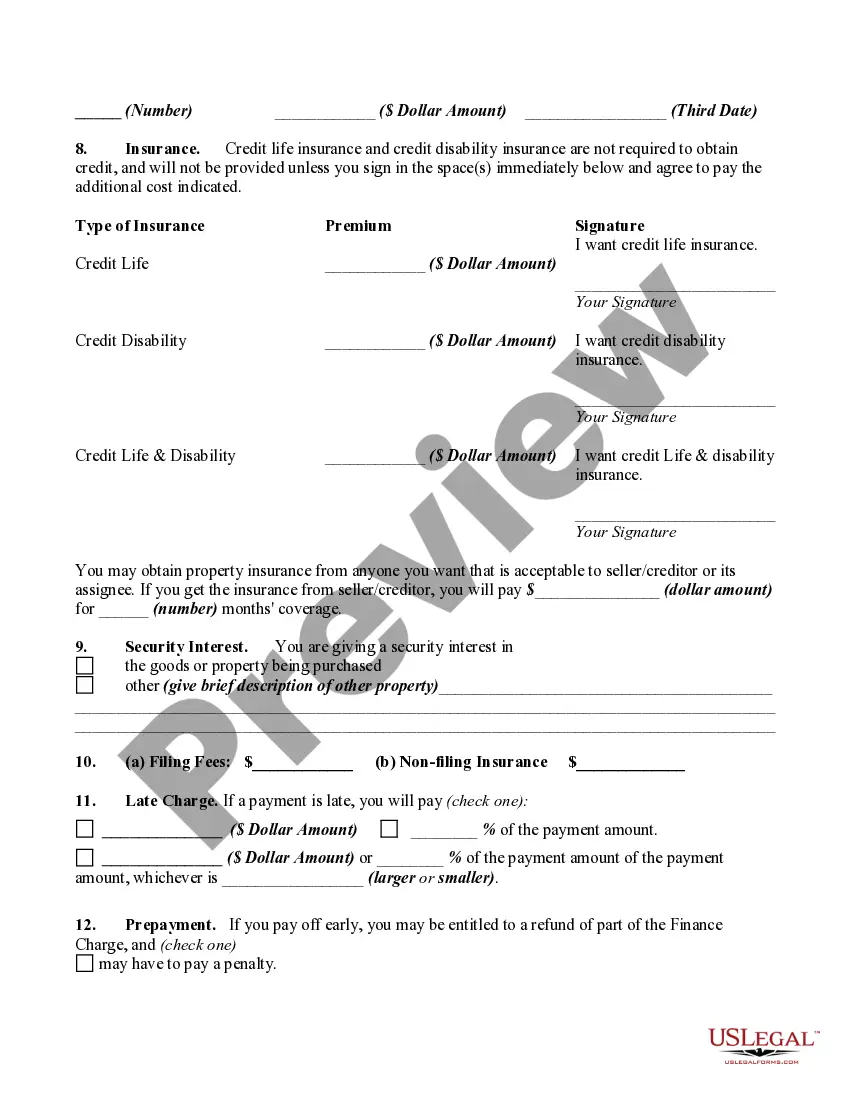

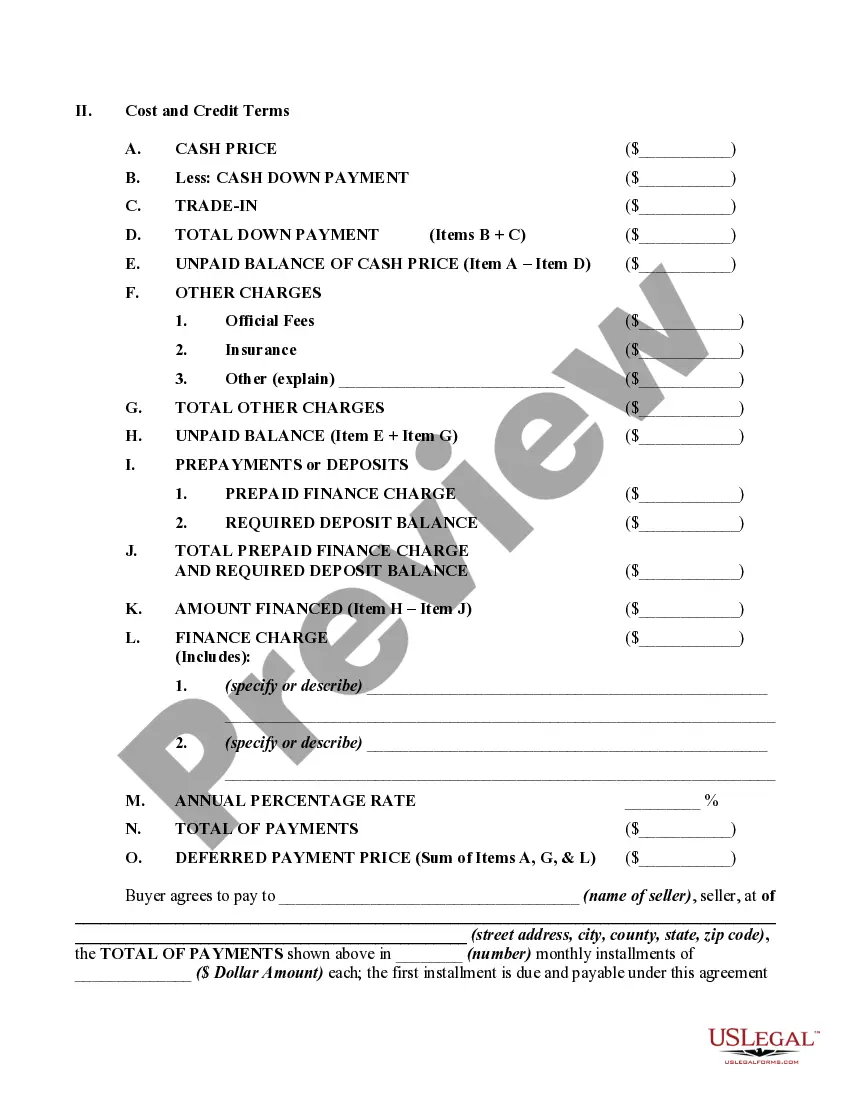

In a retail installment sale to a consumer as defined by Regulation Z of the Federal Trade Commission (FTC), the creditor must make the disclosures required by Regulation Z clearly and conspicuously in writing, in a form that the consumer may keep. The disclosures must be grouped, must be segregated from everything else, and must not contain any information not directly related to the disclosures required by Regulation Z (although the disclosures may include an acknowledgment of receipt, the date of the transaction, and the consumer's name, address, and account number). 12 C.F.R. § 226.17(a)(1). Regulation Z sets forth several closed-end model forms and clauses which illustrate other formats for these disclosures. 12 C.F.R. Part 226, Appendix H.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in at least 10- point, bold face, type or print and must be worded as shown if the form.

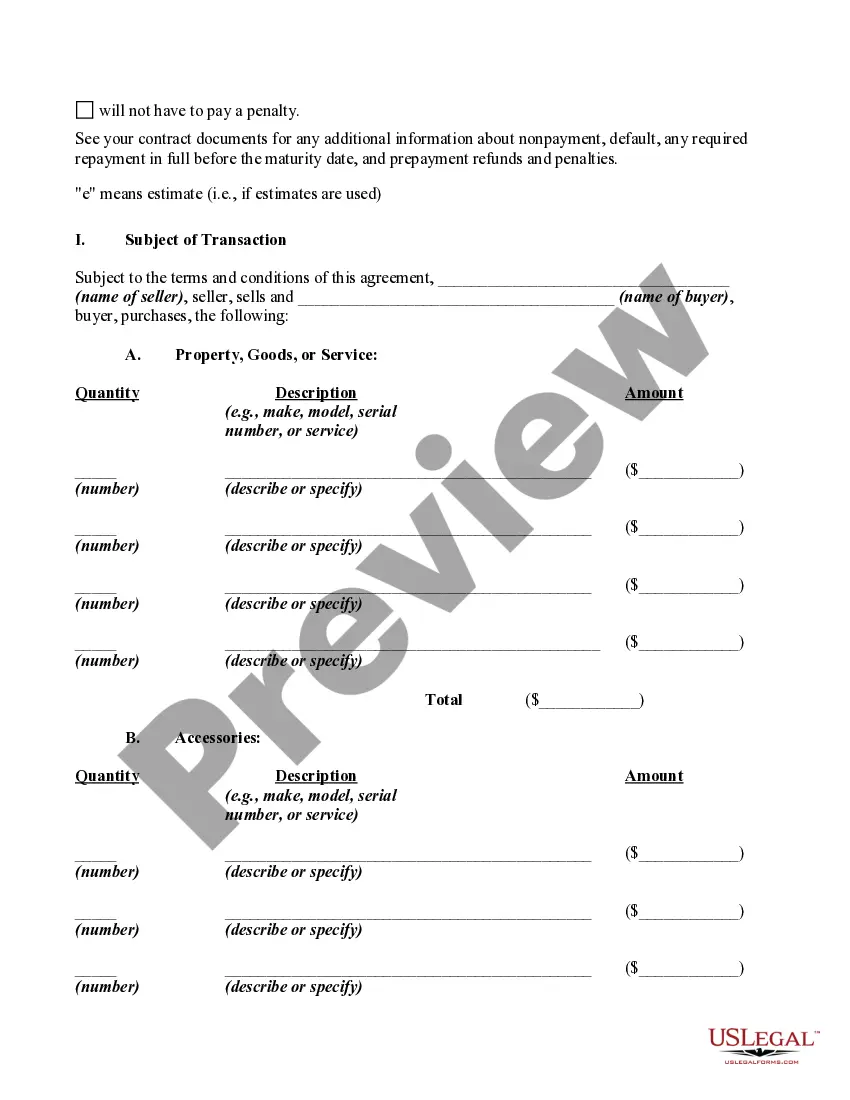

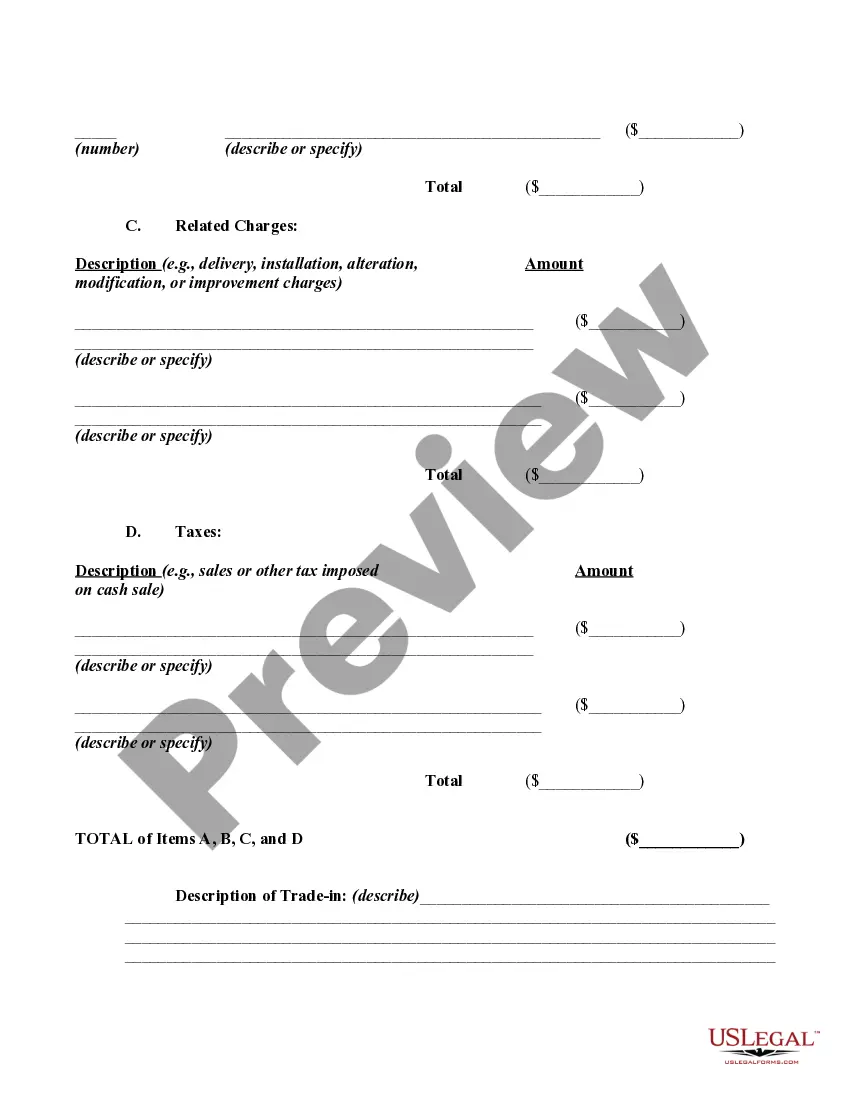

A Georgia Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of a retail sale, installment plan, and the security agreement for the purchased goods. This agreement is commonly used when a buyer purchases goods on credit from a seller, with repayment made in installments over a set period. The Georgia Retail Installment Contract and Security Agreement typically include key details such as the buyer's and seller's information, the description of the goods