoice of Consultant may have different types based on the nature of the consulting services provided. Some common types include: 1. General Consulting Invoice: This type of invoice is used for a broad range of consulting services, such as business strategy, marketing, finance, or legal advice. 2. IT Consulting Invoice: IT consultants may require a specialized invoice to outline services like software development, system integration, cybersecurity audits, or network design. 3. Management Consulting Invoice: Management consultants typically provide advisory services related to organizational processes, leadership, HR, or change management. Their invoices may detail these specific services. 4. Financial Consulting Invoice: Consultants specializing in finance and accounting may issue invoices that itemize services like financial statement preparation, tax consulting, investment analysis, or financial planning assistance. By tailoring the Georgia Invoice of Consultant to the specific service provided, consultants can ensure accurate invoicing and efficient payment processes while maintaining compliance with Georgia's invoicing regulations.