An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date

Description

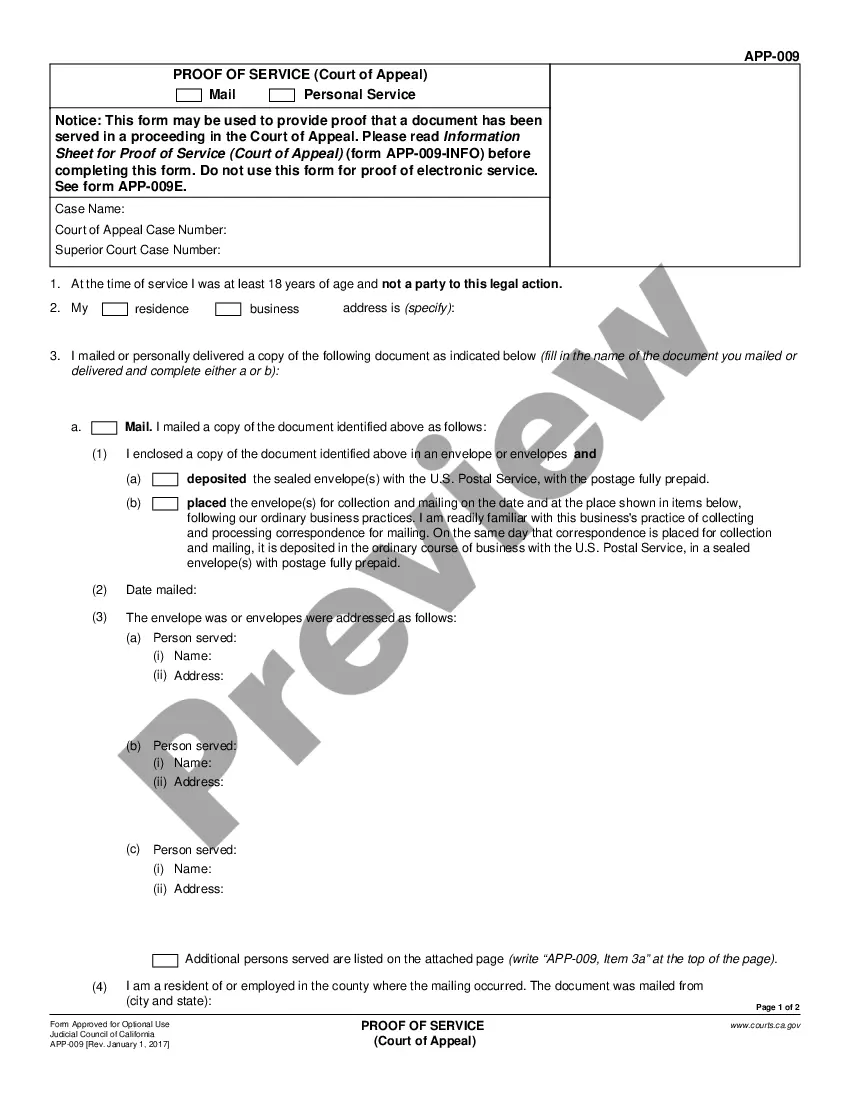

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

US Legal Forms - among the biggest libraries of legal kinds in America - gives a wide array of legal document layouts you are able to down load or print out. While using web site, you will get a huge number of kinds for enterprise and personal uses, sorted by categories, says, or key phrases.You will find the most up-to-date versions of kinds much like the Georgia Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date within minutes.

If you currently have a monthly subscription, log in and down load Georgia Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date from your US Legal Forms catalogue. The Obtain switch will show up on each and every type you view. You get access to all previously downloaded kinds from the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, here are straightforward directions to get you began:

- Make sure you have picked the correct type for your personal area/area. Click on the Preview switch to check the form`s content material. See the type explanation to actually have chosen the proper type.

- If the type doesn`t fit your needs, make use of the Lookup discipline at the top of the monitor to find the one that does.

- If you are pleased with the form, validate your decision by simply clicking the Buy now switch. Then, choose the pricing prepare you want and offer your credentials to register to have an profile.

- Process the transaction. Utilize your credit card or PayPal profile to complete the transaction.

- Select the formatting and down load the form in your system.

- Make modifications. Fill out, edit and print out and signal the downloaded Georgia Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date.

Every template you included with your bank account does not have an expiry particular date and it is yours forever. So, if you would like down load or print out one more copy, just visit the My Forms area and click on in the type you want.

Get access to the Georgia Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date with US Legal Forms, the most extensive catalogue of legal document layouts. Use a huge number of skilled and express-particular layouts that meet up with your small business or personal requires and needs.

Form popularity

FAQ

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

A note extension agreement is a contract between two parties where they mutually agree to extend the expiration date of the original note agreement.

A promissory note is a documented promise to repay borrowed money. Promissory notes are binding legal documents used to protect both the lender and the borrower. The promissory note is paper evidence of the debt that the borrower has incurred.

What is a Mortgage Modification Agreement? The mortgage modification agreement is a legal document between a lender and borrower to change an existing loan's terms. A typical modification may include reducing the interest rate, extending the repayment term, lowering monthly payments, or even forgiving part of the debt.

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

For example, if a borrower has problems paying back their loan, or if the lender is asking for less time to repay it, the borrower can request an extension of their promissory notes.

A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.