being sold, the purchase price, the down payment (if any), and the terms of the installment plan. The agreement also specifies the interest rate, late payment fees, and any penalties for defaulting on the payment. In Georgia, there are several types of Retail Installment Contract and Security Agreements, including: 1. Auto Loan Agreement: This type of agreement is specifically designed for purchasing vehicles, such as cars, trucks, or motorcycles, on credit. It outlines the details of the vehicle, loan amount, installment terms, and the security interest in the vehicle until the loan is fully repaid. 2. Furniture/Consumer Goods Contract: Used for purchasing furniture, appliances, or other consumer goods on credit, this agreement details the specific items being sold, the total purchase price, installment terms, and the security interest in the goods until the debt is satisfied. 3. Electronics/Technology Purchase Agreement: This type of agreement is tailored for purchasing electronic devices, such as computers, smartphones, or home entertainment systems, on installment basis. It includes the details of the items, purchase price, installment plan, and the security interest in the electronics until the debt is fully paid. 4. Home Improvement Contract: This agreement is used when purchasing services or goods related to home improvements, renovations, or repairs on an installment basis. It typically outlines the scope of work, the cost, installment terms, and the security interest in the property until the completion of payments. These various types of Georgia Retail Installment Contract and Security Agreements protect the rights of both the buyer and the seller. They establish a legal framework for the transaction, ensuring that the buyer receives the goods as intended and that the seller is compensated according to the agreed-upon terms. It is essential for all parties involved to review and understand the terms of the agreement before signing to avoid any misunderstandings or disputes in the future.A Georgia Retail Installment Contract and Security Agreement is a legal document that outlines the terms and conditions of a retail sale, installment plan, and the security agreement for the purchased goods. This agreement is commonly used when a buyer purchases goods on credit from a seller, with repayment made in installments over a set period. The Georgia Retail Installment Contract and Security Agreement typically include key details such as the buyer's and seller's information, the description of the goods being sold, the purchase price, the down payment (if any), and the terms of the installment plan. The agreement also specifies the interest rate, late payment fees, and any penalties for defaulting on the payment. In Georgia, there are several types of Retail Installment Contract and Security Agreements, including: 1. Auto Loan Agreement: This type of agreement is specifically designed for purchasing vehicles, such as cars, trucks, or motorcycles, on credit. It outlines the details of the vehicle, loan amount, installment terms, and the security interest in the vehicle until the loan is fully repaid. 2. Furniture/Consumer Goods Contract: Used for purchasing furniture, appliances, or other consumer goods on credit, this agreement details the specific items being sold, the total purchase price, installment terms, and the security interest in the goods until the debt is satisfied. 3. Electronics/Technology Purchase Agreement: This type of agreement is tailored for purchasing electronic devices, such as computers, smartphones, or home entertainment systems, on installment basis. It includes the details of the items, purchase price, installment plan, and the security interest in the electronics until the debt is fully paid. 4. Home Improvement Contract: This agreement is used when purchasing services or goods related to home improvements, renovations, or repairs on an installment basis. It typically outlines the scope of work, the cost, installment terms, and the security interest in the property until the completion of payments. These various types of Georgia Retail Installment Contract and Security Agreements protect the rights of both the buyer and the seller. They establish a legal framework for the transaction, ensuring that the buyer receives the goods as intended and that the seller is compensated according to the agreed-upon terms. It is essential for all parties involved to review and understand the terms of the agreement before signing to avoid any misunderstandings or disputes in the future.